Co-authored with “Hidden Opportunities.”

The U.S. economy continues to slow down as the Federal Reserve continues its inflation containment efforts. While rates have been rising aggressively for 12 months, the cumulative impact of the Fed’s rate hikes has yet to be fully felt.

When borrowing costs rise, capital becomes more expensive, and companies work hard to optimize their costs, starting with headcount. The tech leaders who were blindly di-worsifying into buzzwords and meme plays, and speculating with cryptocurrency “assets” are slashing the workforce and are refocusing on profitability. Layoffs are making the headlines frequently, not just in the tech sector but across other parts of the economy. Retailers, manufacturers, media companies, and the financial industry have all announced cuts. Highly people-oriented firms like Accenture and Deloitte have also begun cutting down a significant portion of their workforce to preserve profitability and brace for slow growth.

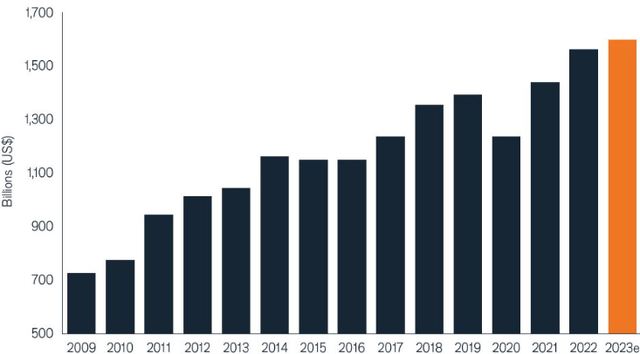

For people in the workforce, we can’t say how safe your job is. But we can tell you that profitability will continue to be a priority for U.S. companies, and dividends will hit new peaks in 2023.

Janus Henderson

Growing dividends and share buybacks during uncertain economic conditions indicate the alignment toward shareholder value creation. Janus Henderson expects payouts to strike new all-time highs in 2023, with Oil and Gas producers and financial sector companies to account for half of the dividend growth. We’ll discuss two big dividends from these highly shareholder-oriented sectors.

Pick #1: DMLP – Yield 13.5%

Dorchester Minerals, L.P. (DMLP) acquires, owns, and administers Royalty Properties, which consist of producing and non-producing mineral royalty, overriding royalty, net profits, and leasehold interests located in 592 counties in 28 states. The partnership earns a fee based on the volume and price of crude oil and natural gas extracted from its reserves.

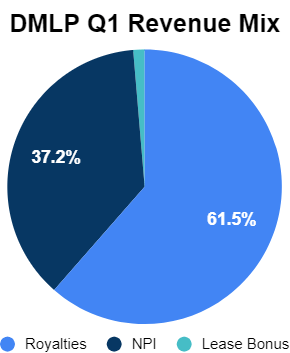

DMLP 10-Q

DMLP has 26 full-time employees and is designed to make maximum distributions to shareholders. Common shareholders receive 96% of funds available for distribution, and the general partner collects a fixed 4%. Being a royalty firm, DMLP uniquely differentiates itself on the fact that its distributions constitute a very high percentage of its top line (not the bottom line as with every other company). During FY 2022, the company distributed 80% of its revenues. The partnership’s recent $0.9897/share quarterly distribution, along with the payments made during the past three quarters, calculates to a 13.5% yield. Notably, Q1 distributions include royalty income from the sale of oil and gas between November 2022 and January 2023.

The partnership ended Q1 with $45 million in cash and cash equivalents on its balance sheet. Most importantly, DMLP utilizes no debt in its business, and its partnership agreement prohibits the firm from incurring indebtedness above $50,000. This provides adequate protection against rising interest rates. A review of DMLP’s 10-Q confirms no debt aside from modest accounts payable and operating lease liabilities.

Note that DMLP issues a Schedule K-1 at tax time. Since the partnership’s revenues fluctuate with commodity price and volume, its distributions are variable.

Why was the Q1 distribution higher than most investors expected?

We always invite good news with open arms, but it is prudent to examine if it is too good to be true.

During Q1, DMLP reported a 173% YoY increase in Net Profit Interest (“NPI”) revenue. These levels were substantially higher than past quarters. NPI is a highly underrated and rare form of royalty agreement that provides a payout of an operation’s net profits to the parties of the agreement. E&P companies reporting record profits as a result of lean operations and higher commodity prices comes as a direct benefit to DMLP shareholders.

