This article is part of a series that provides an ongoing analysis of the changes made to Gabelli Funds’ 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 5/12/2023. Please visit our Tracking Mario Gabelli’s Gabelli Funds 13F Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q4 2022.

GAMCO’s (OTC:GAMI) (NYSE:GGN) (NYSE:GNT) Assets Under Management (AUM) is at around $35B. Their 13F portfolio is diversified with over 1200 positions in recent reports. Around 43 of them are sized above 0.5% of the portfolio and they are the focus of this article.

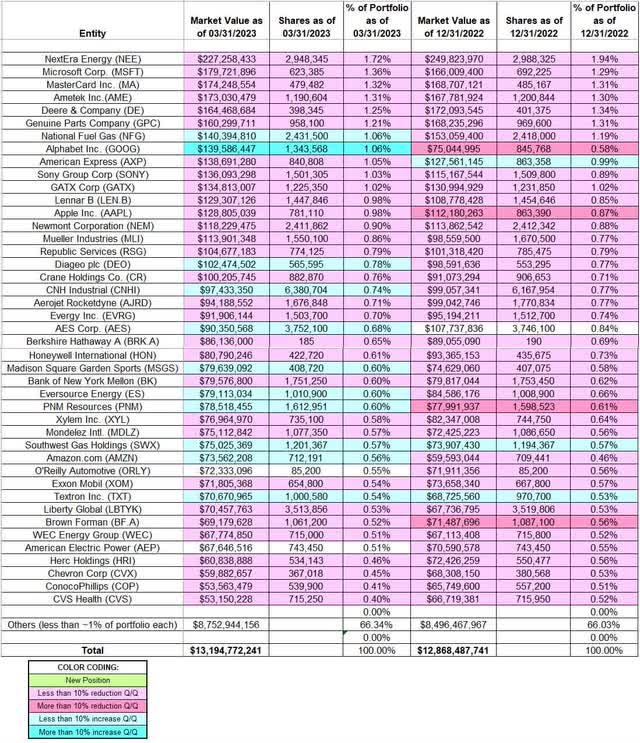

This quarter, Gabelli Funds’ (NYSE:GAB) (NYSE:GDV) (GUT) (NYSE:GGT) (NYSE:GLU) (NYSE:GRX) (NYSE:GCV) 13F portfolio value increased ~3% from $12.87B to $13.19B. The top five holdings are at ~7% of the 13F assets: NextEra Energy (NEE), Microsoft (MSFT), Mastercard (MA), Ametek (AME), and Deere & Company (DE).

Stake Increases:

National Fuel Gas (NFG): The ~1% of the portfolio NFG stake was built in the 2011-12 timeframe at prices between ~$43 and ~$75. The stake had seen minor trimming since. The ten quarters through Q2 2022 saw a ~25% reduction at prices between ~$38 and ~$74. The stock currently trades at ~$52. The last three quarters have seen only minor adjustments.

Alphabet Inc. (GOOG): GOOG is currently at ~1% of the portfolio. It was established in 2016 at prices between ~$34 and ~$40. There had been minor selling since. Recent activity follows. The seven quarters through Q3 2022 saw a ~20% trimming at prices between ~$87 and ~$150. That was followed with a ~40% reduction last quarter at prices between ~$83.50 and ~$105. This quarter saw the stake rebuilt at prices between ~$87 and ~$109. The stock currently trades at ~$123.

Diageo plc (DEO): DEO was a fairly large stake that has been sold down over the last decade through minor trimming in most quarters. Recent activity follows. 2020 saw a ~12% selling at prices between ~$110 and ~$171. The stock is now at ~$179 and the stake is at 0.78% of the portfolio. The last several quarters saw only minor adjustments.

Amazon.com (AMZN): AMZN is a very long-term stake. The original position was sold down in 2011 and rebuilt in the 2013-14 timeframe in the mid-teens price-range. The stake has wavered. Recent activity follows. 2020 saw a ~10% stake increase at prices between ~$89 and ~$170. The six quarters through Q2 2022 had seen a similar increase at prices between ~$104 and ~$185 through consistent buying in most quarters. The stock is now at ~$116 and the stake is at 0.56% of the portfolio. There was a ~7% trimming in the last two quarters while this quarter saw a marginal increase.

AES Corporation (AES): AES is a 0.68% of the portfolio long-term stake that has remained remarkably steady although adjustments were made in most quarters. The stock currently trades at $20.81.

AES Corp. (AES), CNH Industrial (CNHI), Eversource Energy (ES), Madison Square Garden Sports (MSGS), PNM Resources (PNM), Southwest Gas Holdings (SWX) and Textron Inc. (TXT): These very small (less than ~0.75% of the portfolio each) stakes saw minor increases this quarter.

Stake Decreases:

NextEra Energy (NEE): NEE is currently the largest 13F position at 1.72% of the portfolio. It was built during 2011 in the low-teens price range. The next several years saw minor trimming at higher prices. 2020 saw an about turn: ~250% stake increase at prices between ~$48 and ~$77. The five quarters through Q1 2022 had seen a ~10% trimming at prices between ~$71 and ~$93. The two quarters through Q3 2022 saw a ~16% stake increase at prices between ~$69 and ~$91. The stock currently trades at $74.48. There was minor trimming in the last two quarters.

