Executive Summary

The Travelers Companies, Inc. (NYSE:TRV) is a US-based property and casualty insurance company, one of the country’s largest insurers. Thanks to a reliable and recurring underwriting performance, the insurer repurchased its shares actively and gradually increased its quarterly dividend over the last seventeen years.

The market rewarded the company’s conservative and straightforward capital distribution.

Company Overview

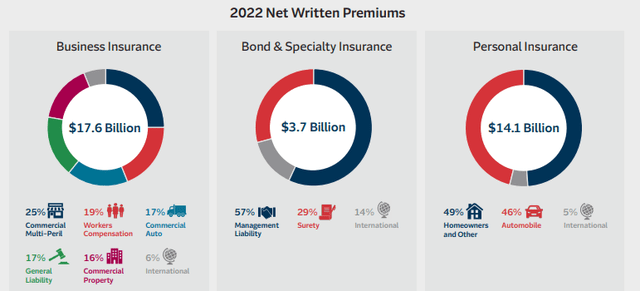

With 2022 net earned premiums of $33.8 billion, Travelers Companies, Inc. is a general business holding company that operates mainly in the United States (94.1% of the net written premiums in 2022). The company provides various commercial and personal P&C insurance products and services to businesses, government units, associations, and individuals.

Travelers Companies, Inc. groups its operations into three business segments:

2022 Annual Report – Travelers Companies, Inc.

Competitive Position: A Leading Player In The U.S. P&C Insurance Market

The Travelers Companies, Inc. is a leading provider of property casualty insurance for auto, home, and business. Hence it has a top position in both commercial and personal insurance lines of business. Mainly present in the U.S., the insurance portfolio of the U.S-based insurer is well-diversified regarding the types of products.

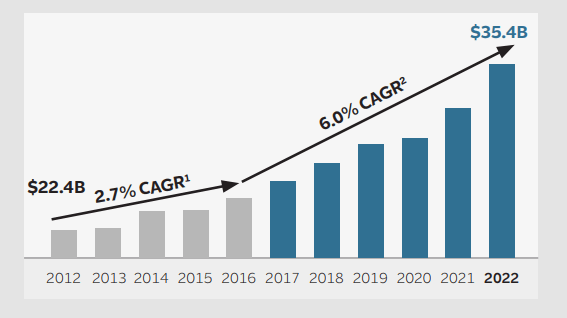

With a 4.2% annualized growth rate from 2012, Travelers Companies, Inc. is not a fast-growing company, although the premium growth accelerated from 2016 with a 6% CAGR.

2022 Annual Report – Travelers Companies, Inc.

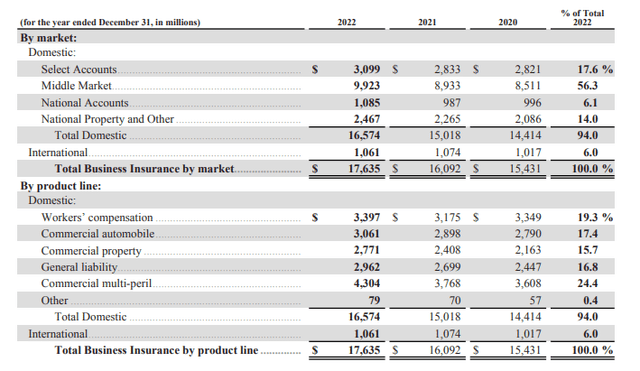

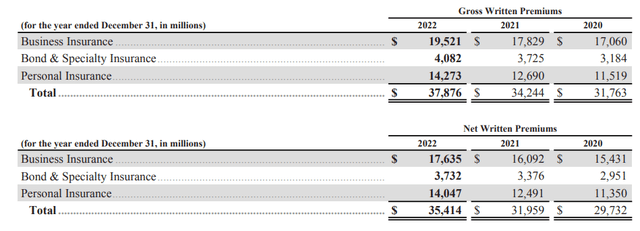

The growth in premium volume is mainly driven by the Business and Internal insurance segment, the company’s most prominent business segment. The business divisions’ net written premiums grew from $15.4 billion in 2020 to $17.6 billion in 2022.

