Introduction

Huntington Ingalls Industries (NYSE:HII) is one of the few stocks I sold over the past three years. In this case, it was purely a strategic decision, as I went from five to four defense contractor stocks, which is still a lot for a portfolio of fewer than 25 stocks. The decision was based on buying more growth in the defense industry. Huntington Ingalls is a lot of things. However, it is not a company with a lot of growth – at least not historically speaking.

But that’s OK.

Huntington Ingalls is a value stock – and one of the best at that.

In this article, we’ll discuss what makes the company behind the HII ticker attractive. This includes its valuation based on improving free cash flow, steady new orders, and its ability to enhance shareholder value in the years ahead.

So, let’s get to it!

Huntington Ingalls Is A Value Stock

What’s a value stock? According to Investopedia:

A value stock refers to shares of a company that appears to trade at a lower price relative to its fundamentals, such as dividends, earnings, or sales, making it appealing to value investors.

With that said, and without looking at any numbers, HII has the perfect foundation to be called a value stock. It operates in an ultrawide moat industry, as it specializes in constructing and delivering robust naval ships and cutting-edge technologies to protect America’s seas, skies, lands, space, and cyberspace. In this case, I’m paraphrasing the company, which isn’t exaggerating, as it’s the only producer of aircraft carriers.

Together with General Dynamics (GD), it builds the overwhelming majority of Navy ships, which secures America’s ability to operate overseas.

Huntington Ingalls Industries

HII’s two main segments, Ingalls Shipbuilding, and Newport News Shipbuilding, have established themselves as the largest shipbuilders in the United States, having built more ships across various classes than any other US naval shipbuilder.

HII’s third segment, called Mission Technologies, offers a diverse range of services and products, including command, control, communications, computers, cyber, intelligence, surveillance, and reconnaissance (C5ISR) systems and operations.

This segment also leverages artificial intelligence and machine learning for battlefield decision-making and a wide range of related products and services. The Mission Technologies segment is relatively young and shaped by recent acquisitions like the 2021 Alion deal.

Mission Technologies takes HII to another level, as it is now capable of better competing with its peers when it comes to technology applications. It doesn’t have to outsource all of these services.

Almost needless to say, the company primarily conducts its business with the US Government, which makes the company a defensive, anti-cyclical value stock whose biggest risk is supply risk, if we assume that Navy spending continues to rise on a long-term basis.

Furthermore, while the company’s roots go all the way back to 1886, its stock price goes back to 2011, when the company was spun off from defense heavyweight Northrop Grumman (NOC). The biggest part of its longer-term capital gains was generated in the years after that spin-off.

TradingView (HII)

With that in mind, two things need to be said before I move to the next segment of this article:

- Excluding dividends, HII shares are trading at February 2017 levels. That’s six years without gains.

- HII shares peaked in early 2020 when COVID hit.

- While HII isn’t cyclical, the pandemic came with significant supply disruptions, which made life hard on HII, which depends on material and labor availability.

Based on this context, let’s take a closer look at the risk/reward for investors.

Where’s The Value For Shareholders?

Essentially, there are three things to keep in mind.

- Orders growth (future revenue growth needs to be taken care of).

- Supply chains. This means the company’s ability to turn orders into finished ships.

- Free cash flow generation. As HII is extremely capital intensive, higher revenue doesn’t automatically mean more money to reward shareholders.

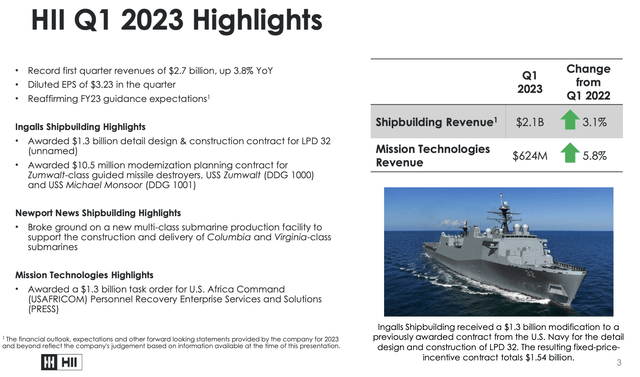

In the first quarter, revenue growth was 3.8% compared to the same quarter in 2022, resulting in record revenue of $2.7 billion. Unfortunately, diluted earnings per share decreased from $3.50 to $3.23 during this period.

