Introduction

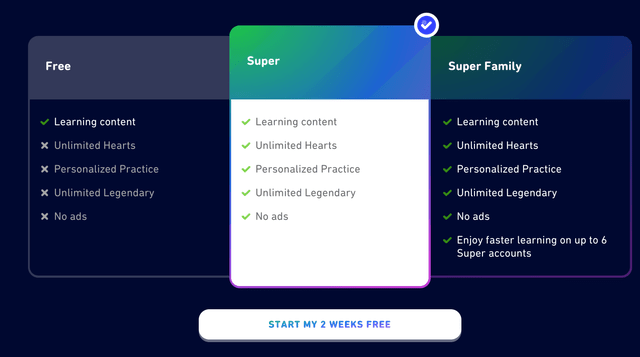

Duolingo (NASDAQ:DUOL) is the most popular global language learning app with 72.6m monthly active users. The business offers a freemium model where language learners can either: 1) use the app for free with ads (ad-supported plan) or 2) pay a small monthly or annual fee to circumvent ads, gain access to individualised practice modules, and utilise other helpful features (Super Duolingo). Duolingo’s “Super Family” plan offers a cheaper alternative when multiple users wish to sign-up for Duolingo together on a single plan.

Duolingo Pricing Plans (Duolingo Website)

I’ve written several articles on Seeking Alpha about Duolingo in the past 12 months. Since I wrote those first two articles with a “buy” rating in late-2022 (see here and here), DUOL stock is up 68% and 118%, respectively. In January 2023, I changed my rating to a “hold” (see here) based on uncertainty about rising user backlash on Twitter and other public review sites as a result of their latest app update which forced users to follow a set learning path and reduced autonomy over their learning experience. In particular, I was concerned that:

- Duolingo’s rate of user growth could slow in Q4 2022 and Q1 2023, leading to slower revenue/bookings growth; and

- User churn could increase, forcing Duolingo to increase sales and marketing spend to acquire new customers and leading to worse-than-expected adjusted EBITDA.

With the benefit of two quarters of hindsight, it is clear that these concerns were overblown and Duolingo is up a whopping 108% since that article was published in January 2023. While much of this share price increase is the result of multiple expansion, Duolingo has also continued to execute phenomenally, beating top- and bottom-line guidance in both Q4 2022 and Q1 2023, whilst also accelerating their timeline to GAAP profitability.

Overall, Duolingo remains one of the highest-quality consumer software businesses I have studied and has a long runway of growth ahead of them. The only reason I have retained a “hold” rating on the stock is the massive recent run-up in share price which has led to, in my opinion, an overly inflated valuation multiple, which sits well above multiples for other high-quality software businesses (both B2B and consumer).

Duolingo 2023 Share Price (Google)

In this article, I discuss Duolingo’s latest Q1 2023 results and what investors should be looking out for going forward.

Phenomenal user growth

Remarkably, in Q1 2023, Duolingo reported their 7th straight quarter of accelerating user growth.

Daily active users (their core engagement metric) increased 25% QoQ and 62% YoY to 20.3m. Monthly active users increased 20% QoQ and 48% YoY to 72.6m. Moreover, the ratio of daily to monthly active users reached a record high of 28%, indicative of increased engagement across their user base.

Another core user metric – the number of paid subscribers – increased 63% YoY and paid subscribers as a percentage of total monthly active users reached an all-time high of 8.0%, up from 6.8% in Q1 2022. As I’ve mentioned in my latest articles, I expect paid subscriber penetration to increase steadily over the coming years to the range of 12-15% based on management’s guidance.

| Quarter | Monthly active users | Monthly active users YoY growth | Daily active users | Monthly active users YoY growth |

| Q1 2023 | 72.6m | 48% | 20.3m | 62% |

| Q4 2022 | 60.7m | 43% | 16.3m | 61% |

| Q3 2022 | 56.5m | 35% | 14.9m | 51% |

| Q2 2022 | 49.5m | 31% | 13.2m | 44% |

| Q1 2022 | 49.2m | 23% | 12.5m | 31% |

| Q4 2021 | 42.4m | 15% | 10.1m | 20% |

| Q3 2021 | 41.7m | 13% | 9.8m | 16% |

| Q2 2021 | 37.9m | (3%) | 9.1m | 2% |

In their Q1 2023 earnings call, CEO Luis von Ahn attributed Duolingo’s strong user growth to business-as-usual: a combination of continued improvements across both the product experience and marketing efficiency.

