Hecla Mining Q1 2023 Update

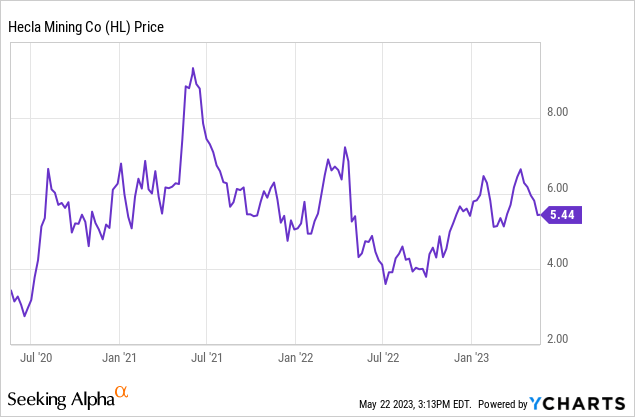

YCharts

This is an update on Hecla Mining Company (NYSE:HL), the leading silver miner (SIL) in the U.S. with over 240 million ounces of silver reserves.

In my previous coverage of the company, I recommended its stock as a “BUY,” based on its impressive fourth-quarter results, promising three-year outlook, and the advantageous acquisition of Keno Hill.

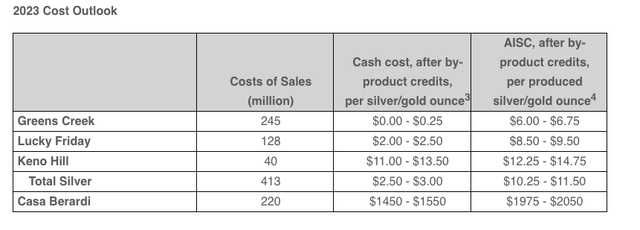

First, to refresh our memory, let’s revisit Hecla’s guidance for 2023. The company extracts gold and silver from three primary mines (Greens Creek, Lucky Friday, and Casa Berardi), along with a new project (Keno Hill), which is in the ramp-up and development phase, with production expected by Q3 of this year.

Hecla’s guidance. (Hecla Mining)

In this update, I explore Hecla’s financial and operational results for Q1, 2023. Some investors might view the headlines or the company’s news release and interpret this as a poor quarter. However, I believe its earnings were mostly in line with expectations.

I also anticipate that Hecla is well-positioned for a successful 2023, with conditions likely to improve further in 2024 and the following years. Read more below.

Hecla’s Q1 Earnings: Strong Production

The main story here is that Hecla’s silver mines continue to be very strong performers, while one of its gold mines, Casa Berardi, lags behind.

However, this quarter was by no means disappointing. Here are some of the highlights.

-

In Q1, Hecla produced 4 million ounces of silver, a 10% increase year-over-year.

-

The company reported record quarterly production at Greens Creek, with a daily throughput of 2,591 tons, leading to the production of 14,885 ounces of gold.

-

The Keno Hill mine, recently purchased from Alexco Resource, is 75% towards completion and is on schedule for a third-quarter mill startup.

-

Financially, Hecla produced silver at industry-leading all-in sustaining costs of $8.96 per ounce, which resulted in robust margins and an operating cash flow of $40.6 million, plus nearly $70 million in free cash flow.

-

Its financial situation improved, ending the quarter with $96 million in cash and cash equivalents, an untouched credit facility, and $240 million in liquidity. Long-term debt is stable at $517 million, virtually unchanged from the previous quarter.

Let’s talk about some of the top-performing mines before getting into the challenges this quarter. Greens Creek and Lucky Friday produced outstanding results.

-

Greens Creek set a record in terms of throughput as its AISC dropped by over 50% to $3.82 per ounce. This single mine generated a remarkable $37.1 million in free cash flow for Hecla.

-

Lucky Friday followed closely as the second-best performer. Production increased by 3% compared to the previous quarter, while AISC decreased by nearly 20% to $10.69 per ounce of silver produced. This led to the generation of $31.4 million in free cash flow, a significant rebound from the -$21.15 million cash deficit from the last quarter.

Why Hecla’s Earnings Faltered

Now, for the not-so-good.

