Investment thesis

One constant between the well-regarded value investors is that they all own payment companies. Buffett has American Express (Amex) (NYSE:AXP), Akre has Mastercard (MA) and Fundsmith has Visa (V), just to name a few. For this reason, we are considering the key players in the industry, beginning with Amex. We will consider the current economic conditions and how we think Amex will develop in the medium term. We will also consider how the payments industry is shaping up due to the disruption we have seen in recent years, alongside Amex’s current strategy. Finally, we will consider Amex’s financial performance in conjunction with its peers, with an eye on valuation.

Company description

American Express Company provides charge and credit payment card products, finance, and travel-related services worldwide.

The company operates through three segments:

- Card issuing business (GCSG / GCG segments) – Amex offers a broad set of card products, rewards, and services to its consumer and commercial customer base.

- Merchant acquiring business (GMNS segment) – This segment seeks to build and manage relationships with merchants around the world that choose to accept American Express cards.

- Card network business – Amex operates a payments network through which they establish and maintain relationships with third-party banks and other institutions.

Amex’s service differs from a traditional credit card as they maintain a direct relationship with both the card members and merchants. This creates what Amex refers to as a “closed-loop transaction”, in which they have direct access to information at both ends of a card transaction.

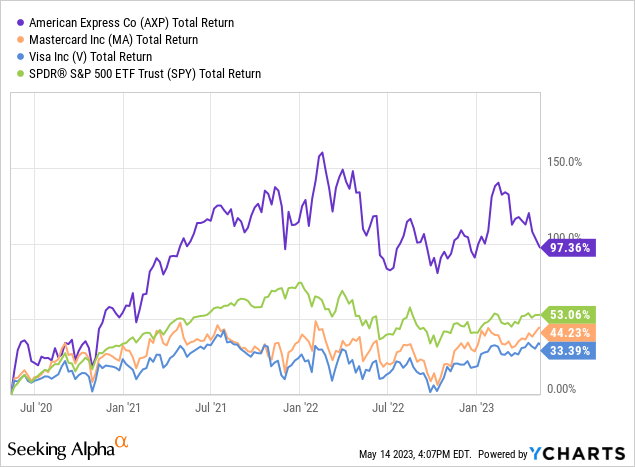

Amex currently has around 19% market share, with Visa at 54% and Mastercard at 23%. In the last 3 years, Amex’s stock price has outperformed its competitors and the market as a whole.

Economic conditions

If we cast our minds back to 2020/2021, we observed an unexpected rise in demand during the lockdowns. Consumers, many of whom received income support, took to online shopping to entertain themselves. This drove greater transaction volume and for many businesses, a record year for income.

2022 was far less bullish as the post-lockdown demand dried up. We saw inflation increasing quickly due to supply chain disruptions, the Russian invasion of Ukraine, and greater money supply. To combat this, governments began raising interest rates from record-low levels, to cool demand. The US has finally seen successive months of falling inflation, suggesting this is taking effect. For consumers, this has caused a significant increase in their key expenses, such as bills and mortgage payments, contributing to a cost-of-living crisis for many.

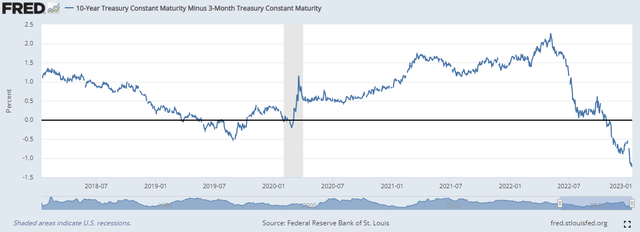

With inflation remaining high as of early 2023, we believe that rates could rise again before the end of H1-23. Inflation looks on course to reach a sustainable level at the beginning of next year, although as time progresses, the expected timeline continues to be pushed. Markets are pricing in an almost 30% chance rates will rise further in June. With rates having to remain elevated for an extended period, a recession in many nations could be triggered. The US could narrowly avoid this, owing to its tight labor market. Looking at the 10Y / 3M yield curve, we see a large inversion.

