Overview

Cboe Global Markets (BATS:CBOE) is an exchange operator that has two core holdings, each of which is a significant business in its own right. The first is BATS Global Markets, an equity stock exchange, options exchange, and foreign exchange operator with a global footprint. The second is the Chicago Board Options Exchange, which is the largest options exchange in the US. These two core exchanges continue to be expanded by acquisitions of various smaller exchanges as well as alternative trading systems (exchange-like entities regulated as broker-dealers, mostly focused on electronic trading). The company also purchased its first digital asset exchange operator last year.

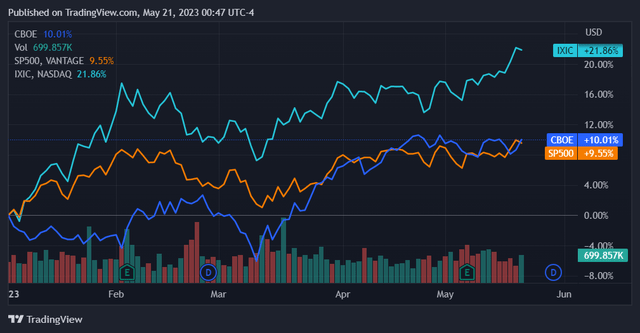

CBOE stock has done decently this past year. It has caught up to the S&P 500 in terms of price return but has continued to trail the NASDAQ Composite.

Seeking Alpha

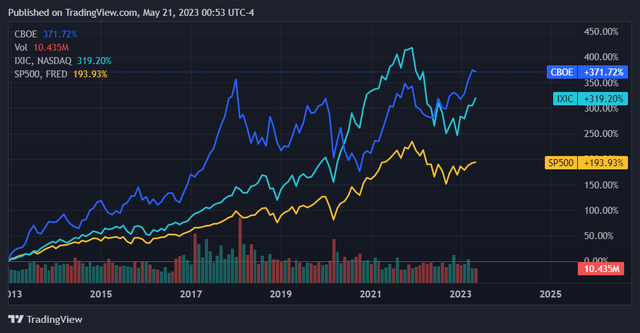

Over the past decade this stock has done well while being relatively volatile. Over the past decade, the stock seemed to have outperformed the NASDAQ Composite while subsequently regaining its relative premium in Q4 2022 and into this year.

Seeking Alpha

In this article I’ll review CBOE and determine if it’s still a good buy at this price point, as well as outline its business.

Business

As an exchange operator, CBOE is in a unique class of business with a distinct set of properties. At its core it is of course a set of exchanges that represent venues for trading securities. It is also a technology company, and at this point primarily so. This is because most of the trading CBOE supports is electronic. Most equities trading in the US is electronic at this point, and this is increasingly the case for equity options as well as for equity trading in other developed markets globally.

Being an exchange operator is mostly two types of revenue: charging for access to the exchange, and charging to access the market data of the exchange. Market makers, broker-dealers, and brokers will all be connected to the exchange along with institutional investors. There is always one side of the market providing liquidity and there is always one side of the market absorbing liquidity. Market makers and broker-dealers do both at the same time.

Of course, the idiosyncrasies of the exchange business generally prevent CBOE and its competitors from having unit economics that are quite as good as what we would see with top technology firms. This comes down to elevated regulatory costs as well as the unique layers of technology and people often required in the complex securities industry. Not every trade can be electronic, even today.

On the other hand, there are significant economies of scale in the exchange business, and this has resulted in ongoing consolidation on a global scale. A notable example of this was when the New York Stock Exchange was bought by the Intercontinental Exchange (NYSE:ICE). These economies of scale occur in the exchange business because of the sophisticated technology required to stay relevant in the modern electronic trading business. Exchange technology has to be distinctly low-latency while operating with very high reliability for use by market participants. There is also always real money on the line. Needless to say, this kind of technology doesn’t come cheap. Building this software, as with all software, is primarily a fixed cost. This creates a better cost profile and improving incremental margins for larger scale players.

CBOE’s level of scale (market cap: $14.67B) as the 8th-largest publicly traded exchange operator gives it a seat at the table in a growing industry that should have good long-term structural margins and continued high barriers to entry. High technology and regulatory expenses prevent competitors from readily entering the space. As such, CBOE ends up with a significant economic moat at both an industry level (barriers to entry) and at a company level (economies of scale). These factors can potentially make it an interesting investment for the long-term.

