Introduction

I’m back to doing what I have been doing since 2020: buying Raytheon Technologies (NYSE:RTX) stock. After writing an article titled Where Will Raytheon Stock Be In 2025? in early April, it’s time to dig a bit deeper. Not only because I have some good reasons that support my decision to buy more RTX but also because a lot has happened. For example, Washington has now become both a tailwind and a headwind, thanks to supportive budget talks and highly unproductive debt ceiling developments, leading the market to pressure government-dependent companies like RTX. The good news is that this opens up new buying opportunities. After all, Raytheon is now benefiting from cyclical demand growth, boosting its free cash flow and ability to provide its investors with much higher distributions down the road.

In this article, we’ll discuss all of that and more as I present four reasons that explain why I am buying more RTX stock – both for myself and the accounts I manage.

Reason 1 – Cyclical Growth Is Back

The first reason why I like Raytheon is one of the most important reasons. As most readers know, Raytheon Technologies is the result of a merger between United Technologies and Raytheon. Back in April 2020, the merger was completed after United Technologies spun off its non-aerospace units Otis Worldwide (OTIS) and Carrier Global (CARR), which are now two highly-successful stand-alone businesses.

The reason I’m bringing this up is that nobody has experienced what the new RTX business is capable of in terms of growth. After all, the first (almost) three years of its existence saw commercial inventory de-stocking and severe supply chain headwinds. On top of that, pre-merger Raytheon did not have commercial exposure. United Technologies had only limited defense exposure.

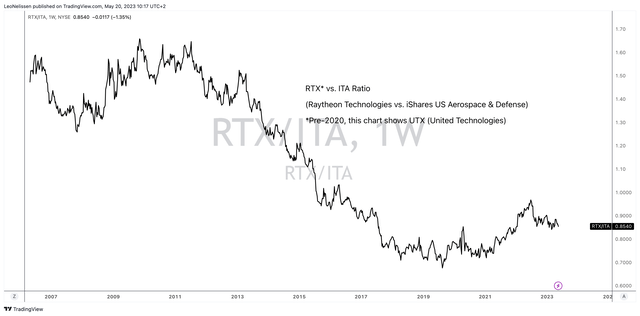

With that said, the chart below shows the ratio between RTX and the iShares U.S. Aerospace & Defense ETF (ITA). As stated in the chart, pre-2020, this chart displays the former United Technologies stock price.

TradingView (RTX/ITA Ratio)

What we see is that RTX underperformed between the Great Financial Crisis and its merger. These were the best years for aerospace producers, especially for commercial players who used low rates and pricing power to grow.

What’s interesting is that (the new) RTX started to outperform the market in 2020.

I expect that to continue, as RTX is now offering the best of two worlds: high-tech defense exposure and a top-tier commercial portfolio.

Especially, the company’s cyclical (commercial) business is now making a full comeback, allowing the company to boost its revenue and earnings.

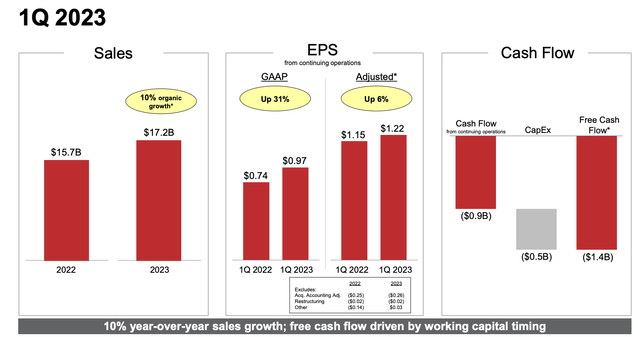

In 1Q23, the company reported $17.2 billion in revenue. This number increased by 9.4% versus 1Q22 and $220 million higher than expected. The company reported $1.22 in adjusted EPS, which was $0.09 higher than expected and an increase of 6% versus 1Q22.