10Y / 3M yield curve (FRED)

Higher interest rates are great for a credit card business, as they can competitively charge a higher rate for customer borrowing and are more likely to be able to levy fees. Further, with a cost-of-living crisis in full swing, people are more likely to rely on their credit cards to make ends meet. In the case of Amex, we observe the net interest margin increasing from 71% in FY19 to 78% in FY22.

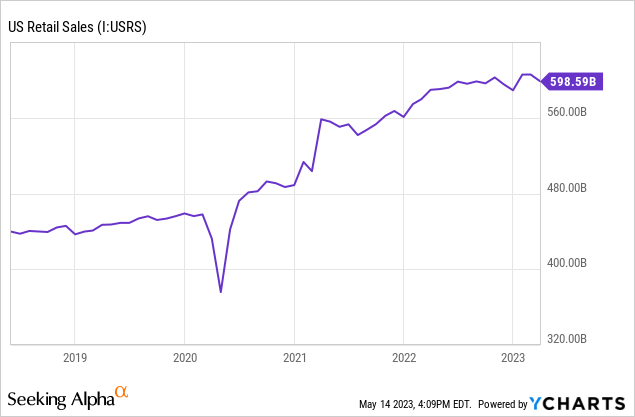

This can become problematic, however, should demand begin to fall. The Eurozone and the UK are currently growing at below 1% quarterly, with the US marginally better. The problem comes as although Amex may increase its take-rate, if volume falls sufficiently, it could lose out on a net basis. As the following graph illustrates, retail sales look to be flatlining.

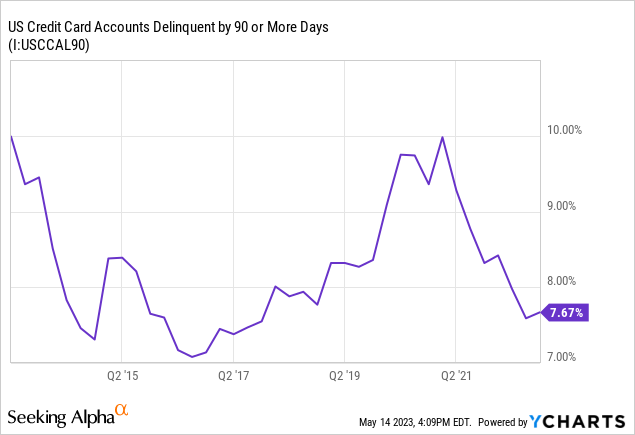

The combination of rising interest rates and declining growth leads to a greater risk of delinquencies. We generally observe a several hundred bps increase when a recession occurs. With Amex operating a tier 1 asset base of 11.1%, it has far more assets relative to its asset base in loans when compared to banks. TransUnion (TRU) believes credit card and personal loan delinquencies will reach a level similar to that of 2010 in 2023. If we look at the current delinquency rates for all loans, we do not see a noticeable uptick.

Overall, it is likely 2023 will be a far more difficult year for consumers and businesses, which will lean on Amex’s ability to grow. We believe demand will continue to fall until an expansionary policy is initiated. A portion of this will be buffeted somewhat by the level of inflation we have, as consumers must spend on necessities thus driving up average transaction prices.

Consumer credit/payments industry

As part of our analysis of Amex, we have observed some key themes within the industry that will likely impact the business.

Greater scrutiny

As we have established, there has been an above-average level of loan origination since 2021. For this reason, TransUnion believes we will see tighter underwriting standards in anticipation of a weakening in the economy. They quantify a reduction of 7.6% in card originations. Due to this, we will likely see a flatlining or decline in Amex’s loan book (credit cards issued, spending limits change, etc.) in 2023, which will noticeably impact its ability to grow revenue. Given that interest rates were increased late in 2022, we believe the interest rate effect will outweigh a reduction in loan origination activities.

Reduction in bonus offers

With the boom in card originations, many companies were offering enticing offers. It is likely much of this will now stop, providing businesses an opportunity to cut costs as they are less interested in credit origination. One of Amex’s largest selling points is its rewards system. Their card member rewards and card member services costs are up 27% and 48% between FY22 and FY21, with rewards representing by far their largest cost. As a result of this, there is some scope to reduce costs.

