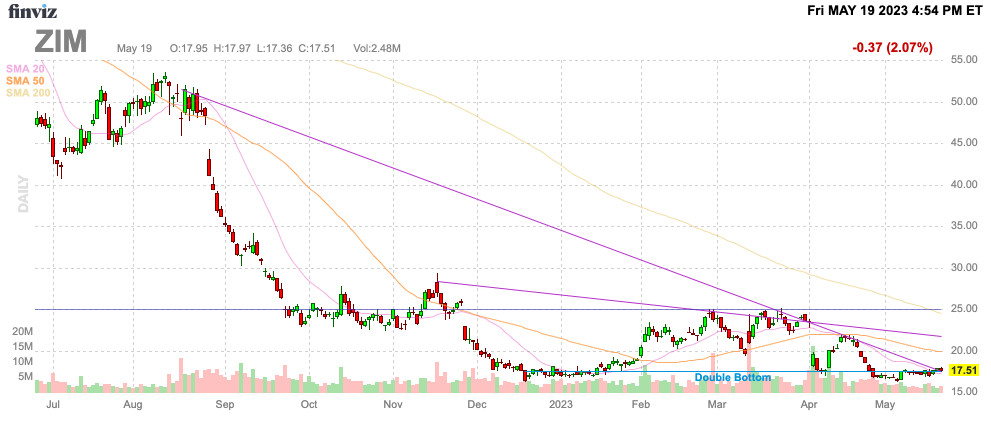

As ZIM Integrated Shipping Services (NYSE:ZIM) is set to report Q1’23 earnings on Monday before the market opens, the market still appears bullish on the container shipping stock. The company is set to report a large loss for the quarter, but some investors still forecast a dividend surprise, which would require a profit for the quarter. My investment thesis remains Bearish on the stock heading into a lackluster year ahead.

Source: Finviz

Lots Of Red Ahead

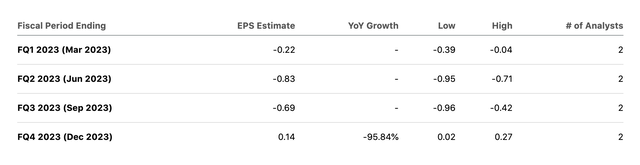

Analysts forecast ZIM reporting the following numbers for Q1 as follows:

- Consensus EPS Estimate is -$0.22 vs. $14.19 year ago

- Consensus Revenue Estimate is $1.59B (-57.3% Y/Y)

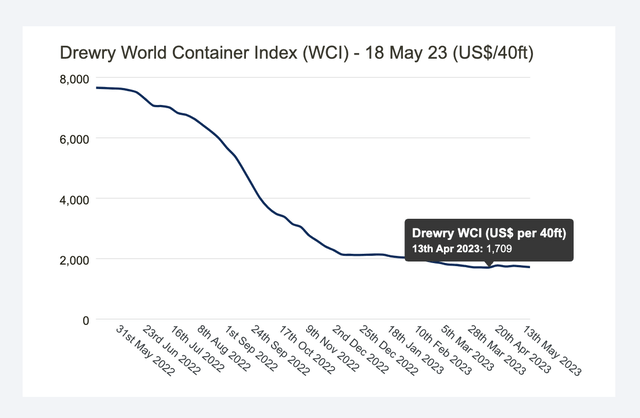

ZIM faces a tough market ahead with the Drewry Index trading mostly along the bottom for the last month or so. The May 18 shipping rate for a 40-foot container was $1,720, up so slightly from a $1,709 low rate back on April 13.

Source: Drewry Index

The negative part for bulls is the shipping index rate continues to dip again from the $1,774 high back on April 20. The World Container Index dipped $54 in the last month alone and appears poised to set new lows.

The index actually sits 21% higher than the average 2019 (pre-pandemic) rates of $1,420 in a positive sign, but also an indication of how low the rates can head. Investors should assume this is the low rate of the cycle.

