Investment Summary

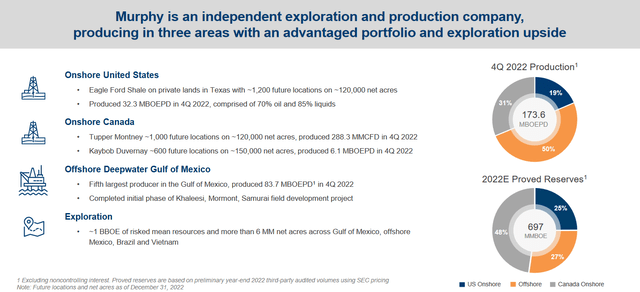

Murphy Oil Corporation (NYSE:MUR) is a renowned multinational energy company that operates on a global scale, involved in the exploration, production, refining, and marketing of valuable oil and gas resources. With a presence in multiple regions across the world, such as the United States, Canada, Malaysia, Vietnam, and Ecuador, Murphy Oil boasts a diverse portfolio of assets. The company’s upstream operations revolve around the exploration and extraction of crude oil and natural gas from various reserves. On the other hand, its downstream activities center on the refining and marketing of petroleum products to cater to the needs of consumers and industries.

The last earnings report highlighted the company’s ability to outperform its own estimates and led to 172.5 thousand barrels of oil produced each day, driven by the excellent performance of assets and locations in the Gulf Of Mexico. Looking at a YoY basis the company increased the bottom line impressively, but the last year did have a $300 million derivative loss in the quarter which did drag down the results. Nonetheless, MUR has kept up strong margins and the valuation right now makes it a buy in my opinion. The solid performance recently paired with the strong balance sheet makes me optimistic about the outlook for the company.

The Outlook For Oil And Gas

A complete transition away from oil and natural gas in the near future seems unlikely, given the need for significant shifts in major trends like replacing non-renewable energy sources. The sheer manpower and capital needed for this is just not possible to come up with right now even if we wanted. The logistics around changing the entire system we have built up is a project that will take many decades. Additionally, natural gas in the US continues to show resilience, with a projected 3% increase expected in 2023 compared to 2022 levels. This contradicts the notion of an immediate transition toward a greener society.

To capitalize on this ongoing trend, Murphy is actively allocating a substantial amount of capital to shareholders through dividends and buybacks. Despite the uncertain environmental landscape, there are estimates suggesting a recovery in the oil industry, even if sentiments surrounding non-renewable energy sources remain negative. Murphy strategic approach aims to position the company ahead of the curve in anticipation of a future where oil and gas may no longer be the primary energy sources. However, this transition is a distant prospect, and in the meantime, there are ample investment opportunities for those seeking to benefit from the profitability of companies like MUR.

Company Overview (Investor Presentation)

Given the focus on maintaining a clean and efficient balance sheet, coupled with ongoing accusations, MUR finds itself in a strong position to leverage any favorable industry tailwinds and drive further growth. While the long-term trajectory may point towards reduced reliance on oil and gas, MUR recognizes the existing market dynamics and remains committed to maximizing its profitability until the energy landscape undergoes a more substantial transformation. This will continue to bring value to shareholders as the company is able to give a large portion of it back to shareholders, through the above-mentioned means like dividends and share buybacks.

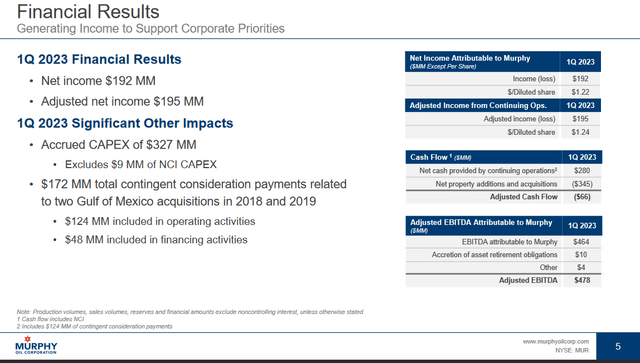

Quarterly Result

As mentioned at the beginning of the article, MUR managed to outperform its own estimates in terms of production. The company averaged 172.5 thousand barrels of oil produced each day for the quarter. Much driven by the great performance of some of the assets in the Gulf Of Mexico.

But it wasn’t just here there was an outperformance, natural gas production in Tupper Montney came in almost 10% higher than the estimates previously, reaching 292 MMFCD in the first quarter.

Earnings Highlights (Investor Presentation)

Looking at what the management had to say, they recognized the success in the Gulf Of Mexico and I would expect the trend to continue with outperformance and solid margins, Roger W. Jenkins, CEO said the following “In the Gulf of Mexico, we brought online Samurai #5 following last year’s discovery of additional pay zones in the field, and production is exceeding expectations”.

