Investment Thesis

Comfort Systems USA, Inc. (NYSE:FIX) is well positioned for revenue growth, thanks to a healthy backlog of $4.44 billion as of Q1 2023. The company is expected to benefit from strong demand in end markets, driven by trends such as the construction of new data centers, reshoring of manufacturing in the U.S., and battery manufacturing for Electric Vehicles. These trends should contribute to an increase in the backlog and support future revenue growth. Additionally, the company’s inorganic growth strategy through tuck-in M&A activities should also contribute to top-line growth.

From a margin perspective, Comfort Systems USA, Inc. is expected to benefit from the inclusion of high-margin service projects, sales leverage, improved supply chain conditions, and moderate inflation. However, the company’s current valuation is much higher than historical averages and these growth prospects in terms of revenue and margins seem to be already priced into the stock. Therefore, despite the positive growth prospects, I have a neutral rating on the stock.

Revenue Analysis and Outlook

Over the past year, Comfort Systems USA has benefitted from robust end-market demand, driven by increased infrastructure investments and a boost in industrial manufacturing activities. The company recently released its first-quarter earnings for 2023, which showed similar positive trends.

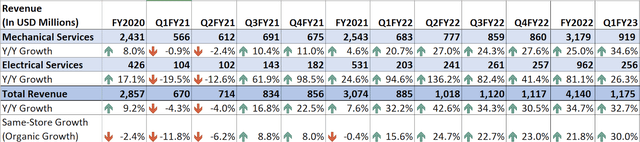

During the first quarter of 2023, Comfort Systems USA experienced strong demand in both segments, accompanied by effective backlog execution and price increases aimed at offsetting the impact of inflation. As a result, the company achieved a significant year-over-year revenue growth of 32.7%, reaching $1.17 billion. This growth was primarily driven by a 30% year-over-year increase in organic revenue (same-store growth) and a 2.7 percentage point contribution from acquisitions. Revenue growth was well-distributed across segments, with the Mechanical segment experiencing a 34.6% year-over-year increase and the Electrical segment showing a 26.3% year-over-year growth.

FIX’s Historical Revenue (Company Data, GS Analytics Research)

Looking ahead, I am optimistic that Comfort Systems USA will continue to achieve revenue growth, benefiting from a robust backlog, secular demand trends, and strategic bolt-on M&A activities.

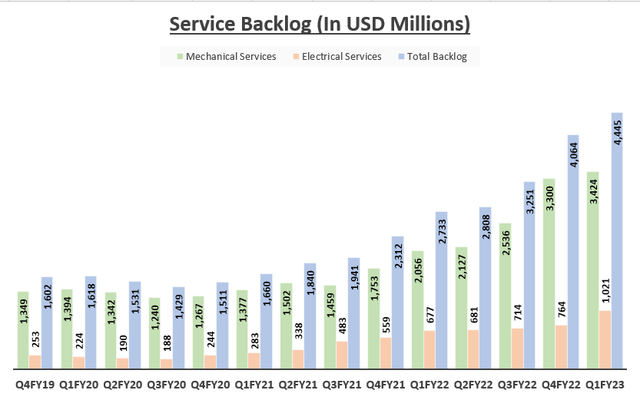

The company’s backlog, which serves as an indicator of future revenue, demonstrated healthy growth. In the first quarter of 2023, despite good backlog to sales conversion, the total backlog increased by 62.6% year-over-year and 36.7% sequentially from Q4 2022, reaching $4.44 billion. On an organic basis (same-store), the backlog increased by 58% year-over-year. This growth was driven by a 66.7% year-over-year increase in the Mechanical segment’s backlog, reaching $3.42 billion, and a 50.8% year-over-year increase in the Electrical segment’s backlog, reaching $1.02 billion. The substantial growth in backlog highlights the favorable conditions in the end markets for both segments and the positive impact of the price increases implemented by the company.

FIX’s Order Backlog (Company Data, GS Analytics Research)

I anticipate that Comfort Systems USA will continue to experience an increase in backlog levels in the coming quarters, providing support for the company’s long-term revenue growth. This growth is expected to be driven by strong demand momentum, bolstered by secular trends such as the construction of data centers and reshoring manufacturing operations in the United States.

The growing need for data centers, driven by the digitization and AI advancements in various industries, requires the installation of proper HVAC systems, creating demand for FIX’s products and services. Additionally, challenges in the global supply chain have led to a push for reshoring manufacturing operations, which aligns with the long-term tailwind from the CHIPS and Science Act and presents opportunities for FIX in the manufacturing sector. Furthermore, the increasing adoption of Electric Vehicles (EVs) fuels the demand for battery manufacturing, providing another secular tailwind for FIX in its end markets. Considering these factors, I believe the demand environment will remain strong, contributing to the growth of the company’s backlog and supporting future revenue growth.

