Back in March, I wrote that the stock of Marathon Petroleum (NYSE:MPC) had some upside, but not enough to put it in the buy category. With stock trading lower since then, let’s take a close look at its most-recent earnings from earlier this month.

Q1 Earnings

For the quarter, MPC saw its revenue decline -9% to $35.1 billion from $38.4 billion. Analyst were looking for revenue of $35.2 billion.

Refining and marketing margin was $26.15 per barrel of net refinery throughput. That was up from $15.31 a year ago. In Q4, excluding LIFO inventory credits, the margin was $28.16.

Adjusted EBITDA nearly doubled to $5.2 billion from $2.6 billion a year ago. Refining and marketing segment EBITDA nearly tripled to $3.9 billion from $1.4 billion. Midstream adjusted EBITDA, meanwhile, rose 9% to $1.5 billion.

Earnings soared from $845 million, or $1.49 a share, last year to $2.72 billion, or $6.09 a share. MPC’s diluted weighted average shares were -21% lower year over year. Analysts were looking for EPS of $5.80.

Net refinery throughput was 2.84M bbl/d, largely unchanged from 2.83M bbl/d a year ago. Crude capacity utilization was 89% versus 91% a year ago.

MPC generated operating cash flow of about $4.1 billion, while free cash flow was $3.6 billion. It spent $3.2 billion to buy back stock in the quarter. The board also announced an additional $5 billion share repurchase authorization.

It ended the quarter with $27.7 billion in consolidated debt, but only $7.0 billion at the MPC level, with the bulk held at its midstream operator MPLX (MPLX). MPC had $11.5 billion in cash and short-term investments on its balance sheet.

Overall, it was another strong quarter from MPC as crack spreads remained elevated compared to historical levels. Utilization levels remained solid, while MPLX also showed nice growth as well. The company also continued with its aggressive buyback plan, continuing to put its ample cash flow to work to significantly reduce its share count.

Outlook

Looking ahead, MPC guided for refinery throughput of 2.86M bbl/d for Q2. Crude throughput is expected to be 2.65 bbl/d. Utilization is forecast to edge up to 91% in Q2, as there will be less turnaround activity than in Q1.

It projected refining operating costs per barrel of $5.20. As the year progresses, it expects it to trend more towards $5.00.

MPC is expecting distribution costs of $1.35 billion and turnaround costs of $400 million. Corporate costs are expected to be around $175 million.

Turning to growth projects, the company completed its STAR project in Q1. STAR is projected to add 40,000 barrels per day of incremental crude capacity and 17,000 barrels a day of resid processing capacity. MPC decided to upgrade the resid hydrocracker unit instead of expanding the GBR cokers, as it offered better conversion and increased liquid volume yield. Start-up activities are in progress and it expects to ramp production throughout Q2.

Meanwhile, Phase 1 of its Martinez renewable fuels facility reached full production capacity, and Phase 2 construction is underway. Pretreatment capabilities are forecast to come online in the second half, allowing the facility to ramp up to full capacity by year-end.

Discussing the current market on its Q1 call, CVP of Global Feedstock Rick Hessling said:

“So we’ll touch on the West Coast here in a moment. But when you think globally, it’s a great call out to put Asia and Singapore in a bucket, but I’d also throw Europe into that bucket as well. And if we’ve learned anything over the last couple of years as trade flows and cracks or the world is more connected than it’s ever been. So it’s a really good call out in drawing if there is a truly impact to the U.S. refiners. One thing I’d say is as we look at Asia and Europe specifically, we actually see that as support for U.S. cracks. We see it as bullish for MPC. I mean we’re hearing rumors of both regions you mentioned, Singapore and Asia and Europe, we’re hearing rumors of run cuts there, which we see as bullish for us, especially on the West Coast, as you know, the incremental barrel at times comes from Asia. And if it doesn’t come to the West Coast, we see that as positive for margins and cracks.

“And then lastly, I’d say our breakeven is structurally lower than it’s been in the past. And as we view Europe as the marginal player in the world, we have a competitive advantage, as you know, on energy costs, feedstock acquisition, complexity of our refineries, our workforce, our reliability. And then last, but certainly not least, we have an incredible global export program on products. So we’re able to clear our markets quite well. So we believe when you add all of those up, it really gives us quite the competitive advantage, specifically in the West Coast, but I would say in PADDS 2, 3 and 5 where we operate.”

The company also noted that on the demand side, it is seeing optimism with regard to the summer driving season. It said it is seeing some demand curtailment in distillates, and that this is something it is watching closely.

Crack spreads are expected to continue to drift lower as the year progresses, but they have come up for the spring and summer since last time I looked at them in my prior MPC write-up. While MPC has added some nice growth projects, it will still be refining margins that play the largest rose in how the company’s future results play out.

CME Group

Valuation

MPC trades at a 4.1x EV/EBITDA multiple based on the 2023 EBITDA consensus of $15.9 billion. Based off of the 2024 EBITDA consensus of $12.3 billion, it trades at around 5.2x.

It trades at 6x forward EPS, with analysts forecasting 2023 EPS of $18.18

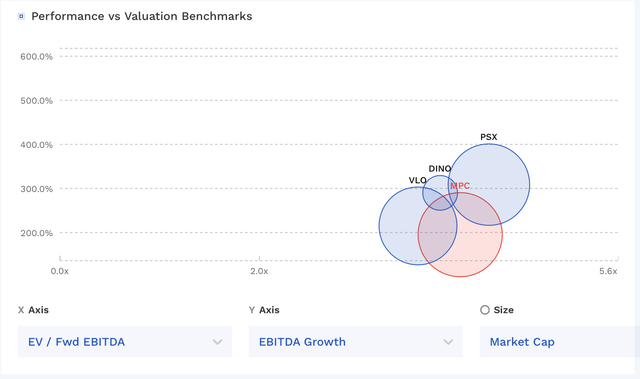

MPC’s stock generally trades in line with other refiners.

MPC Valuation Vs Peers (FinBox)

Conclusion

Overall, MPC is a solid refiner that is enjoying the benefits of a strong margin environment. This won’t last forever, but the company is doing the right thing aggressively funneling its abundant free cash flow to reduce its share count.

MPC’s stake in MPLX, meanwhile, is worth about $22 billion. Based on more normalized refining EBITDA of $3 billion, I have MPC trading on a standalone basis around 6x normalized EBITDA, accounting for its current share stock buyback.

I think MPLX is undervalued, and that 6x for MPC standalone based on mid-cycle EBITDA is attractive. As such, I’m going to raise my rating on MPC stock to a “Buy.” My $140 price target from my previous article remains unchanged.

Read the full article here