With the Brazil rate-inflation gap now closing on 10% (~4% inflation vs. a 13.75% SELIC rate) and the Banco Central do Brasil (i.e., Brazil’s central bank) under intense political pressure, the country looks poised to enter a steep rate cut cycle in the coming months. The only hurdle left is economic growth; another weak print could well trigger an earlier-than-expected pivot. As we enter an easing cycle, leading private sector bank Bradesco (NYSE:BBD), which took the biggest asset quality hit through the monetary tightening phase (for more on their prior asset quality troubles, see my prior coverage), could lead the recovery.

Q1 2023 numbers showed limited tangible signs of a turnaround, with the bank’s NPL ratio still elevated. But the individual segment, the key driver of the deteriorating asset quality, is nearing peak levels, with corporate defaults also reaching lows. In the meantime, Bradesco has embedded little optimism in its guidance, leaving the coverage ratio target unchanged, despite making positive changes with regard to its lending discipline and product mix (i.e., focusing on more accretive, lower-risk products/services). So even in a likely lower GDP growth scenario, Bradesco is much better positioned to navigate the ROE headwinds. As the pending rate cuts drive banks’ cost of equity lower and asset quality higher, Bradesco now has a clear path to regaining a sustained book value premium.

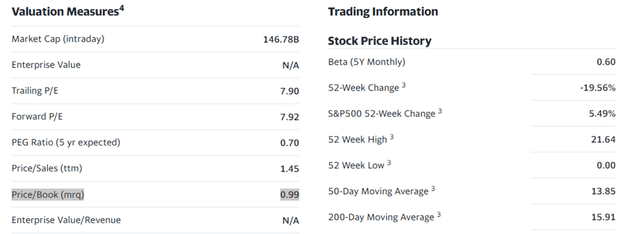

Yahoo Finance

Signs of a Gradual Recovery Materializing in Q1

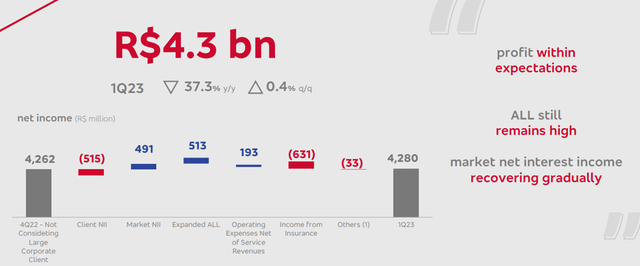

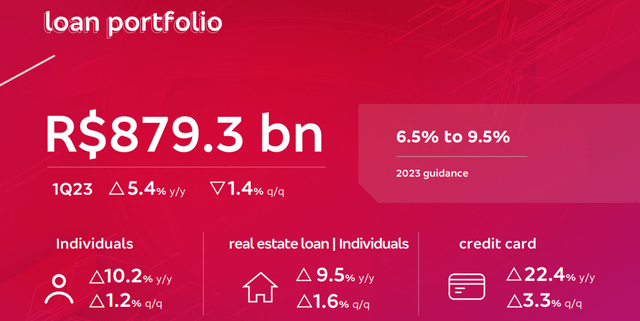

Bradesco kicked off the year with a solid quarter overall – Q1 net income was up sequentially to R$4,280m (implied ~11% return on equity), though the headline figure was helped by lower provisioning relative to non-performing loan formation. The impact of retailer Americanas’ default remains an overhang as well, with lending also now running below the 6.5-9.5% YoY guidance range due to the bank’s tightened credit standards. But as of Q1, the size of the loan book still rose at 4% YoY (5% YoY on the expanded book), supported by 10% YoY loan growth in the individual segment. As a result, net interest income was flat QoQ, as an improvement in market conditions offset any asset quality and loan book headwinds. Non-interest income also came in strongly, helped by the insurance segment (+12% YoY), while fee income lagged due to seasonal headwinds at +2% YoY.

Bradesco

The near-term guidance is also shaping up well – per management, portfolio growth is now on track to reach the middle or upper end of the guidance range, with net interest income growth trending well within the 7-11% guidance range. Given the bank has been increasingly cautious in terms of credit origination and is operating in a slower growth environment, the guidance reaffirmation is a major positive, in my view. Even for the expanded loan portfolio, management seemed confident in its ability to reach the 6.5-9.5% guidance range; should a monetary policy pivot materialize, upward revisions could well be on the cards. Key areas of growth cited include personal loans and payroll deductibles, as well as real estate financing, with the demand outlook from medium to large corporates understandably weaker following the Americanas debacle. And with the bank also now prioritizing an ROE accretive product line, the P&L is much better insulated even in a bear-case macro scenario (low growth/continued high rates).

