Coming on the heels of a profit warning last month, German medical technology and device company Carl Zeiss Meditec’s (OTCPK:CZMWF) half-year earnings letdown wasn’t entirely surprising. Yet again, the culprits were supply chain bottlenecks, particularly on the equipment side, as well as input cost inflation. Also impacting profitability this time around was a COVID-driven slowdown in China to start the fiscal year, which cost the company a chunk of refractive business profits during a typically lucrative Lunar New Year period. While these are largely seasonal factors, a higher R&D and marketing expense run-rate looks to be on the cards – the company has cut its margin guidance for the year to 18.5% at the midpoint (down from 20% prior) and dropped any mention of >20% mid-term margins.

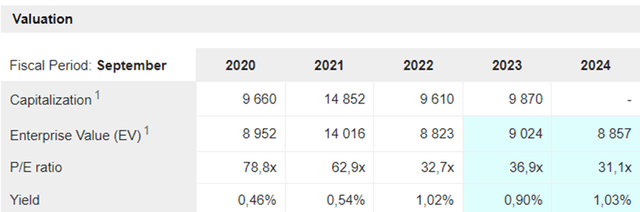

In the meantime, management is pinning its hopes on incremental growth and market share gains from the US intraocular lens (IOL); while there is a clear revenue opportunity here, the lukewarm early response poses downside risk to the current optimism. At >30x fwd earnings (vs. mid to high-teens % earnings growth through FY24/FY25), the stock remains vulnerable to a de-rating, particularly given its outsized single-country exposure to China, as well as the potential for further margin headwinds from a step-up in strategic investments.

MarketScreener

Still Growing the Top-Line, but Higher Costs Weigh on Profitability

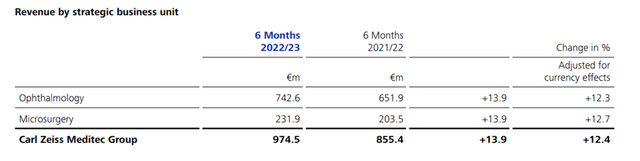

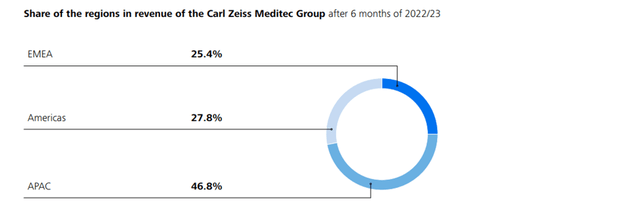

Carl Zeiss’ headline H1 results offered few surprises relative to the detailed preliminary release/profit warning announced in the prior month. With Asia Pacific (mainly China) now its largest regional revenue base, the lingering impact of the ‘zero-COVID’ restrictions and the subsequent infection wave led to a slow start to the year. The refractive business within its ophthalmology segment (77% of overall revenue) suffered the biggest impact, particularly given the Lunar New Year period tends to be particularly lucrative. Still, accelerated ophthalmology device deliveries towards the end of Q2 boosted the overall top line, which was up ~14% YoY for H1 (+12% YoY FX-neutral). The smaller microsurgery segment, which focuses on surgical visualization (23% of the revenue base), also saw a strong ~14% YoY increase, though this was largely helped by the execution of its large order backlog (accumulated from the COVID-impacted period).

Carl Zeiss Meditec

By region, the Americas (+28% YoY; +19% FX-neutral) was the key growth engine this time around, though this was also largely due to a strong order backlog conversion. More concerning is the relatively slower +10.3% YoY growth in the Asia Pacific (+11% YoY FX-neutral), with a strong India and Southeast Asia helping to offset a China (ex-consumables) slowdown.

Carl Zeiss Meditec

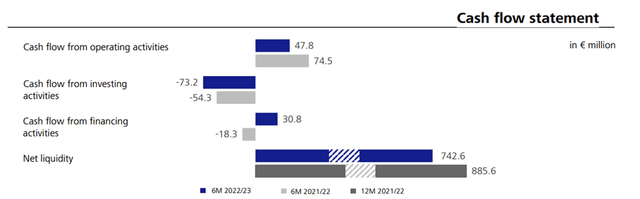

The major disappointment was on the margin side, as a sharp increase across all the major expense lines (selling & marketing, R&D, and admin) led to a decline in operating profitability. Management cited a weaker product mix (due to lower recurring revenue contribution) and input cost inflation as the key drivers, though expense drivers like growth initiatives (mainly strategic investments in Refractive and Surgical Ophthalmology), as well as higher travel and advertising expenses, are likely here to stay. While the adj EBIT improved on Q1 levels, H1 operating profitability was still down ~18% YoY (down ~19% YoY pre-adjustments for intangible asset amortization), with margins contracting 590bps YoY to 15.3%. Cash flow was also down across the board, though the EUR743m net liquidity position (including EUR1.7bn of cash and equivalents) ensures ample headroom for future M&A or reinvestments.

Carl Zeiss Meditec

Guidance Lowered but More Disappointments Potentially on the Horizon

While business did improve from Q2 to Q1, management still lowered and widened its EBIT margin target for the year to 17%-20% (down from 19%-21% prior). Revenue was pegged at EUR2.1bn for FY23, implying 8%-9% YoY growth – while this is largely in line with its underlying market, it still represents a sizeable slowdown from the low-teens % growth algorithm in H1. And after accounting for the strong EUR 573m order backlog, the implied top-line slowdown could be even steeper than expected. Any post-FY23 target was also scrapped from the company’s statement, which likely means the prior >20% mid-term margin target isn’t on the cards any longer.

Going forward, all eyes will be on how the China recovery pans out. Thus far, most of the margin headwinds have been China-driven, as a delayed fundamental recovery has given way to a ~EUR50m de-stocking, which per management, will extend through the year. The biggest concern, though, is in the mid to long-term, as the potential implementation of nationwide volume-based-procurement (VBP) in the intraocular lens market in China threatens Carl Zeiss’ competitive position (high-teens % market share currently). In a likely ‘winner take all’ scenario, losing out on this tender would have significant volume and price impacts, and joint ventures may be needed to cover capacity. Management only expects finality in 2024/2025, though, so expect a China-driven overhang in the meantime.

This MedTech Play is Still Too Pricey

Carl Zeiss’ H1 results fell short again – even after accounting for the big profit warning last month. On the one hand, the supply chain and cost inflation headwinds continue to weigh on margins; on the other hand, seasonal factors such as slower China growth through the Lunar New Year (usually a particularly profitable period) cost the company a large chunk of high-margin revenue in the refractive business. Yet, the biggest surprise was perhaps the lowered margin guidance – with this fiscal year’s margin target lowered to 17-20% (down from 19-21% prior) on structurally higher marketing/R&D, the company’s >20% mid-term margin target looks increasingly out of reach. With major China (currently the #1 revenue contributor) risks on the horizon and the entry into the IOL market in the US off to a slower-than-expected start, the post-earnings sell-off seems justified. Yet, the valuation remains a significant hurdle – despite the sizeable de-rating over the last year, the stock still trades at a premium to its underlying growth potential at >30x fwd earnings. Net, I would remain on the sidelines.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here