Virtual and “online” payment platforms

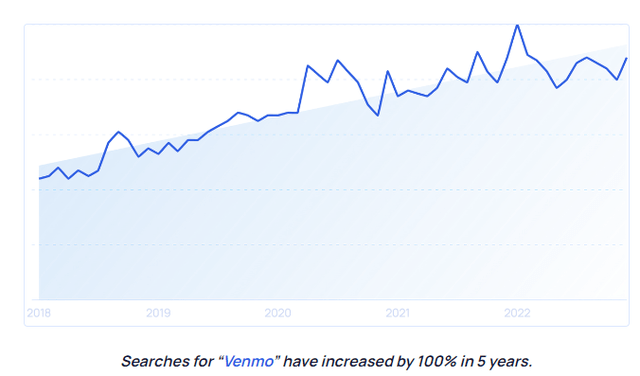

We have seen innovation in the payments market through the digitization of traditional services. Companies have looked to make superior apps and streamline the payment / banking experience. The ability to transact using contactless technology has supported this. Companies such as Zelle, Cash App, and Venmo have grown aggressively in the US, with Europe seeing a boom in so-called “Challenger banks”. These companies have taken volume from the traditional players at an aggressive rate.

Searches for Venmo (ExplodingTopics)

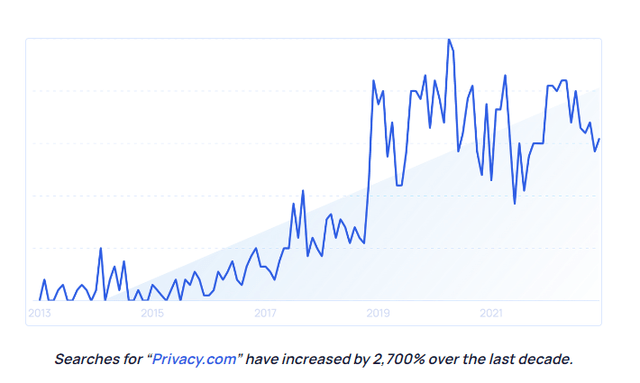

Further, in more recent times we have seen growth in the use of virtual cards, which are seen as preferable for data protection. Both Apple (AAPL) and PayPal (PYPL) have launched these types of cards in recent years.

Searches for Virtual card provider Privacy.com (Explodingtopics)

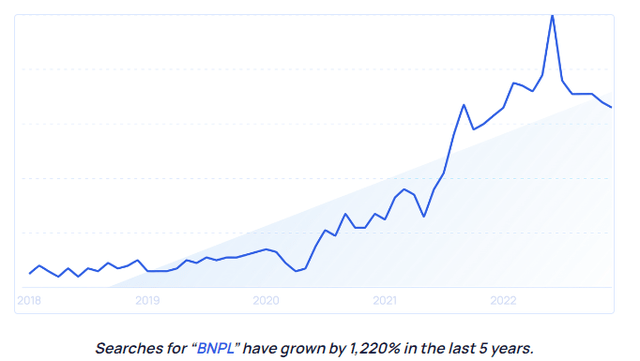

Buy-now-pay-later

BNPL is the concept of borrowing money contractually for a transaction, without a credit score impact (although this is now changing globally, massively disrupting the market).

This is arguably the largest trend in consumer finance since the payday loan days, and just like those days, the market is coming under massive scrutiny. That said, it has already caused much disruption, as consumers in the millions have chosen it as a payment option rather than the likes of Amex. This has been incredibly popular among young adults, a group that Amex would like to target.

With regulation coming in globally, we could see the market decline, similar to payday loans but for now, this is a massive threat to Amex which it cannot compete directly against.

Searches for BNPL (Explodingtopics)

Gen Z

Gen Zs are becoming a leading group within society and are expected to be a leading contributor to global growth through consumption. For this reason, it is expected that payment providers will target this generation, who are currently aged between 18-25. This is a highly accretive acquisition as if you can tie them in long-term, you are looking at decades of recurring income.

This is an area that Amex is investing heavily, considering the growth in Gen Z consumers as a specific KPI. They are doing this through specifically targeted marketing and maintaining their market-leading customer satisfaction levels, including sponsoring Brighton F.C., Wimbledon, and events in the metaverse.

