Thesis

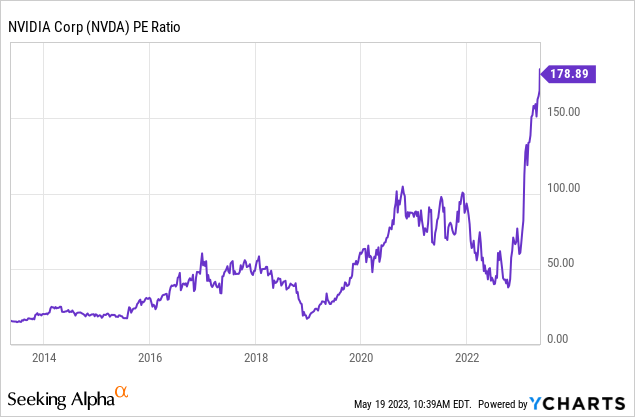

The move in tech stocks this year has been nothing short of astounding. The Nasdaq is now up more than 27% for the year, mainly driven by the FAANG cohort and semiconductors. From the semiconductor group, NVIDIA is up a shocking 117% this year. Yes, you read that correctly – an investor would have doubled the money by buying this stock in January. The name is now trading 28x sales and a P/E ratio above 170:

Whether this behavior is sustainable is a different matter altogether.

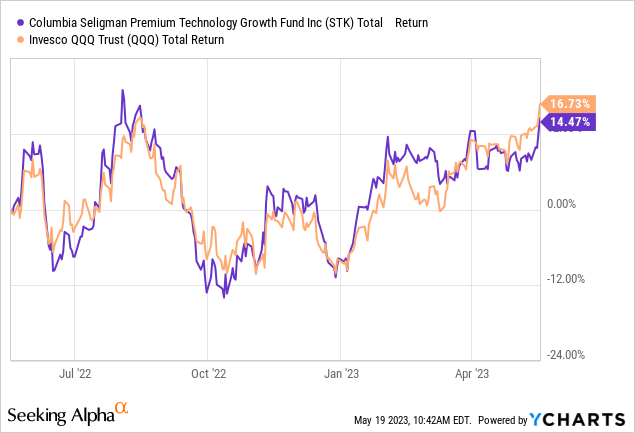

We have covered Columbia Seligman Premium Technology Growth Fund (NYSE:STK) before here, and we outlined how this CEF ultimately serves as a conduit to transform Nasdaq returns into quarterly dividends. As we can see from the ‘Performance’ section below, the STK total return has an almost one for one correlation with the Nasdaq.

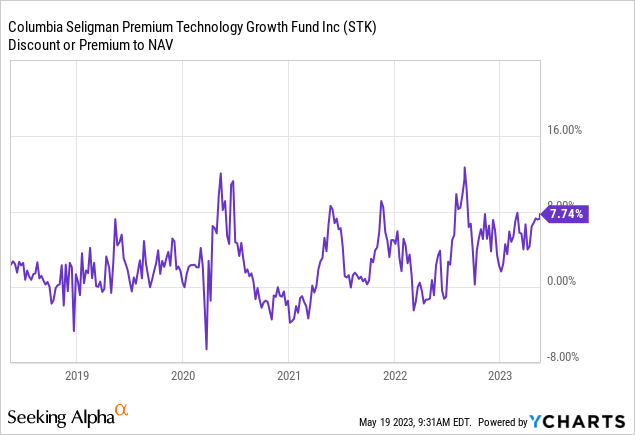

Furthermore, STK has a premium beta to risk-on markets. Not only has STK risen as the Nasdaq has outperformed, but its premium has increased as well, clocking in at +7% now. Expect the premium to NAV to reverse its move when markets retrace.