Notably, for Q1, the higher NPI levels are attributed to higher suspense release (revenues that have been held by a purchaser or lessee, often attributable to multiple months of production) on new wells in the Permian Basin. Out of the $24.6 million distributed to shareholders, $17 million was NPI-based, resulting in a noticeable boost to the quarterly distribution.

The Energy Sector Is Already Priced At Recession Levels

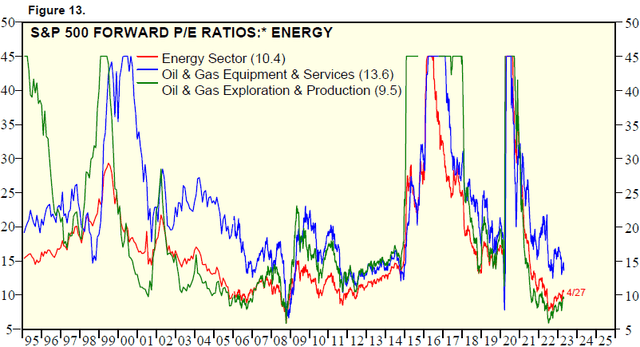

The energy sector is the cheapest of all 11 U.S. market sectors, with a current P/E ratio of 6.7. Looking at the forward P/E, the industry is already priced at recession levels. Source.

Yardeni Research

A recession fear is almost always going to send energy prices plunging. But an objective review of past recessions shows that demand doesn’t necessarily decline. Having learned from the oil shock during the global pandemic, U.S. Exploration & Production firms are better positioned to control their production levels to mitigate the demand projections.

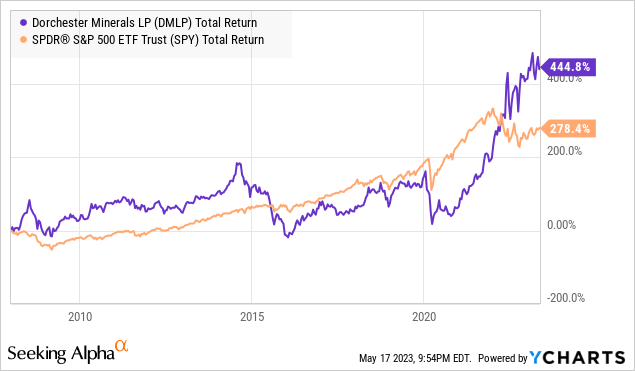

DMLP has demonstrated that its business model and its shareholder-oriented-ness have stood through the test of energy price volatility. An investment made in this royalty firm during the ill-timed January 2008 would have outperformed the S&P 500 (SPY) while paying handsome distributions to shareholders.

With the Chinese economy reopening, the tough sanctions on Russian energy exports, and the likelihood of a mild recession, we expect energy prices to remain above-average levels for the foreseeable future despite interim fear-driven volatility.

DMLP is an excellent addition to a long-term income portfolio to benefit from sticky demand.

Pick #2: ATH Preferreds – Yields up to 8%

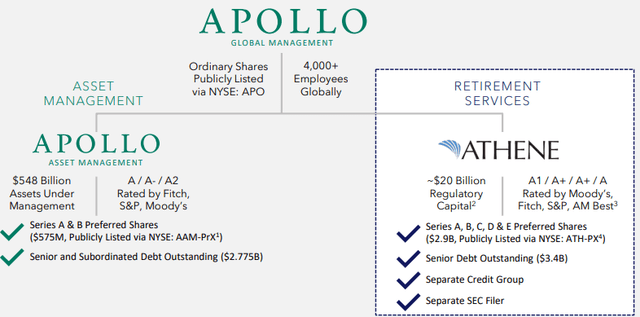

Athene Holding Ltd is an insurance company that specializes in retirement products. Athene is one of two principal subsidiaries of Apollo Global Management, Inc. (APO), one of the largest asset-management firms globally. Athene’s balance sheet carries an A+ credit rating from S&P Global. Source.