So I mean, the main reason our DAUs keep growing is because our product keeps getting better. That’s it. I mean we can track that. We know that, and it’s this compounding effect of just it becoming stickier and stickier. That’s the main reason. Now there are other reasons, for example, you mentioned marketing. We keep getting more efficient and better at marketing. We have really found — our marketing team has really found its stride in terms of what are the things that — the levers that work and don’t.

– Duolingo CEO Luis von Ahn, Q1 2023 Earnings Call

While I was previously concerned about slowing user growth (either due to reduced sign-ups or increased churn) due to backlash from their latest app update, such concerns have not materialised. If anything, Duolingo has blown away my expectations these past two quarters, further reinforcing the cost-effectiveness and utility of their app for language learners.

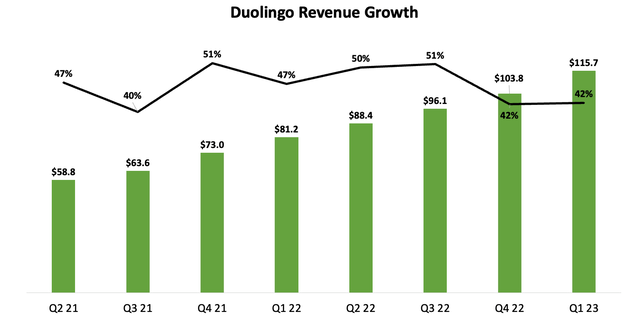

Digging into revenue growth

As usual, Duolingo reported another quarter of solid revenue growth that beat their own internal guidance. While Duolingo guided for $111-114m revenue in Q1, revenue came in at $115.7m, up 11% QoQ and 42% YoY, extending their unbroken streak since IPO of exceeding revenue guidance each quarter. Such strong growth was primarily driven by:

- Continued growth in subscription revenue to $86.2m (+49% YoY), which accounts for 75% of total revenue.

- A return to growth for the Duolingo English Test to $10.0m (+23% YoY), which accounts for 8% of total revenue.

- Exceptional growth in in-app token revenue (i.e., buying “gems”) to $7.9m (+133% YoY), which accounts for 7% of total revenue.

The only weakness in Duolingo’s Q1 report was their ad revenue, which declined 1% YoY to $11.6m and accounts for the remaining 10% of revenue. Such a slowdown in ad revenue was not unexpected given the broader macroeconomic conditions and the slowdown seen in other businesses with a high reliance on ad revenue, such as Meta Platforms (NASDAQ:META) and Alphabet (NASDAQ:GOOGL).

Duolingo Quarterly Revenue Chart (Author Generated from Public Filings)

Owing to these strong results, Duolingo upgraded their FY23 revenue guidance from $486-498m (32-35% YoY growth) to $500-509m (35-38% YoY growth).

Thus, demand remains incredibly robust for Duolingo’s core language learning app with no noticeable impact from recent user backlash.