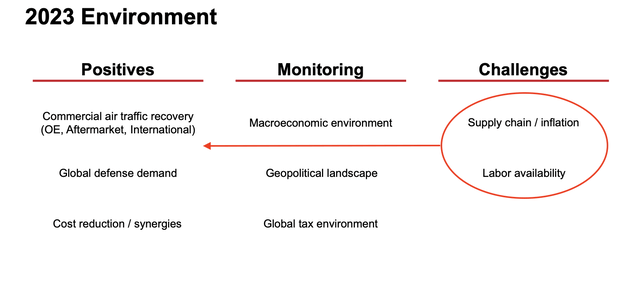

Raytheon Technologies

Raytheon is now finally in a situation where two major issues are starting to turn into tailwinds:

- Cyclical demand is rebounding after weak international travel demand kept a lid on orders.

- Supply chain bottlenecks are easing, allowing production to become more efficient.

According to the company, it benefited from stabilization in the supply chain, while domestic revenue passenger miles have returned to pre-pandemic levels, led by a strong rebound in China.

International revenue passenger miles have reached nearly 80% of 2019 levels, driven by strong consumer demand and record bookings.

Total global air traffic is expected to fully recover to 2019 levels by the end of the year.

Furthermore, the commercial side of RTX’s business has seen robust aftermarket growth, driven by airlines preparing for the busy summer travel season. With increasing air traffic and low retirements, strength is observed in parts, repair, provisioning, and maintenance across the end markets.

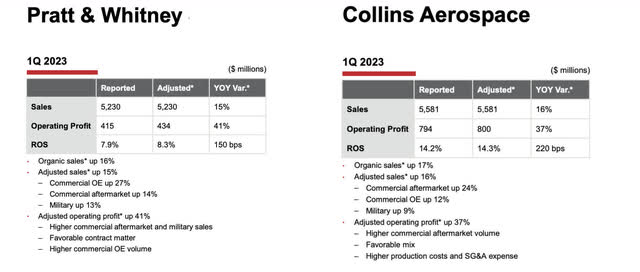

In light of these developments, I want to highlight the performance in the Pratt & Whitney and Collins Aerospace segments, the two segments with more than 50% commercial exposure.

Raytheon Technologies

Sales for Collins reached $5.6 billion, reflecting a 16% increase on an adjusted basis and a 17% increase organically. This growth was primarily driven by the recovery in commercial aerospace end markets, resulting in higher flight hours and increased production rates.

Commercial aftermarket sales experienced significant growth, with a 24% increase on an adjusted basis and a 26% increase organically. This growth was driven by higher provisioning and parts and repair sales. Commercial OE sales also showed positive growth, increasing by 12% compared to the previous year.

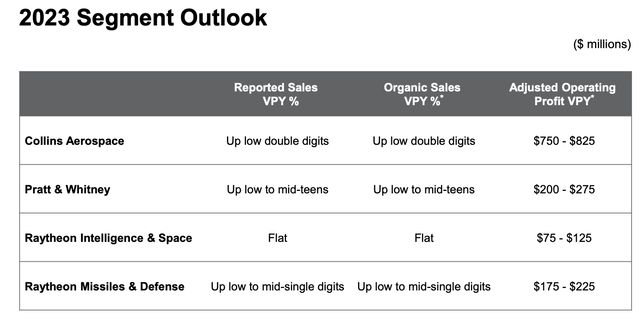

Even better, strength is expected to last. On a full-year basis, RTX expects Collins’ sales to grow in the low-double digits range.

Raytheon Technologies

As the two slides above show (1Q performance and outlook), P&W had a fantastic quarter as well.

Sales for Pratt & Whitney reached $5.2 billion, reflecting a 15% increase on an adjusted basis and a 16% increase organically. Sales growth was seen in all sub-segments.

Furthermore, commercial OE sales saw a significant increase of 27% due to higher engine deliveries in both Pratt’s large commercial engine and Canada businesses. Commercial aftermarket sales increased by 14%, primarily due to higher volume and a favorable mix.

On a full-year basis, RTX expects Pratt & Whitney’s sales to grow in the low to mid-teens and operating profit to increase by $200 million to $275 million compared to 2022.

