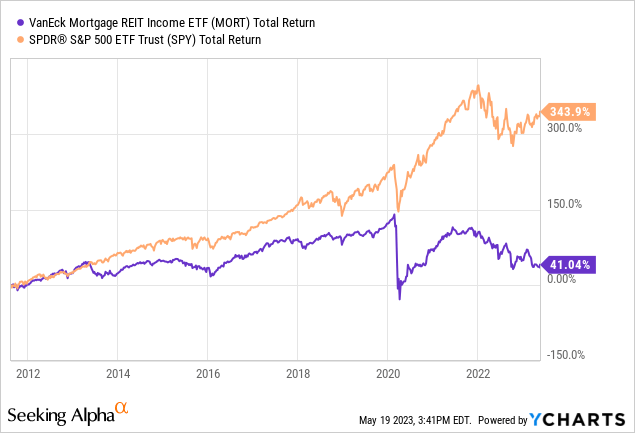

VanEck Mortgage REIT Income ETF (NYSEARCA:MORT) was launched a little over a decade ago and so far it has shown pretty poor performance both in terms of stock performance and total returns (which includes reinvestment of dividends). Unfortunately there is also little reason to believe that this underperformance will change anytime soon.

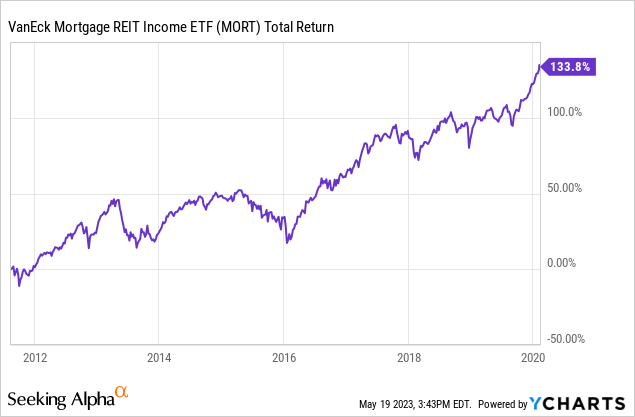

To be fair, the fund and its underlying stocks were doing fine until COVID crash. From its inception to February 2020, it posted 134% in total returns.

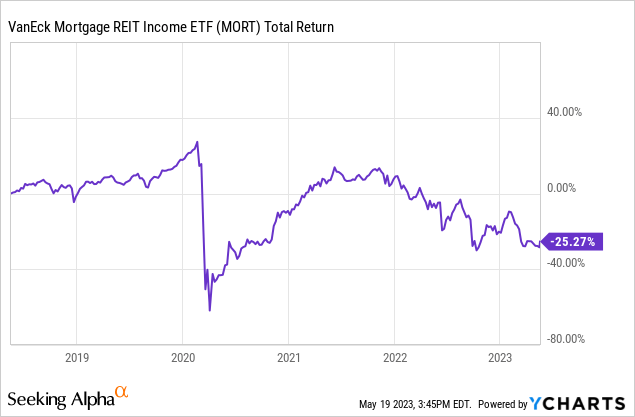

Then came the COVID crash. While MORT was barely recovering from COVID crash it also got hit by 2022 bear market which cemented this fund’s underperformance. One reason mortgage REITs are so quick to drop but take forever to recover is because they are highly leveraged.

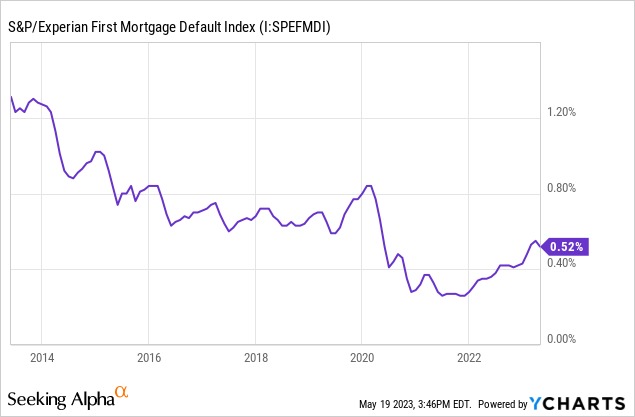

The funny thing is that this underperformance of mortgage REITs didn’t come because people failed to pay their mortgages. As you can see in the chart below, mortgage default rates are at historically low levels and they have been since 2020. Mortgage REITs have been underperforming despite the strength of the real estate market and mortgage market we’ve seen in recent years overall. If this fund is performing this poorly while its underlying sector is doing very well, I can’t imagine how this fund would perform in a situation where we enter a recession and mortgage default rates suddenly triple.

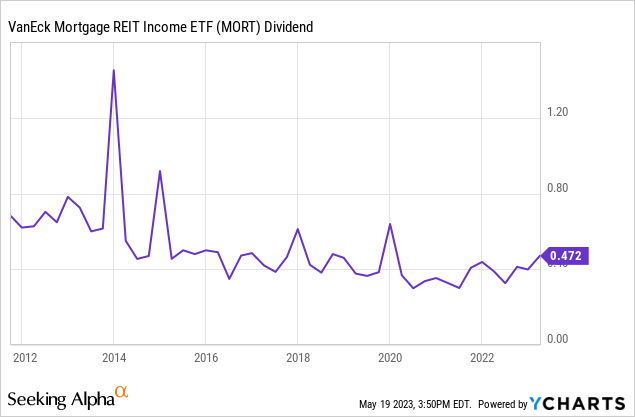

Many people who invest into funds like this say that they don’t care about share price or total returns and they are only in it for the dividend. That might be a fine argument but this fund also has a history of declining dividends since its inception. When the fund was first launched it was paying close to 80 cents per share in quarterly dividends while it is only paying 47 cents per share right now. Even if you completely ignore inflation, that’s a pretty sizeable drop in income for investors who are buying this fund for its rich yield. After adding inflation to the picture, things would look even worse.

