I take investing very seriously. And I take my track record in investing seriously as well. This is especially true when it comes to the very small number of companies that I rate a ‘strong buy’. Last year, for instance, I rated only 28 companies that highly. And of those 28, 21 ended up outperforming the market, with 20 of them generating returns that were positive. Considering how difficult last year was from an investment perspective, I consider that a win. You can imagine my dismay, then, when one of the stocks I rate highly ends up not only underperforming the market, but does so substantially. While some investors and analysts might be tempted to ignore these blotches on their record, I like to dig in and see what transpired. I also like to see if my overall thesis regarding the enterprise has changed and, if it warrants a change in sentiment, how much.

A great example of one company that has failed to deliver is United Natural Foods (NYSE:UNFI). Since I last wrote about the company in December of last year, shares have plunged 29.9% compared to the 10.3% gain seen by the S&P 500. The vast majority of this decline occurred on March 8, after management reported financial results for the second quarter of the company’s 2023 fiscal year. Shares closed down 28.1% that day. Looking into the numbers deeper, I can understand why the market was unhappy with the company’s financial results. But given the transitory nature of its problems and how cheap shares are even with current guidance in play, I cannot help but to believe that shares offer investors tremendous upside potential from here. As such, I have decided to keep the company rated the ‘strong buy’ I had it rated previously.

What went wrong

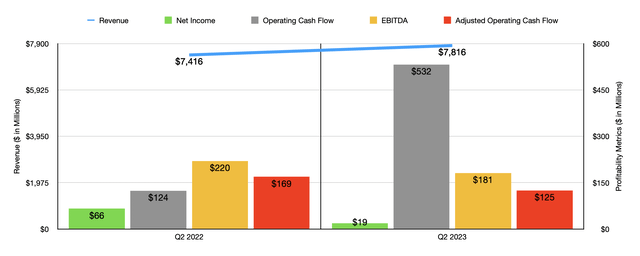

After the management team at United Natural Foods announced financial results covering the second quarter, shares of the food distributor plunged, closing down 28.1%. For those looking solely at the revenue picture, this may seem peculiar. Overall revenue for the company came in at $7.82 billion. In addition to representing an increase of 5.4% over the $7.42 billion reported the same quarter one year earlier, the sales figure also beat analysts’ expectations by $49 million.

Author – SEC EDGAR Data

Year over year, the company did not have any weak spots from a revenue perspective. Its greatest growth, however, came from its Supernatural customer channel. This group of customers consists of chain accounts that are national in scope and that carry mostly natural products. Only one customer, Whole Foods Markets, falls under this category. Revenue there spiked 14.2%, climbing $206 million from $1.45 billion to $1.66 billion. This increase was driven largely by growth in existing same-store sales for that client, with that growth also involving inflationary pressures being passed on to clients and new fresh categories of products. A rise in store count also had a role to play here. The second-largest contributor from a dollar perspective was the Chains category of customers. Revenue here grew $79 million, or 2.4%, thanks to higher demand for the company’s services, an increase in the number of customers at services, and higher selling prices that were largely attributable to inflationary pressures.

So far, things look pretty good. But the problem was not on the top line. The problem, instead, involved the bottom line. During the quarter, the company generated a profit per share of only $0.31. That’s down significantly from the $1.08 per share reported one year earlier. This translated to a decline for net profits from $66 million to only $19 million. There were a couple of different drivers behind this decline. One of these is the fact that gross profit for the company actually dropped by about $6 million even though sales increased. An increase in the LIFO charge to the company’s inventory, combined with lower current period procurement gains caused by inflationary pressure slowing down, as well as by lower inventory gains, were responsible for this. But the bigger pain came from higher operating expenses. These shot up $58 million year over year, though as a percentage of revenue, they were more or less flat after factoring in an $8 million benefit associated with pension plan changes one year earlier.

