Introduction

It’s time to discuss Steel Dynamics (NASDAQ:STLD). This Indiana-based steel giant is one of America’s best-performing industrial stocks and one of the few high-quality dividend growth stocks in that industry. After starting 2023 the way it ended 2022, by rapidly rising to new all-time highs, the stock has run into resistance. Its stock price is now roughly 30% below its all-time high.

In this article, I want to discuss why the stock did so well, why it is now selling off, and what secular developments like supply chain re-shoring mean for the company behind the STLD ticker.

So, let’s get to it!

A Remarkable Steel Stock

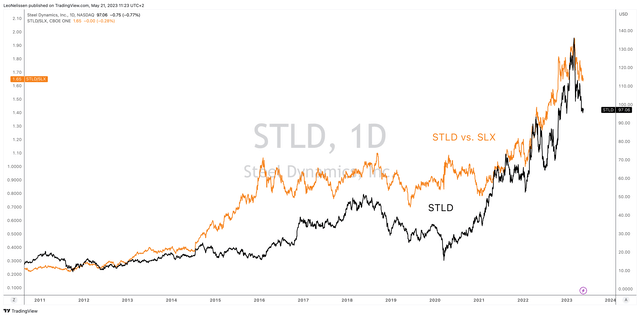

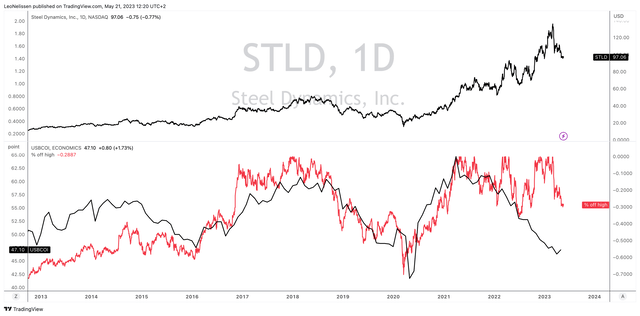

With a market cap of roughly $17 billion, Indiana-based STLD is America’s second-largest steel company. Not only that, but the company is an outperformer. As the chart below shows, the company has consistently made new highs during economic upswings.

Earlier this year, the company’s stock price was 160% above its 2018 peak, which makes STLD one of the best steel stocks in the world. Moreover, the chart below displays the ratio between STLD and the steel ETF (SLX), which shows that STLD usually outperforms its peers during stock price rallies.

TradingView (STLD, STLD/SLX)

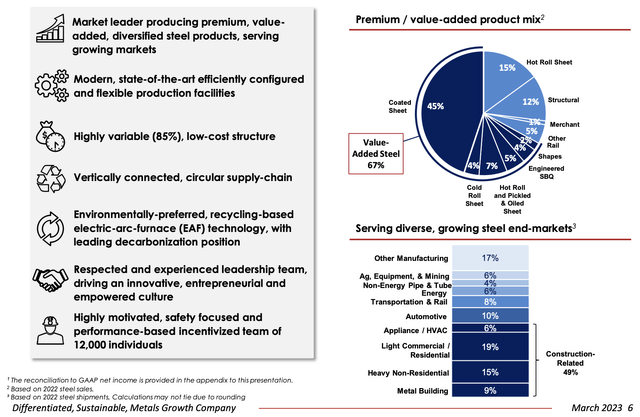

One of the reasons why the STLD stock price is in a long-term uptrend is the fact that the company is producing value-added steel products.

Companies that produce basic steel products are usually way more prone to commodity prices with limited pricing power. This isn’t the case when dealing with STLD. Roughly two-thirds of its product portfolio is value-added steel.

Coated steel, which is the company’s biggest product category, is ideal for uses that require resistant, aesthetic, light, and cost-effective materials. This includes construction, automotive, and other sectors.

Steel Dynamics

In these categories, the company is the market leader, which allows it to go far up the value chain of various steel products.

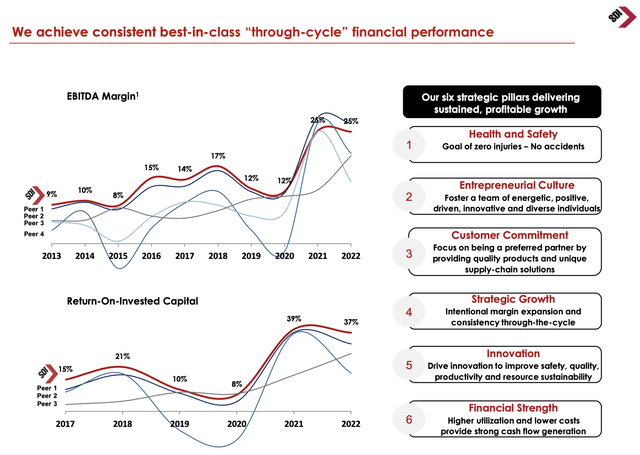

In this case, the company doesn’t just have strong pricing power, but it also enjoys high margins and returns on invested capital. In both categories, the company is a leader in both economic upswings and downswings.