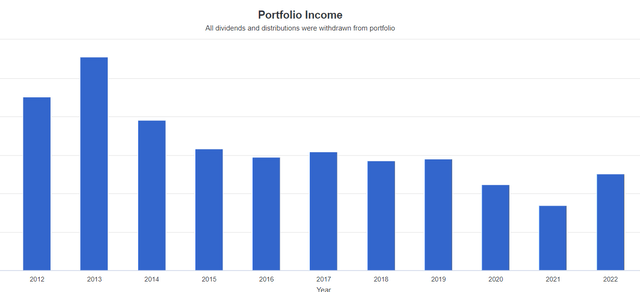

If you had bought $100k worth of this fund in 2012, you would have generated about $12k in income that year, which translates into a yield of 12% for your original investment. Assuming that you are not reinvesting dividends and living on that income, by 2022, your annual income drops to $6.2k, which is a yield of 6.2% on your original investment. After factoring in a decade of inflation, that would be closer to $4k in 2012’s money. This doesn’t look like a great choice for a purely income play either.

Portfolio Visualizer

In the last 10 years we’ve seen different environments. We’ve seen interest rates fall, rise, stay flat, we saw home prices rise, we saw mortgage rates go up and down and this fund seems to have underperformed in every one of those situations. There doesn’t seem to be a time when it outperforms. A few years ago when we had a 0% environment people blamed the low rate environment for underperformance of mortgage REITs and said that they would outperform if interest rates and mortgage rates would rise. In 2022 it happened but underperformance not only continued but also widened.

You also have to keep in mind that this is not a recession-proof business. If you are retired and relying on income from your investments, you want to put your money somewhere that is relatively safe from recessions or at least a place where your dividends and income will continue flowing during recessions. Most mortgage REITs are so leveraged that it’s doubtful if they would survive a recession let alone continue paying rich dividends. During the COVID crash of 2020, many mortgage REITs were down 50-60% in a matter of 4 weeks. If Fed hadn’t stepped in, most of them probably wouldn’t have survived for long.

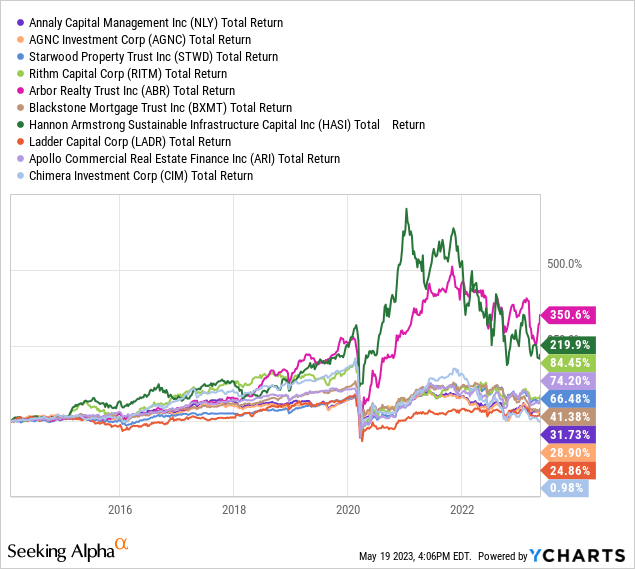

Whether you are an income investor or not, this kind of risk is not acceptable. In the chart below, you will see the decade-long performance of top 10 holdings of this ETF which make up 60% of its weight. Keep in mind that S&P 500’s (SPY) total return during this period was 210%. Out of the 10 companies, only 2 outperformed the markets: Arbor Realty Trust (ABR) and Hannon Armstrong (HASI) latter of which is not even a pure mREIT play. Together, these two companies only account for about 9% of the fund. The rest of the companies underperformed by a large margin even if you reinvested all your dividends.

If a fund has a few stocks underperforming maybe there is a problem with them but when vast majority of stocks in a fund underperform, that tells me that something is wrong with the entire industry.

If investors feel like they must absolutely invest into mREIT sector because of high yields, they might be better served by buying preferred shares instead of common shares of these companies because preferred shares tend to be more stable on average and they tend to get priority in dividend payments if that ever comes into question. On the other hand preferred shares have less room for capital appreciation and less liquidity so they are not exactly good for trading unless you buy them after a market crash like in March 2020.

Don’t get me wrong, I am all for buying high yield stocks, high yield funds and high yield bonds. My portfolio is full of CEFs, high yield ETFs, high yield REITs, utilities and bond funds but I won’t sacrifice my principal while chasing yield. Protecting your principal is extremely important and you don’t want to sacrifice your geese in order to get a bigger golden egg. This is why when you are looking for a high yield fund or stock, it’s important for you to check its long term stock/NAV value graph as well as its dividend history. If a stock or fund’s value has been holding up and dividends are stable, that’s your sign to add it to your watchlist. If you see either one eroding, stay away. Unfortunately this fund has both its principal value and dividends eroding since its inception so it’s a “no” for me.

Read the full article here