We now have Fed Funds above 5%, yet rate sensitive Nasdaq names are back to their August 2022 levels. Our opinion is that the most advertised recession in recent memory drove many investors to short the market, only to be proven wrong. There are generally two ways to short the market – either outright or through options. Options experience time decay (theta), hence market timing is key when utilizing this method. Market timing is quasi-impossible though, and we believe we are now seeing the unwind of massive short bets that were supposed to pay out in Q1 or Q2. The economy has been more resilient than many expected, and the large bets they placed are now being unwound.

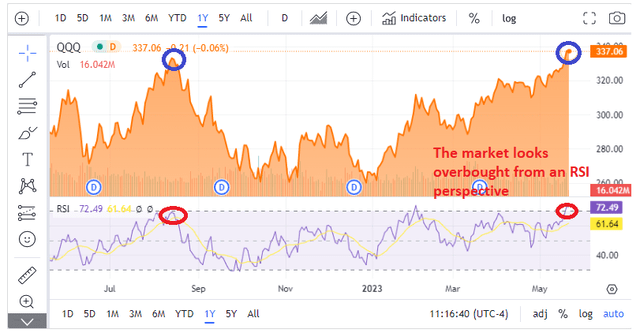

We do think there will be another leg down in this market, but we do not know exactly when either. With STK though, an investor can keep it simple – the fund has rallied tremendously this year and its premium is now moving close to the top of its historic range. Unless one thinks we are back in a secular bull market in tech stocks with rates at 5%, then it is a sure bet we will have a nice retracement:

Nasdaq RSI (Seeking Alpha)

The last time the market was so overbought from an RSI perspective was in August 2022. We all know what followed. As a reminder for novice investors:

The relative strength index (‘RSI’) is a momentum indicator used in technical analysis. RSI measures the speed and magnitude of a security’s recent price changes to evaluate overvalued or undervalued conditions in the price of that security. The RSI is displayed as an oscillator (a line graph) on a scale of zero to 100. The indicator was developed by J. Welles Wilder Jr. and introduced in his seminal 1978 book, New Concepts in Technical Trading Systems.1

Given the above, we are inclined to take profit from STK and Sell here.

Performance

The CEF mirrors the Nasdaq performance when utilizing a total return metric:

The fund does well what it is supposed to, namely transforming equity returns into dividends.

Holdings

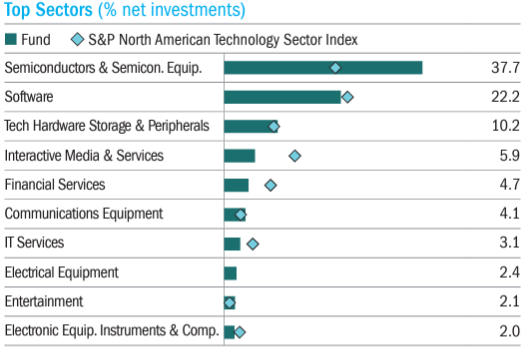

The fund mirrors the Nasdaq to a large extent, although it does take more concentrated exposures in the semiconductors and software sectors:

Top Sectors (Fund Fact Sheet)

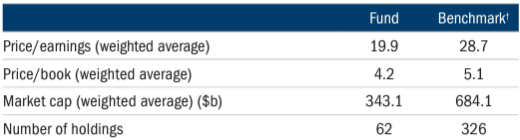

The fund tries to purchase names with a relative attractive valuation when compared to the wider sector:

Valuation Metrics (Fund Website)

Premium/Discount to NAV

The CEF is now closing in the top end of its historic range:

The fund premium has a beta to the overall market, with the premium increasing as the market moves up. Risk-off scenarios can see deep contractions in said premium.

Conclusion

STK is an equity buy write CEF. The vehicle focuses on technology stocks and has rallied 24% this year as tech has moved higher. The fund also has a premium to NAV which has a high beta to market moves – the premium rallies as the fund rallies. We feel the Nasdaq is now entering overbought territory, driven mainly by managers covering their unsuccessful short bets. Timing is key when shorting, but timing is very hard to achieve. We believe we are going to see a retracement of the current move this year, so we are happy to take some profits here and Sell STK.

Read the full article here