Bradesco

Asset Quality Still an Overhang, but Light is Emerging at the End of the Tunnel

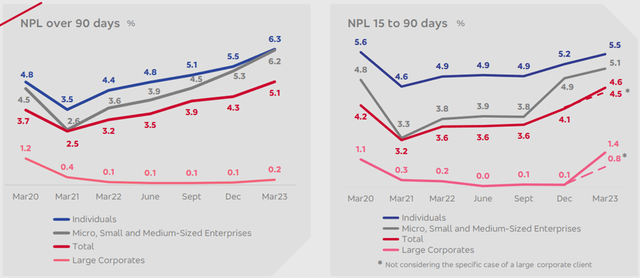

Having suffered from continued asset quality issues since the rate hike cycle began, compounded by single-issuer defaults (most notably Lojas Americanas, which Bradesco had a relatively large exposure to), all eyes were on any tangible improvements in Q1. In this regard, the quarterly numbers disappointed – yet again, the bank suffered a material deterioration in its non-performing loan book, with the overall NPL ratio rising sequentially to 6.1%. By duration, most of the stress appears to be at the 90-day mark, with NPL formation here running at 7.3% of the book (8.0%, including renegotiated credit). The >90-day delinquencies also deteriorated sequentially to 5.1% overall, led by worsening trends in the individuals and SME segments.

Bradesco

Digging deeper, the asset quality deterioration was mostly down to its consumer (+80bps QoQ) and small/medium business portfolios (+90bps QoQ). More specifically, a large chunk of the delinquencies appears to be a result of the bank’s Americanas exposure; while the loss provisioning might have cushioned the worst of the impact, expect some lingering effects in the coming quarters. That said, the QoQ decline in net provisions to R$9.5bn is a good signal, implying a cost of risk in line with guidance at 5.9% (down sequentially). Relative to the high base (even higher post-Q1), management is seeing signs of a fundamental turnaround, though. With the bank also tightening lending standards, all signs point to a pending recovery across new vintages and cohorts. For now, management has guided to peak NPL formation in the next quarter, followed by a reduction from Q3 onwards; an earlier-than-expected policy pivot would, however, accelerate this timeline.

Bradesco

Primed for a Re-Rating Ahead of Brazil’s Monetary Policy Pivot

Bradesco hasn’t yet shown tangible signs of a turnaround, but the stock has rallied over the last month on rate-cut optimism. With inflation decelerating well below interest rates (the SELIC rate is currently at 13.75%) and the broader economy set to slow this year, the market’s view seems justified. Relative to the other Brazilian banks, Bradesco has suffered the most from asset quality; Q1 was more of the same, as the bank continued to post increases in its NPL ratio, largely due to the delinquencies in the individual segment. But with corporate defaults easing substantially and individual asset quality likely to benefit from a neutral to accommodative policy environment, Bradesco likely has the largest upside potential from here.

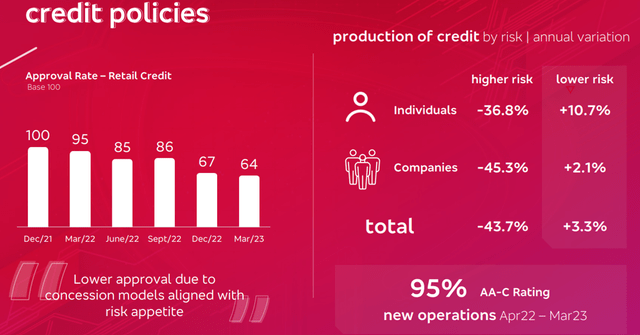

In the meantime, management is doing its part ahead of an increasingly likely growth slowdown scenario – not only has Bradesco tightened its credit conditions, it has also refocused its business mix according to a higher ROE/lower risk criteria. Thus, I would expect an upside to the bank’s ROE in the coming months; as the ROE/CoE spread widens in the right direction alongside improving asset quality and cost of equity declines, Bradesco looks set for outsized gains as we enter a lower rate regime.

Read the full article here