As fears about Beijing’s potential invasion of Taiwan once again gain traction and prompt investors like Warren Buffett to unwind their long positions in TSMC (NYSE:TSM), there are nevertheless reasons to be optimistic about the future performance of one of the most important semiconductor companies in the world. One of the most important things that we need to understand is that TSMC’s reshoring efforts could help the company minimize geopolitical risks and help its shares to appreciate in the near term as its business is about to start operating on American soil next year. As such, the latest selloff of TSMC’s shares could represent a decent buying opportunity for investors who want to own a stake in one of the most important companies in the world that’s responsible for the manufacturing of the majority of chip supplies around the globe.

TSMC Goes All In

In late April, TSMC revealed a relatively disappointing earnings report for Q1. Even though the company’s gross and net margins were 56.3% and 40.7%, respectively, TSMC’s revenue decreased by 4.8% Y/Y to $16.72 billion and missed the estimates by $170 million. This is mostly due to the inventory overhang of its customers, who had a hard time selling their products due to the turbulent macroeconomic environment. However, there’s an indication that the demand is coming back and we’re approaching a market bottom.

In the latest conference call, TSMC’s management noted that the gradual recovery of the semiconductor business is likely to begin in the second half of the year as its customers are preparing to launch their new products. There are rumors that TSMC’s biggest customer Apple (AAPL) booked almost 90% of the company’s 3nm capacity for 2023 as it’s about to release its new devices by the end of the year. That’s why there are reasons to believe that TSMC would be able to pick up momentum later this year and retain it later on. This is likely one of the main reasons why the Street expects the company to aggressively improve its top-line performance in FY24 and beyond.

At the same time, due to the lack of meaningful competition, TSMC has everything going for it to continue to expand its business in the following years. The company is already working on an advanced 3nm process called N3E, which Apple is likely to migrate to in the future, while TSMC’s 2nm technology is on track for volume production in 2025 and will likely become the most advanced semiconductor technology in the industry in energy efficiency and density. Thanks to this, TSMC has all the chances to continue to extend its technology leadership and retain its edge in the business without facing any major competition in the foreseeable future.

On top of all of that, one of the major upsides of TSMC is the fact that it has gone all in on diversifying its supplies to mitigate any geopolitical risks as it appears that the globalization in the chip business is now dead. The company has already invested over $40 billion on two fabs in Arizona, which will start producing chips on American soil next year, and additional subsidies from the federal government could encourage it to accelerate its reshoring efforts.

In addition to that, TSMC is about to spend $7.4 billion on a new fab in Japan and is likely to proceed with a factory in Europe, especially after the passing of the EU Chips Act that was implemented a few weeks ago.

Considering all of this, it’s safe to say that mitigation of geopolitical risks makes it possible for TSMC to better protect its business and restore investors’ confidence at the same time.

Did Warren Buffett Sell Too Soon?

In my latest article on TSMC, which was published before the release of the recent earnings results, I noted that one of the main reasons why Warren Buffett decided to unwind his position in the company is due to the increase in geopolitical risks. Earlier this month, Warren Buffett himself admitted during the annual meeting of Berkshire Hathaway (BRK.A)(BRK.B) shareholders that that was the case. While the geopolitical issues would be discussed shortly, it’s important to understand whether TSMC’s shares have any upside at the current levels in the first place without the geopolitical risk premium.

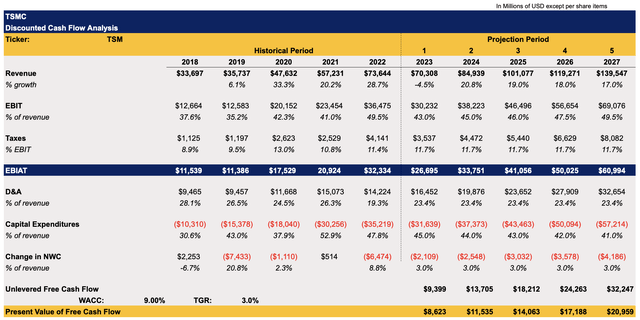

Below is my updated DCF model that has revised assumptions for the top-line performance and earnings, which were decreased due to the company’s weaker performance in Q1. Other assumptions for the other metrics in the model remained the same.

TSMC’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

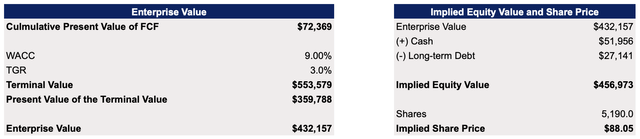

The updated model shows that TSMC’s enterprise value is $432 billion while its fair value is $88.05 per share, below my previous estimates and close to the current market price. This could indicate that solely from the fundamental standpoint, the upside in TSMC’s shares is limited at this stage.

TSMC’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

However, the Street disagrees with that statement, and I would argue that despite my calculations, there’s nevertheless a case to be made that TSMC’s shares represent an upside at the current levels. This is mostly due to the fact that the macro conditions could improve faster, while the recovery of the semiconductor industry in the second half of the year has all the chances to pick up pace due to new product launches. If that’s the case, then those developments would require an upward revision of assumptions in the model that would lead to greater fair value estimates. As such, there’s a case to be made that TSMC’s shares have additional room for growth in the following months since current growth assumptions could be too conservative.

TSMC’s Consensus Price Target (Seeking Alpha)

All Eyes On Beijing

Considering all of this, it’s safe to say that the only major thing that stops investors like Warren Buffett from holding a long position in TSMC is the increase in geopolitical risks, which gained greater importance in recent years. Since Sino-American relations are unlikely to improve anytime soon while American officials believe that Beijing aims to be capable to invade Taiwan by 2027, then it’s likely that a lot of people won’t invest in TSMC despite its unchallenged leadership position in the semiconductor industry.

Even though the company works on restoring investors’ confidence by diversifying its operations, there are questions about whether its business would be as attractive elsewhere as it’s in Taiwan. There are worries that TSMC’s global diversification would lead to lower profitability as a result of higher costs of doing business in the developed world.

On the other hand, there’s also a case to be made that in the worst-case scenario, TSMC would at least remain in business thanks to those diversification efforts. As such, while its latest actions might not be economically viable in the long run, they are nevertheless necessary to mitigate major risks since Beijing’s potential actions in the future are outside of the management’s control.

The Bottom Line

It’s perfectly rational for investors to divest from TSMC due to the rise of geopolitical risks and look for opportunities closer to home. In addition, the diversification of TSMC’s supplies also comes at a price and could lead to lower margins that would negatively affect the business’s bottom-line performance in the following years.

However, if Beijing sticks to the status quo in the next few years, then TSMC’s shares would have an opportunity to greatly appreciate as growth opportunities would outweigh risks in such a scenario. This is mostly because TSMC’s business has a unique positioning in the semiconductor industry, where it has little to no competition and a growing demand for its products. Therefore, even though Warren Buffett divested from the company, a bet on TSMC could nevertheless generate great returns for those who don’t mind being exposed to geopolitical risks.

Read the full article here