Just over two months ago, I wrote on McEwen Mining (NYSE:MUX), noting that while recent developments were positive, there was no margin of safety present above US$9.00 per share. This is because the stock was trading just below an estimated fair value of US$9.90 in a period of excessive optimism for copper and copper miners (COPX) and gold miners, suggesting the stock was vulnerable to a correction if we saw any negative change in sentiment. While the stock briefly pushed higher to test the US$10.00, it’s suffered a 19% drawdown since, and has still yet to fully relieve its overbought condition. Worse yet, silver, gold, and copper prices are lower, affecting margins for its precious metals segment. Let’s dig into the stock’s Q1 results below.

Q1 Production & Sales

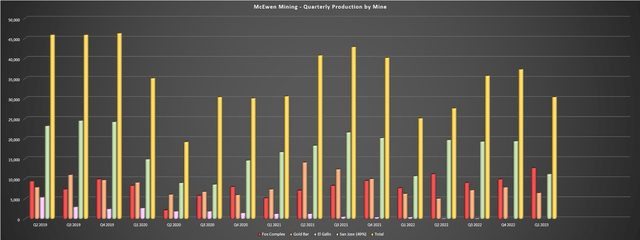

McEwen Mining released its Q1 results earlier this month, reporting quarterly production of ~30,400 gold-equivalent ounces [GEOs], a 21% increase from the year-ago period. Higher production was driven by a much better quarter at the company’s Fox Complex (~12,700 GEOs vs. ~7,700 GEOs) with the shift to mining at Froome, a slight increase in output at Gold Bar despite inclement weather, and an increase in production at San Jose in what’s typically a seasonally weaker period for the mine. That said, this sharp increase on a year-over-year basis was because of being up against easy comparisons, and while output was higher at two of its three assets, all-in sustaining costs came in north of $1,700/oz at two of these assets, resulting in razor-thin all-in cost margins at Gold Bar and negative all-in cost margins at San Jose.

McEwen Mining – Quarterly Production by Mine (Company Filings, Author’s Chart)

Digging into Gold Bar’s results a little closer, the asset benefited from a new mining contractor and a lower strip ratio, but unfortunately dealt with tough weather in the period, with two access roads flooded. Despite the headwinds, production was slightly higher at ~6,300 GEOs, benefiting from increased throughput at much higher grades (0.83 grams per tonne of gold vs. 0.62 grams per tonne of gold) from Gold Bar South [GBS]. From a negative standpoint, leaching is taking longer than expected at GBS. However, from a positive standpoint, productivity has improved with the new mining contractor in place as of January, and over 15,000 ounces were placed on the leach pad during Q1, setting up the mine for a stronger quarter ahead.

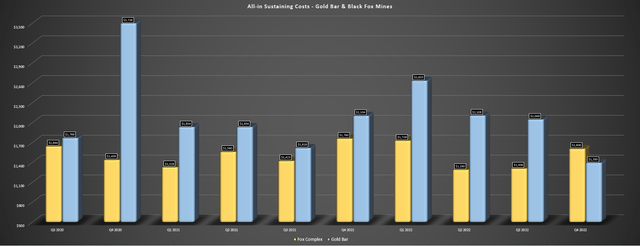

At the Fox Complex, McEwen Mining processed ~108,000 tonnes at 4.11 grams per tonne of gold vs. ~68,000 tonnes at 3.86 grams per tonne of gold, with increased throughput benefiting from restructuring of crushing operations. The result was ~12,700 GEOs were produced (+66% year-over-year) in the period at all-in sustaining costs of $1,311/oz, down from $1,729/oz in the year-ago period. That said, the mine benefited from lower sustaining capital which helped to pull down AISC, and when including significant exploration spend at Fox West, its Fox operations continue to operate at a loss on an all-in cost basis (including exploration/advanced project expenditures).

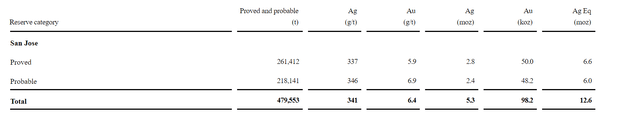

Finally, San Jose’s performance wasn’t anything to write home about, with ~11,200 attributable GEOs produced at all-in sustaining costs of $2,234/oz (Q1 2022: ~10,700 GEOs at $2,103/oz). While throughput was higher in the period, grades were considerably lower, at 3.9 grams per tonne of gold and 215 grams per tonne of silver, respectively, related to negative grade reconciliation. And while negative grade reconciliation is never a positive sign, the bigger issue here is the mine life, with just ~1.0 million tonnes of material in reserves relative to an annual production rate of ~520,000 tonnes (2-year average). This points to just two years of mine life, and relying on higher metals prices isn’t an option as it is for some mines, with these reserves already based on prices well above the industry average ($1,800/oz gold and $24.00/oz silver).

McEwen Mining has a 49% interest in Minera Santa Cruz S.A. (“MSC”) which owns the San Jose mine in Argentina.

