Having a good investment philosophy matters as much as picking the “right” stocks. That’s because even dominant companies can fall on hard times due to industry pressures or unforeseen circumstances, as has been the case with Intel (INTC) and Boeing (BA) in recent years.

That’s why it may be a good idea to have healthy allocation to big pharmaceutical, tobacco, and defense contractors in one’s portfolio, with the operative word being “big”.

That’s because each of those industries have sticky and moat-worthy revenue bases that tend to be recession-resilient. This brings me to Raytheon (NYSE:RTX), which I last covered here back in October of last year, identifying an undervalued opportunity.

It appears that the market had also picked up on this opportunity, as the stock has given investors a 16% total return since then, surpassing the 12.5% return of the S&P 500 (SPY) over the same timeframe. In this article, I highlight recent business developments and provide an updated valuation and recommendation.

Why RTX?

Raytheon is a premier defense and aerospace company, with 182K employees worldwide, serving military, government, and commercial customers. It was formed after merging with United Technologies and, over the trailing 12 months, generated $68.6 billion in total revenue.

Raytheon provides a form of certainty in an uncertain world, as a continuous, seemingly revolving door of global tensions will necessitate its products and services. This is reflected by RTX’s very high backlog of $180 billion, consisting of $71 billion worth of defense and $109 billion worth of commercial projects.

Also encouraging, RTX saw sales growth of 10% YoY to $17.2 billion during the first quarter. RTX also benefits from a “non-seasonal” business, as it receives steady program-based revenues. This is reflected by management guiding for $72.5 billion in total revenue for the full fiscal year. This equates to about $18 billion per quarter, and implies a steady increase in the remainder of this year from the Q1 level.

Looking ahead, RTX benefits from its support of the F-35 program through its Pratt & Whitney division, which makes the F135 engine for the aircraft. Next year’s defense department budget included RTX’s design over that of GE’s (GE). This is a big win, as RTX should reap benefits from this over the long term, with the F-35 program is expected to last until the year 2070. Moreover, RTX has continued to generate a steady series of wins since the end of the first quarter, not least of which includes a $1.0 billion contract for the Javelin Weapon System.

Risks to RTX include its business being largely tied to that of defense spending by the U.S. However, I don’t see global tensions easing anytime soon, and the current U.S. administration’s most recent fiscal year 2024 budget request is up by 3% over the current year, to $886 billion. This includes support for a number of RTX’s programs, including the F135 engine, as management outlined along with international opportunities during the recent conference call:

The proposed budget includes broad-based support for many of our key programs, technologies and capabilities, including a request to fund multiyear munitions purchases for AMRAAM. It also prioritizes HACM, that’s the Hypersonic Attack Cruise Missile, as the future long-range hypersonic missile.

Looking internationally, we’re also seeing strong demand for defense capabilities as our allies prioritize additional defense spending. Poland recently announced plans to spend 4% of their GDP on defense this year. That’s the highest level across all of the NATO countries.

And we continue to support Ukraine’s ongoing needs, including the Pentagon’s accelerated deployment of the Patriot missile defense system, adding another RTX capability to the Ukraine mission.

Meanwhile, RTX maintains a strong A- credit rating, which especially comes in handy in the current era of higher interest rates, and carries reasonable leverage for a technology and manufacturing company, with a net debt to TTM EBITDA ratio of 2.5x.

Management is also committed to capital returns, as RTX is a dividend aristocrat with 29 consecutive years of dividend raises under its belt. It currently yields 2.5% and that’s well-covered by a 45% payout ratio. Notably, management also expects to repurchase $3 billion worth of common stock this year, which is a tax efficient way of returning capital to shareholders.

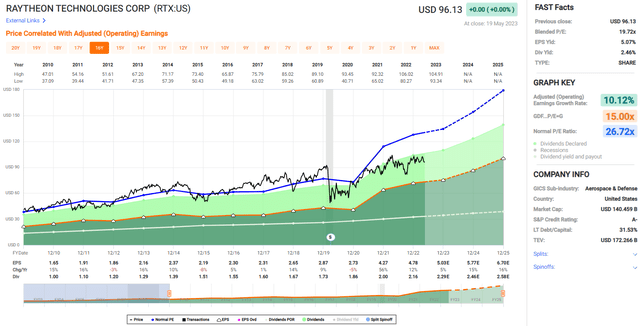

Admittedly, RTX is no longer cheap at the current price of $96 with a forward PE of 19.1. However, it’s not expensive either considering that analysts expect around 8% annual EPS growth between now and the end of next year, and the long-term revenue visibility.

RTX also sits well below its normal PE of 26.7, and sell side analysts who follow the company have a consensus Buy rating with an average price target of $110, representing a potential 17% total return over the next 12 months.

FAST Graphs

Investor Takeaway

Raytheon Technologies is a company that has long been regarded as a stalwart among defense contractors. Its revenues are well-supported by multiple government programs, and this includes the F-35 program, which should generate steady long-term revenues for RTX.

Plus, ongoing geopolitical tensions makes RTX highly relevant for the foreseeable future. While RTX is no longer as cheap as it was last October, investors still have a decent opportunity to pick up this dividend stalwart for potentially strong long-term total returns.

Read the full article here