The moments between your milestones are not filler.”― Nelou Keramati.

Today, we put Milestone Pharmaceuticals Inc. (NASDAQ:MIST) in the spotlight for the first time. The company should submit a New Drug Application, or NDA, around its primary drug candidate next quarter, and executed a capital raise in March in anticipation of the rollout of said drug. Will FDA approval power the shares higher? An analysis follows below.

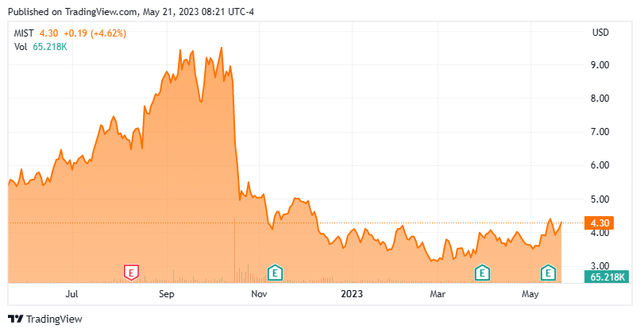

Seeking Alpha

Company Overview:

Milestone Pharmaceuticals Inc. is headquartered north of the border in Montreal, Canada. The company is focused on the development and commercialization of cardiovascular medicines. The stock currently trades around $4.25 a share and sports an approximate market capitalization of $185 million.

