I knew Zevra Therapeutics (NASDAQ:ZVRA) when it was KemPharm, a commercial stage developer of prodrugs. Zevra, on the other hand, develops treatments for rare diseases. In May last year, Zevra, then KemPharm, acquired arimoclomol, an orally-delivered, first-in-class molecule targeting Niemann-Pick type C disease (“NPC”), and morphed into a rare disease player. Arimoclomol is a late stage product with a completed phase 3 and the company is about to submit an NDA.

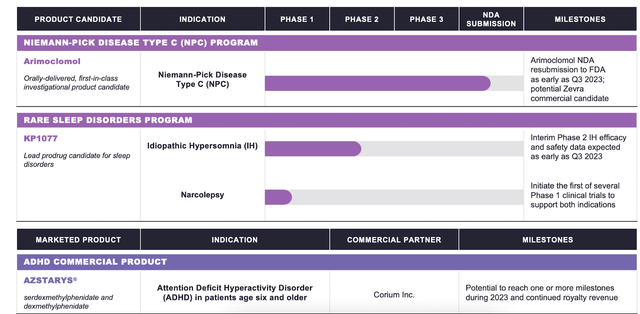

The pipeline looks like this:

Zevra pipeline (Zevra website)

Arimoclomol will resubmit an NDA to the FDA “as early as in Q3, 2023,” says the company. There are 1800 US patients for NPC, and no approved therapies. The asset has orphan drug designation, fast track designation, and rare pediatric disease designation for NPC by the European Medicines Agency (EMA) and FDA as a breakthrough therapy in NPC. Note that the parent company withdrew a Marketing Authorization Application from the EMA last year, citing the “EMA’s concerns and their estimate that these could not be addressed in the time available.”

Arimoclomol was developed more than two decades ago by Hungarian scientists and was thought to have therapeutic effects on a number of diseases, including ALS. In 2021, it failed an ALS phase 3 trial, failing on all endpoints, although remaining safe and well-tolerated. In 2021, Orphazyme, the previous owner of arimoclomol, received a CRL for the drug for an NDA for NPC. The CRL asked for more data:

The FDA issued the CRL based on needing additional qualitative and quantitative evidence to further substantiate the validity and interpretation of the 5-domain NPC Clinical Severity Scale (NPCCSS) and, in particular, the swallow domain. Further, the FDA noted in the CRL that additional data are needed to bolster confirmatory evidence beyond the single phase 2/3 clinical trial to support the benefit-risk assessment of the NDA.

A Type A meeting held later that year resulted in the following take-aways:

The FDA recommended that the Company submit additional data, information, and analyses to address certain topics in the CRL and engage in further interactions with the FDA to identify a pathway to resubmission.

The FDA concurred with the Company’s proposal to remove the cognition domain from the NPCCSS endpoint, with the result that the primary endpoint is permitted to be recalculated using the 4-domain NPCCSS, subject to the submission of additional requested information which the Company intends to provide. To bolster the confirmatory evidence already submitted, the FDA affirmed that it would require additional in vivo or pharmacodynamic (PD)/pharmacokinetic (PK) data; the Company is considering the optimal path forward to address the FDA’s requests.

After buying the asset, Zevra continued with an open label four year extension study, and recently produced some interim analysis in two posters at the World Symposium. I could not locate the actual abstracts, but the company said that data showed that arimoclomol could possibly reduce the long term progression of NPC. The company plans to use this data as part of the NDA resubmission. Interestingly, this data used a 5-domain NPCCSS, which, as I just noted, has been discarded for a 4-domain NPCCSS scale.

In 2021, the company published phase 2/3 safety and efficacy data from a trial in NPC. This was the basis of the subsequent NDA. The trial’s data was as follows:

The primary endpoint was change in 5-domain NPC Clinical Severity Scale (NPCCSS) score from baseline to 12 months. Fifty patients enrolled; 42 completed. At month 12, the mean progression from baseline in the 5-domain NPCCSS was 0.76 with arimoclomol vs 2.15 with placebo. A statistically significant treatment difference in favour of arimoclomol of -1.40 (95% confidence interval: -2.76, -0.03; P = .046) was observed, corresponding to a 65% reduction in annual disease progression. In the prespecified subgroup of patients receiving miglustat as routine care, arimoclomol resulted in stabilisation of disease severity over 12 months with a treatment difference of -2.06 in favour of arimoclomol (P = .006). Adverse events occurred in 30/34 patients (88.2%) receiving arimoclomol and 12/16 (75.0%) receiving placebo. Fewer patients had serious adverse events with arimoclomol (5/34, 14.7%) vs placebo (5/16, 31.3%). Treatment-related serious adverse events (n = 2) included urticaria and angioedema. Arimoclomol provided a significant and clinically meaningful treatment effect in NPC and was well tolerated.

The company’s second asset, a legacy prodrug, is KP1077, targeting rare sleep indications. It has an ongoing phase 2 trial in idiopathic hypersomnia, which will topline in 2023. A second program is narcolepsy, where an IND has been “opened.” The company says that a positive phase 2 IH trial may lead directly to a phase 3 narcolepsy trial, jumping a few steps.

Their third product is AZSTARYS®, approved in March 2021 for ADHD in patients 6 years or older. The product is licensed to Corium.

Financials

ZRVA has a market cap of $186mn and a cash reserve of $95mn. Research and development (R&D) expenses were $8.8 million for Q1 2023, while general and administrative (G&A) expenses were $6.8 million. At that rate, they have cash for some 4-5 more quarters.

As with such old molecules, I always look for patent terms. Here, the data provided by the company is vague. It does not say what sorts of patents and in which jurisdictions have 2029 expiry:

We have additionally received method of use and method of treatment patents, and have filed related patent applications, related to the arimoclomol families (pursuant to the recent acquisition of Orphazyme) in various jurisdictions, including the United States, European countries, Israel, Japan, South Korea, Canada, China, Brazil, Russia and Turkey, with anticipated patent expiration date of 2029, excluding any potential patent term adjustments or extensions. We anticipate filing additional patent applications related to the arimoclomol families.

I am guessing US patent protection is not for long.

Risks

I am averse to companies with such old products that they are trying to get to the market after multiple failures. An inertia sets in, and these products only help management earn salaries for some more time. This may not always be true, but I believe that for these companies, there’s a heavy burden of proof.

Cash position and possibly patent runway are also inadequate.

Bottomline

I see nothing here. There may be some upside if Zevra submits an NDA, but I tend to avoid these sorts of companies.

Read the full article here