2022 Annual Report – Travelers Companies, Inc.

Specialty and personal business divisions’ premium volume also increased during the 2020-2022 period.

2022 Annual Report – Travelers Companies, Inc.

Investors should not be dazzled by the positive commercial development observed during the last three years. An insurer does not make money by writing more premiums.

An insurance company makes money by only two means: it invests very efficiently the premiums paid by its policyholders or writes more premiums than it pays claims.

Hopefully, Travelers Companies, Inc. has succeeded in generating underwriting income over the cycle.

Operating Performance: The Resilience Of The Underwriting Expertise

The primary obvious metric for a P&C insurer is the combined ratio. It could be challenging to compare two different P&C insurers if the market is entirely different. Still, it is the most straightforward metric to say, at least, if a P&C insurer is profitable.

In Travelers’ case, the answer is simple: the company is profitable. It is mainly due to a strong underwriting discipline and a leading position in its markets.

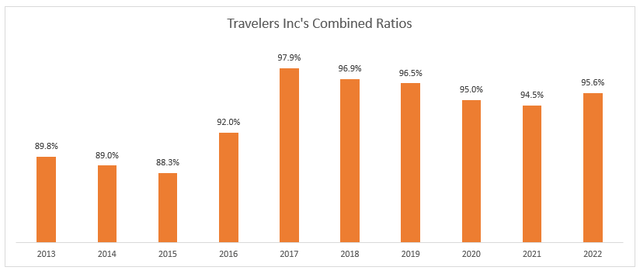

A 98% combined ratio for most insurance companies is the holy grail of underwriting performance. Travelers Companies, Inc. recorded a 10-year average combined ratio of 93.6%.

Travelers’ Annual Reports (info gathered by the author)

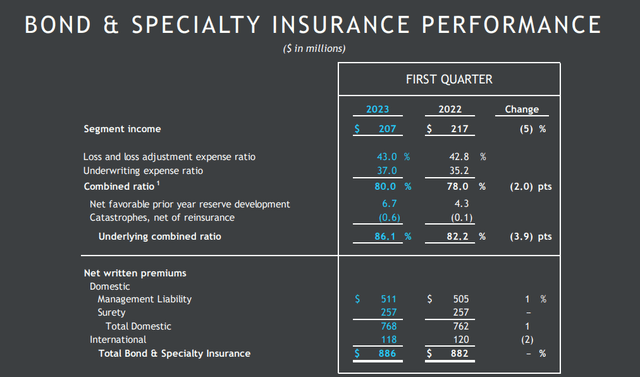

The insurer benefited from an excellent position in the specialty insurance market. The specialty insurance divisions delivered a reliable combined ratio oscillating between 75% and 85% over the years. In 2020, 2021, and 2022, the combined ratio of the specialty and bond insurance activities was 87.4%, 81.5%, and 75.3%, respectively.

In 03M2023, the specialty segment continued to perform well, with an underwriting gain of $165 million, resulting from a combined ratio of 80% for a premium revenue of $820 million.

Q1 2023 Presentation – Travelers Companies, Inc.

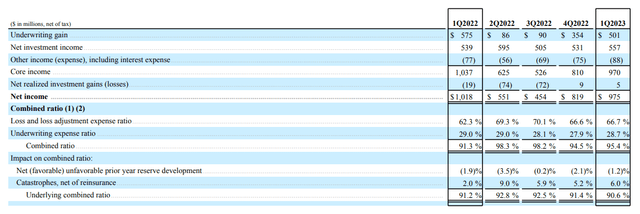

The company’s underwriting income was $501 million, for earned premiums totaling $8.9 billion.

