Thesis

The Simplify Intermediate Term Treasury Futures Strategy ETF (BATS:TYA) is a fixed income exchange traded fund. As per its literature:

The Simplify Intermediate Term Treasury Futures Strategy ETF seeks to provide total return, before fees and expenses, that matches or outperforms the performance of the ICE US Treasury 20+ Year Index on a calendar quarter basis. The Fund does not seek to achieve its stated investment objective over a period of time different than a full calendar quarter.

As per its definition, the ICE US Treasury 20+ Year Index is designed to measure the performance of U.S. dollar-denominated, fixed rate treasury securities with a minimum term to maturity greater than twenty years. STRIPs are excluded for the purpose of this index. The best known cash ETF in the space is the iShares 20+ Year Treasury Bond ETF (TLT) which is set to replicate the ICE US Treasury 20+ Year Index via cash bond purchases.

TYA on the other hand, utilizes futures rather than cash bonds. Treasury futures are standardized contracts used to buy or sell U.S. government bonds for future delivery. They have less of an impact on the balance sheet versus an outright bond, and are traded on futures exchanges. Treasury futures are settled through physical delivery if held to maturity. This means that on the expiration date, the seller of the contract must deliver the underlying Treasury security to the buyer.

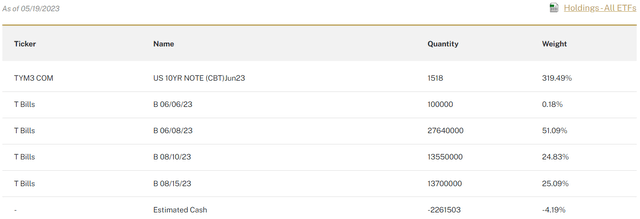

An easy way to visualize what TYA is doing is by looking at its holdings:

Holdings (Fund Website)

We can see the fund holding a large position in the “TYM3” treasuries futures contract, and most of the cash sitting in short dated T-Bills. As mentioned above, treasury futures have a low impact on the balance sheet, with only a margin requirement by the exchanges, hence the fund can hold most of its cash in T-Bills.

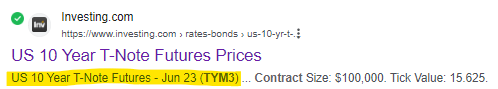

Now the problem which we have with this fund is that upon closer inspection we uncover that the “TYM3” contract is actually a 10-year treasury futures contract:

10Y Treasury Futures (Investing.com)

Why would this fund hold 10-year treasury futures when its stated goal is to track the ICE US Treasury 20+ Year Index? As we have seen above, the index is composed of securities with maturity dates above 20 years.

We are presuming the fund manager is trying to speculate the 10-year point in the curve will do better than the long end, and thus create value for the fund, yet this is outside the stated goal for the fund. We do not like these sort of actions outside a stated mandate because they go contrary to what the fund is supposed to do. If the goal is to follow the 20-year treasury bond futures, then just roll that contract.

From a performance standpoint TYA underperforms TLT significantly, both on a 1-year and 2-year lookbacks. There is a cost component when rolling futures, but more importantly when Fed Funds were not as high as today the vehicle did not clip any yield from its cash holdings. A pure cash fund like TLT will have coupons coming in from its holdings. TYA invests in short term T-Bills, and when Fed Funds were very low, the vehicle has a very low coupon stream coming in.

Given where we are in the rates cycle, with what we believe the last Fed hike behind us now, we think TYA will post a positive performance in the next 18 months. However, TLT is a much better choice than TYA given its consistency in achieving its stated goals. We do not like TYA’s composition or its current holdings which deviate from its stated goals. New investors should shy away from this name, while existing shareholders should Hold for now, expecting lower rates in 2024.

Performance

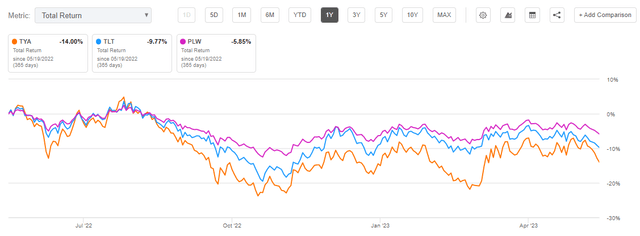

Let us have a look at how TYA did in the past year:

1-year Total Return (Seeking Alpha)

We are comparing TYA here with the iShares 20+ Year Treasury Bond ETF and the Invesco 1-30 Laddered Treasury ETF (PLW), two cash bond funds. TLT has a duration of around 17 years, while PLW has a duration of roughly 10 years. TYA has consistently underperformed both cash bond funds in the past year.

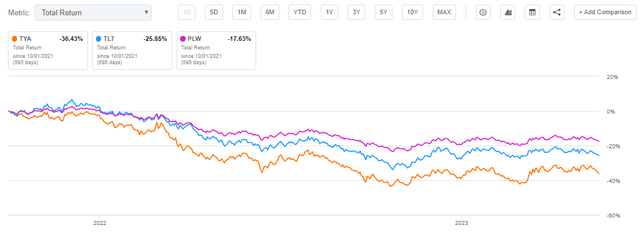

In fact, the ETF has underperformed since inception:

2-year Total Return (See)

The fund IPO was in late 2021, and has managed to underperform both cash vehicles ever since.

Conclusion

TYA is a fixed income ETF. The vehicle aims to replicate the ICE US Treasury 20+ Year Index on a quarterly basis via holding futures contracts. Unlike outright cash bonds, futures have a low impact on the balance sheet, allowing most of the held cash to be invested in short term T-Bills. While there is a roll component to the fund, where rolling into a new contract can cost the fund returns, the current issue with this vehicle is the fact that it is holding 10-year Treasury futures rather than 20 or 30 year ones. We are not sure why the fund is doing something outside its stated mandate, but we are presuming the manager thinks that point in the curve is more attractive. Due to the cost associated with rolling futures and the fact that historically the front end of the curve has yielded less than the long end, TYA underperforms significantly its cash bond peer TLT. TLT is down -25% on a 2-year basis while TYA is down -36%. New investors should shy away from TYA given its structural issues, while existing shareholders should Hold for now, expecting lower rates in 2024, and with a target exit date in late 2024.

Read the full article here