The Watches of Switzerland Group (OTCPK:WOSGF) is an unlisted stock trading on the OTC market. There was no annual report from its US website. So we went with the UK version. We hope this doesn’t distort the information that we gathered.

There really doesn’t seem to be much wrong with this stock. Yet, the Watches of Switzerland Group has seen its stock slide over a 1-year period. There has been a recent uptick in the stock, though. The shorter-time framed charts show that the stock price is rising. This might be the start of an uptrend and as investors warn its best not to take in profits too soon. We recommend holding the stock for those investors lucky enough to have bought some. For the others, it’s best to wait and watch the price action over the next month before buying some shares.

Background

The Watches of Switzerland Group has a well-invested portfolio featuring 131 showrooms in the U.K. and 40 stores in the U.S. The thing that really impresses us is the amount of time that WOSGF has been in business, over 90 years. Even so, the company gets a lot of points for operational excellence. Cutting-edge technology is employed with dynamic inventory management to optimize stock availability.

The recent IPO may have accelerated performance as CEO Brian Duffy emphasizes that the Group has produced record sales and profits. U.S. sales of £428 million were +48% on last year, boosted by a robust market, the Betteridge acquisition and the relaunch of luxury jewelry. The U.S. poses a strong growth opportunity for the Group and they could emerge as the clear market leader going forward.

The people who tend to purchase these sort of luxury watches are wealthy. The average age of a millionaire in the U.S. is 62. Consequently, the well-invested showrooms of WOSGF make for an attraction for these people who are not as tech savvy. Luxury watches make for great investments and the robust sales at WOSGF and the market in general is strong evidence of this. The WOSGF stores are truly one of a kind with spacious browsable environments that are sought out by this niche market. There is emphasis on delivering a world class customer experience and WOSGF has taken this a step further with ‘Xenia’ client service program across the U.K. and U.S.

What luxury watches have going for them?

Having bought a few of these timepieces, the first thing that comes to mind is the strong value retention of these items. They are both a functional good and at the same time are considered investment assets. The functionality comes in the form of being an excellent accessory to complement a well-dressed individual. Sometimes, a first impression is all that matters and a luxury watch ticks all the boxes when it comes to this. If you were to interview for a new job or get promoted, being well-groomed adds weight. On top of this utility, there is the real possibility that the watches increase in value. After all, it is something that can be passed down to the next generation.

Project pipeline

The European market is something that WOSGF is looking to tap into its next steps. FY23 will see the launch of three mono-brand boutiques in Stockholm, Sweden. A couple of stores are expected in Copenhagen, Denmark and one in Dundrum Dublin, Republic of Ireland.

In addition, in the existing U.K. and U.S. markets, a further 19 mono-brand boutiques are to be added to the showroom portfolio.

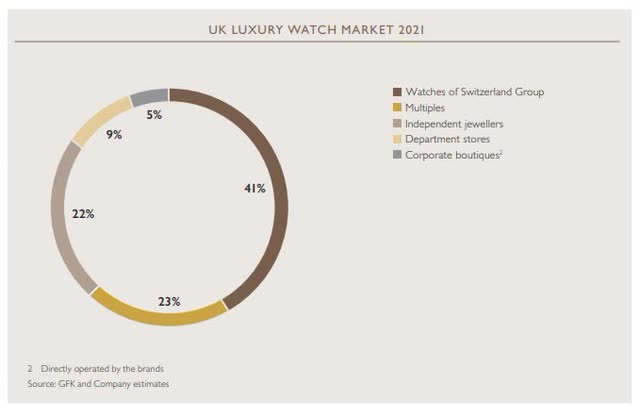

The U.S. is the largest global market for Swiss watch exports after having gone past China. Over in the U.K., WOSGF is the noticeable market leader as can be seen from the image below.

Directly operated by the brands (GFK and Company estimates)

Additionally, WOSGF is a major player in the pre-owned watch market. This is actually a growing sector since the supply of certain watches is much less than the demand in the first-hand market. Once again, this factor highlights the value proposition that luxury watches offer. There is a good amount of liquidity and the likelihood of really preserving value.

This article’s main focus will be on watches, but we wish to point out that the complementary luxury jewelry business is also doing well. This is due to this market growing at a CAGR of 7.7% from 2007 to 2021. There are well-known brands like Bvlgari, Gucci, Roberto Coin and Messika among several others that are retailed.