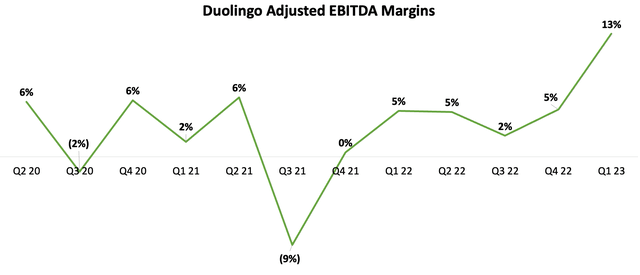

Demonstrating significant operating leverage

In the current market climate (unlike in 2020/2021), investors have become hyper-focused on profitability (i.e., net income and adjusted EBITDA margins) and free cash flow. Investors want to see that companies are reducing costs, improving cash burn, and increasing margins, helping to reduce their reliance on capital markets for funding. And this is indeed what Duolingo has done over the past two quarters, which is likely a major contributing factor to the 110% increase in shares so far in 2023.

In Q1, Duolingo reported adjusted EBITDA of $15.1m (vs. guidance of $10.0-11.4m), representing a 13% adjusted EBITDA margin. As can be seen below, Duolingo has consistently reported positive adjusted EBITDA since their IPO; however, their operating leverage has become particularly noticeable in the past quarter as growth in sales and marketing spend (+11% YoY), and general and administrative expenses (+13% YoY) increased much slower than revenue growth (+42% YoY), fuelling margin expansion.

What is even more pleasing about these results is that Duolingo smashed adjusted EBITDA guidance while increasing research and development spend a whopping 54% YoY. If Duolingo had increased research and development spend in line with other expenses, adjusted EBITDA margins would have exceeded 20% in Q1.

This quarter we achieved a 13.1% Adjusted EBITDA margin. That means that about 32% of our year-over-year incremental revenue flowed through to the bottom line. We did this while also hiring more than 30 people into the business as we continue to invest in our products. We will keep running the company with discipline, and expect to deliver meaningful leverage in operating expenses, putting us well on the path to our long-term target of 30-35% Adjusted EBITDA margin.

– Duolingo CEO Luis von Ahn, Q1 2023 Earnings Call

On the back of these strong Q1 results, Duolingo raised their FY23 adjusted EBITDA guidance from $49-60m (10-12% margin) to $55-61m (11-12% margin).

Duolingo Quarterly Adjusted EBITDA Margin (Author Generated from Public Filings)

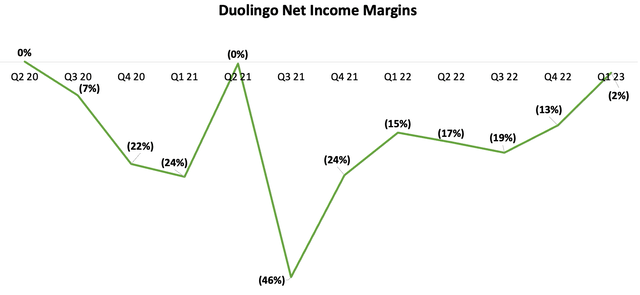

While adjusted EBITDA is a profitability metric frequently touted by management, I prefer to look at net income, which takes into account both stock-based compensation and potential amortisation of software-related investments. In Q1, Duolingo reported a net loss of $2.6m, so it would be premature to call the business “profitable” based on positive adjusted EBITDA. However, the trend in net loss is very promising and it appears that Duolingo should begin generating positive GAAP net income sometime during the remainder of 2023.

Duolingo Quarterly Net Income Margin (Author Generated from Public Filings)

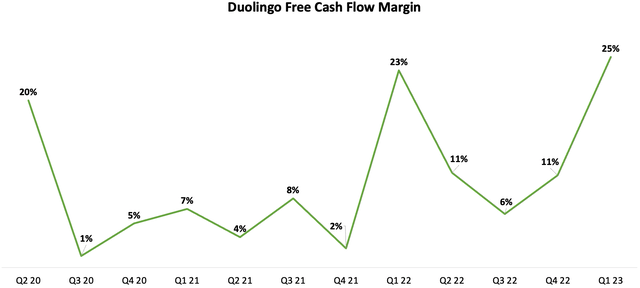

My preferred measure of profitability is free cash flow because it represents the actual cash being generated by a business after all maintenance CapEx has been subtracted. Similar to net income and adjusted EBITDA, Duolingo’s free cash flow margin has exploded higher over the past two quarters, reaching an all-time high of 25% in Q1. In other words, Duolingo generated 25 cents of free cash flow for every $1 of revenue in Q1.

