Introduction

iShares MSCI USA Value Factor ETF (BATS:VLUE), listed on the Cboe BZX exchange, is an exchange-traded fund that invests in mid- and large-cap U.S. stocks with, as iShares explains, “lower valuations based on fundamentals”. The expense ratio is 0.15%, with net assets under management of $6.44 billion as of May 19, 2023. The fund had 146 holdings as at the same date. The fund invests in accord with its benchmark, the MSCI USA Enhanced Value Index. Stocks are selected for low price-to-earnings, price-to-book, and enterprise-value-to-cash ratios.

It has been some time since I reviewed VLUE; my last piece was published in March 2022. Unfortunately, while I was bullish on the fund, VLUE has under-performed since then. 2022 was a very difficult year for stocks, and ultimately VLUE has seen some downside beta since then. According to Seeking Alpha data, the S&P 500 U.S. equity index has fallen -3.12% on a level-only basis, while on a price-only basis VLUE’s comparable decline was -13.73%.

It is worth reviewing the fund at these lower prices, especially since I have updated my valuation approach to include various other factors, and to focus not on theoretical value but on nominal returns (with consideration for volatility). Speaking of volatility: VLUE’s three-year, monthly beta is 1.11x by my calculations. On an upside-only basis, the fund has an even higher beta at 1.28x. So, VLUE does show some behavioral capacity to out-perform, but there are downside risks in bearish markets. Value is of course separate to volatility; I will re-value VLUE in this article. The correlation is broadly strong, but not perfect: about 0.85x over the past three years.

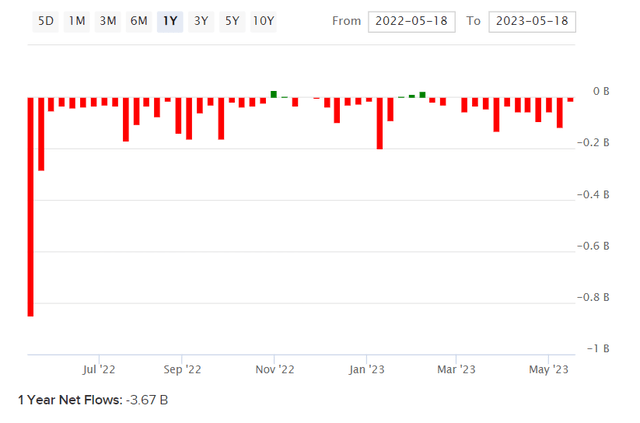

VLUE used to be far more popular as evidenced by data illustrating net fund flows (see below). Over the past year, net fund flows have been high, at -$3.67 billion. These flows were almost unidirectional, and exhibit great risk aversion.

ETFDB.com

It is worth noting, as I did in my previous article in 2022, that VLUE was (and still is) highly exposed to the economically sensitive Technology sector. Given we have just been through a period of dramatically rising interest rates, tech stocks have taken a beating. Tech stocks’ values are often derived from cash flows that are typically further out into the future; net present values can therefore get hit hard when discount rates rise (discount rates are a function of interest rates among other factors).

Return Profile

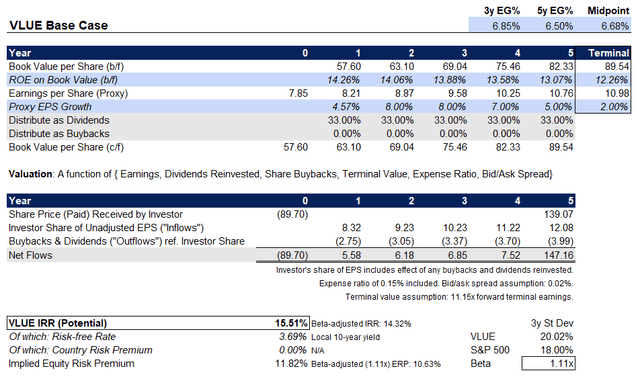

To review VLUE’s value, I will start by referencing the fund’s benchmark index’s most recent factsheet. The financial data available can serve as a proxy for the VLUE portfolio. The factsheet reported, as of April 28, 2023, trailing and forward price/earnings ratios of 11.66x and 11.15x, respectively (implying forward earnings growth of 4.57%), with a price/book ratio of 1.59x (implying a forward return on equity of 14.26%). The indicative dividend yield of 2.83% reflected a dividend distribution rate of circa one third of earnings.

The portfolio mix is such that in spite of a forward earnings growth (in the first year) of about +4.6%, analysts evidently think earnings growth will speed up thereafter. That is based on the fact that Morningstar’s three- to five-year average earnings growth estimate is currently 8.09%, much higher than the forward one-year expectation implied by MSCI’s analysts. Also, we would indeed need to speed up earnings growth from year two in order to have the fund maintain a return on equity in the current region of 14.26%. Assuming a slightly sub-consensus midpoint average rate of 6.68% over the next three to five years, I assume the return on equity ultimately matures to just over 12% by my terminal year six.

Keeping other factors constant, my IRR on this basis is 15.51% per annum over the next five years.

Author’s Calculations

The implied ERP is high, at 10.63% on a beta-adjusted basis. I wanted to present this estimation first, but I actually think the forward earnings multiple is quite low. Assume a terminal year maturity growth rate of 2% (to perpetuity), and a 10-year yield of say 3% (this would imply a real interest rate of about 1%) and an equity risk premium of 5.5%. If we lever the ERP by the fund’s current beta of 1.11x, you get a forward multiple of 14.07x. I think there is room for further expansion, but as earnings multiples go, the current multiple of just 11.15x does seem low.

Improving the forward multiple to 14.07x by the terminal year raises the IRR potential to as much as 19.86%.

On the other hand, back in March 2022 (my last piece), the forward multiple was only 10.12x. If we remove the assumption of earnings multiple expansion, and further assume that earnings growth is mediocre (about 2-3% on average), with a waning return on equity to about 10.5% in our terminal year, our IRR drops to 11.34%. In this scenario, the beta-adjusted ERP is 6.88%; still undervalued, I would suggest. An equity risk premium in the range of 3.2-5.5%, essentially up to 5.5% (beta adjusted) is fair for a mature market like the United States.

All considered, VLUE offers a range of potential scenarios, with an IRR of over 15% in my base case following analyst estimates of earnings growth, an upside scenario of almost 20%, and a much weaker scenario of 11.34% (this being base on earnings growth well below consensus).

I have to take a bullish stance on the fund, all considered. There is a good level of diversification, the portfolio is invested in various sectors, and the fund’s current portfolio construction is ultimately trading (albeit by design) at a low multiples. The fund’s index rebalances semi-annually, so you can expect the portfolio to change its composition once every six months:

The MSCI Enhanced Value Indexes are rebalanced on a semi-annual basis, usually as of the close of the last business day of May and November, coinciding with the May and November Semi-Annual Index Reviews (SAIRs) of the MSCI Global Investable Market Indexes.

Therefore, it may be worth revisiting the fund later in June/July. On the other hand, one can probably assume not much change to the portfolio considering the low prevailing multiples on offer here. I think VLUE offers good value, and I have to take a risk-adjusted view that the fund is undervalued and offers a good margin of safety, with an implicitly high IRR potential. In fact, I would conclude by saying the primary “risk” here is upside risk.

Read the full article here