A few months ago, I wrote a review of Barings Corporate Investors (NYSE:MCI), noting it was a seemingly well-run middle-market focused credit fund with a strong long-term track record paying a generous 7% yield.

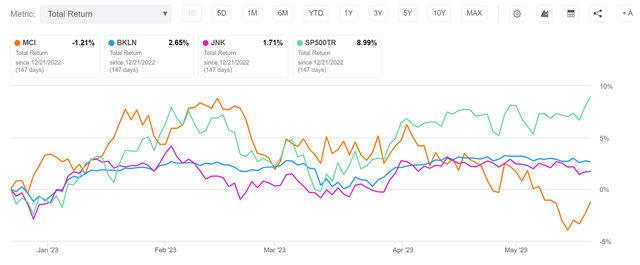

While I liked the fund overall, I was cautious in my article as I foresaw a slowing economy and challenging macro environment. Since my article, the fund has returned -1.2% in total returns, modestly underperforming the Invesco Senior Loan ETF (BKLN) and the SPDR Bloomberg Barclays High Yield Bond ETF (JNK), both of which have delivered positive returns YTD (Figure 1).

Figure 1 – MCI has underperformed in market price (Seeking Alpha)

Since a few months have passed, what is my current thoughts on the MCI fund?

Overview of MCI

For those not familiar, the Barings Corporate Investors is a closed-end fund (“CEF”) with over 50 years of history and $330 million in assets. The fund invests in privately placed non-investment grade corporate debt like bank loans and mezzanine debt instruments. MCI’s loans are primarily made to small and middle-market U.S. companies that are typically purchased directly from the issuers. In addition, the MCI fund may invest in marketable investment grade (“IG”) and high yield (“junk”) bonds and common stocks that the manager deems to be attractive.

Strong Q1 Performance

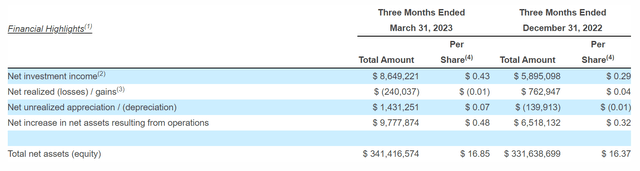

For the 3 months ended March 31, 2023, Barings Corporate Investors reported net investment income (NII) of $8.6 million or $0.43 / share vs. $5.9 million or $0.29 in the prior quarter (Figure 2).

Figure 2 – MCI Q1/23 financial summary (barings.com)

The fund realized a nominal $0.01 / share loss vs. a $0.04 gain in the prior quarter, while unrealized appreciation was $0.07 / share vs. a $0.01 / share loss prior.

MCI’s net asset value (“NAV”) per share increased 2.9% QoQ to $16.85 / share from a combination of NII and unrealized appreciation, less distributions paid.

In the quarter, MCI made 5 new investments for $8.6 million and 14 add-on investments to existing companies for $2.3 million. Two loans were repaid at par for $5.3 million and one mezzanine debt was repaid at par for $2.9 million.

Boosts Dividend To Highest In Decade

In a show of confidence in the underlying business fundamentals, management and the board of trustees authorized an increase in the quarterly dividend to $0.32 / share, payable on June 2023 to shareholders as of May 31, 2023. This represents an increase of $0.04 / share or 14.2% and represents the highest quarter dividend payment for MCI in the past decade.

As far as management is concerned, they do not appear to be worried about a deteriorating credit environment nor an impending recession.

What About Madison Indoor Air?

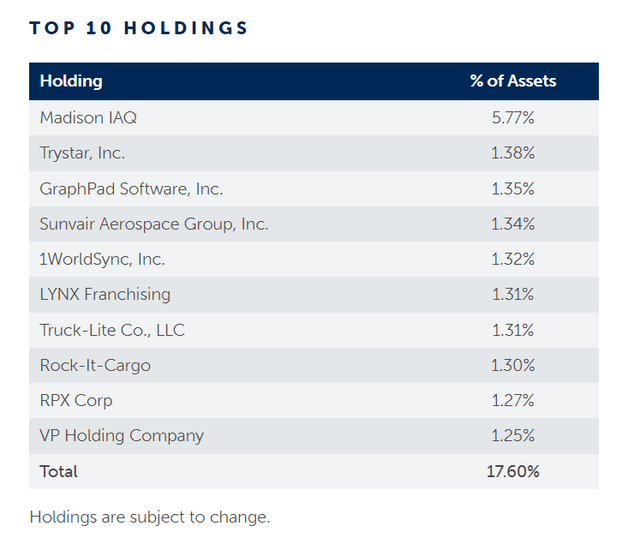

In my last article, I mentioned some credit concerns with Madison Indoor Air Solutions, the largest position held in the MCI fund (Figure 3).