Steel Dynamics

Not only does this data show how resilient the company’s margins are during downswings, but it also explains why STLD is a source of outperforming capital gains.

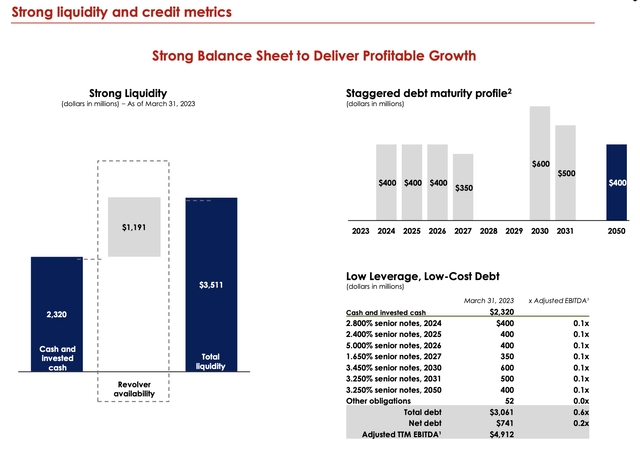

The company also has an incredibly healthy balance sheet. The company has $3.5 billion in available liquidity, most of which is cash on hand.

Furthermore, STLD has no debt maturities in 2023 and a net debt ratio of less than 0.3x EBITDA. Even the total debt ratio remains below 1x EBITDA. The company enjoys a BBB credit rating. At the end of this year, the company is expected to have $130 million in net cash, meaning more cash than gross debt.

Steel Dynamics

This company also comes with a strong dividend track record.

The STLD Dividend & Shareholder Commitment

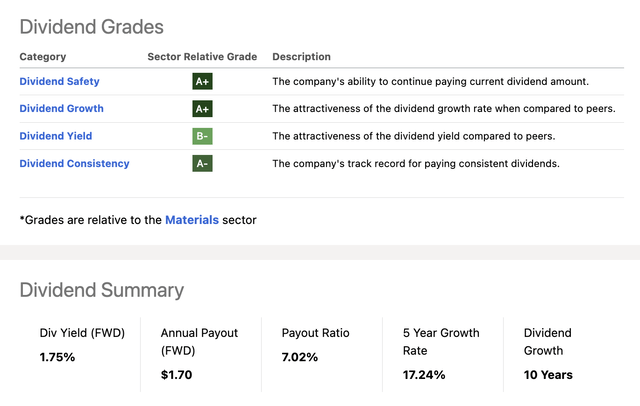

STLD doesn’t just come with steady long-term capital gains, but it also has a fantastic dividend scorecard. The company scores high on safety, growth, and consistency.

Seeking Alpha

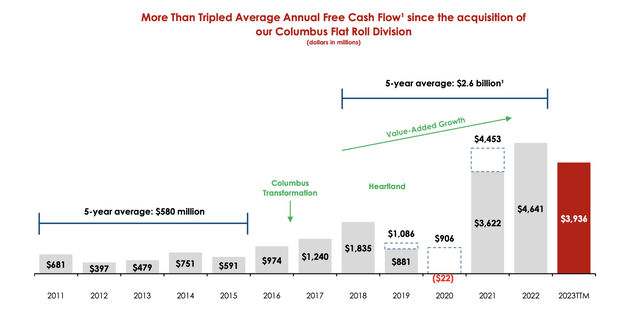

- Steel Dynamics has a 1.75% yield protected by a 7% payout ratio. This is a result of increasingly efficient and profitable operations. Prior to 2016, the company generated roughly $580 million in annual free cash flow. The five-year average ending 2022 was $2.6 billion.

Steel Dynamics

- Over the past five years, the average annual dividend growth rate was 17%.

- On February 27, management announced a 25% dividend hike.

- The company has hiked its dividend for ten consecutive years, which includes the pandemic and the manufacturing recession of 2015/2016, which did a number on STLD and its peers.

Furthermore, in the first quarter, the company authorized repurchases of $980 million, which, according to the company, reflects the strength of its capital foundation and strong cash flow generation. Given the numbers we just saw, that makes sense.

This capital allocation strategy prioritizes high-return strategic growth and shareholder distributions while maintaining investment-grade credit metrics. Everything else wouldn’t be sustainable.