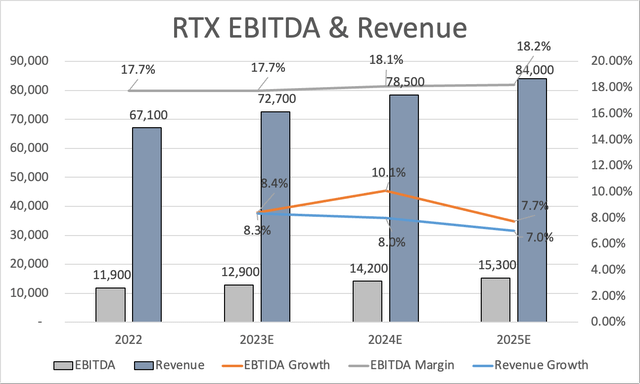

These numbers are absolutely fantastic and paving the way for prolonged EBITDA growth in the high-single-digit range.

All of this is further supported by reason number two to buy RTX.

Reason 2 – Targeted Defense Spending & New Capabilities

One thing has become obvious over the past 12 months: higher global tensions have caused a significant increase in defense demand, which is expected to last.

After a 2023 defense budget boost, Raytheon is looking forward to 2024. The company called the President’s fiscal year 2024 budget request of $886 billion (+3% Y/Y) encouraging, as it supports key programs, technologies, and capabilities, including multiyear munitions purchases for AMRAAM and prioritizes the Hypersonic Attack Cruise Missile (“HACM”) as the future long-range hypersonic missile. The budget also includes the engine core upgrade for the F135 engine, benefiting Pratt & Whitney.

Defense One

To benefit from targeted defense spending in high-demand areas, Raytheon invests in new test equipment, tooling, and automation at facilities in Tucson, Andover, and Huntsville to support key programs such as AMRAAM, Stormbreaker, SM-3, SM-6, and Patriot GEM-T.

Related, the Pratt Asheville site in North Carolina is making progress towards improving productivity and cost in support of high-volume programs like GTF and F135, which is the engine of the F-35 fighter jet.

Needless to say, these developments also translate to a strong military/defense performance.

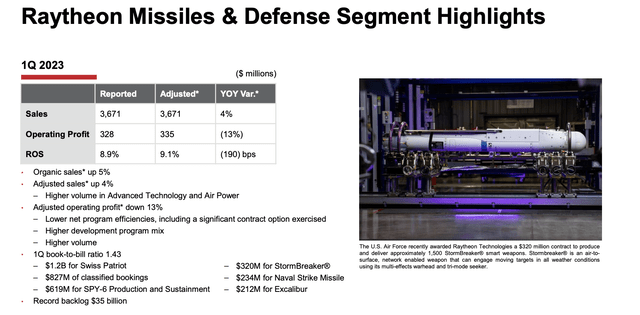

The RMD (Raytheon Missiles & Defense) segment reported sales of $3.7 billion, reflecting a 4% increase on an adjusted basis and a 5% increase organically.

Growth was mainly driven by higher sales in the Advanced Technology and Air Power programs. Adjusted operating profit for RMD in 1Q23 was $335 million, a $52 million decrease from the prior year. This decline was due to lower net program efficiencies and a higher mix of development programs, partially offset by higher volume. The company is still seeing supply chain headwinds related to castings, forgings, and certain raw materials. I expect these headwinds to be resolved at the end of this year.

Raytheon Technologies

Furthermore, this segment’s backlog reached a record level of $35 billion, resulting in a book-to-bill ratio of 1.43 for both the quarter and the rolling four-quarter basis.

This indicates that RMD is getting $1.43 in new orders for every $1 in finished products, which indicates higher future revenue growth.

On a full-year basis, RTX expects RMD segment sales to grow in the low to mid-single digits range.