Figure 3 – Madison IAQ is MCI’s largest position (barings.com)

In the article, I noted that Madison IAQ was downgraded by Moody’s in October 2022 due to projected revenue declines and a heavy debt burden from its aggressive M&A growth transactions (note, the downgrade report appears to no longer be freely available).

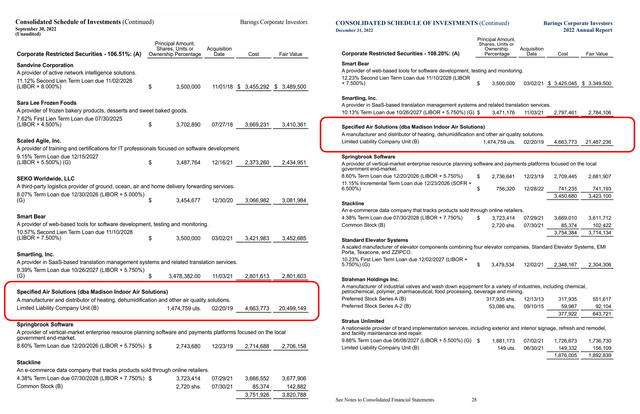

However, what is perplexing is that with a credit downgrade, one would expect a decline in the carrying value of the investment. Instead, we got a 4.9% increase in the carrying value of the Madison IAQ investment between the fund’s September 2022 report and the December 2022 report (Figure 4).

Figure 4 – Madison IAQ was marked up instead of down (MCI fund reports)

While I’m sure there is probably a very good reason for a mark-up instead of a mark-down for the Madison IAQ position, for a risk-averse investor like myself, this raises a serious Red Flag.

Simply put, I have no confidence in my ability to estimate the direction of the fund’s NAV, if an obvious credit downgrade do not lead to a mark down. I never put blind faith in someone else’s valuation. For me, I have to understand how and why something is valued, before I feel comfortable enough to invest. If I cannot trust the NAV, I cannot invest.

Do Other Investors Share My Concern On The NAV?

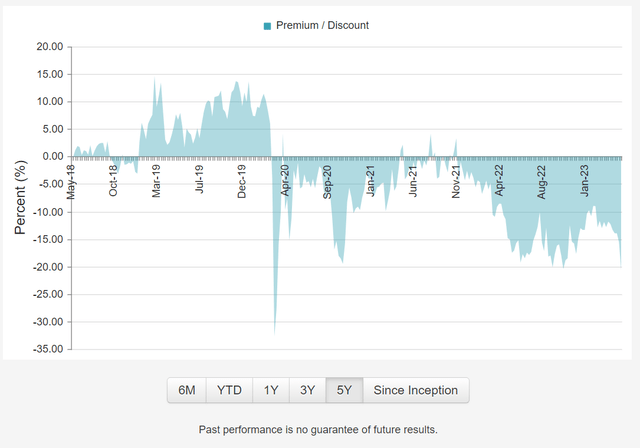

Private market assets are notoriously difficult to value and may be mispriced as fund managers tend to be reluctant to mark down their investments. However, investors appear to share my concern regarding MCI ‘s NAV, as it is currently trading at a steep 16.0% discount to NAV, near the widest in years (Figure 5).

Figure 5 -MCI trading at 16% discount to ‘NAV’ (cefconnect.com)

Even though management appear to be reluctant to mark down its holdings, the market appears to be marking it down for them.

Conclusion

Whereas in my prior article, I had a favourable view of Barings Corporate Investors, as it had a strong long-term track record with a generous yield, the discrepancy in the marking of the Madison IAQ position has shaken my confidence.

Simply put, I have no confidence in the accuracy of the fund’s NAV. While there is probably a perfectly good explanation for the positive increase in carrying value for the position, I am personally going to pass on this fund.

In my opinion, once a fund or investment raises a question of confidence in management, it is often better to stop and look for something else. There are plenty of other investment opportunities with less operational risk to consider. I wish current shareholders the best of luck and hope it is simply me being too cautious.

Read the full article here