The biggest change was in their rewards, their biggest selling point. Amex has partnered with businesses that market directly to Gen Z individuals, thus directly connecting them with their target audience. As an example, in the UK Amex is offering £10 cashback per month for preferred cardholders if they order once on Deliveroo (OTCPK:DROOF – E-commerce Food delivery business that targets Gen Z). The gold card has an annual fee of £160 and so it looks like a no-brainer for the Gen Z cohort. This is just one example of many intelligent tweaks Amex has made to the types of rewards offered to adjust its target audience. This harps back to Amex’s difference from other players, their “closed-loop” allows this to happen quickly and effectively. This strategy is far from complete, but Amex has managed to sell itself once again to a generation, not as a credit card business but as a part of their life, the ultimate status symbol. As consumers spend, they are rewarded. It is as Bloomberg calls it, a “lifestyle business”.

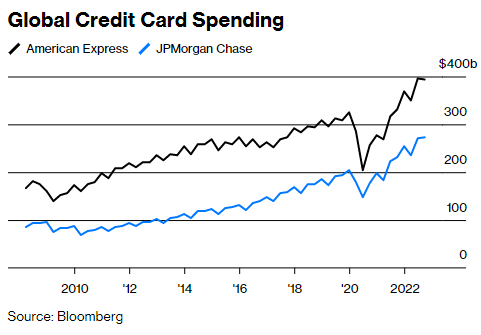

Global sales v. the leading traditional bank (Bloomberg)

As Bloomberg rightly mentions, those who rise high can fall quickly. Amex has given a young generation a significant amount of credit, many for the first time, with less secure incomes. Should a recession occur, many could lose their jobs and default. This could lead to an above-average default rate for Amex.

Financials

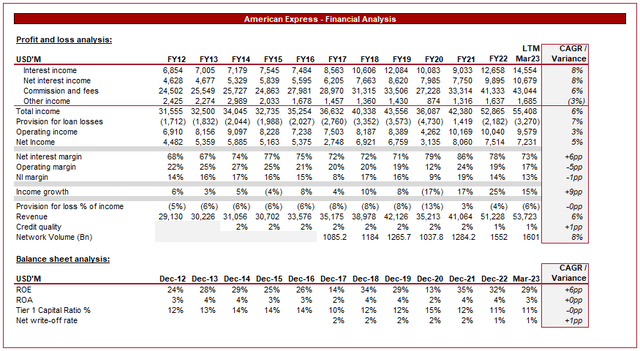

Amex financial performance (Tikr Terminal)

Amex has performed well in the last 10 years, growing income at a CAGR of 6%. This is relative to an increase in volume of 8% in the last 5 years. Much of this growth occurred in the second half of the period, owing to its strategic shift towards a younger audience.

As mentioned previously, net interest margins have improved due to rising interest rates. OPM and NIM have underperformed in our view, remaining flat across the period. The reason for this is increased costs, particularly in rewards, which are used to entice new users.

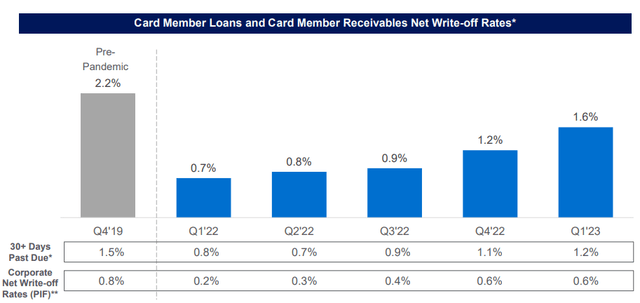

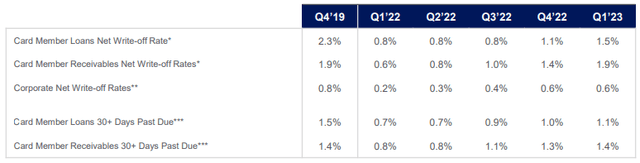

Unsurprisingly, provision for losses has increased substantially having fallen to a record low level in FY22, relative to income (when excluding COVID-19). It is our view that this may increase further in 2023, which will mean margin compression all else held equal. This is reflective of the net write-off rate, which has fallen to a six-year low. Q1 data suggests write-offs and provisions are beginning to tick up and so although these levels gave investors good profits in FY22, it does leave the business susceptible to increases in FY23.

