Ginkgo Bioworks’ (NYSE:DNA) first quarter results were something of a mixed bag, with continued progression on a number of metrics offset by rising costs and declining revenues. Ginkgo’s success or failure is unlikely to be demonstrated in the near term, but weak growth and large losses could continue to place downward pressure on the stock. While an increasing number of programs is a positive, Ginkgo still needs to demonstrate that customers can consistently commercialize products to create faith in the business model.

Asset Manager in Disguise

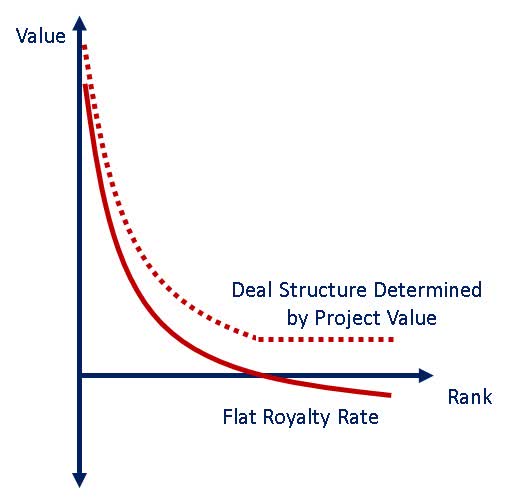

Ginkgo’s decision to capture value primarily through downstream value creates an extra layer of potential risk and return in the business. Ginkgo can create value through the capabilities and scale of its platform, but also by choosing which programs to undertake and with what deal structure.

Ginkgo’s access to data potentially gives it better insight into the probability of program success, allowing it to structure deals so that returns are increased while risk is reduced. This makes Ginkgo similar to an asset manager, choosing where to invest (participate in downstream value) and where not to invest (receive upfront fees). It is too early to know whether Ginkgo is capable of doing this, or even if they are really trying, but it could be an underappreciated source of value. Ginkgo has already taken steps in this direction by offering “engineering” services on low risk programs, where customers only pay if the program is successful.

Conversely, customers also likely have access to proprietary data, which they could leverage to negotiate favorable deal economics. For example, larger, more sophisticated customers with internal strain engineering capabilities may only choose to utilize Ginkgo for high risk projects that they want performed at a low cost. This is a risk that I have previously highlighted.

Figure 1: Illustrative Cell Engineering Project Value (Source: Created by author)

Cell Engineering

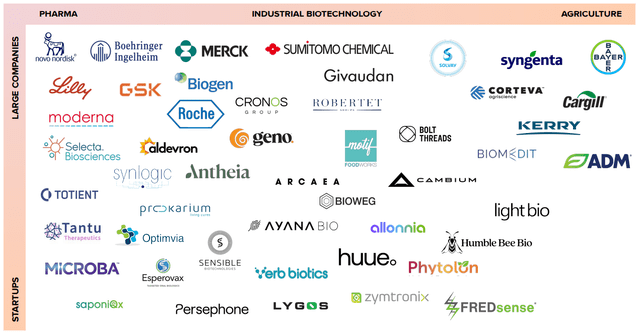

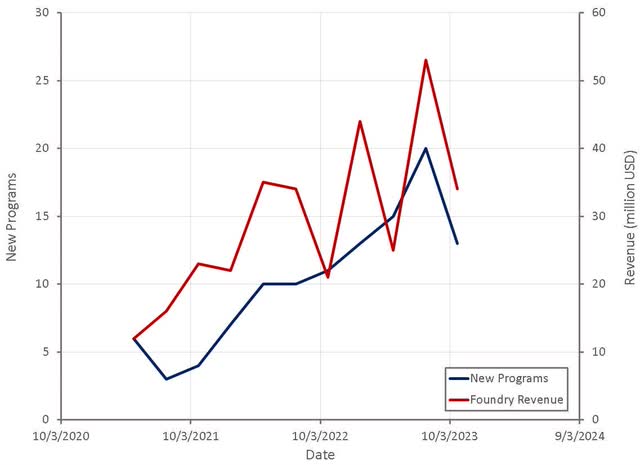

Ginkgo is now referring to its Foundry business as Cell Engineering, as management believes it is more reflective of the nature of the business. Unsurprisingly, Cell Engineering growth continues to be driven by the pharma and biotech segment as well as the food and agriculture segments. Ginkgo provides a horizontal platform which is more likely to gain traction in mature industries. The use of biotechnology within pharma and agricultural is relatively mature, leading to greater adoption in these segments. Demand is likely to remain relatively concentrated within a small number of verticals in the short term, as there is a lack of companies who have the capabilities necessary to take a strain and manufacture at scale. Ginkgo’s management recently highlighted difficulty within the industrial biotechnology segment due to companies finding it difficult to access capital.