Huntington Ingalls Industries

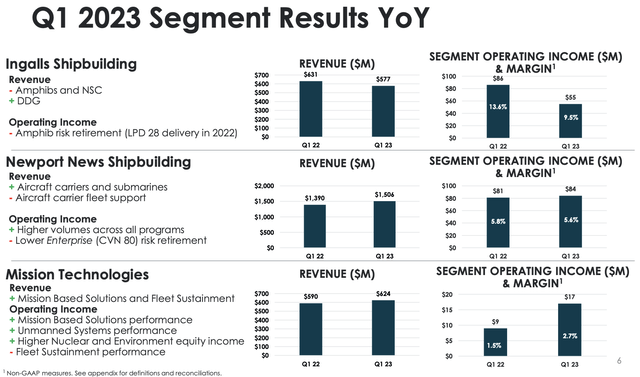

The biggest headwind was Ingalls, as revenue in the first quarter decreased by 8.6% to $577 million, primarily due to lower revenues on the LPD, LHA, and NSC programs. Operating income for Ingalls was $55 million (down from $86 million), with an operating margin of 9.5%. The decline was attributed to lower-risk retirement on the LPD and LHA programs.

Newport did much better, as revenue increased by 8.3% to $1.5 billion, driven by growth in aircraft carrier and submarine revenues, partially offset by lower support services revenues. Operating income for Newport News in the first quarter of 2023 was $84 million, a 3.7% increase compared to the same period last year.

Huntington Ingalls Industries

Mission Technologies reported revenue of $624 million, a 5.8% increase compared to the first quarter of 2022. The growth was driven by higher volumes in mission-based solutions and fleet sustainment. Operating income for Mission Technologies was $17 million, compared to $9 million in the previous year. That’s not a huge number, but at least the company is seeing satisfying growth rates in this young segment.

New contract awards in the quarter were roughly $2.6 billion, leading to a backlog of about $47 billion, of which $26 billion is currently funded.

Contracts included a $1.3 billion detail, design, and construction contract for amphibious transport dock LPD 32 at Ingalls and the Columbia-class bill 2 advanced procurement contract worth $567 million at Newport News.

Related to (future) orders, the company commented on the 2024 defense budget request from the President, which includes continued investment in shipbuilding programs, funding for the second Columbia-class submarine, two Virginia-class attack submarines, and two Flight III Arlebird-class destroyers. It also covers the funding for nuclear aircraft carriers, refueling and overhaul programs, and investment in the submarine industrial base. The budget request also includes $600 million for the engineering overhaul of the USS Boise, which is a Los Angeles-class submarine launched in 1991.

However, funding for the LPD program or a third DDG 51 destroyer was not included, although advanced procurement was provided by Congress in the previous fiscal year.

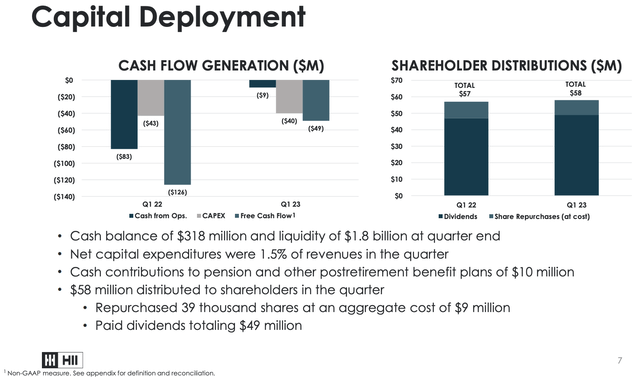

With that in mind, in 1Q23, the company reported $49 million in negative free cash flow, which was caused by capital expenditures exceeding already negative operating cash flow.