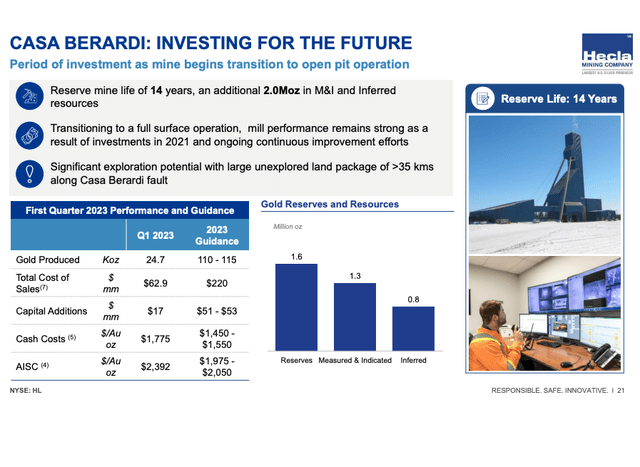

Hecla’s Casa Berardi mine continues to be a drag on its earnings and cash flow as the mine transitions from an underground to an open pit operation. Last year saw sky-high all-in sustaining costs, and this year is no different. For 2023, the company has guided for the mine to produce 110,000 – 115,000 ounces of gold at AISC ranging between $1,975 – $2,050/oz.

In the first quarter, the mine’s output didn’t meet the set guidance. The mine produced 24,686 ounces of gold, a 20% decline from the previous quarter, at an extremely high AISC of $2,392 per ounce.

Given that gold prices ranged from $1,800 to $2,000 per ounce in the first quarter, the mine wasn’t profitable. Overall, Casa Berardi led to a loss of -$16.7 million for the company. Ouch.

The company attributes the unsatisfactory performance to lower underground grades.

Casa Berardi is transitioning from underground to open pit mining (Hecla Mining)

However, anyone closely tracking Hecla’s trajectory should know that these results were anticipated. The company maintains that its gold production at Casa Berardi is heavily biased towards the second half of 2023, implying that the AISC should decrease during this period.

Also, it’s important to remember that an estimated $51 to $53 million is allocated for capital expenditure at this mine for the year as the tailings facility undergoes expansion.

Hecla Mining: The Bottom Line

Although initial figures from Casa Berardi might not appear as robust as expected, a more detailed examination unveils reasons for optimism. Investors can anticipate higher production and reduced costs at this mine during the second half of 2023, continuing into 2024.

Simultaneously, Hecla’s two primary silver mines, Green’s Creek and Lucky Friday, have demonstrated exceptional performance. These two mines are among the highest quality in the industry.

Once Hecla’s three primary mines are operating strongly later this year – coupled with the increased production at the recently acquired Keno Hill mine – Hecla Mining Company earnings and cash flow may positively surprise the market.

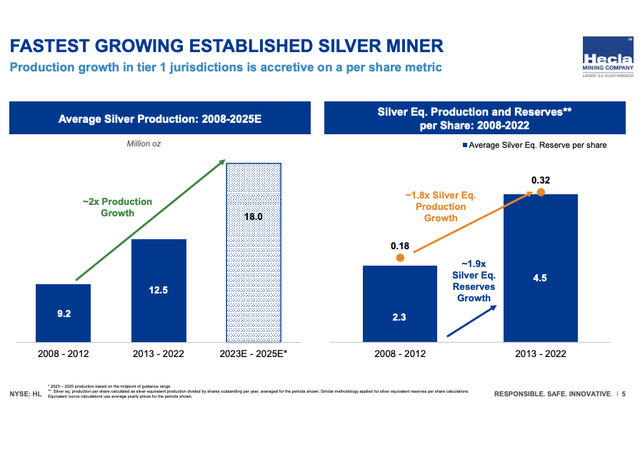

Hecla Mining

Hecla Mining Company can also be viewed as a strong growth stock in the precious metals sector. Production is set to increase from an average of 12.5 million oz per year (2013-22 average) to 18 million ounces (2023-25).

Meanwhile, Hecla Mining Company also produces most of its metals in the U.S., which is considered one of the best mining jurisdictions in the world. It has a much lower jurisdiction and political risk than many of its silver mining peers, which operate largely in Mexico or South America.

Hecla Mining Company is worth a look here for investors bullish on gold & silver.

Read the full article here