Microsoft Corp. (MSFT): MSFT is a 1.36% long-term stake. The last major activity was in the 2011-12 timeframe when there was a ~20% reduction in the high-20s. There had been minor selling since. There was a ~10% reduction this quarter at prices between ~$222 and ~$288. The stock currently trades at ~$318.

Mastercard Inc. (MA): The 1.32% of the portfolio MA stake saw a ~47% selling during the 2016-20 timeframe at prices between ~$85 and ~$365. 2021-22 timeframe also saw a ~17% reduction at prices between ~$283 and ~$393. The stock currently trades at ~$386. They are harvesting gains. There was marginal trimming this quarter.

Ametek Inc. (AME): AME is a 1.31% of the portfolio position built in the 2011-12 timeframe at prices between ~$22 and ~$40. Since 2015, there has been a ~40% selling at prices between ~$44 and ~$148. The stock is now at ~$148. They are harvesting gains.

Deere & Company (DE): DE is a 1.25% of the portfolio long-term stake. The last decade has seen consistent selling every year. The period since 2010 saw the original position reduced by ~80% at prices between ~$75 and ~$445. The stock is currently at ~$364. They are harvesting gains. There was marginal trimming this quarter.

Genuine Parts Company (GPC): GPC is a 1.21% of the portfolio stake built in 2011 in the high-50s price-range. Recent activity follows. The last seven quarters saw a ~8% trimming. The stock is now at ~$165.

American Express (AXP): AXP is a ~1% long-term position that saw a ~50% selling over the 2017-2020 timeframe at prices between ~$74 and ~$135. The seven quarters through Q3 2022 saw a ~17% reduction at prices between ~$114 and ~$198. The stock is now at ~$153. The last two quarters saw only minor adjustments.

Sony Group (SONY): The ~1% of the portfolio SONY stake was built in the 2013-14 timeframe at prices between ~$11 and ~$22. Since 2019, there have been a 43% selling at prices between ~$42 and ~$126. The stock currently trades at ~$98. They are harvesting gains.

GATX Corp. (GATX): GATX has been in the portfolio for well over a decade. 2011 saw a roughly one-third stake increase at prices between ~$31 and ~$44. The 2014-16 timeframe saw a ~11% selling at prices between ~$36 and ~$63. The period since 2018 has seen another ~24% reduction at prices between ~$55 and ~$125. The stock is now at ~$114.

Apple Inc. (AAPL): AAPL is a long term ~1% of the portfolio stake. 2016 saw a ~50% stake increase in the mid-20s price range. 2017-2019 timeframe saw a ~60% reduction at prices between ~$30 and ~$74. Since then, the activity had been minor. There was a one-third reduction over the last three quarters at prices between ~$126 and ~$175. The stock currently trades at ~$175.

Newmont Corporation (NEM): NEM is a 0.90% of the portfolio long-term stake that has been in the portfolio for well over a decade. The position has wavered. Recent activity follows. Q2 2020 saw a ~12% selling at prices between ~$47 and ~$68. The last eleven quarters have seen only minor adjustments. The stock currently trades at $43.66.

Crane Company (CR): The 0.76% of the portfolio CR stake is a long-term position. The sizing peaked at ~1.35M shares in 2011 but has seen selling since. Recent activity follows. There was a ~13% selling in 2020 at prices between ~$40 and ~$88. The stock is now at $74.45. The last several quarters saw minor trimming.

Honeywell International (HON): HON is a 0.61% of the portfolio long-term stake that has seen selling since 2015. The 2016-2019 timeframe saw a combined ~55% reduction at prices between ~$104 and ~$182. Next year saw another ~38% selling at prices between ~$113 and ~$215. 2021 had also seen minor trimming while H1 2022 saw a marginal increase. The stock currently trades at ~$197. There was minor trimming in the last three quarters.

Liberty Global (LBTYK): LBTYK is a 0.53% of the portfolio stake. The bulk of the current stake was built in 2014 at prices between ~$30 and ~$40. It was sold down by ~30% next year at prices between ~$33 and ~$43. The last major activity was a ~16% stake increase in H2 2021 at prices between ~$25 and ~$30. The stock is now at $17.81. There was minor trimming in the last few quarters.

Aerojet Rocketdyne (AJRD), Bank of New York Mellon (BK), Berkshire Hathaway (BRK.B), Brown-Forman (BF.B), Chevron Corp. (CVX), ConocoPhillips (COP), CVS Health (CVS), Evergy Inc. (EVRG), Exxon Mobil (XOM), Herc Holdings (HRI), Lennar (LEN.B), Mueller Industries (MLI), Mondelez International (MDLZ), Republic Services (RSG), WEC Energy Group (WEC), and Xylem Inc. (XYL): These small (less than ~1% of the portfolio each) stakes were reduced during the quarter.

Kept Steady:

American Electric Power (AEP) and O’Reilly Automotive (ORLY): These two very small (less than ~0.60% of the portfolio each) stakes were kept steady this quarter.

The spreadsheet below highlights changes to Gabelli Funds’ 13F holdings in Q1 2023:

Mario Gabelli – Gabelli Funds’ Q1 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Gabelli Funds’ 13F filings for Q4 2022 and Q1 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here