Thesis

My thesis here is really simple. I will argue that Google (NASDAQ:GOOG) and Meta Platforms’ (NASDAQ:META) AI potential are mispriced. And I will make the argument in two steps. First, I will analyze META and GOOG’s substantial valuation discount compared to other AI stocks such as Microsoft (MSFT). And the key point I want to make here is that META and GOOG are priced as if they have already lost the AI race. And this leads to the second part of my argument. I will argue that the competition among Google’s TensorFlow, Meta’s LLaMA, and Chat-GPT has only begun. There is no clear loser or winner in my view.

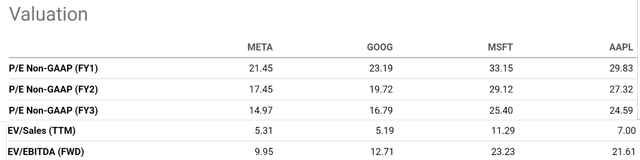

The first part of the argument is relatively easy, and I will make it very quickly here using the table shown below. As you can see, in terms of FY1 P/E ratios, META and Google are priced in the range of 21x to 23x. Compared to Microsoft’s 33x P/E, this is a discount of about 1/3. At the same time, bear in mind that both Google and META hold more cash and less debt on their balance sheet. As a result, the valuation discount is even more dramatic when you consider leverage-adjusted valuation multiples such as EV/sales and EV/EBITDA ratios. As seen, META and GOOG are discounted from MSFT and Apple (AAPL) by about ½ in these ratios. Note that the point here is not to compare their balance sheet strength. All of them have superb balance sheet strength. My goal here is to analyze valuation multiples only.

Then I will move on to the second part of my argument about the AI race.

Source: Seeking Alpha data

TensorFlow, LLaMA, and Chat-GPT

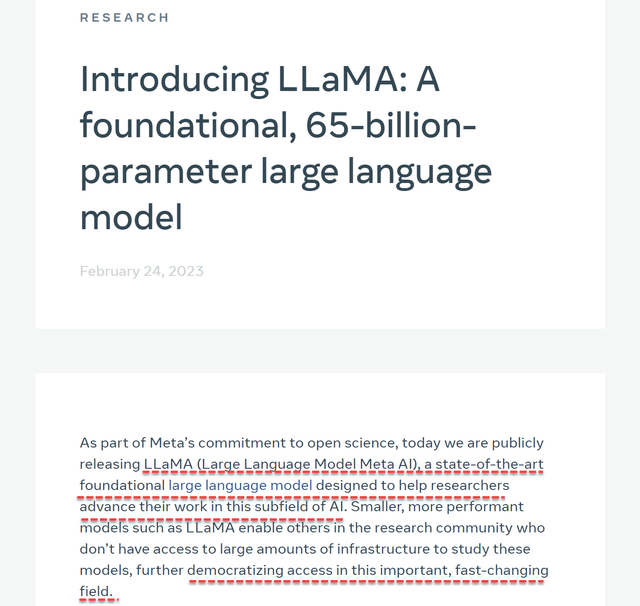

For readers new to these AI terminologies, the best analogy that I can think of is to compare their role in the AI world to the role operating systems play in the PC world. All three platforms are based on deep learning models and their goal was to facilitate the development and training of other learning models (similar to the goal of operating systems in the PC world). META reiterated this mission statement in their most recent research paper on LLaMA (see the highlighted sentences below). The whole paper is an interesting read for investors who are interested in large AI models these days (and their mindboggling parameters and computation power).

Source: META research article

Most of us know about Chat-GPT recently because of its huge popularity. However, the other platforms are also widely used and deeply entrenched in the AI industry. And each platform has its own strengths and weaknesses. For example, GOOG’s TensorFlow is a popular choice for developers because it is open-source and easy to use. However, it can be slow and inefficient for large-scale projects. LLaMA is a newer platform that is designed to be faster and more efficient than TensorFlow. However, it is not as widely adopted as TensorFlow, which means that there are fewer resources available for developers. And of course, Chat-GPT is a platform that is specifically designed for natural language processing tasks. It is very accurate and efficient, but it is not as versatile as TensorFlow or LLaMA.