Figure 2: Ginkgo Customers (Source: Ginkgo Bioworks)

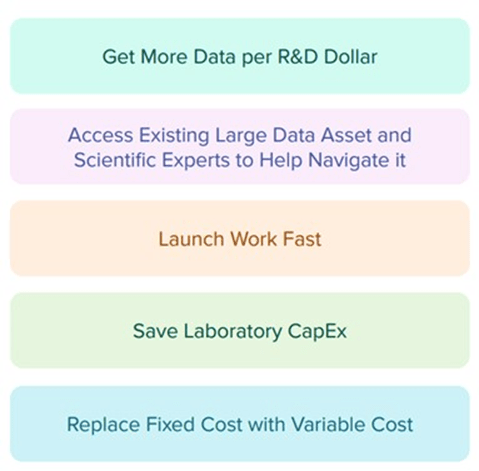

While it is still early days for Ginkgo’s platform, the narrative continues to be based around economies of scale and data creating a barrier to entry over time. I don’t like the comparison with AWS, but there are important similarities. AWS and Ginkgo are both attractive for startups as they turn CapEx into OpEx and lower barriers to entry. There is also potentially an argument to be made for Ginkgo benefiting from greater economies of scale than cloud computing providers. Ginkgo is creating a differentiated technology stack and data asset that could be difficult to replicate.

Figure 3: Potential Reasons for Outsourcing R&D to Ginkgo (Source: Ginkgo Bioworks)

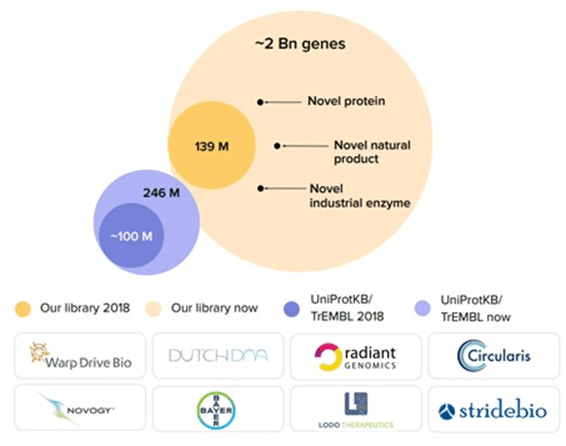

While the logic behind Ginkgo’s data strategy is obvious, it is not really clear how data is improving the commercialization of products. Ginkgo’s data library increased by an order of magnitude over the past five years, and yet it is difficult to see a corresponding increase in successful programs.

Figure 4: Ginkgo’s Data Asset (Source: Ginkgo Bioworks)

Ginkgo continues to add capabilities to its platform through acquisitions. StrideBio is a leader in AAV capsid protein structures and identifying key regions of the structure that would be worth modulating. Ginkgo reportedly has 30 ongoing conversations with potential customers related to the StrideBio acquisition.

Some of these acquisitions are being used to support the introduction of new services. Ginkgo recently announced the introduction of a number of new services, although this appears to be a sales move as much as anything, helping customers to understand the services and value that Ginkgo can already provide.