Q1 2023 Financial Supplements – Travelers Companies, Inc.

32.9% of the total underwriting revenues were fueled by a segment representing less than 10% of the total earned premiums.

Thanks to the solid performance of the specialty business, Travelers, Inc. has been well-equipped to record reliable and recurring underwriting gains, despite the catastrophe losses observed in personal and commercial segments. Nonetheless, the insurer did not rest on its laurels.

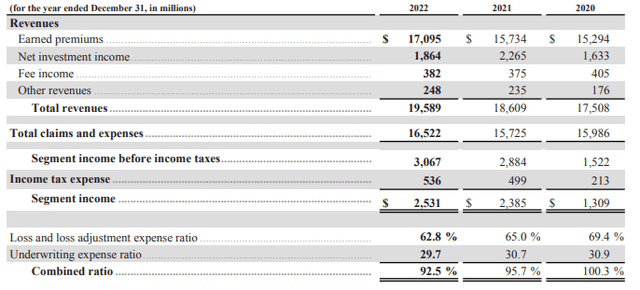

Over the last few years, the insurance company launched tariff and underwriting initiatives to restore the underwriting margins of the personal and commercial insurance divisions. Those repricing initiatives resulted in an improved underwriting income for the commercial insurance segment.

The combined ratio of the commercial business dropped from 100.3% in 2020 to 92.5% in 2022.

2022 Annual Report – Travelers Companies, Inc.

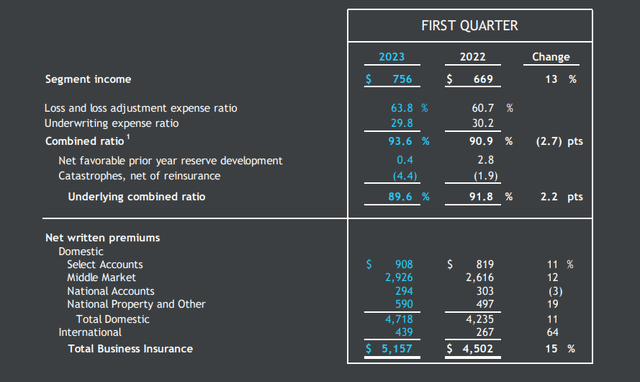

Despite higher catastrophe losses, the 03M2023 combined ratio remained low at 93.6%.

Q1 2023 Presentation – Travelers Companies, Inc.

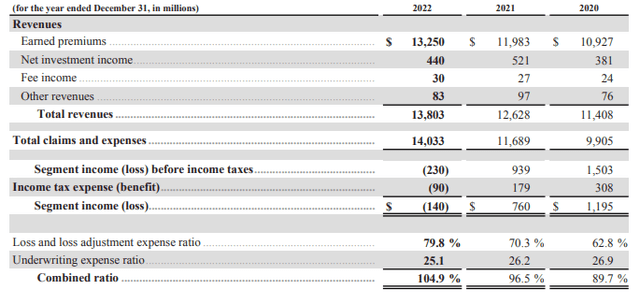

Due to the stay-at-home orders, the personal business benefited from COVID-19 in 2020 and 2021. Unfortunately, the segment suffered from claims inflation and catastrophe losses in 2022, resulting in a combined ratio of 104.9%.

2022 Annual Report – Travelers Companies, Inc.

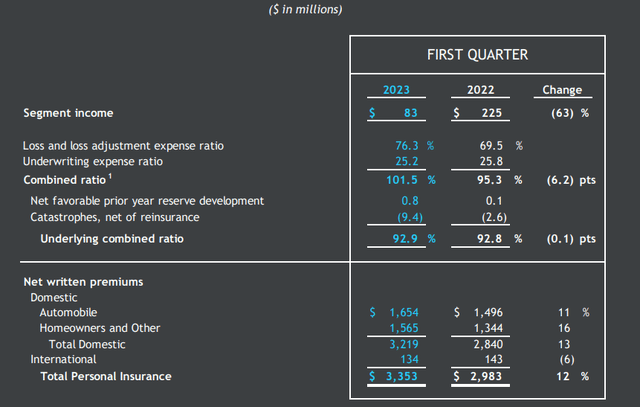

In 03M2023, the personal insurance business continued to be loss-making with a combined ratio of 101.5%.