Loan net write off (Amex) Overdue loans (Amex)

Relative performance

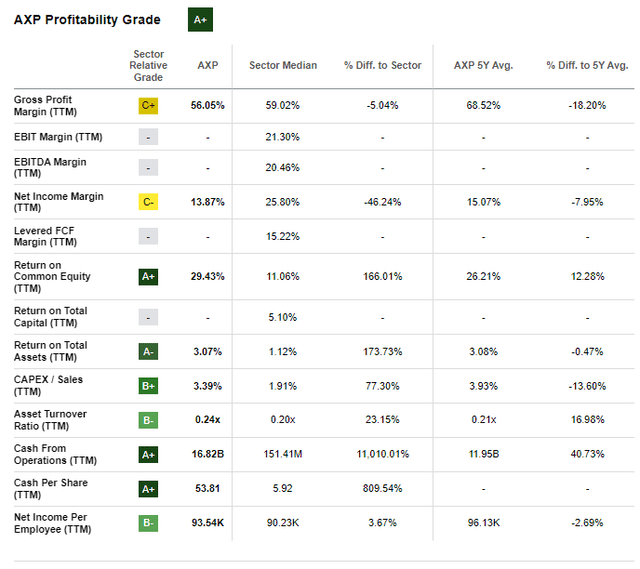

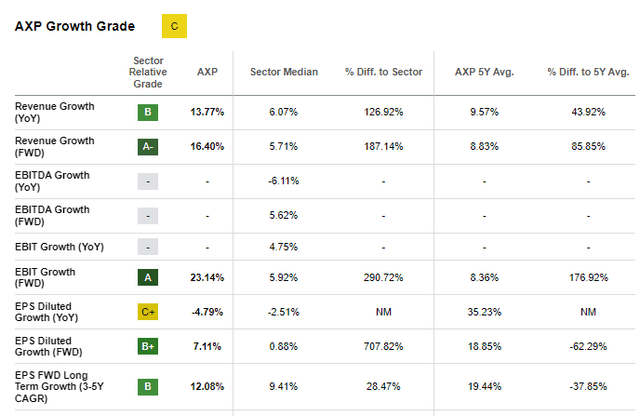

Profitability (Seeking Alpha) Growth (Seeking Alpha)

Given Amex’s “closed-loop”, the company has peers in 3 segments. Those are payment facilitators (Mastercard, Visa, Discovery (DFS)), payment platforms (PayPal, Adyen (OTCPK:ADYEY), Fiserv (FISV), Block (SQ)), and credit card providers (BoA (BAC), Citi (C), Cap One (COF), Chase (JPM)). For this reason, we have utilized Seeking Alpha’s relative assessment tool.

When compared to its payment peers, Amex is inferior from a profitability perspective (NIM/OPM), although the gap closes when comparing efficiency and growth. This is a reflection of the payment company’s dominant market share and the fact they specialize in just payments. The fact Amex has been able to grow in line with these businesses suggests it is successful in competing. This said, Amex is inferior in NIM terms and so deserves a discount in relative valuation.

Valuation

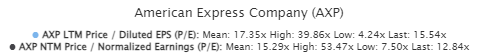

Valuation (Tikr Terminal)

Amex is currently trading at a LTM earnings multiple of 16x and a NTM earnings multiple of 13x. With the company trading at a discount to its average, this looks to be an opportunity.

In the long term, we see no material change to the company’s market positioning. It remains the desirable product for many, and a useful product for its users. We believe the current discount reflects the market pricing in the uncertainty around how much further profitability could decline in the near term.

Conclusion

We concur with Bloomberg’s fantastic article on Amex, it is not a boring credit card business but a brand. Management has done a great job of continually developing this brand from generation to generation. Given the maturity of the business and its ability to obtain superior insight, it would be difficult to ever bet against the business, but times are getting tough.

The biggest issue is that demand must fall with current interest rates and inflation levels being too high for consumers to bear. This will inevitably trickle down to Amex.

With the company trading at a discount to its average trading, we see this as an opportunity. A company like this rarely goes on discount and we believe investors would do well to buy in a moment of weakness.

Read the full article here