Figure 5: New Ginkgo Services (Source: Ginkgo Bioworks)

Biosecurity

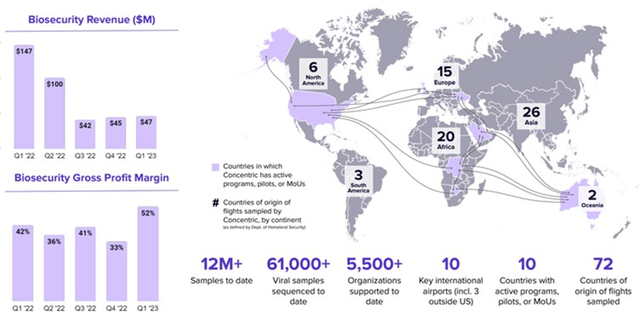

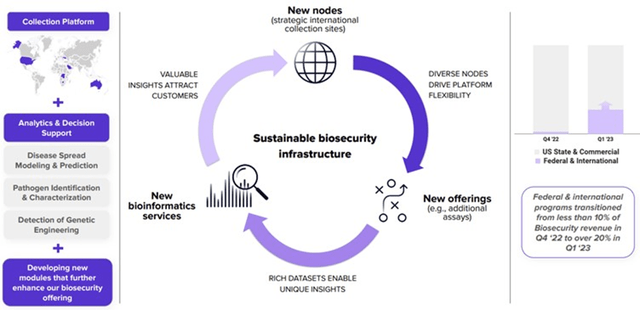

Ginkgo’s Biosecurity business continues to face headwinds as K-12 COVID testing services decline, but there also appears to be a viable long-term business developing. Management estimates that over 20% of the first quarter’s Biosecurity revenue came from more recurring sources, such as federal and international contracts, compared to well under 10% in Q4 of 2022.

The second quarter is expected to still include some K-12 school testing revenue, before dropping off significantly in the second half of the year. Management is currently guiding very little K-12 testing revenue after the second quarter.

Figure 6: Ginkgo’s Biosecurity Business (Source: Ginkgo Bioworks)

While Biosecurity revenues are declining, Ginkgo is slowly building a more sustainable business with a larger geographic footprint. How strong demand remains in the near term as the pandemic moves to the back of people’s minds is unclear, but given the threat presented by biotechnology as capabilities increase, biosecurity is a high potential business.

Figure 7: Ginkgo’s Expanding Biosecurity Network (Source: Ginkgo Bioworks) Figure 8: Ginkgo’s Biosecurity Platform (Source: Ginkgo Bioworks)

Financial Analysis

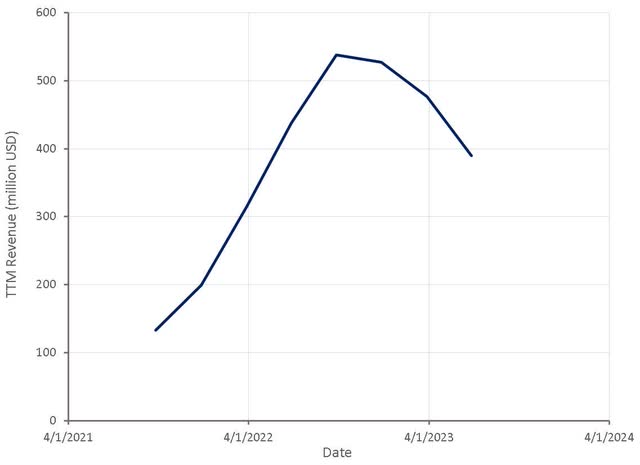

Ginkgo continues to expect 100 new cell programs in 2023, at least 175 million USD of Cell Engineering revenue and at least 100 million USD of Biosecurity revenue. This is likely conservative guidance, though, with Cell Engineering downstream value potentially providing substantial upside. Regardless, revenue is likely to be down significantly compared to 2022, which, along with increasing losses, will probably keep Ginkgo’s stock under pressure throughout 2023.

Figure 9: Ginkgo Bioworks Revenue (Source: Created by author using data from Ginkgo Bioworks)

Ginkgo’s Cell Engineering business continues to be volatile, but is growing. The relatively small number of new programs added in the first quarter is somewhat concerning, particularly given the macro backdrop, but management still appears to be confident of achieving their full year targets.