As such, my overall conclusion is that there is no clear winner or loser in the competition between these three platforms at this point. And next, I will argue that each platform is backed by a major technology company with deep pockets. This means that each platform has the resources to continue developing and improving its technology. The competition between these three platforms is likely to continue for some time. In the end, one may dominate or all three co-exist. It is too early to say which platform will ultimately emerge as the winner.

The AI race is just beginning

When it comes tech stocks, our overall philosophy is NOT to invest in a given stock based on our confidence in a single product, whether it is iPhone or AI. Instead, we focus on sustainable funding for R&D and the efficiency of the R&D process.

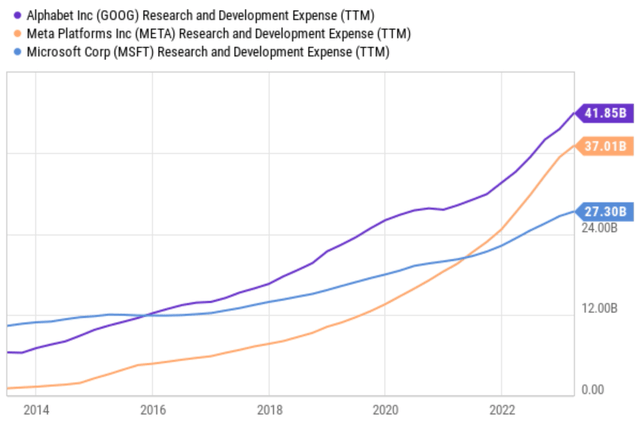

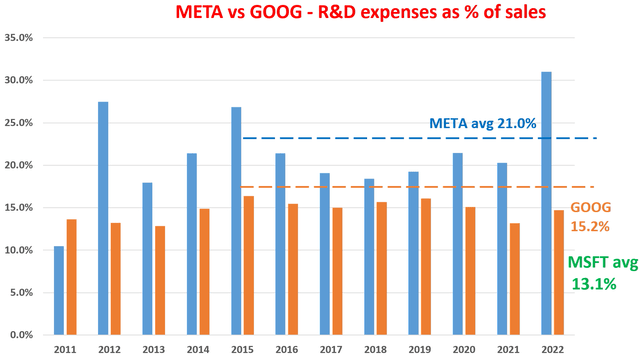

In terms of R&D, all major players invest heavily in new R&D, and they have well-established product lines to sustainably and aggressively purpose new directions. As shown in the charts below, Google and Meta are actually spending more on R&D than MSFT in recent years – both in terms of absolute dollar amount and as a percentage of total sales. To wit, Google spent $41.9 billion on R&D TTM, Meta spent $37.0 billion, and Microsoft spent “only” $27.3 billion. And AI has been a concentration area where all these major players are currently emphasizing. Estimating a number would be difficult because many of their research areas overlap (e.g., META virtual reality and AI, or MSFT’s intelligent office suites and AI). But based on their public disclosures and the interviews with industry experts, my estimate is about 20-30% of their R&D budget is dedicated to AI research.

Source: Seeking Alpha data Source: Author based on Seeking Alpha data

And I foresee the AI race to be a long drawn-out race. All players are well-positioned to keep investing in these areas and stay in the race for many years to come. They all have strong financial positions, existing products that enjoy the cash-cow status and superb profitability, and access to a vast pool of talent.

