Co-authored with Treading Softly.

Have you ever found yourself sitting back and watching a younger man or woman try to work hard to achieve success? Sometimes they’re willing to take on big risks or make big sacrifices to see the success that they’re dreaming of. The older I get, the more I realize that I don’t want to make big sacrifices, and I don’t want to take big risks to gamble on a potential future – especially when I already have such a strong foundation to stand on.

There is a popular saying amongst the older group of people – we look at something and say, “That’s a young man’s game.” The essence here is that that’s something that a young person is probably willing and ready to do, that an older person is not willing to do, simply because they don’t need to, or they’re not willing to risk it, or they’ve gained the wisdom through life to know it’s not worth it.

Similarly, when it comes to the market, I’m not one to gamble on penny stocks. I don’t want to trade naked puts or naked calls. I simply want to use the market as an employee to generate income from my portfolio to pay my way through life. I like things to be as simple and as straightforward as possible. That’s why I developed our unique Income Method to help me achieve just that – simple, repeatable, steady success from the market via cash dividends pouring into my portfolio.

Today, I want to look at two fantastic opportunities for a consistent income that is also steadily growing year after year, with decades of proven success in growing income for their holders. They’ve survived through all sorts of market conditions and economic situations and continue to output outstanding income.

Let’s dive in!

Pick #1: WPC – Yield 6.2%

W. P. Carey Inc. (WPC) has evolved into one of the largest triple-net-lease property real estate investment trusts, or REITs. They are internally-managed and own a portfolio of operationally-critical commercial real estate. Years of steady acquisitions and pruning of errors has left them with a fantastic global portfolio designed to weather any storm, and yes, that includes a global pandemic. WPC reported earnings on Friday, April 28th.

WPC has a proven history as a dividend growth pick, with 25 years of consecutive dividend hikes under its belt. WPC has proven that it can grow through various economic conditions, including the Great Financial Crisis, which was particularly difficult for REITs.

WPC isn’t slowing down, reporting adjusted funds from operations, or AFFO, of $1.31/share and maintaining guidance of $5.30-$5.40/share for the year. WPC intends on acquiring $1.75-$2.25 billion in real estate by the end of the year. It has acquired a little over $740 million to date.

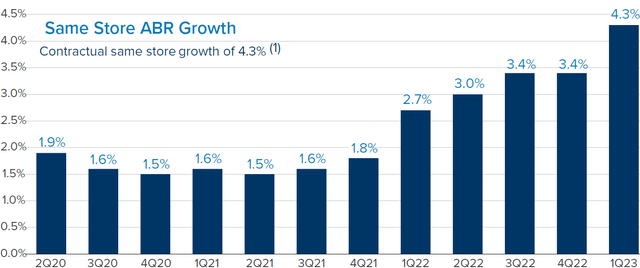

The market has been bearish on REITs because of rising interest rates. Since REITs use leverage, Wall Street has a knee-jerk sell reaction. This ignores the significant benefits of inflation. WPC’s same-store rent hit 4.3% in Q1, more than twice what it was in 2021. Source.

WPC Q1 2023 Presentation

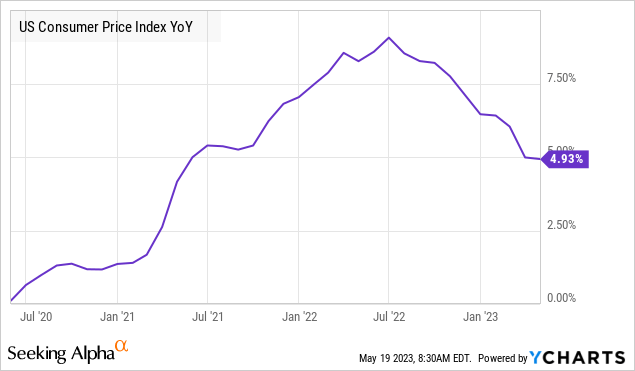

WPC benefits from CPI escalators in its portfolio and from renegotiating leases when the terms expire. Notice that inflation started in 2021, and the positive impacts weren’t seen on WPC’s same-store metrics until 2022.

This is because leases with CPI escalators don’t update every single month. They frequently are updated once a year or sometimes every 3 or 5 years. As a result, this level of growth will continue for several years. Management projects 4% same-store growth in 2023 and 3% in 2024, even if CPI declines to 2% by the end of this year.