Moreover, in response to the rising demand, particularly in modular construction, Comfort Systems USA is investing in additional manufacturing capacity in Texas and North Carolina. This expansion is expected to be operational by mid-2023 and will further support revenue growth in the coming years by enabling the company to capture and meet market demand.

Additionally, Comfort Systems USA has a successful track record of inorganic revenue growth through small tuck-in M&A activities. In 2022, acquisitions contributed approximately 13 percentage points to the company’s revenue growth. With the recent acquisition of Eldeco, an industrial electrical firm specializing in electrical design and construction, FIX strengthens its Electrical segment and expects an annualized revenue contribution of approximately $130 million to $140 million. The company’s favorable balance sheet, with a leverage ratio of less than 0.8x, supports its M&A strategy. I expect further potential tuck-in M&A to continue contributing to inorganic top-line growth in the coming years. Overall, I hold an optimistic view of FIX’s revenue growth prospects in the future.

However, it is important to note that while I am optimistic about the underlying demand environment and future revenue growth, revenue growth is expected to normalize in the coming quarters. This is due to challenging year-over-year comparisons and a lower impact of price increases amid moderating inflation. Therefore, the company’s revenue growth rate is likely to slow down compared to the peak growth phase witnessed over the past few quarters.

Margin Analysis and Outlook

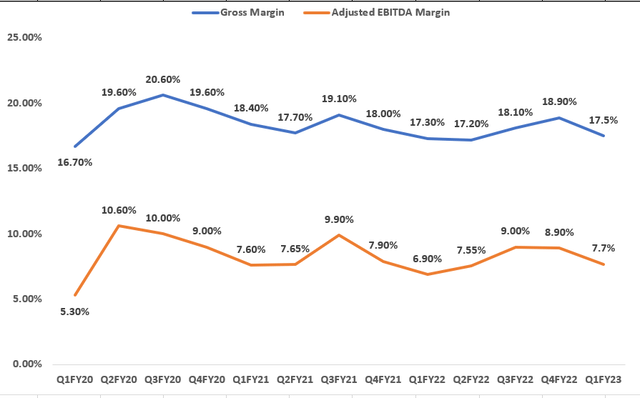

Over the past year, Comfort Systems USA experienced margin growth challenges due to inflationary pressures on material and equipment costs, as well as supply chain disruptions. However, in the first quarter of 2023, the company successfully mitigated these headwinds through sales leverage and implementing price increases to compensate for the impact of inflation on customers. Additionally, the margins were positively influenced by a favorable settlement of a dispute-related claim. As a result, Comfort Systems USA achieved a year-over-year expansion of 20 basis points in gross margin, reaching 17.5%, and an 80 basis points increase in adjusted EBITDA margin, reaching 7.7%.

FIX’s Historical Gross Margin and Adjusted EBITDA Margin (Company Data, GS Analytics Research)

Moving forward, I anticipate that Comfort Systems USA will continue to deliver margin growth in the coming quarters. The company’s high-margin service projects, which encompass pure service (repair and replacement) as well as hourly work (service calls, maintenance, and monitoring), are expected to continue increasing in the future improving mix. The company should also benefit from price increases. Additionally, as overall revenue continues to increase, I expect the company to benefit from sales leverage, further enhancing margins.

Furthermore, the supply chain issues that have posed challenges in the past are gradually easing, which should alleviate any additional costs associated with the supply chain. Additionally, the company foresees a moderation in inflation going forward. These factors contribute to a more favorable cost environment, which should aid the company in achieving margin growth as the year progresses. Therefore, I hold an optimistic view regarding Comfort Systems USA’s margin growth prospects.

Valuation and Conclusion

Comfort Systems USA is presently trading at a price-to-earnings (P/E) ratio of 21.28x based on the FY23 consensus estimate of $7.11 per share and a P/E ratio of 18.51x based on the FY24 consensus estimate of $8.18 per share. These valuations are higher than the company’s historical 5-year average forward P/E of 18.37x. I like the company’s growth prospects. However, with the stock trading at higher than its historical P/E levels even on FY24 earnings estimates, I believe investors are already pricing in these growth prospects. Also, while the 30% Y/Y kind of increase in revenues is no doubt excellent, it should eventually normalize to a more reasonable levels as the impact of post-reopening surge in demand and price increases moderate. Hence, I have a neutral rating on the stock for now.

Read the full article here