Stock futures traded slightly lower Monday with time running out on the White House and House Republicans to reach an agreement to raise the U.S. debt ceiling.

These stocks were poised to make moves Monday:

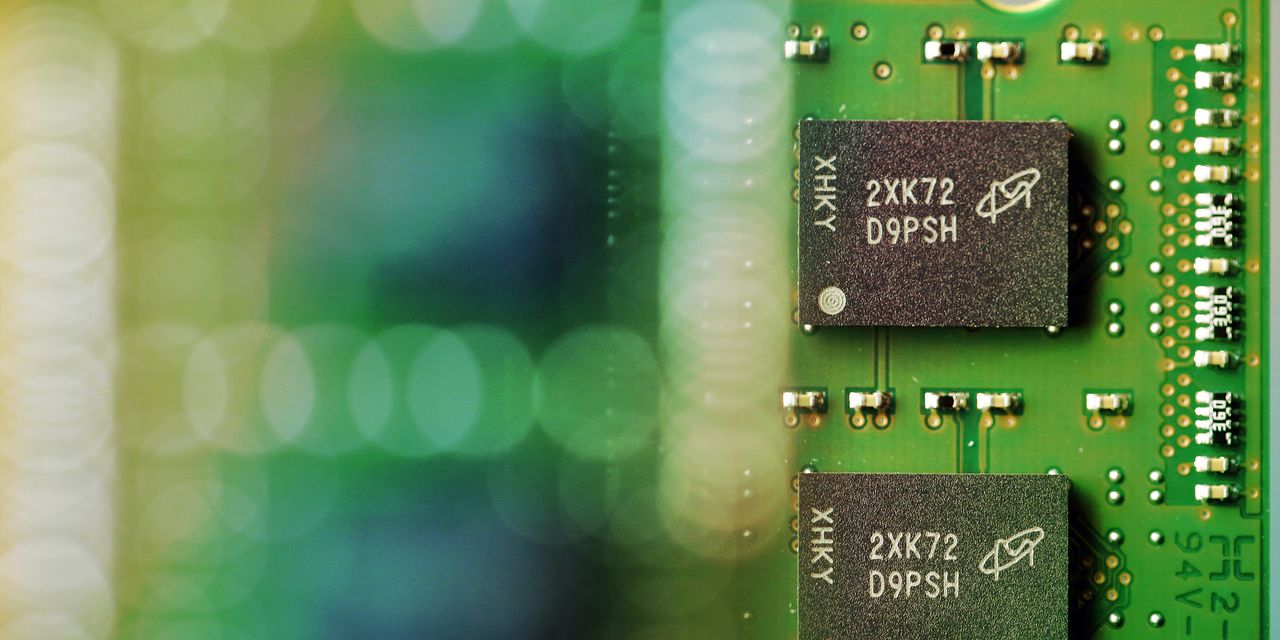

Micron Technology

(ticker: MU) declined 5% in premarket trading after Beijing banned companies involved in China’s critical information systems from buying chips from the U.S. chip maker, saying they posed a major national-security risk. China’s investigation into Micron was seen as retaliation for the U.S. reducing China’s access to key technology.

Meta Platforms

(META) was down 1.3% after the parent of Facebook was fined $1.3 billion by privacy regulators in the European Union for sending user information to the U.S. The fine is a record for the bloc, according to The Wall Street Journal. “We will appeal the ruling, including the unjustified and unnecessary fine, and seek a stay of the orders through the courts,”

Meta

said in a statement.

Ford (F) is

hosting its 2023 “Capital Markets Day” in Dearborn, Mich. It’s calling the event “Delivering Ford+,” a strategy around digitizing the car, adding software on both electric and traditional vehicles. The auto maker reaffirmed that it expects adjusted earnings before interest and taxes in 2023 of $9 billion to $11 billion.

Ford

also announced it had signed long-term lithium supply agreements. Ford shares rose 0.2%.

Albemarle

(ALB) was up 1% after the lithium miner said it would supply more than 100,000 metric tons of battery-grade lithium hydroxide that will be used to make about 3 million electric vehicle batteries for Ford.

PacWest Bancorp

(PACW) shares were rising 3.7% after the regional lender said in a filing Monday it will sell a portfolio of 74 real estate construction loans with a total balance of about $2.6 billion.

DraftKings

(DKNG) was rising 2.9% after shares of the sports-betting company were upgraded to Buy from Neutral at

UBS.

Foot Locker

(FL) declined 2.5% in premarket trading to $29.47. The stock sank more than 27% on Friday after the footwear retailer slashed its earnings and sales guidance for the fiscal year. Williams Trading downgraded the stock to a Sell from Hold with a price target of $25, down from $38, the Fly reported.

Nike

(NKE) also was downgraded to Sell from Hold at Williams Trading. Nike was down 1.5% after tumbling 3.5% on Friday.

Full Truck Alliance

(YMM), the China-based digital freight company, reported fiscal first-quarter earnings and revenue that beat analysts’ estimates. American depositary receipts of

Full Truck Alliance

were rising 7.2%.

Videoconferencing company

Zoom Video Communications

(ZM),

Heico

(

HEI

), and

Nordson

(NDSN) are scheduled to report earnings after stock markets close Monday.

Write to Joe Woelfel at [email protected]

Read the full article here