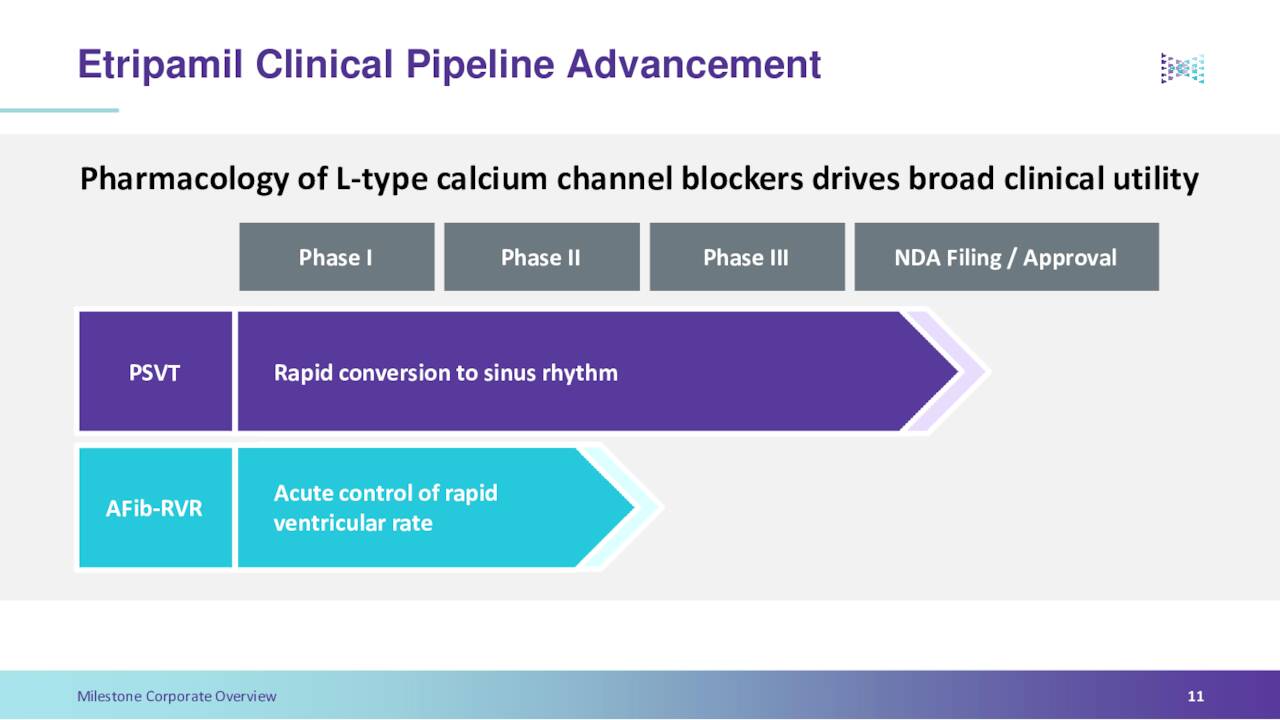

March Company Presentation

Milestone Pharmaceuticals’ lead product candidate is called etripamil. This a novel and potent calcium channel blocker. Currently, etripamil is in Phase 3 clinical trial for the treatment of paroxysmal supraventricular tachycardia, or PSVT, as well as within Phase II clinical trial for the treatment of atrial fibrillation and rapid ventricular rate (aFIB-RVR). Milestone Pharmaceuticals Inc., licensed etripamil via a collaboration agreement with Ji Xing Pharmaceuticals.

The company has met with the FDA. Based on that event and data from late-stage studies, the company believes it is ready to file its NDA for etripamil to treat PSVT sometime in the third quarter of this year. If approved, etripamil would be the first fast-acting, patient-administered treatment for this affliction. Etripamil is delivered in the form of a nasal spray. It is designed to be absorbed into the bloodstream in less than 10 minutes through the inner lining of the nose.

PSVT is an abnormally fast heart rhythm due to improper electrical activity in the upper part of the heart. From the company’s website:

PSVT affects approximately two million Americans and results in as many as 300,000 new diagnoses and over 600,000 healthcare claims in the U.S. per year, including emergency department visits, hospital admissions, and ablations.“

PSVT can be dangerous and even life-threatening. The impacts of the disease can vary and be dependent on other morbidities of the individual. PSVT can last several years or a lifetime and requires lab testing and/or imaging to confirm.

aFib impacts some five million people in the United States and is a common arrhythmia marked by an irregular and often rapid heartbeat. This condition can include episodes of abnormally high heart rate. These often present with symptoms such as palpitations, shortness of breath, dizziness, and weakness. Oral calcium channel blockers and/or beta blockers are the common medications used to reduce the heart rate in aFib. Management projects etripamil’s target addressable market for aFib is approximately three to four million patients in 2030. The company has an ongoing Phase 2 proof-of-concept trial targeting AFib-RVR.

Analyst Commentary & Balance Sheet:

On April 12th, Oppenheimer maintained their Outperform rating on MIST on April 12th, but lowered their price target to $13 from $16. H.C. Wainwright reissued their Buy rating and $15 price target on May 15th. These are the only two analyst firm ratings on Milestone Pharmaceuticals in 2023.

Approximately four percent of the outstanding float is currently held short. There has been no insider activity in the stock so far in 2023. The company ended the first quarter with just over $100 million in cash and marketable securities on its balance sheet. Management has stated, “Cash resources as of March 31, 2023, together with strategic March 2023 financing, is expected to fund operations into mid-2025.”

In late March, the company entered into a $125 million strategic funding agreement with RTW Investments. This included proceeds of $50 million via convertible notes, as well as a commitment of $75M in non-dilutive royalty funding.

Verdict:

The current analyst firm consensus has Milestone Pharmaceuticals Inc. losing just over $1.50 a share in FY2023 on $1 million in revenue. In FY2024, estimates of losses range from $1.01 to $2.76 a share with a sales range between $1 million to $40 million.

Milestone does not have multiple “shots on goal,” as its fate will be determined by the success or failure of etripamil. The company has recently addressed its near-term funding needs, and an NDA should follow next quarter. If all goes well, etripamil will hit the market to treat aFib-RVR sometime in the first half of 2024. Milestone can also leverage its relationship with Ji Xing Pharmaceuticals to help get etripamil approved in China for aFib-RVR where is recently began a Phase 3 study.

Given the potential size of the market and novel delivery system, Milestone seems to warrant a small “watch item” holding right now as the company moves closer to commercialization.

Sometimes the biggest milestone is deciding to create one.”― Craig D. Lounsbrough.

Read the full article here