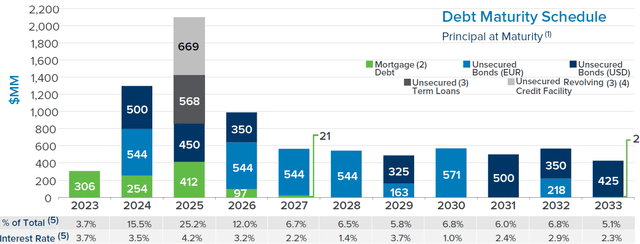

Meanwhile, on the debt side, the majority of WPC’s debt is fixed-rate. It has a minimal amount of debt maturing this year and a little over 40% of debt maturing in the next four years.

WPC Q1 2023 Presentation

WPC recently closed on a 3-year €500 million term loan fixed using a swap at 4.34%. So while interest rates are higher than WPC’s current average, the strength of WPC’s balance sheet still allows it to borrow at attractive prices relative to the +7% yields it is able to invest at.

The tailwinds from inflation are greater than the headwinds of rising interest rates, especially since interest rates are likely to come down before WPC has to refinance a material level of debt over the next 4 years.

WPC is a reliable dividend growth stock that can be held with confidence through any economic conditions.

Pick #2: Realty Income Corporation – Yield 5.1%

Realty Income Corporation (O) is a top-quality triple-net-lease property REIT that is also a Dividend Aristocrat. The “Monthly Dividend Company” reported Q1 earnings on May 3rd, with a slight increase in guidance. Realty Income continues to grow methodically, and we can expect the dividend will continue to grow as well with O maintaining the habit of small raises every quarter.

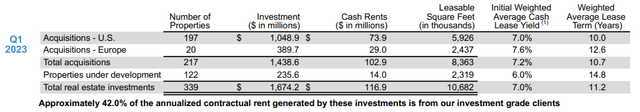

O invested over $1.6 billion for the quarter, at an average cap rate of 7%. This is higher than the 5-6% cap rates that have been common in recent years. Source.

Realty Income Q1 2023 Supplement

With an average lease term of 11.2 years, these acquisitions are far more about future earnings growth than immediate growth. Even with its A-rated balance sheet, the cost of borrowing has gone up for O, with the most recent offerings at 4.7% and 4.9%. Much higher than its average unsecured bonds, which are under 3.5%.

It is worth noting that O’s $400 million in 2028 bonds have the option to be called at par value as early as January 2024. This means that if interest rates decline, O will be able to refinance without penalty at lower rates.

So, while O’s 1% AFFO/share growth doesn’t seem like much today, as interest rates peak and trend down, O will have the option to refinance its leverage at lower interest rates and those interest savings will go straight to the bottom line.

While we wait, we can expect slow, but methodical growth in earnings per share and the dividend from Realty Income as usual.

Conclusion

With decades of proven success, both W. P. Carey Inc. and Realty Income Corporation are excellent REITs to start building the foundation of your dividend portfolio. Both have existed through high-interest rates and low-interest rates, economic booms, and economic recessions. All while continuing to pour out income into their shareholders’ hands at a growing rate year after year. This is the kind of investment that a retiree dreams of, something that is stable and reliable. They don’t need to worry about the price movement day to day because they know that the next dividend check is in the mail.

Building a portfolio is similar to building a beautiful home or structure. You are both the architect and the construction crew, designing and constructing the structure. A key part of every building is its foundation; a weak foundation will cause a building to crumble in a matter of months or years versus standing for centuries to come. The greatest structures built by humanity have amazing foundations that have been able to stand the test of time. Every income portfolio should be comprised of at least 40 individual picks – Our Rule of 42 – but you’re going to need some picks that are considered foundational picks that you can stand upon and rely upon without needing to constantly spot-check them. Picks such as the ones we discussed today are foundational picks for your income portfolio. I consider it a must-own in my personal portfolio.

This way, while you’re enjoying your retirement, you know that your employees are hard at work earning you income every day, every month, and every quarter. The beauty of being a landlord or a boss is that you don’t have to do the hard work – you’ve got people doing that for you and earning you money. We have got our ‘model portfolio’ yielding +9% to work for us!

That’s the beauty of our Income Method. That’s the beauty of income investing.

Read the full article here