Thesis

I have previously argued that UBS Group AG (NYSE:UBS) scored a ‘monster bargain’ buying Credit Suisse for about $3.25 billion. And following UBS Q1 2023 results and early management guidance about the merger integration, I am gaining confidence in my assessment that UBS closed an exceptionally attractive deal; and that the bank’s shares are very likely deeply undervalued.

Reflecting on a strong Q1 earnings report, and encouraging management guidance relating to the CS integration, I update my EPS expectations for UBS through 2025; and I now calculate a fair implied target price of $35.69/ share.

Making Progress on The CS Deal

According to UBS latest F4 filing, the Swiss banking giant is making progress with the CS acquisition deal, and early management estimates about financials are encouraging.

Although the integration work will likely occupy UBS management’s time and effort throughout a four-year period, the bank anticipates that the CS takeover will be legally finalized within the next few weeks (I estimate late June/ early July).

In the context of the takeover, UBS has offered an estimate on the likely financial impact of ideal, disclosing that it expects to realize a $35 billion accounting gain on ‘badwill accounting’, which will give the bank substantial buffer to absorb losses and integration expenses. Additionally, UBS revealed $17 billion in asset write-downs and litigation provisions related to the merger.

Admittedly, the disclosed accounting gain is lower than many analyst forecasts, which have estimated a transaction-related gain of up to $50 billion. But investors should also not forget that these accounting estimates do not change the value obtained through the deal, and there are good arguments to be made that the real economic value is in line with analyst estimates at around $50 billion (note that UBS management is clearly incentivized to aggressively mark down value estimate and gradually phase the value back in through earnings once the economic benefit of assets is captured).

What The New UBS Will Look Like

UBS management affirmed that the merger will not change the bank’s existing strategy, emphasizing a commitment to low-risk operations and an asset-light approach in the Wealth and Asset Management sectors, with the investment bank targeted to account for less than 25% of RWA. However, the Credit Suisse deal will bring scale to the strategy, bringing UBS’ total invested asset base to CHF ∼5 trillion. This positions UBS to be the world’s second-largest wealth manager, trailing only behind Morgan Stanley. Moreover, in terms of asset management, UBS is projected to secure the third position in Europe and the eleventh globally. Or in the words of UBS CEO Sergio Ermotti:

… if I look at every business, it will be stronger and better, it will generate more profits; and our shareholder will benefit

Following the completion of the transaction, UBS AG and CS AG will function as a consolidated entity, under the responsibility of the UBS Group of Directors and UBS Executive Board. However, it is important to note that both franchises will continue to retain separate operational structures for the foreseeable future, with a gradual phased approach to integration.

There are a few notable updates to be shared relating to management talent: Ulrich Koerner, the CEO of CS AG, will become a member of both CS and UBS operational division. The divisional heads of CS will report to Koerner and the respective UBS Board member following the completion of the transaction. Sarah Youngwood, the current CFO of UBS, will depart from the company, and Todd Tuckner, the CFO for the GWM division, will assume the role of CFO. Additionally, Iqbal Khan will remain the President of Global Wealth Management, and Beatriz Martin Jimenez, currently the Head of UBS UK and Group Treasurer, will take on the positions of Head of Non-Core and Legacy and President of EMEA.

With regards to the CS’s Swiss business, UBS has said to evaluate all possibilities, but indicated no ambition of a sale or spin-out.

Strong Q1 Report Supports Earnings Confidence

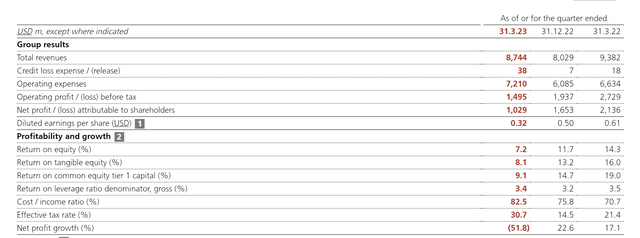

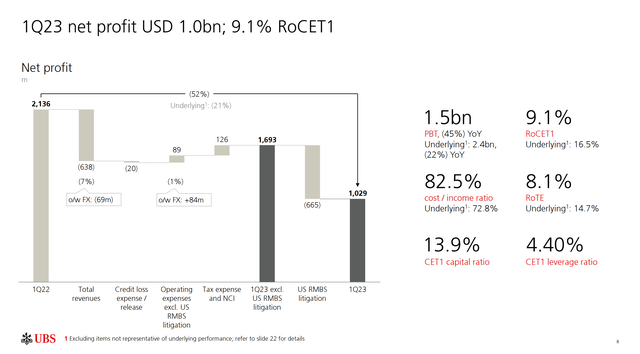

During what has undoubtedly been a very noisy quarter, the UBS standalone franchise performed exceptionally well and highlighted earnings resilience. In Q1 2023, the Swiss bank generated total sales of about $8.7 billion, versus $9.4 billion for the same period in 2022 (7% YoY contraction), and approximately in line with the topline estimated by analysts.

With regards to profitability, UBS’ profit from operations came in at $1.5 billion, implying a 8.1% return on tangible equity and a 82.5% cost income ratio.

UBS Q1 2023 reporting

While profitability is clearly down vs. Q1 2022, investors should consider, however, that UBS’ results were impacted by $665 million litigation expense relating to the settlement of the RMBS U.S. lawsuit.

UBS Q1 2023 reporting

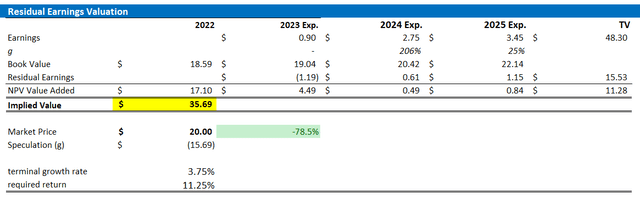

Valuation Update – Raise Target Price

Accounting for a strong Q1 earnings report, and encouraging management guidance relating to the CS integration, I update my EPS expectations for UBS through 2025: I now estimate that the Swiss banking giant’s EPS in 2023 will likely end up somewhere between $0.8 and $1.0, as compared to about $2 prior (reflecting frontloading of restructuring charges). However, I materially raise my EPS expectations for 2024 and 2025, to $2.75 and $3.45, respectively.

In addition, I update my terminal growth rate expectation to 3.75% (almost two percentage points higher than estimated nominal global GDP growth), and cost of equity estimate to 11.25%.

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price for UBS equal to $35.69/ share.

Company Financials; Author’s Estimates; Author’s Calculations

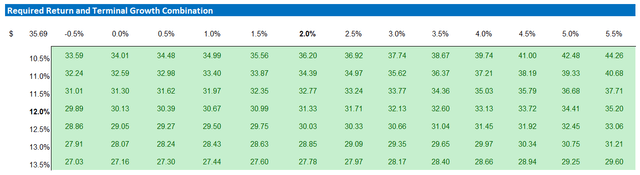

Below is the updated sensitivity table.

Company Financials; Author’s Estimates; Author’s Calculations

Conclusion

I was bullish on UBS before the CS deal, as I viewed the Swiss bank as an exceptionally well-positioned and well-managed wealth and asset manager. But now, after UBS acquired its biggest competitor for close to nothing, and making good progress with the deal execution, my long-term thesis is becoming even more colorful.

Reflecting on a strong Q1 earnings report, and encouraging management guidance relating to the CS integration, I update my EPS expectations for UBS through 2025; and I now calculate a fair implied target price of $35.69/ share.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here