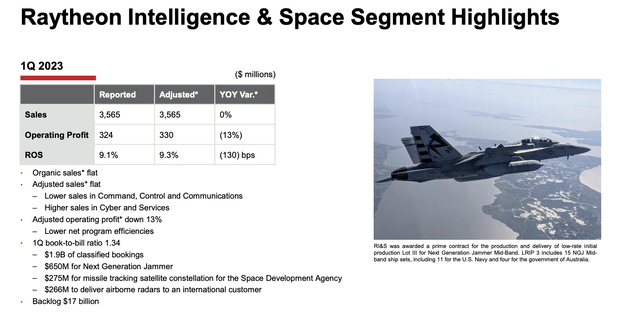

Similar strength was observed in the RI&S (Raytheon Intelligence & Space) segment, which reported sales of $3.6 billion, in line with expectations and flat compared to the prior year on both an adjusted and organic basis.

This segment suffered a bit from lower command, control, and communication sales, which offset higher revenue from cyber.

That said, the segment had a book-to-bill ratio of 1.34, which a backlog value exceeding $17 billion. This, too, indicates higher revenue growth down the road. But not this year, as RTX expects RI&S’ sales to remain flat.

Raytheon Technologies

As the outlook slide in this article shows, both defense segments are expected to show operating profit growth, which I expect to last.

This brings me to reason 3.

Reason 3 – The Dividend & Buybacks

Raytheon is a dividend growth stock – unfortunately, with a short history, but that’s OK.

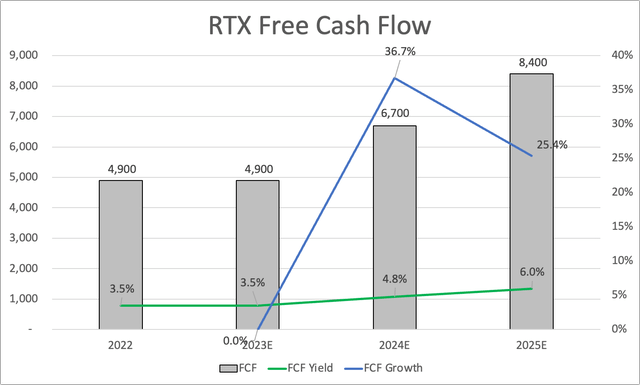

RTX uses both dividends and buybacks to distribute cash to shareholders. This year, the company is looking to buy back $3 billion worth of stock. This translates to 2.1% of its market cap. In 1Q23, the company bought back $560 million.

Leo Nelissen

As the company is expected to boost free cash flow by 37% next year, it is in a good position to maintain high buybacks, leading me to expect a new buyback program announcement in 4Q23.

Furthermore, the company hiked its dividend by 7% this year to $0.59 per quarter per share. This translates to a 2.5% yield.

The company aims to return $20 billion in the four years following its merger.

With regard to the dividend, I expect dividend growth to enter double-digit territory starting next year when free cash flow is expected to those to $6.7 billion.

Reason 4 – Valuation

I already briefly discussed it, but RTX is now on its way to generating $8.4 billion in free cash flow in 2025. That would imply a 6.0% free cash flow yield. Not only does this pave the way for accelerated shareholder distributions (supported by a healthy 2.2x 2023E net leverage ratio and a Baa1 credit rating), but it also indicates a healthy valuation.

Furthermore, after 2023, I expect EBITDA growth to pick up again.

Leo Nelissen

Accelerating growth is likely because I expect both supply chain issues and labor availability to turn into tailwinds. While issues have eased, they are still headwinds in the first half of 2023.

Raytheon Technologies

Hence, I stick to what I wrote in my prior article regarding my longer-term outlook.

That said, considering that Raytheon tends to consistently trade close to a 4% free cash flow yield, we can assume that RTX could see a market cap of $210 billion at the end of 2025 if analyst estimates turn out to be correct. Note that this includes a potential FCF target downgrade in June (the company sees $9 billion in FCF while analysts expect $8.5 billion).

