Sarepta Therapeutics (NASDAQ:SRPT) is a large (~$14 billion market cap) biopharmaceutical company that markets 3 RNA-targeted products for Duchenne muscular dystrophy (DMD) patients. In previous coverage, SRPT was touted as a Strong Buy because the FDA flip-flopped and held a Cellular, Tissue, and Gene Therapies Advisory Committee (CTGTAC) meeting for SRP-9001, handing investors a positive catalyst. The vote favored Sarepta as expected, sending shares to a 52-week high of $152.89 (or 16% over the price at publication). While the FDA doesn’t always follow its experts’ opinions, an upcoming confirmatory trial later this year bodes well for Longs’ hopes that the Agency will be lenient and approve the DMD gene therapy.

The Agency wasted time during Ad Comm trying to undermine the case for SRP-9001 by bringing up clinical efficacy according to the North Star Ambulatory Assessment (NSAA), which was Study 102’s primary functional endpoint. All four of the FDA’s analyses were about change (Δ) in NSAA scores. Topic 2 even directed CTGTAC to discuss the clinical significance of exploratory NSAA subgroup analyses! However, such items are NOT required for Accelerated Approval. In fact, the only question up for voting was “Do the overall considerations of benefit and risk, taking into account the existing uncertainties, support Accelerated Approval of SRP-9001 — using as a surrogate endpoint, expression of Sarepta’s micro-dystrophin at Week 12 after administration of SRP-9001 — for the treatment of ambulatory patients with Duchenne muscular dystrophy with a confirmed mutation in the DMD gene?”

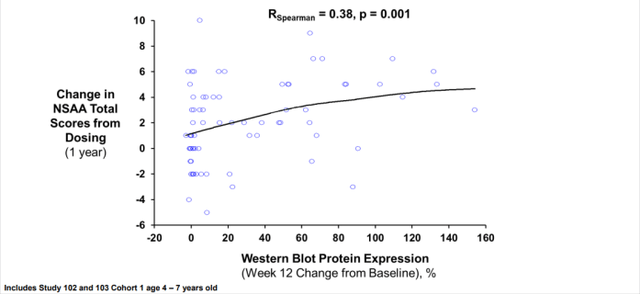

As discussed in the previous article, Study 102 met its primary biological (the surrogate) endpoint, with micro-dystrophin expression of 23.8% at Week 12 in the SRP-9001 group compared to 0.1% for placebo (p < 0.0001). The level of change from baseline (“CFB”) was magnitudes higher than the 0.28-0.8% mean CFB of normal dystrophin demonstrated by Sarepta’s exon-skipping products. Because of this large increase, the FDA questioned its validity as a surrogate endpoint reasonably likely to predict clinical benefit. Specifically, Analyses 3 and 4 tried to show a lack of clear dose-dependent expression increase or association between micro-dystrophin and ΔNSAA Total Score. However, functional improvement with natural dystorphin may be saturable after some threshold, flattening the curve (Figure 1). For Studies 102 and 103, the direction was positive and correlation was significant.

Figure 1. Association Between SRP-9001 Dystrophin and NSAA 1-Year Change

Sarepta

Finances and Takeaways

Q1 earnings were mixed. A $387.3 million debt extinguishment contributed to a net loss of $516.8 million. EPS would’ve missed by $0.18 even without it, due to ramp ups in research and development ($245.7 million, +26% year-over-year) and selling, general and administrative expenses ($110.7 million, +54% YOY). Another beat in revenues saw 28% growth YOY (Table 1), although EXONDYS sales may be close to peaking. Sarepta still has a strong cash position of $1.9 billion as of March 31, 2023.

Table 1. Quarterly Revenues (in $ thousands)

|

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

Q1 2023 |

|

|

EXONDYS 51 |

107185 |

112461 |

115598 |

119117 |

117133 |

126377 |

122262 |

145977 |

132571 |

|

AMONDYS 45 |

193 |

6936 |

26655 |

34745 |

43614 |

54676 |

54893 |

61399 |

65912 |

|

VYONDYS 53 |

17548 |

22442 |

24658 |

24863 |

28078 |

30184 |

30619 |

28557 |

33012 |

|

Products, net |

124926 |

141839 |

166911 |

178725 |

188825 |

211237 |

207774 |

235933 |

231495 |

|

Collaboration |

22005 |

22250 |

22495 |

22736 |

22005 |

22250 |

22495 |

22494 |

22005 |

|

Total revenues |

146931 |

164089 |

189406 |

201461 |

210830 |

233487 |

230269 |

258427 |

253500 |

To conclude, experts found enough evidence of benefit outweighing risk to support Accelerated Approval of SRP-9001. The FDA raised some points that could be important for Full Approval, but little of that matters now because the results of the confirmatory trial, good or bad, would trump those concerns. The biggest risk could turn out to be a manufacturing issue regarding the commercial (to-be-marketed) product. That and the narrow margin of CTGTAC’s vote keep the stock from a Strong Buy. As before, trading for options such as the June 16 $135 strike is viable.

Read the full article here