Microsoft Corporation (NASDAQ:MSFT) has our proprietary Stocks In Demand, SID Buy Signal, so we have added it to our new, one year, 2024 Model Portfolio. We had a Buy Signal in our previous MSFT article and we now are upgrading to a Strong Buy Signal. As long as it continues to outperform the Index, it will stay in the portfolio. MSFT has a low beta, so we expect it to go down less than the S&P 500 Index (SP500) when this bear market goes down to retest the bottom.

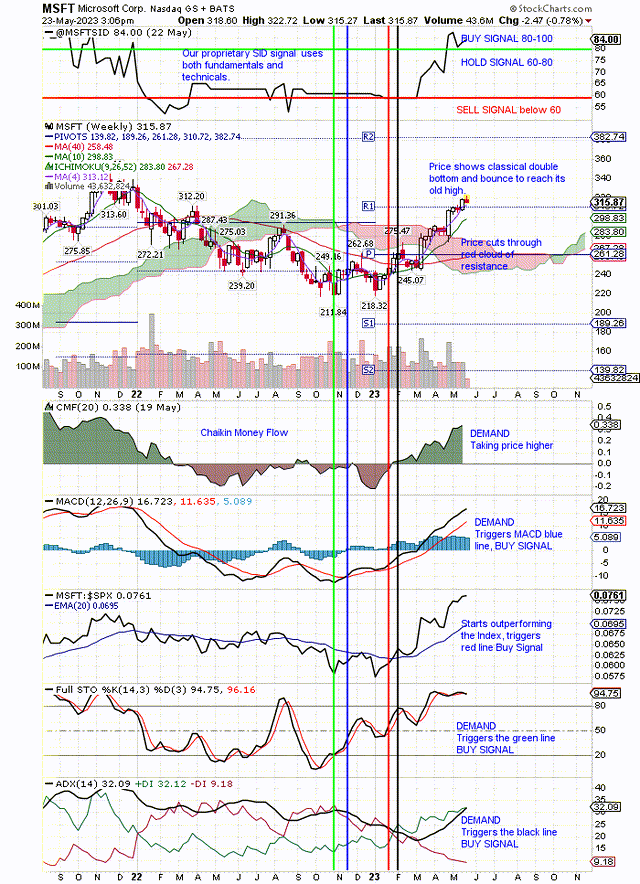

Our SID Buy Signal uses both fundamentals and technical indicators. We use the MSFT chart below to see the technical Buy signals. We like to use SA Quant ratings and articles to do our fundamental due diligence. We see the good SA ratings for Profitability, Momentum and Revisions. We have a problem with the weak scores for Valuation and Growth.

The recent surge in artificial intelligence, or AI, may solve some of the growth challenges. It was very surprising that MSFT was able to beat Alphabet Inc. (GOOG, GOOGL) aka Google by incorporating AI into its existing platform. That tells me how good the management is at MSFT. Unfortunately for MSFT, the guys at GOOGL are smart enough to catch up very quickly. GOOGL has already reorganized its AI departments to do just that. Most companies will be using AI to improve their products.

PEG is the metric that combines both Growth and Valuation. As you might expect, the low growth and high P/E give us a PEG that is overvalued because the PEG is above 2. Growth needs to move up, or price needs to move down, to bring this PEG down to more acceptable levels. Right now, the market is giving MSFT an AI premium in price. It expects growth to improve and for analysts to upgrade.

Because MSFT is overvalued, we know that it will go down when the recession comes and the market goes down. Most overvalued stocks will drop when the market drops. However, even if MSFT drops with the market, it may drop less than the market and continue to outperform the Index. In that case, it would stay in our Model Portfolio, even if our SID Buy Signal drops to a Hold Signal.

Right now, the analysts’ consensus 12-month target is about $331. Price continues to move up reaching for that target. As soon as it hits that target, we expect to see a pullback in price to retest support. The growth of AI in MSFT may force analysts to raise that target.

We will have to watch that movement. Right now, 44 of 53 analysts on Wall Street have a Buy rating on MSFT, so you can see that it is quite possible they will raise their targets. We are not that sanguine, but it is an indication that they might move the target higher. Also Seeking Alpha has a good rating for Revisions.

Here is the weekly chart for MSFT showing our Buy Signals, Notice the vertical line; technical Buy Signals occur well ahead of our SID Buy Signal. Valuation problems with MSFT cause our SID Buy Signal to lag the purely technical buy signals. The advantage of our lagging SID signal is that it provides a great degree of confidence in higher prices.

Our lagging SID Buy Signal provides confidence to upgrade to Strong Buy (StockCharts.com)

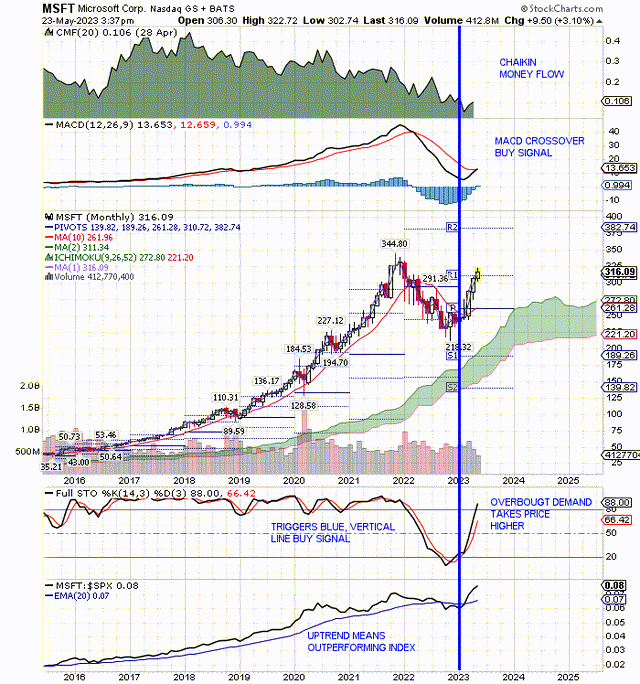

Here is the monthly chart, and it shows MSFT targeting its old high with our technical, vertical, blue line, Buy Signal.

MSFT targeting its old high (StockCharts.com)

Read the full article here