Kinnate Biopharma (NASDAQ:KNTE) develops small molecule kinase inhibitors to treat genomically defined cancers. The company has two molecules in the clinic, exarafenib and KIN-3248.

Exarafenib is an oral, small molecule pan-RAF inhibitor. It is in a phase 1 trial in patients with advanced solid tumors harboring BRAF-altered and/or who have NRAS mutant melanoma. This is a two-part dose escalation trial, A and B. A, again, has two parts, A1 and A2. A2 is completed; it evaluated exarafenib as a monotherapy across BRAF alterations and tumor types. A2 is ongoing, evaluating exarafenib in combination with binimetinib, a MEK inhibitor. B is also ongoing; this is a dose expansion part evaluating exarafenib monotherapy at 300 mg bid in patients with BRAF-altered cancers including lung cancer, melanoma and other solid tumors.

KIN-3248 is a small molecule kinase inhibitor. It targets oncogenic mutations in FGFR2 and FGFR3 genes. These mutations are responsible for driving resistance to current FGFR2- and FGFR3-targeted therapies in intrahepatic cholangiocarcinoma (ICC) and urothelial carcinoma (UC). The company has preclinical data showing inhibition of such clinically relevant mutations. Their aim is to increase the duration of response through this type of inhibition. A first in human safety and tolerability phase 1 study is ongoing in adults with advanced tumors harboring FGFR2 and/or FGFR3 gene alterations.

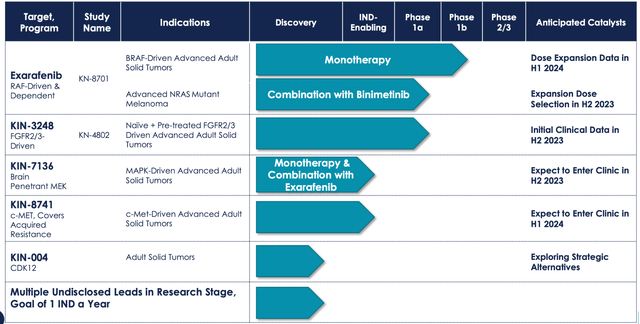

Here is their clinical pipeline:

KNTE PIPELINE (KNTE WEBSITE)

Coming back to exarafenib, this molecule is targeting BRAF/NRAS mutations. These two mutations together represent a broad population of patients with significant unmet need. BRAF Class II/III alterations represent 50% of oncogenic BRAF alterations, with an estimated occurrence of 2.1% in solid tumors. NSCLC, CRC, melanoma and prostate are cancers where this commonly occurs, and are associated with comparatively poorer clinical outcomes, with shorter median OS.

The other target is NRAS mutant melanoma, which is a RAF-dependent cancer comprising 20-25% of all melanoma patients. There are no approved targeted therapies, and these patients have poorer clinical outcomes.

In a phase 1 monotherapy trial whose results were recently published, exarafenib achieved MTD with a best-in-class profile. The molecule achieved substantial exposure at 300 mg bid. However, the safety profile, despite what the company says, could have been better. 2 patients discontinued due to drug related problems. 18% of patients had grade 3 or higher AEs. Most of these were liver toxicities, with AST or ALT increases. Other, possibly liver related AEs, were on the skin, with rash, pruritus and so on. Some of these dose limiting toxicities were at the highest dose tested, 400 mg bid, however the company does not offer details about which doses saw the liver tox.

The difference between exarafenib and currently available RAF inhibitors like Pfizer’s Braftovi, Novartis’ Tafinlar and Roche’s Zelboraf is that these earlier ones target class I BRAF kinase mutations, while exarafenib also target class II and III mutations. These currently untargeted mutations constitute around 55% of oncogenic BRAF mutations.

The trial showed early signs of efficacy. There were 6 PRs in all, including 5 RECIST confirmed. There was a 30% ORR in Class II & NRAS (3 of 10) at 300 mg bid, with an average of 61% tumor reduction and 7 months duration of treatment in responders Class II. Other key highlights:

-

33% (1 of 3) ORR at 300 mg bid

-

71% (5 of 7) tumor reduction across doses

-

86% (6 of 7) DCR across doses NRAS

-

29% (2 of 7) ORR at 300 mg bid

The other program, KIN-3248, is running a phase 1 trial and does not have clinical data. In preclinical trials, KIN-3248 showed that it can directly target FGFR2/3 Driver alterations and acquired resistance mechanisms. In an in vivo setting, it also demonstrated tumor reductions in the face of FGFR2 resistance.

Financials

KNTE has a market cap of $186mn and a cash balance of $231mn. First quarter research and development expenses for 2023 were $26.5 million, while general and administrative expenses were $8.1 million. That gives them a cash runway of some 5 quarters.

The stock is heavily fund owned. Early investors, Foresite and Orbimed are the largest holders. Insider transactions mostly constitute purchases by these funds, who have added to their positions recently.

Risks

When a company has more cash than market cap, it is a warning signal. A company’s market cap is, broadly, a sum of its cash, management and pipeline, i, its assets. It is simple arithmetic to see that the market is putting a very low value to its pipeline and management.

The liver toxicity seen in the trial has not been commented upon by management. It could be nothing, because we don’t know how much it was, how it was resolved, and in which doses it occurred. However, it is still a bad sign.

Bottomline

There’s not much here. The approach to Class II and III BRAF is interesting, however, the RAF class is a tough nut to crack, and we will want to see a lot more data before we can form an opinion.

Read the full article here