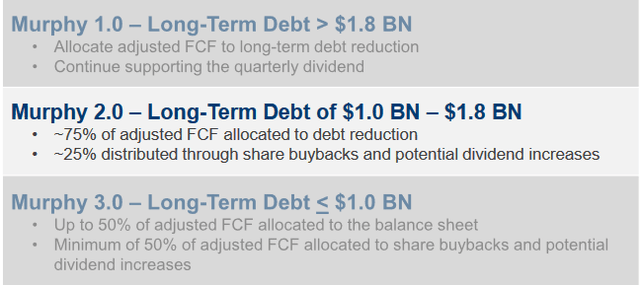

Capital Allocations (Investor Presentation)

Looking ahead, the company seemed certain about its guidance for the year, and I think the recent report might help support the case that MUR will reach a 10% oil volume in 2023 compared to 2022. As for what investors might see some benefit is the capital allocations program the company has. They maintain 3 different stages and are currently in Murphy 2.0, where 25% of adjusted FCF is used for dividends and buybacks. The point where investors would get a lot of value from being invested would be when long-term debts reach under $1 billion, a reduction of around $800 million from current levels, which wouldn’t be possible until 2024 if the $600 million in levered FCF are maintained as in 2022.

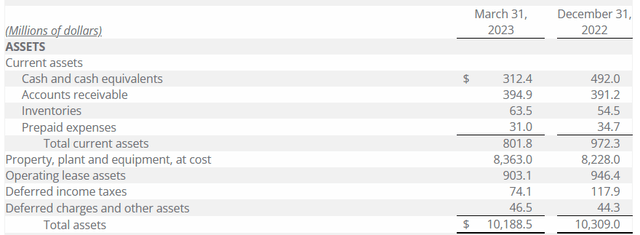

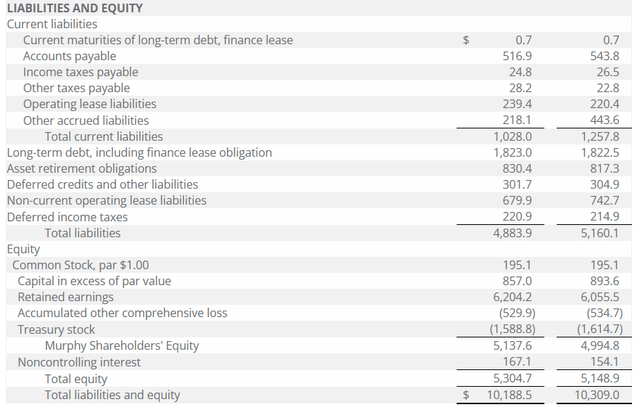

Financials

Looking at the balance sheet for the company a slight decrease in total assets has happened QoQ, but not enough to warrant any concerns in my opinion. The decrease was only around $120 million and the company still maintains over $10 billion in assets. Where I might see some concern though would be the cash position, decreasing nearly 43% from $492 million to $312 million. Margins are likely to be under pressure as oil markets aren’t at their highs, or anywhere near that. But as the market hopefully stabilizes somewhat I would expect the long-term positive trend to help MUR keep up margins, which would lend to better FCF to build up a cash position.

Company Assets (Q1 Earnings Report)

Looking at the long-term debts they have shifted little between the quarters, only slightly increasing by $1 million. It still sits at $1.8 billion which puts the company in the company in Murphy 2.0. I am not worried about the level of debt the company has as, the net debt/EBITDA ratio still sits quite low at 0.87 which leaves room to increase without becoming a concern, anything below 3 is great.

Company Liabilities (Q1 Earnings Report)

Moving into the coming quarters, production will be key to watch in terms of revenues, but looking at the balance sheet, a slight increase in the cash position would be of great benefit in my opinion. It would provide the company with a more flexible financial state which would lend them to be able to continue investing heavily in the Gulf of Mexico where they have production.

Valuation And Wrap Up

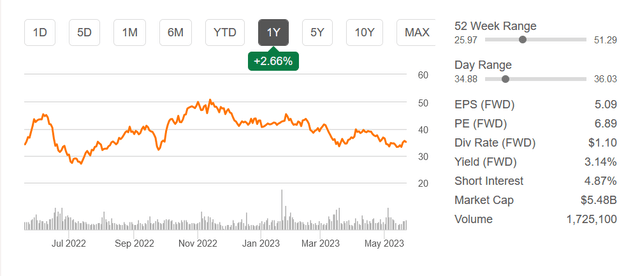

All in all, I think Murphy Oil Corporation is a buy right now. The demand for oil and natural gas will be here for many more decades. During that time I think MUR will be able to generate ample cash flows to give investors long-term value through buybacks and dividends. The balance sheet is kept under strict management and $1.8 billion in long-term debt is very manageable. The recent earnings report also highlighted the potential of the Gulf Of Mexico which MUR continues to invest in.

Stock Chart (Seeking Alpha)

With 2023 expected to generate 10% more in oil volumes than 2022 I think MUR is a solid investment right now. It offers a slightly more globally diversified exposure to the industry, as opposed to more purebred companies solely operating in the United States or in Canada. With a forward p/e of under 7, there is room for a correction upwards to between 8 – 9 which the sectors have.

Read the full article here