Q1 2023 Presentation – Travelers Companies, Inc.

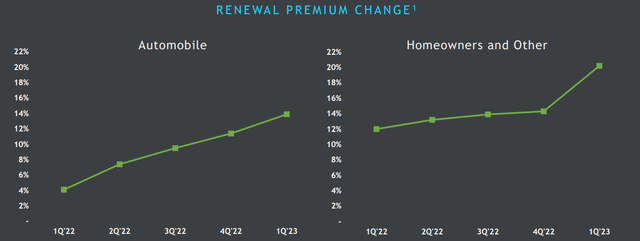

Higher catastrophe losses adversely affected the combined ratio despite massive tariff increases.

Q1 2023 Presentation – Travelers Companies, Inc.

However, those tariff increases are a good sign for improved profitability over the next quarters.

Travelers can count on the resilience of the specialty lines and the efforts made on both personal and commercial lines to deliver reliable underwriting income. Nonetheless, investors should keep in mind that catastrophe losses might deteriorate the underwriting profitability despite the reinsurance schemes and the underwriting and pricing efforts made by the company.

Stock Repurchase Program and Dividend: Nothing To Say, It Is Terrific

Travelers, Inc. is not a double-digit growing company. But no one could have the nerve to say Travelers Companies, Inc. is a non-rewarding listed insurer. Every long-term shareholder has been rewarded for their patience, investment, and trust in the company’s strategy.

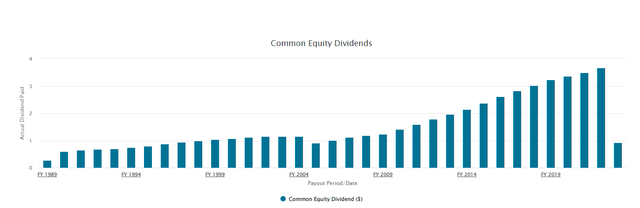

In 2006, the insurance company’s dividend was $0.91 per share. In 2022, the dividend per share amounted to $3.67, a 300% increase in sixteen years.

Travelers Companies, Inc.’s Investor Website

In 2023, the company’s management announced an 8% quarterly dividend increase.

Furthermore, the insurer massively repurchases shares each year. In 2006, the outstanding shares were 678 million. During the first quarter of 2023, the outstanding common shares amounted to 231 million, a circa 66% reduction since 2006.

With its consistent and straightforward capital distribution policy, Travelers Companies, Inc. could be a good choice for a dividend seeker. With a low payout ratio (around 30%), investors could continue being confident in the gradual increase in the cash dividend.

Stock Valuation: A High-Quality Company With A Book Value Premium

The company was rarely cheap in terms of valuation, usually traded from 1.2 to 1.5 times the book value. Investors always appreciated the company’s underwriting performance supporting the excess capital distribution to shareholders. With a price-to-book of 1.8, Travelers, Inc. is more expensive than its peers. Nonetheless, it is partially deserved, as the insurance company has proven its resilience and shareholder-friendly philosophy.

Final Thoughts

With a current expensive valuation, Travelers Companies, Inc. remains a very profitable insurance company that outperforms most of its peers in terms of profitability. Furthermore, the insurer is well-diversified and increases its dividend and repurchases its shares year after year. A lazy dividend seeker, who is not interested in any valuation consideration, should have this stock in their portfolio. An investor, more focused on some risk/reward metrics, could look at other insurance companies, which are more undervalued than the New York-headquartered P&C company.

Read the full article here