The Watches of Switzerland Group has a strong after-sales and servicing business. We believe that this important service should boost revenues as it prolongs the life of the products being sold by the company, thereby making the purchase worth the heavy price.

Long-standing partnerships

The one thing that pleases us greatly is that WOSGF has had long relationships with the luxury timepiece establishments that it sells. WOSGF has retailed with Rolex for over a hundred years. In 1919, the company was selected as one of the first retailers to sell the brand. The relationship with Patek Philippe goes back over half a century. The Audemars Piguet partnership spans five decades. These collections are on the top of watch enthusiasts’ wish lists. WOSGF’s relationship with Omega goes back to the 1950s. Omega is synonymous with space, James Bond and the Olympics. The Cartier relationship extends over seven decades. The storied company is widely regarded as the pioneer in watchmaking for men.

Tag Heuer is another brand that has a long-standing history with the retailer, having been in collaboration for 40 years. Other noteworthy brands that have been on offer for long periods of time are Breitling, IWC, Hublot, Panerai and Vacheron Constantin among several others. If you were to see the full range of high-end watches, you would definitely be spoilt for choice.

Financial Review

For WOSGF, growing revenue and profit is very important and a core part of their business strategy. Operating profit had shot up in the year, boosted by higher revenue. Net margin is on the rise having increased by 130 bps for the 52 weeks ended 1 May 2022. Free cash flow is also going up, having increased by £2.4 million to £112.1 million in the period to 1 May 2022. However, free cash flow conversion (a measure of liquidity) has dropped to 69.1% from 104.1% in the prior year.

The good profitability management can be seen in the fact that the adjusted EBIT increased by 68% on the prior year and basic EPS has grown from 21.1p to 42.2p. Additionally, return on capital employed and 4-wall EBITDA have increased substantially.

When looking at certain aspects of the business, we must mention that average selling price increased across all brands in comparison to the prior year. The number of showrooms is expanding as well, both in the U.K. and the U.S.

At first glance, the solvency ratios don’t appear too good. We feel that the total debt/equity (MRQ) is rather high at 126.85. This is because total debt of $626.47 million appears to be a relatively high figure. You’ll have to look at the complete picture and when you do this, the debt load is actually quite modest. With net debt at only 0.08 times EBITDA (as of May 2022), WOSGF cannot be seen as a reckless borrower. Furthermore, with the market cap at $2.39 billion, the Group can always raise cash to bolster its balance sheet.

With all the positive earnings, we believe its debt servicing ability would have improved even more. The Group is rated very highly at Simply Wall Street with no risks listed at all on the horizon. Analysts are in agreement that the stock price will go up as much as 42.3%. Another encouraging sign is that Watches of Switzerland Group has been able to grow its EBIT by 29% in twelve months, making debt repayment that much easier.

Risks

The business model was resilient during the pandemic. Nonetheless, there could be a drop in the stock price if risks are not properly managed. We identify data protection and cybersecurity as one such risk. Any kind of breach or hack may make the company vulnerable and this is a large retail operation so it automatically gets exposed to this type of risk.

The other risk that may result in the business being harmed is related to client experience and market risks. The waiting times for luxury watches could rise given the demand for them and this could adversely affect the client experience. In terms of competition, if the Group does not make the right moves there could be a loss of market share. Moreover, any drop in the ability to retain supplier agencies can negatively impact the business.

Then there is the real threat of ‘smart watches’ changing long term consumer attitudes leading to a reduced demand for luxury watches.

Conclusion – Don’t ignore the technicals

The stock has underperformed and it pays no dividend. While, the future prospects of the company’s business seem alright, there is an underlying issue. Could it be that too much cash is being held or some other fundamental reason? There has been a gradual rise in the cash position over the past decade. This may be an issue as too much cash can be seen as a drawback by investors. Nonetheless, the total cash per share is 0.55 and this indicates that the cash position is not too high. Yet, the buildup of cash over the years can be viewed negatively by Wall Street. We feel that the fundamentals look strong and so it is the technical front that might be to blame. You’d be better served picking some of the stocks that have been on a consistent uptrend for the time being.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here