Valuation

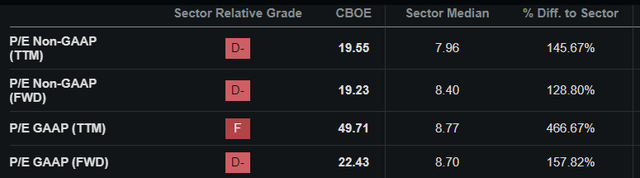

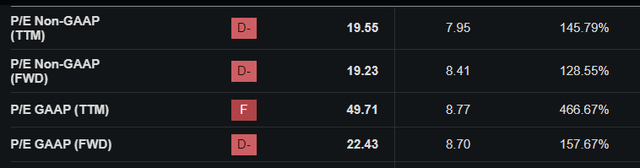

The market seems to have already priced in CBOE’s prospects, and the stock is quite expensive relative to other financial stocks.

Seeking Alpha

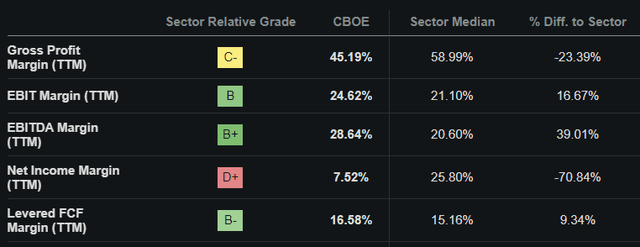

Its margins are also a mixed bag, with higher than sector-average EBIT/EBITDA margins but significantly worse net income margins, with levered FCF margins roughly at median levels.

Seeking Alpha

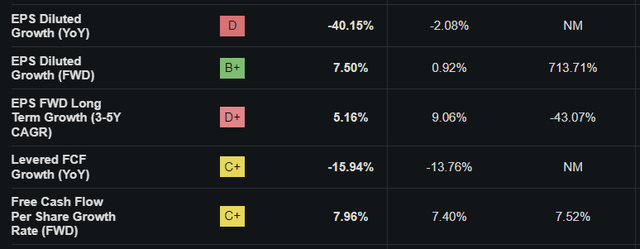

CBOE’s EPS growth rate appears quite good for the year ahead but less so on a 3-5 year interval. FCF and FCF per share growth are nothing special.

Seeking Alpha

Essentially, this stock is already expensive and doesn’t have anything exciting about its fundamentals in the near to medium term. Even with some near-term improvement in its fundamentals, we would very well still consider it expensive on a relative basis.

Looking at the stock’s price return since inception shows a somewhat different angle. The stock seems to have hit an all-time high recently, although this isn’t too far off from its previous peak. This price return chart makes the stock look potentially expensive in the near-term, but I don’t consider this the kind of stock where that would be a primary concern.

Seeking Alpha

Risks

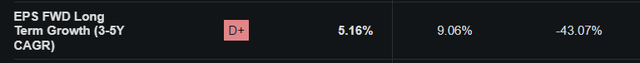

Given the favorable long-term parameters for this company’s business, the core risk here is centered around its valuation. CBOE is currently trading at a significant premium to its earnings as well as to the financial sector median, indicating a future-looking growth premium for its shares. This is at the same time that it is projected to have a subpar EPS growth rate for the next 3-5 years.

Seeking Alpha Seeking Alpha

This combination of high price/earnings ratio and low 3-5 year projected EPS growth could result in investors establishing lower growth expectations for the time horizon beyond that for CBOE. This could in turn lead to a reduction in the growth premium currently embedded in CBOE’s valuation. In this scenario earnings would stay at this current expected trajectory but the stock’s future earnings are overall perceived as less valuable by investors, which could result in a sell off and a new steady state in which the stock starts to trade regularly at a lower p/e multiple.

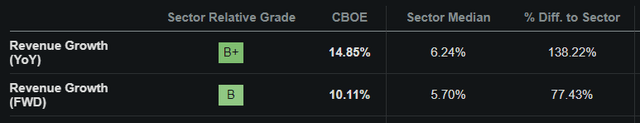

With that being said y/y and forward growth for CBOE still looks good, and I continue to believe in the truly long-term earnings prospects here.

Seeking Alpha

Conclusion

CBOE looks like a long-term buy and hold stock with a target investment horizon of 10-25 years. This should allow for enough time for the economic benefits here to manifest across both the sector and the stock.

I don’t have a view on the short-term trajectory for CBOE, but I am confident that its economic properties should allow it to continue seeing decent or good earnings growth reliably over a long time horizon. On this basis, it’s a buy.

Read the full article here