Figure 10: Ginkgo Bioworks Foundry Revenue (Source: Created by author using data from Ginkgo Bioworks)

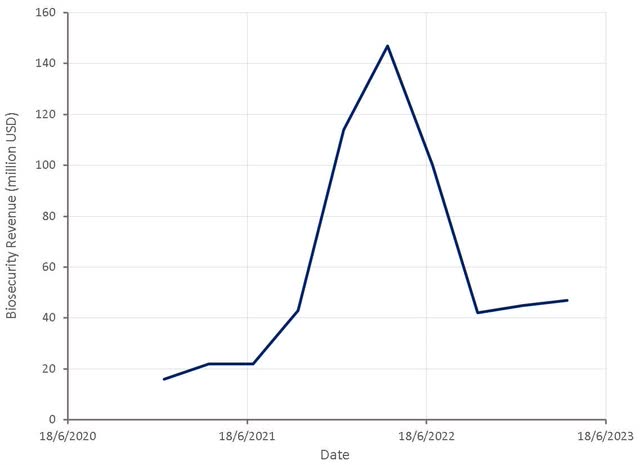

Biosecurity revenue is down significantly compared to 2022 and this situation will get worse going forward as COVID testing continues to roll off. This was inevitable after the end of the pandemic, but elevated Biosecurity revenue over the past few years likely gave many investors a false impression of Ginkgo’s maturity.

Figure 11: Ginkgo Bioworks Biosecurity Revenue (Source: Created by author using data from Ginkgo Bioworks)

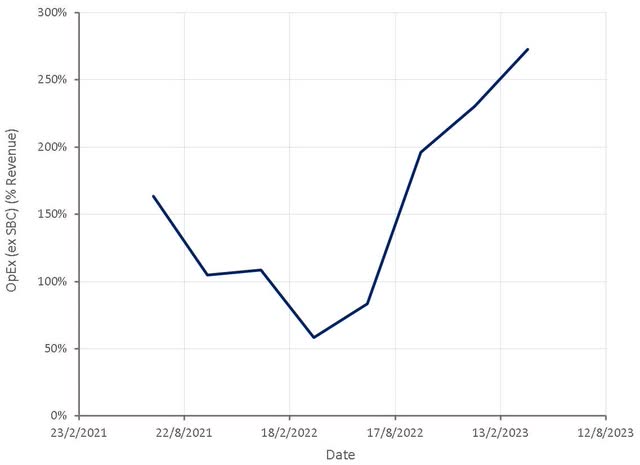

Ginkgo’s operating expenses (ex-SBC) have continued to increase as the company invests in future growth. The first quarter of 2023 included roughly 19 million USD of non-recurring M&A and integration related expenses, though. Rising costs along with declining revenue is leading to larger adjusted EBITDA losses, which is one thing that investors are currently intolerant of. Adjusted EBITDA was negative 100 million USD in the first quarter, illustrating how far Ginkgo still has to go before it demonstrates the viability of its business model.

Figure 12: Ginkgo Bioworks Operating Expenses (Source: Created by author using data from Ginkgo Bioworks)

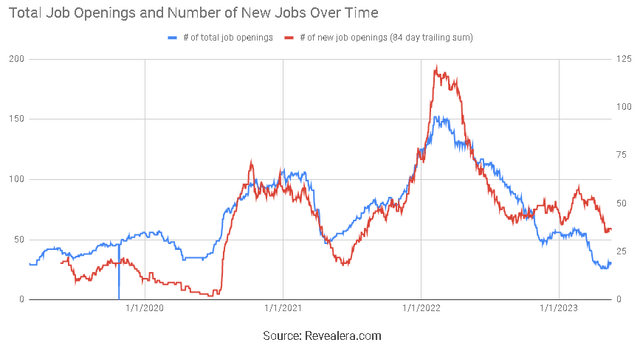

The number of job openings at Ginkgo has trended downward over the past 12 months, although the importance of this is somewhat difficult to parse. This could be due to a weak demand environment, regardless it is likely a necessity given Ginkgo’s growing losses.

Figure 13: Ginkgo Bioworks Job Openings (Source: Revealera.com)

Given the nature of Ginkgo’s business, it is somewhat surprising that it hasn’t benefitted from the recent hype around artificial intelligence. Whether this is just because strain engineering is too far removed from LLMs in the minds of investors, or because investors are doubting Ginkgo’s business is unclear.

Ginkgo probably needs to get more runs on the board and improve profitability before investors begin to buy back into the narrative. This will take time, though, as Ginkgo’s customers must successfully commercialize a sufficient number of programs. In the meantime, Ginkgo’s valuation still leaves room for further downside.

Read the full article here