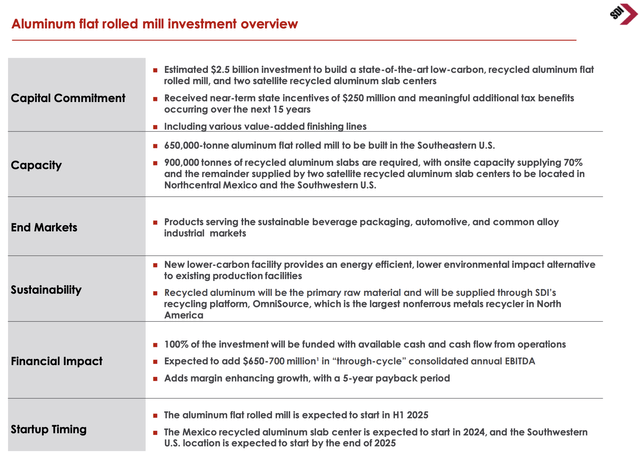

The company’s aluminum growth strategy will be funded with available cash and cash flow from operations and a commitment to strong and responsible shareholder distributions.

When it comes to aluminum, the company is working on a state-of-the-art facility located in Columbus, Mississippi, aimed to serve various sectors. This would add significant through-cycle annual EBITDA for the company, based on a capacity of 650 thousand tons per year. The project was well-funded and expected to start operations in the mid-2020s.

Steel Dynamics

So, why is STLD selling off?

Recent Developments, Including Its Sell-Off

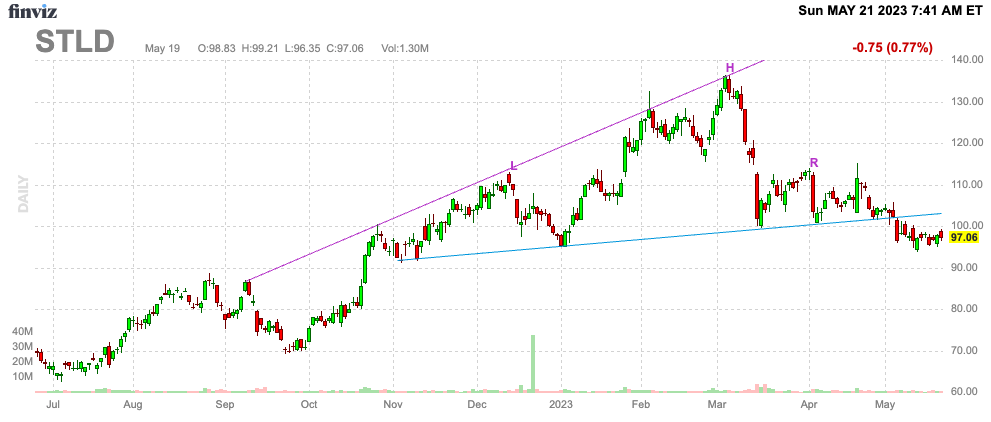

STLD shares are selling off. The stock price is currently roughly 30% below its 52-week high, which makes it one of the more severe stock price declines in recent history.

The chart below shows the STLD stock price and the direct comparison between the ISM Manufacturing Index and the distance STLD shares are trading below their all-time high (in %).

TradingView (STLD, ISM Index)

What we see is that economic growth expectations have come down a lot. The ISM index is now indicating manufacturing contraction, which is leading investors to sell cyclical stocks – including STLD.

However, STLD shares aren’t selling off as much as they did in prior cycles. One reason is secular tailwinds, which weren’t a huge factor in the past.

In 1Q23, total revenues were $4.89 billion, which is 12.2% below the 1Q22 result. Despite this decline, the company commented on the health of its market.

The metals market, for example, saw increased volumes and improved metal margins. Ferrous scrap prices saw improvement in December and throughout the first quarter. Steady pricing at higher levels was anticipated due to increased seasonal demand from North American steel mills in the second and third quarters.

The steel operations of the company achieved record quarterly shipments of 3.3 million tons. Its steel production utilization rate, excluding Sinton, was 94% compared to the domestic industry rate of 75%.

Adding to that, the non-residential construction markets are expected to remain strong, with forecasts indicating strong starts, build rates, and increased spending in 2023 compared to the previous year.

Furthermore, onshoring manufacturing businesses and infrastructure spending programs are expected to provide momentum for additional construction spending.

There’ll be continued onshoring of manufacturing businesses and infrastructure spending programs should provide momentum for additional incremental construction spending.

Onshoring is one of my biggest themes since the pandemic, as it benefits the US tremendously. This includes steel companies like STLD, which not only delivers steel for construction but also for automobile markets.