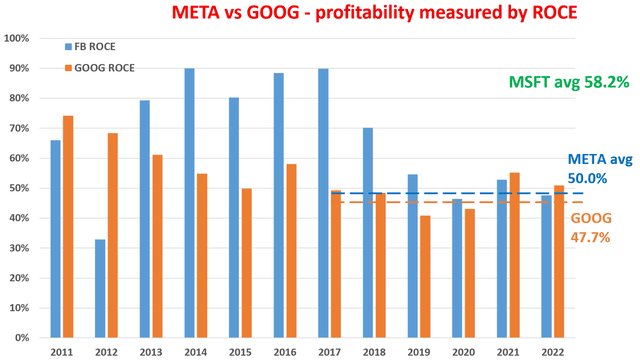

As an example, the following chart highlights their profitability in terms of ROCE (return on capital employed). I’ve written articles purely dedicated to the analyses of the ROCE for GOOG and META before, and you can find the details there if interested. Just a very brief recap here and then I will just directly quote and comment on the results. In these results, I treated the following things as their capital actually employed: working capital consisting of payables, receivables, inventory (but not cash), net property, plant, and equipment, and finally R&D expenses. As seen, META’s ROCE averaged about 50% since 2017 (after its profitability normalized from the 90% level in earlier years). And GOOG’s ROCE averaged around 48%. MSFT’s ROCE is relatively higher at about 58.2% on average since 2017. And the key word here is precisely “relatively.” A ROCE on the order of 50% is very competitive already and can support healthy growth with minimal reinvestment, as detailed next.

Source: Author based on Seeking Alpha data

Return projections, risks, and final thoughts

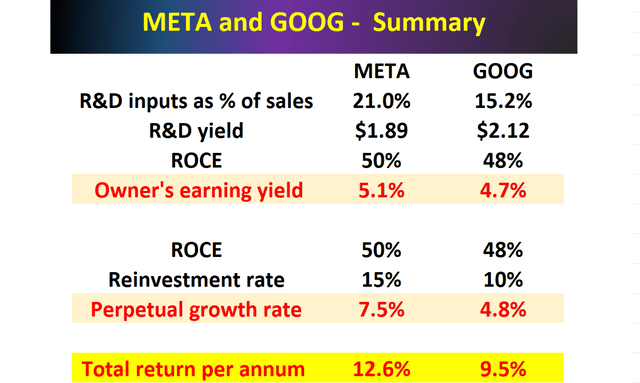

In the long term, how sustainably a business can grow its earnings relies on two parameters: ROCE and reinvestment rate (RR, a.k.a., the plow-back ratio). More specifically, Long-Term Growth Rate equals the product of ROCE and RR.

Based on this framework, the table below summarizes my projected potential returns for META and GOOG. As seen, at their current RR (about 15% for META and 10% for GOOG), they could maintain a 7.5% and 4.8% organic growth rate (this is real growth with inflation excluded). At their current valuation multiples, they also offer an owner’s earnings yield (“OEY”) of around 5%. As a result, both offer very favorable odds for total annual return potential in the double digits, even before adding the inflation escalator.

Source: Author based on Seeking Alpha data

Risks

Here I will focus on the uncertainties surrounding their R&D, since this is the part that is most relevant to the thesis. Both META and GOOG are under pressure to reduce their R&D expenses. Both META and GOOG are under pressure to continue investing in innovation to stay ahead of the competition. However, both companies will have to balance various competing pressures including macroeconomic conditions, the trend in the digital ad space, and also regulatory policies. The global economic slowdown could lead to a decrease in revenue for both META and GOOG. Advertising is especially sensitive to an economic slowdown, which could make it more difficult to sustain their high R&D expenses. The rise of ad blockers could also lead to a decrease in revenue for these companies, which is a key area for both and contribute the bulk of their current profit. Regulatory challenges in some parts of the world could also make it more difficult for these companies to sustain their high R&D expenses.

Verdict

All told, my final verdict is that these risks are more than properly priced in already. And as such, I view both stocks as substantially mispriced. In a nutshell, I view them as two strong AI contenders priced as losers at the beginning stage of the AI race. As such, they offer return potentials that are much more favorable than other major AI stocks can offer (say MSFT) in my view. As mentioned above, both offer very favorable odds for total annual return potentials close to or exceeding 10% even before considering inflation escalator or valuation expansion. In contrast, my projection for MSFT’s total return potential is in the upper-single digit due to its elevated valuation (thus lower OEY), lower RR, and also a very likely P/E contraction.

Read the full article here