The problem for ZIM is that the lows weren’t reached until the start of Q2. Whatever the container shipping company reports in Q1, the numbers will only get worse for Q2 and possibly into Q3.

Apparently, not many analysts forecast quarterly numbers on ZIM, but the consensus from 2 analysts is a far larger Q2 loss. In total, these quarterly losses amount to only a $1.60 loss for 2023 while the average of 6 analysts have a yearly forecast predicting a much larger loss of $2.54 per share.

Source: Seeking Alpha

The implication is that the quarterly numbers above will likely be far worse. The average analyst is actually predicting a nearly $0.25 additional loss per quarter during 2023.

Remember, ZIM still plans to take on newbuilds over the next couple of years amounting to 41 vessels with 58 charters up for renewal during 2023 and 2024. The company will likely not renew existing charters to not be stuck with extra inventory, but these container ships will hit the market whether ZIM markets them or someone else.

On the Q4’22 earnings call, CEO Eli Glickman was clear the vessels chartered from tonnage providers were at rates that will only be kept with renewals at lower rates:

Now, when we look at the vessels that come up for renewal, in ‘23 and in ’24, that’s clearly 50 vessels, most of them it is very likely, depending on what the market does, but if the market conditions remain difficult, most of those vessels will be delivered. We do not intend to break any of our commitments, vis-a-vis any of the tonnage provider, we will make the decision to redeliver tonnage when we have the ability to do so, or engage early with some tonnage provider to potentially discuss extension, if we think and at a lower rate, obviously, if we think that this suggests will be overused for us for longer period.

Only last month, ZIM announced the commissioning of 2 new LNG-powered vessels right into a market where demand is low. The container shipping company commissioned these vessels under a long-term chartering agreement with Seaspan Corporation at rates that are unlikely to be favorable to ZIM at this point considering the deals were signed back in February 2021.

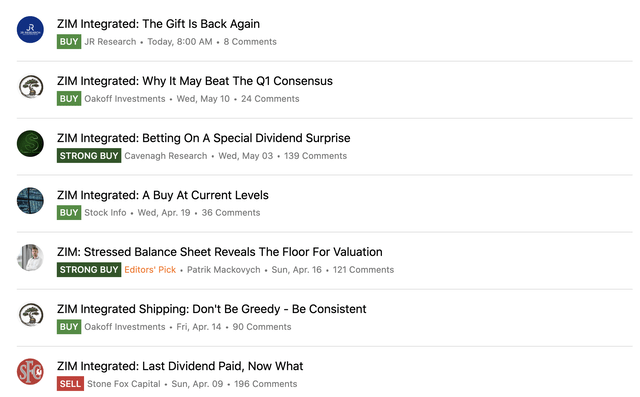

Too Many Bulls

The amazing part of the ZIM story is how bullish Seeking Alpha contributors have become. Since Stone Fox Capital wrote the bearish article back in early April, the last 6 articles from 5 different contributors have all been bullish.

Source: Seeking Alpha

As established above, ZIM is set to report a Q1 loss starting a long string of large losses in the years ahead. Most investors buy this stock for the dividend and the company appears unlikely to pay a dividend with operating losses.

ZIM guided to 2023 adjusted EBIT between the $100 and $500 million range, providing investors with hope. As discussed before, the company was very bullish on shipping rates rising in the 2H of the year and that still appears unlikely.

Just today, Foot Locker (FL) highlighted an elevated inventory level leading to slashed financial targets. The footwear retailer will surely reduce demand for additional shipments from the likes of NIKE (NKE) in the year ahead. Foot Locker as depressed sales and inventory up 25% not providing an ideal time to forecast a rebound in container shipping rates.

Takeaway

The key investor takeaway is that a lot of investors still appear bullish on ZIM despite the company not expected to report a profit for several years. The primary investor base expects a dividend and the container shipping company switching to losses could usher out the remaining bulls expecting additional dividends.

Read the full article here