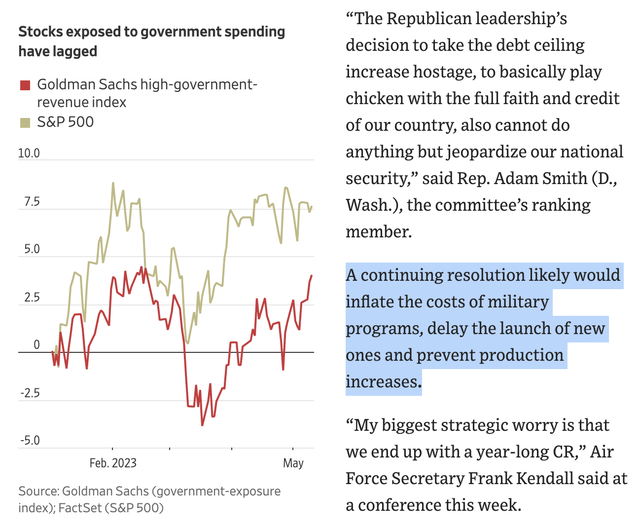

With that in mind, we could get a better buying opportunity. I recently wrote an article covering the debt ceiling talks in the nation’s capital, which aren’t going smoothly.

Especially companies dependent on government revenues are suffering, as highlighted by the Goldman Sachs (GS) High-Government Revenue Index.

Wall Street Journal

The closer we get to June without a debt ceiling deal, the more nervous markets will become, as it increases the likelihood that companies like Raytheon will see short-term demand weakness.

In my article, I explained that neither party is likely to give in.

The most likely scenario is a short-term deal in early June, which hikes the spending limit. However, this would mean that new negotiations are necessary roughly 12 months from now. It’s a kicking the can down the road approach, which would make next year’s talks even trickier (election).

So far, this is looking like the most likely path, as new headlines suggest that no progress is being made.

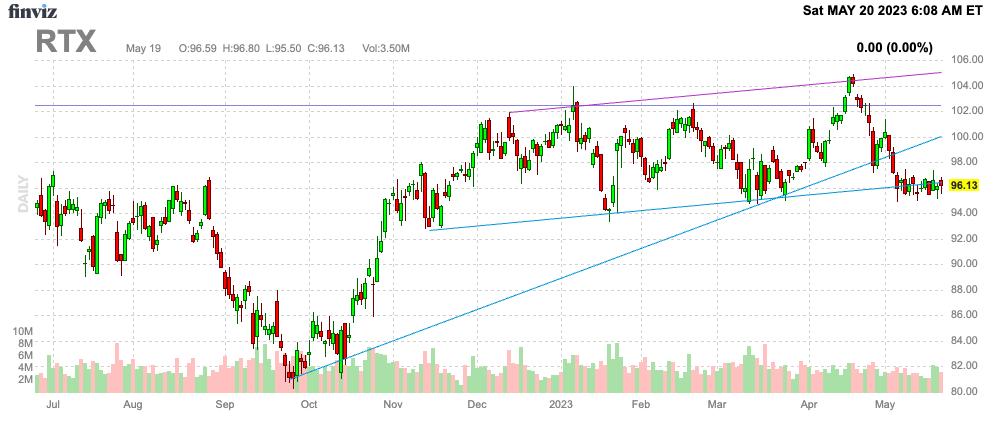

Hence, I believe that we will get more buying opportunities in the weeks ahead, as I don’t rule out more downside in the share price of Raytheon and its peers.

FINVIZ

Once a (short-term) deal is achieved, I expect RTX to advance quickly to $110.

Takeaway

Raytheon Technologies presents an attractive investment opportunity for several reasons.

Firstly, the company is poised to benefit from cyclical growth, with its commercial business making a strong comeback, driving revenue and earnings growth.

Secondly, targeted defense spending and the development of new capabilities position RTX to capitalize on increased global tensions and defense demand.

Thirdly, RTX rewards its shareholders through dividends and buybacks, with plans to return $20 billion in the four years following the merger.

Lastly, the company’s valuation and future prospects indicate potential market cap growth, making it an appealing long-term investment. While short-term market uncertainties related to government revenues may create buying opportunities, the overall outlook for RTX remains positive, with a mid-term target price of $110.

Read the full article here