Athene Corporate Overview – April 2023

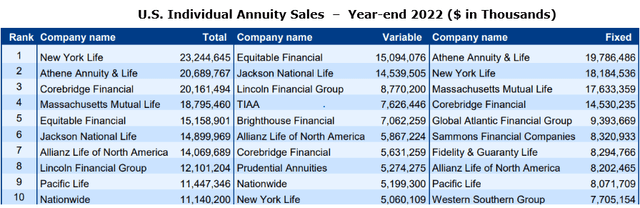

Athene is a market leader in fixed annuities, one of the hottest retirement products in this high-interest-rate environment. During Q1 2023, total annuity sales hit new records and reached $92.9 billion (a 47% YoY increase), according to LIMRA (an industry-funded researcher tracking the products since the 1980s). Source.

Insurance Newsnet

Athene maintains a disciplined capital investment strategy, with 94% of its assets held in cash or fixed-income securities. Additionally, ~96% of the company’s fixed-income portfolio is invested in investment-grade assets.

Athene maintains robust statutory capitalization with $2.3 billion in Excess Equity Capital, well above regulatory requirements. The insurance company spent $141 million on preferred dividends and $98 million on interest expenses toward its long-term debt in FY 2022. These were adequately covered by the $6.2 billion in net cash from Athene’s operating activities. Additionally, Athene ended FY 2022 with 740 million in cash and cash equivalents.

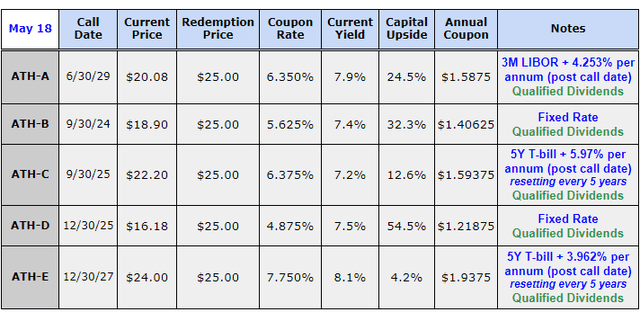

Athene has five classes of preferred securities that carry investment-grade ratings. These preferreds pay qualified dividends and present an attractive upside from current price levels.

-

6.35% Fixed-to-Float, Non-Cumulative, Series A Redeemable Perpetual Preferred (ATH.PA)

-

5.625% Fixed Rate, Non-Cumulative, Series B Redeemable Perpetual Preferred (ATH.PB)

-

6.325% Non-Cumulative, Rate Reset, Series C Redeemable Perpetual Preferred (ATH.PC)

-

4.875% Fixed Rate, Non-Cumulative, Series D Redeemable Perpetual Preferred (ATH.PD)

-

7.75% Non-Cumulative, Rate Reset, Series E Redeemable Perpetual Preferred (ATH.PE).

Author’s Calculations

ATH-D – This preferred offers a 7.5% current yield and a massive 54% upside to par. It is a fixed-rate preferred that becomes callable in December 2025. At this time, ATH-D presents the best prospects of current income and upside over the longer term.

Athene preferreds offer a well-covered dividend stream at bargain prices. We are close to peak interest rates, and ATH-D, ATH-B, and ATH-C provide attractive opportunities to lock in high yields before they disappear.

Conclusion

In October 2021, Mark Zuckerberg, CEO of Meta Platforms, Inc. (META), announced the Metaverse as the new direction for Facebook, and the concept was introduced to the world with massive promises. As the reality began to set in about the prospects and potential of this offering, the company was quick to pivot and lay off a massive chunk of its workforce as part of changing directions. When times are tough, compassion and consideration go out the door. If your paycheck from work is your only source of income, I urge you to diversify. Corporate America will no doubt prioritize profitability, and investors can benefit from this infamous stubbornness.

At High Dividend Opportunities, we focus on our returns from Corporate America’s drive toward profitability by investing in securities that prioritize the distribution of excess profits to shareholders. Our “model portfolio” has +45 holdings with an overall +9% yield to capture the dividend tailwind upon us.

As the U.S. economic growth comes to a halt, we don’t know which job market sectors will weaken. It is crucial to assess the sustainability of your income sources. Regardless of market price action, 2023 will be an excellent year for income investors. Act fast; the yield train won’t wait for long!

Read the full article here