Duolingo Quarterly Free Cash Flow Margin (Author Generated from Public Filings)

Overall, I feel very confident that Duolingo can continue to demonstrate significant operating leverage over the coming quarters and report free cash flow margins in excess of 20%. Adjusted EBITDA margins should also trend higher towards management’s long-term target of 30-35% over the next 3-5 years. As that happens, Duolingo will become profitable on a GAAP basis, meaning normal valuation metrics (e.g., P/E ratios) can be used to value the business.

Duolingo’s balance sheet remains pristine

Duolingo has an enviable balance sheet with $641.1m of cash and cash equivalents, and no outstanding debt. Given their consistent track-record of free cash flow generation, this cash balance should increase over time if there are no major acquisitions. Overall, investors can rest assured that Duolingo is well capitalised to sustain a prolonged macroeconomic downturn and is even in a position to engage in aggressive M&A activity to acquire potential competitors in distressed financial situations.

Tapping into the AI revolution

Artificial intelligence (AI) lies at the core of Duolingo’s language learning app. Duolingo’s Co-Founder and CEO, Luis von Ahn, was a former Professor of Computer Science at Carnegie Mellon University and Duolingo’s language app has integrated AI since inception, long before the recent buzz surrounding large language models like ChatGPT. Nonetheless, Duolingo recently partnered with OpenAI (the creators of ChatGPT) to launch a new premium subscription tier (Duolingo Max) with two new features (explain my answer and roleplay), which may also be driving the recent run up in the stock.

So that has allowed us to develop new features. For example, we developed 2 new features as part of our new higher-tier subscription offering called Duolingo Max. One of them is called Explain My Answer, which basically explains whenever you have a mistake, it gives you a human language understandable explanation. And the other one is called Roleplay, where you can basically role play or you can pretend to be something like — pretend to be ordering a croissant in France or something. And so that gives you conversational practice.

– Duolingo CEO Luis von Ahn, Q1 2023 Earnings Call

I remain incredibly excited (both as a user and shareholder) of this new Duolingo Max subscription and will be keeping an eye out for mass rollout and initial reviews. Anything that materially improves the user experience and allows Duolingo to charge higher prices is bullish for their long-term growth and profitability trajectory.

Valuation remains the main risk

While Duolingo’s operating results in recent quarters are hard to fault, I have reservations about investing at the current price, given the valuation.

At the time of this article, Duolingo trades on a forward EV/sales multiple of 10.3x, making it one of the more expensive software stocks listed on the US market.

On an enterprise value basis, Duolingo trades at 208x LTM adjusted EBITDA and 99x LTM free cash flow, representing a 1% free cash flow yield.

Duolingo Forward EV/Sales Multiple (Koyfin)

While revenue, adjusted EBITDA, and free cash flow are growing strongly and show no signs of slowing down, this valuation seems very rich for a consumer software business (which generally have much higher churn rates than B2B software businesses) and is likely driven by the recent buzz surrounding AI and ChatGPT.

As such, I prefer to sit on the sidelines and wait patiently for a more attractive buying opportunity, such as that offered to investors in late-2022 when I first purchased shares in Duolingo.

Conclusion

While I have concerns about Duolingo’s valuation, I have been very impressed with their execution over the past two quarters (and since IPO). User growth has accelerated for the past seven quarters and revenue growth has exceeded 40% YoY each quarter since IPO. With their capital-light business model, I have no reason to doubt their ability to achieve 30-35% adjusted EBITDA margins at scale, particularly if they begin to pull back on research and development spend once their new Duolingo Max subscription tier and maths app become widely launched.

I’ll be waiting patiently on the sidelines for another opportunity to add to my position at a more attractive valuation.

Read the full article here