After the bell on Monday, we received fiscal first quarter results from Zoom Video Communications, Inc. (NASDAQ:ZM). Perhaps the biggest of the pandemic darlings, the company saw its revenues surge and stock soar due to the dramatic shift to employees working from home. Since then, however, the growth boom has all but ended, with the company’s latest report continuing to show many of the same weakening trends.

For Q1, revenues came in at $1.105 billion. This figure did beat street estimates by roughly $30 million, after analysts were quick to cut their numbers following weak guidance at the company’s Q4 report. Revenue growth over the prior year period was down to just 3%, after peaking at 369% during the height of the coronavirus sales boom. On the bottom line, non-GAAP EPS of $1.16 beat by 17 cents, although this was actually less than the 23-cent average beat over the last four quarters.

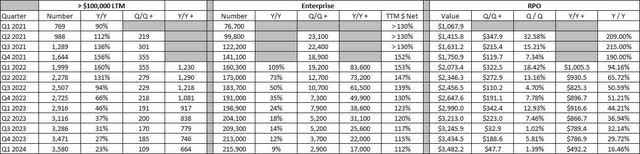

Management talked about exceeding revenue guidance due to Enterprise growth. The company added another nearly 3,000 Enterprise customers in the quarter, but this was the lowest number in years. In fact, as the table below shows, the year-over-year increase of 17,000 customers here was less than half of the numerical increase seen in the year-ago period. Yet again, the trailing twelve-month net dollar expansion rate dipped 3 more percentage points and is now more than 40 points off its high.

Key Customer Data (Company Earnings Reports)

Likewise, the number of customers delivering more than $100,000 of revenue in the trailing twelve months also showed its weakest growth in years, on both a sequential and year-over-year basis. If we look at remaining performance obligations (“RPO”), the year-over-year increase came in at less than half a billion dollars. While roughly 16.5% growth here looks nice considering the near-flat revenue growth figure, yearly RPO growth was more than 44% a year earlier and over 94% in Q1 of the year before that.

When it comes to guidance, management said total revenue is expected to be between $1.110 billion, and $1.115 billion, and revenue in constant currency is expected to be between $1.120 billion and $1.125 billion. This forecast is roughly in line with estimates calling for $1.11 billion. For the fiscal year, total revenue is expected to be between $4.465 billion and $4.485 billion, and revenue in constant currency is expected to be between $4.495 billion and $4.515 billion. The street was at $4.45 billion, so this guidance at first glance looks rather good.

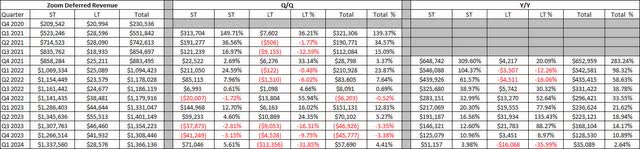

Management did raise its guidance for the year, but basically by the amount it beat by in Q1. Thus, the overall forecast for the back half of the year isn’t expected to be too much different than what the street currently expects. Additionally, as the graphic below shows, deferred revenue trends are looking just as weak as some of the other key metrics shown above. Total deferred revenue growth was just $35 million year over year, less than 3% growth, which is down about $200 million or almost 20 percentage points over the prior year period. I was thinking that deferred revenue could decline in Q2 on a year-over-year basis, and on the conference call, management confirmed that this would likely occur.

Total Deferred Revenue (Company Earnings Reports)

Zoom reported a net profit of just $15 million in Q1, down about $100 million year over year primarily due to restructuring efforts and litigation settlements. Non-GAAP income did rise by a little more than 10% year over year, but the adjusted operating margin only increased by one percentage point. The company continues to generate a ton of cash, almost $397 million in the period, but that was down from $501 million in the year-ago period.

Zoom shares rose about $1 in the after-hours session, and that gain might seem small to someone who only looked at the headline beats and full year guidance raise. The internal numbers here still were not great, making me wonder about the next 2-4 quarters, especially if the US enters a recession. The average price target on the street remains almost $85, implying a double-digit upside from current levels, but we’re only about two years removed from that average valuation approaching $500.

I will be very curious to see one notable investor’s reaction to this news. Zoom is a key holding in Cathie Wood’s flagship ARK Innovation ETF (ARKK) as well as the ARK Next Generation Internet ETF (ARKW). The ETF firm put out a $1,500 price target for Zoom just a little more than 3 years from now in a model released last year. However, Ark’s model featured thousands of Monte Carlo simulations that have Zoom delivering over $54 billion in revenues for that fiscal year. That’s quite a bit of growth acceleration from the less than $4.5 billion in guidance for this year just detailed on Monday.

In the end, Zoom delivered an okay set of results on Monday, but the report was far from a home run. Q1 numbers came in better than thought, but the full year guidance raise wasn’t exactly what it seemed. All of the company’s key metrics continue to weaken, and quite considerably, leading future revenue growth to be a major question mark. Shares were initially up slightly on the news, but this is a company that’s not close to firing on all cylinders at the moment.

Read the full article here