Huntington Ingalls Industries

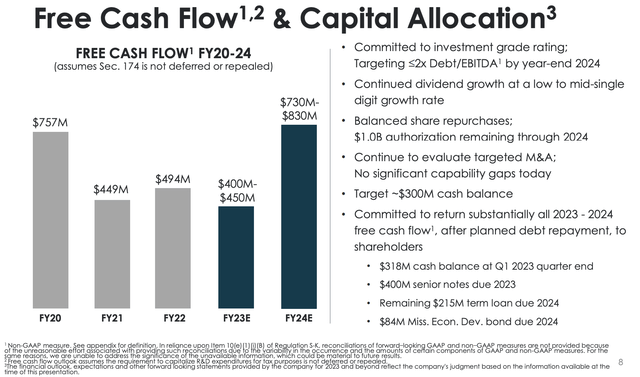

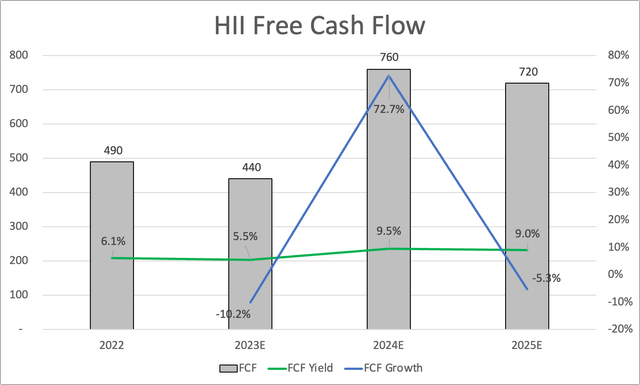

This sounds worse than it is, as the company is sticking to its guidance, which includes keeping free cash flow somewhat in line with prior-year results. However, after this year, the company is expected to roughly double free cash flow due to new deliveries and easing supply chain tailwinds.

Huntington Ingalls Industries

This is a huge deal for a number of reasons (this is the part where it becomes interesting for shareholders):

- At the end of 2024, the company is expected to reach its leverage target. Its 2023 implied net leverage ratio is 2.2x EBITDA. Its credit rating is BBB- (affirmed on April 5, 2023).

- The company’s free cash flow is expected to remain elevated after 2024, with an implied free cash flow yield of almost 10%.

Leo Nelissen

- HII is expected to return almost all of its free cash flow to shareholders after reaching its debt target. This implies that the company has a lot of room to hike its dividend and repurchase stock.

The company currently pays a $1.24 per share per quarter dividend. This implies a 2.5% yield. On November 2, 2022, the company announced a 5.1% hike.

This year’s implied cash payout ratio is 45%. In 2024, that number drops to 26%, which implies a lot of room to boost dividend growth.

Although demand for HII shares is currently low, as investors favor lean defense contractors with greater exposure to high-tech areas such as hypersonics and space, value investors are likely to return once HII demonstrates an ability to increase its free cash flow.

Based on these numbers, I believe that HII is at least 50% undervalued.

That said, investors looking for HII (or any defense) exposure should be aware of the elevated risks tied to ongoing debt ceiling talks. As I wrote in a recent article, I expect that to remain a struggle, leading to a nervous market and new buying opportunities in industries dependent on government revenues, which includes defense.

Takeaway

HII hasn’t done so well over the past six years. The company is suffering from slow growth, supply chain headwinds, and the fact that investors prefer stocks with more high-tech exposure.

However, HII is far from a bad stock. The company has become a true value stock with an implied 2024 free cash flow yield of almost 10%. This is expected to last and benefit investors thanks to a very healthy balance sheet.

After 2023, I expect the company to boost its dividend and use aggressive buybacks to distribute free cash flow.

The valuation is also highly attractive, leading me to believe that HII is up to 50% undervalued.

In conclusion, while Huntington Ingalls may have faced challenges in recent years with slow growth and supply chain disruptions, it has transformed into a strong value stock.

Read the full article here