San Jose Reserves (Hochschild Annual Report)

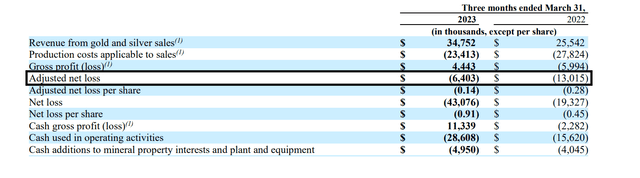

To summarize, while the results were significantly better on a year-over-year basis, they were hardly impressive relative to other operators, and it’s difficult to be optimistic about San Jose’s future based on its current reserve base. Plus, even if we take a stance that Hochschild (operator at San Jose and 51% owner) can replace reserves, McEwen’s current operations are hardly impressive with an average AISC of $1,446/oz even during a period of relatively low sustaining capital (~$4.3 million). And even with an average realized gold price just shy of $1,900/oz, its 100% owned operations generated revenue of just $34.8 million and an adjusted net loss of $6.4 million.

Costs & Margins

Moving over to costs and margins, McEwen Mining’s all-in sustaining costs at its 100% owned operations came in at $1,446/oz, down from $2,146/oz in the year-ago period. And while this was despite inflationary pressures experienced on a year-over-year basis for most consumables, the company did see some relief from a fuel standpoint with energy prices correcting in Q1. That said, labor/contractor inflation continues to be stickier than expected, impacting McEwen Mining which relies on contractors in Nevada, a prolific mining region. And while the pullback in diesel price should help its Nevada operations which are high-volume and low-grade relative to Fox, the recent gold price correction won’t help either of its operations, nor its San Jose Mine given the even sharper correction in silver.

Gold Bar & Fox – All-in Sustaining Costs (Company Filings, Author’s Chart)

As shown above, McEwen Mining’s trend in AISC at its 100% owned operations has certainly been positive, but it’s important to note that these costs have corrected from industry-lagging levels, making the cost improvements less notable. And while the company was benefiting from ebullient sentiment regarding copper miners in Q1 which helped its valuation as the bulk of its sum-of-the-parts valuation is driven by its stake in McEwen Copper (Los Azules and Elder Creek), copper prices have corrected violently since Q1, which could continue to impact MUX with less appetite for copper miners as they retreat from a near-parabolic rally from October 2022 to April 2023 (~60% rally). Let’s look at McEwen Mining’s valuation and see whether this appears priced into the stock.

Copper Futures Price (StockCharts.com)

Valuation & Technical Picture

Based on ~51 million fully diluted shares and a share price of US$7.90, McEwen Mining trades at a market cap of US$403 million, which would be a very reasonable valuation if it had a profitable precious metals’ portfolio with long-life assets. However, as discussed in previous updates, San Jose’s mine life (49% attributable) is dwindling and negative grade reconciliation affected operations last quarter. Second, the Fox Complex is a smaller operation that doesn’t benefit from economies of scale and has an 8% stream affecting current mined areas, making it a relatively marginal operation with royalties on several source areas. Finally, while GBS is higher grade, lower-strip, and is easier to mine given that it doesn’t have carbonaceous ore, it is a minuscule operation that will struggle to maintain costs below $1,500/oz. Hence, in a conservative gold price scenario of $1,850/oz, it’s hard to be optimistic about its precious metals’ portfolio generating any meaningful free cash flow.

McEwen Mining – Q1 Adjusted Net Loss (Company Filings)

The Fuller deposit has a 10% NPI royalty, the Grey Fox deposit has a 2.65% NSR, and Froome has an 8% gold stream with a purchase price of ~$570/oz. The deposits benefiting from no royalties are Stock East/West.

Fortunately, McEwen Mining has a large stake in McEwen Copper (51.9%), which underpins its valuation, with a fair value estimate of $285 million for this stake and an additional $40 million in value for its royalty portfolio. This makes up ~80% of McEwen Mining’s market cap today, suggesting investors are getting its precious metals portfolio for a cheap price of $78 million). However, as discussed previously, I think it’s difficult to assign even $150 million in value. However, even if we assign $180 million in value to this portfolio, which assumes Hochschild (OTCQX:HCHDF) successfully grows reserves and operations continue to improve at Fox, this places a fair value on McEwen Mining from a sum-of-the-parts basis of US$9.90.

Although this points to 25% upside from current levels, cyclical stocks should only be bought when a large margin of safety is priced in. And I would never buy a small-cap miner that’s not generating any free cash flow with a history of being a serial share diluter without a minimum 50% discount to fair value. And if we apply this discount to McEwen Mining, this points to a low-risk buy zone of US$4.95, suggesting that despite the recent pullback, the stock is nowhere near a low-risk buy zone yet. Obviously, waiting for US$5.00 or lower could end up leading to a missed opportunity, but with several well-run producers in this sector returning capital to shareholders regularly, there are far more attractive opportunities elsewhere, and it only makes sense to stoop to owning lower-quality names if a massive margin of safety is available.

Summary

While several miners have sold off sharply from their highs following gold’s failed breakout attempt, McEwen Mining has pulled back more than the index (~24% vs. ~13%), which isn’t surprising given its outperformance year-to-date. The problem is that the correction is coming after a near-parabolic rally to US$10.00, and while the mild correction in gold prices doesn’t affect high-margin operators like Agnico Eagle (AEM) and Orla Mining (ORLA), it is an issue for high-cost operators like Equinox Gold (EQX), McEwen Mining and Hochschild. Plus, MUX has yet to completely relieve its overbought condition, which will likely require a larger correction through time or price. To summarize, I see MUX as an inferior buy-the-dip candidate, and I continue to focus on more attractive opportunities elsewhere in the sector.

Read the full article here