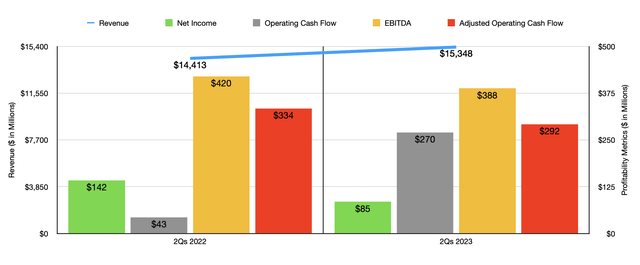

Author – SEC EDGAR Data

Unfortunately, other profitability metrics also worsened during this time. It is true that operating cash flow jumped from $124 million to $532 million. But if we adjust for changes in working capital, we would see this number drop from $169 million to $125 million. Meanwhile, EBITDA for the company dropped from $220 million to $181 million. As you can see in the chart above, the financial performance achieved in the second quarter of the year went a long way toward negatively affecting financial results for the first half of 2023 relative to the first half of 2022 as a whole.

If the bottom line results achieved by United Natural Foods were not bad enough, management also ended up changing their guidance for the 2023 fiscal year. Previously, management was forecasting net income of between $247 million and $266 million. That has now been revised lower to between $90 million and $142 million. On an adjusted basis, net income of between $185 million and $237 million will be substantially lower than the $296 million to $314 million previously forecasted. Even EBITDA was forecasted lower. In guidance provided during the first quarter of the year, management stated that it would come in at between $850 million and $880 million for the year. That number has now been pushed lower to between $715 million and $785 million.

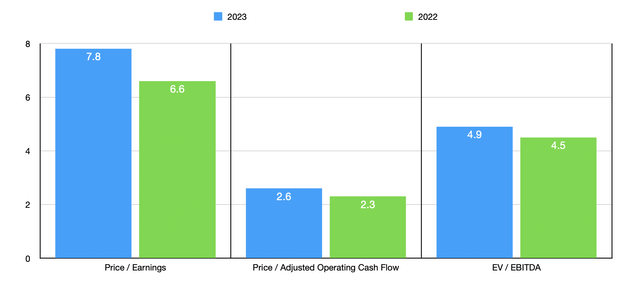

Author – SEC EDGAR Data

Truth be told, I would have imagined that the market would have recognized just how unjustifiably low shares were priced in response to these troubles. However, the stock still remains horribly depressed. But when you price shares, they do look incredibly cheap. As you can see in the chart above, the company is trading at a forward price to adjusted earnings multiple of 7.8. That’s up from the price to earnings multiple of 6.6 using data from 2022. The price to adjusted operating cash flow multiple should be about 2.6 compared to the 2.3 reading that we would get using data from 2022. This assumes that adjusted operating cash flow will change this year at the same rate that EBITDA is forecasted to change. And that would imply a reading for this year of $631 million. And finally, the EV to EBITDA multiple for the company should be 4.9. By comparison, that number would be 4.5 using data from last year. As part of my analysis, I also compared the company to five similar firms. On both the price to earnings basis and the EV to EBITDA basis, it ended up being the cheapest of the group. And when it comes to the price to operating cash flow approach, only one of the five companies was cheaper than our target.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| United Natural Foods (UNFI) | 7.8 | 2.6 | 4.9 |

| The Andersons (ANDE) | 17.4 | 1.3 | 7.7 |

| Performance Food Group Company (PFGC) | 22.6 | 9.7 | 10.1 |

| SpartanNash Company (SPTN) | 12.7 | 5.4 | 6.4 |

| US Foods Holding Corp. (USFD) | 20.7 | 10.5 | 9.7 |

| Sysco Corporation (SYY) | 21.6 | 13.6 | 12.2 |

Takeaway

I know that the past few months have been very painful for shareholders of United Natural Foods. A decline in profitability negatively affected shares, as did a significant decrease in guidance for the year. I can understand why the market became agitated, especially when you consider how volatile the market is today. Having said that, I believe that the market has significantly overreacted, especially when you consider how cheap shares are at the moment. In fact, while I have not made the decision yet, I am considering allocating capital from one of my other holdings into this one. I have a difficult time believing that shares can remain this depressed for this long.

Read the full article here