Petroleum prices have fallen from more than $120 shortly after the outbreak of the Ukraine-Russia war last year to about $70 a barrel today. While BP (NYSE:BP) reported strong earnings for its first-quarter due to above-average prices for petroleum, energy prices have started to decline broadly… and may continue to fall in the coming months as the market readies itself for a recession.

I believe investors still have a good opportunity to sell BP at a good price but I see considerable EPS risks on the horizon. Since BP’s earnings are cyclically inflated, I expect a continual down-trend in the producer’s profit picture and the risk profile, in my opinion, is very much skewed to the downside!

BP’s earnings are in a cyclical decline

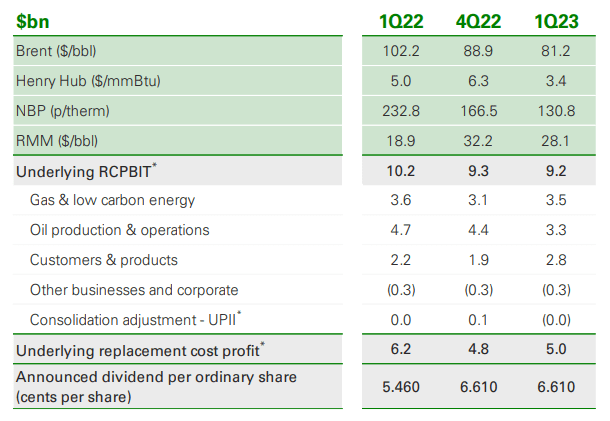

BP submitted a solid earnings sheet for the first-quarter that showed profitability in all of its core segments: gas & low carbon, oil production & operations and customer & products. BP’s profits for the first-quarter totaled $5B with gas & oil segments both showing very decent profitability. However, BP’s quarterly earnings also showed a decline of 19% year over year, indicating that the pricing environment continued to deteriorate. Exxon Mobil (XOM) also reported a steep decline in profits due to lower energy prices, a trend that I discussed in my work ‘Exxon Mobil: The Party Is Likely Over.’

Source: BP

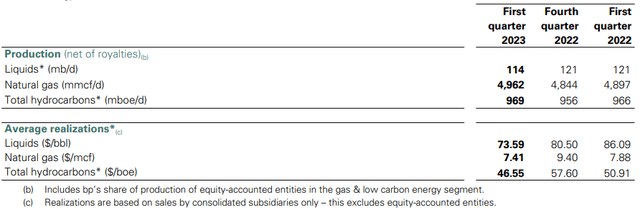

BP’s average price for petroleum has declined considerably in the last year as investors became gradually less concerned about the price impact of the Russia/Ukraine war and sanctions on the Russian energy sector. BP’s average liquids price declined from $86.09 a barrel in the first-quarter of 2022 to $73.59 a barrel in the first-quarter of 2023, showing a decline of 15% year over year.

Source: BP

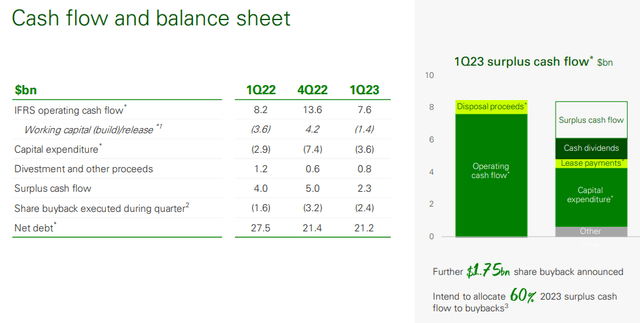

Cash flow and buybacks

BP generated $7.6B in operating cash flow in the first-quarter, showing a decline of 7% year over year and 44% quarter over quarter. BP’s operating cash flow covered its capital expenditures, its lease payments as well as cash dividends and the company was left with $2.3B in surplus cash flow. BP has said it will use a considerable portion of its surplus cash flow, 60%, to stock buybacks which I am not a fan of. I believe stock buybacks should be done when BP’s earnings prospects are undervalued (in a low-price market).

Source: BP

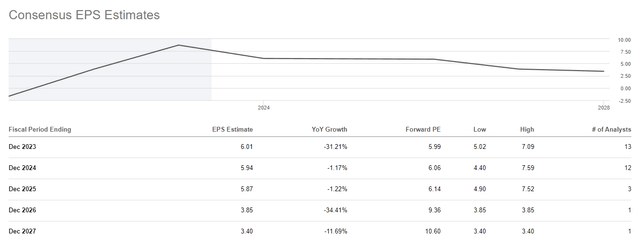

Risk of EPS revisions in a normalizing pricing environment

A barrel of petroleum currently costs about $70 which means prices have continued to decrease after the end of the first-quarter. The risk of a recession, which is hanging over the global economy, could result in further price declines for petroleum and natural gas, thereby weakening the earnings and cash flow potential of large producers like BP significantly for the remainder of the year.

Analysts currently expect BP to have $6.01 per-share in earnings in FY 2023 and $5.94 per-share in FY 2024, implying year over year growth rates of (31)% and (1)%. High prices for petroleum and natural gas are still way higher than the longer term average, which has resulted in cyclically inflated earnings for BP so I believe the producer has significant EPS revision risks in FY 2023.

Source: Seeking Alpha

BP’s valuation vs. U.S. rivals

BP shares are currently trading at a P/E of 6.0X which appears to be cheap, but investors have to take into consideration that BP’s earnings prospects are cyclically inflated and therefore are at great risk of contracting in a recession. I believe there is no reason why petroleum prices couldn’t go back to the $30-40 price range in a recession when petroleum demand and economic output tend to fall. Exxon Mobil is currently trading at a P/E of 11.3X while Chevron (CVX) is trading at a P/E ratio of 10.5X. Although BP has lower P/E ratios than Exxon Mobil and Chevron, all companies will be subjected to the same earnings pressures if petroleum prices to decline.

Risks with BP

The largest risk for BP is that petroleum prices continue to fall and lead to a lower profit baseline for the company. What I see also as a risk is the general trend towards green energy sources whose growth could come at the expense of fossil fuel-oriented producer companies such as BP. The most immediate risk I see for BP is a down-grade of EPS estimates which may result in BP trading at a higher P/E ratio.

Final thoughts

Although BP submitted a strong earnings card for the first-quarter, investors must realize that BP is producer that highly depends on market prices for petroleum and natural gas. With petroleum prices now trading down to just $70 a barrel, BP’s earnings and cash flow risks have significantly increased. BP’s operating cash flow, although significant, declined sequentially as pricing pressures have grown.

Additionally, I believe that BP’s earnings are cyclically inflated, which indicates the potential for revised EPS estimates in a lower-price world. If EPS estimates continue to decline, BP is all but guaranteed, in my opinion, to trade at a higher valuation factor going forward as well!

Read the full article here