This includes its increasing aluminum footprint, which benefits automotive customers, appliances, and a wide range of renewable energy applications.

Another benefit is its recycling platform. The geographic footprint of its metals recycling operations provided a strategic competitive advantage, particularly with growing volumes in Mexico, which enhanced raw material positions and supported future flat-rolled aluminum investments.

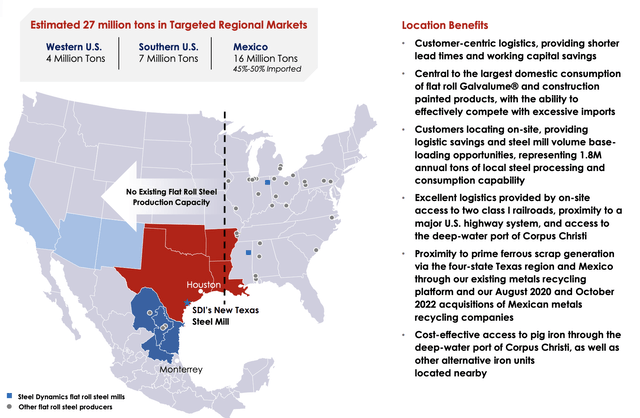

Regarding its geographic footprint, the company is also strategically located, with access to West-Coast demand. The West of the United States has no existing flat-rolled steel production capacity. This opens up possibilities for STLD, as it can expand its reach while also exploiting growing Mexican demand.

Steel Dynamics

So, what about the company’s valuation?

Valuation

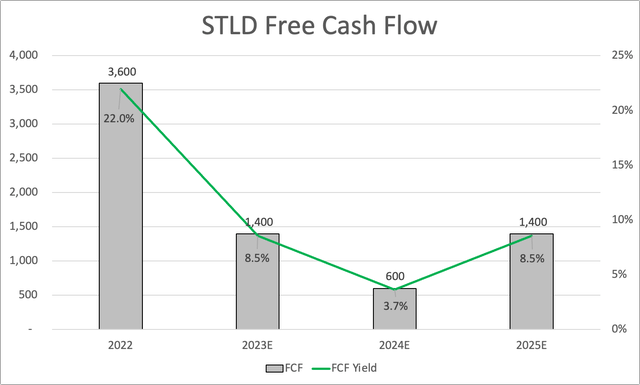

STLD is trading at roughly 11x 2023E free cash flow. Next year, free cash flow is expected to decline to $600 million due to higher CapEx and an expected moderation in steel prices. In 2025, free cash flow is declining, allowing free cash flow to rebound again. My opinion is that 2024 and 2025 numbers will be higher than expected, as I believe we could see a rebound in demand in late-2023 or early 2024.

Leo Nelissen

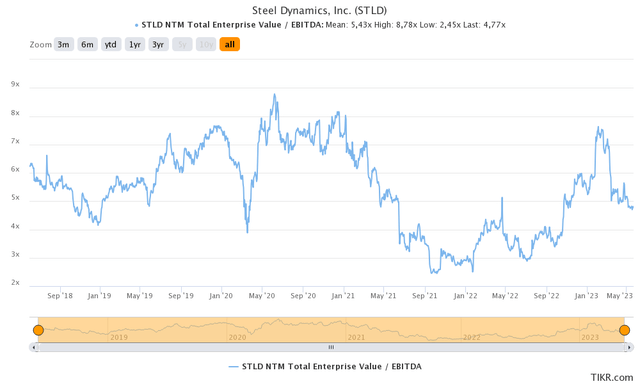

The company is trading below 5x NTM EBITDA, which is below 7x, where I believe STLD should be trading.

TIKR.com

Based on current circumstances, the fair value is roughly 20% to 30% above the current price.

That said, it is highly unlikely that STLD will start a meaningful uptrend without a rebound in economic demand, which means investors need to be careful. Don’t jump into cyclical stocks with too much exposure, as more downside cannot be ruled out – especially if the market becomes more nervous due to ongoing (and failing) debt ceiling talks.

FINVIZ

If I were in the market for more cyclical exposure, I would be looking to buy STLD between $70 and $80.

Takeaway

Steel Dynamics is a standout in the steel industry, with a strong track record and high-quality dividend growth. The company’s success can be attributed to its focus on value-added steel products, which provide pricing power and high margins. STLD also boasts a healthy balance sheet with ample liquidity and a strong dividend track record.

Despite recent selling off, STLD remains resilient due to secular tailwinds such as onshoring and increased construction spending. The company’s aluminum expansion and recycling platform further contribute to its growth potential.

While the current valuation presents an opportunity, caution is advised, as a rebound in economic demand is necessary for sustained growth.

Read the full article here