This article was first released to Systematic Income subscribers and free trials on May 14.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the second week of May.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

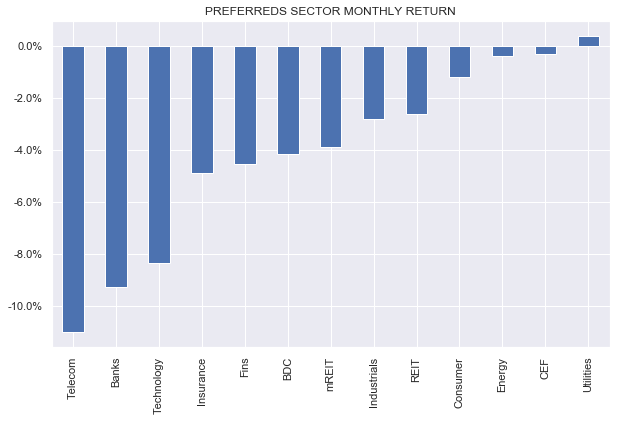

The preferreds sector was roughly flat over the weak, proving resilient to the drop in both Treasuries and stocks.

Systematic Income

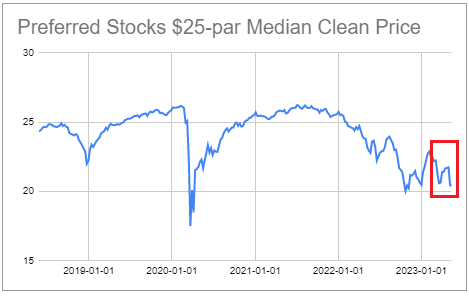

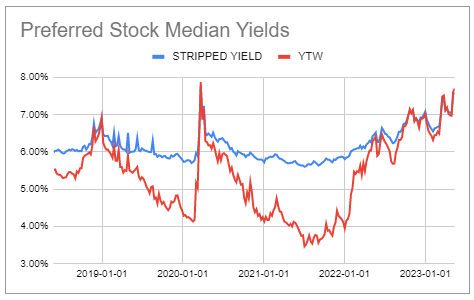

The sector double-dipped recently and trades near its March lows. Although the bank sector is partly responsible for this, it’s not just bank preferreds that have turned lower. Ex-financial preferreds have nearly reached their March lows.

Systematic Income Preferreds Tool

We view this as an attractive time to add preferreds, whether to bank stocks or non-financials that are far removed from the ongoing sector tantrum.

Systematic Income Preferreds Tool

Themes

As many of our readers already know, WFC provided guidance on their Fix/Float preferreds, choosing to go with, in our words, the “crazy” option which used the Libor fallback specified in the original prospectus rather than transition to SOFR.

The reason we called it a “crazy” option was three-fold. One, it rejected the SOFR transition, which nearly all other banks are carrying out. Two, the Libor fallback double-counted the credit spread, applying a new credit spread on top of the old credit spread which was already embedded in the original coupon. And, three, this overly high coupon would be fixed for life, as opposed to move steadily lower over time if market consensus of lower future short-term rates is correct.

There was some pushback on our view that the WFC choice was the “crazy” choice. One reader said that WFC simply went with the contractually mandated option, which is not all that “crazy”. Another said that the WFC.PQ prospectus simply prevents the issuer from transitioning to SOFR.

Our response to this view is that it misses the entire point of the Libor Act (federal legislation enacted in March 2022) which is that issuers could disregard the Libor fallback language in the prospectus (background reading).

In other words, a new law was passed to, in effect, nullify the “contractually mandated” Libor fallback. That’s why nearly all issuers chose to switch to term SOFR, in order to keep the economics (and the spirit) of their stocks in line with the original structure.

There is a more nuanced critique (which we haven’t seen directed at us but one we raise because that’s the kind of thing we like to do) which is that the Libor Act does not cover all Fix-to-floating securities but only the so-called “tough legacy” or “non-workable” contracts that do not provide a clearly defined benchmark replacement to Libor.

One could argue here that the WFC preferreds are not of the “non-workable” variety and, hence, should just use the Libor fallback as defined in the prospectus (in their case the original coupon plus a new spread). After all, it very clearly says in the prospectus what should be done if Libor is no longer available, which is precisely the scenario in which we find ourselves now.

However, our view is that this is not what’s actually going on. In their press release on Libor transition, Citibank said that their preferreds were of the non-workable variety, which was why they were transitioning to SOFR.

Compare the key sentence in the Libor fallback language between Citi and WFC preferreds below.

C.PK

However, if fewer than three banks selected by the calculation agent to provide quotations are quoting as described above, three-month LIBOR for that dividend period will be the same as three-month LIBOR as determined for the previous dividend period or, in the case of the dividend period beginning on November 15, 2023, 0.2381%.

WFC-Q

If the banks so selected by the calculation agent are not quoting as set forth above, three-month LIBOR for that LIBOR determination date will remain three-month LIBOR for the immediately preceding dividend period or, in the case of the dividend period beginning September 15, 2023, 5.85%.

Apart from some minor word choices and the actual fallback rate, these two sentences read pretty much the same to us. The rest of the Libor fallback language is similarly identical.

What this tells us is that there was nothing inherent in the WFC Libor fallback language that made WFC apply its Libor fallback. Citibank looked at much the same language and decided to transition to SOFR while WFC looked at pretty much the same language and chose to go with the Libor fallback. It’s very possible that WFC lawyers made one call and Citi lawyers made a very different one.

The market was clearly surprised by this move, as WFC.PQ jumped 6% towards $25 on the press release. There is a final choice that WFC has to make, and that’s whether to redeem the stocks when they move to the new coupon on the first call date later this year. Our view is that there is only enough craziness a bank can handle, and the stock is going to be redeemed. In other words, none of this will actually matter, since the weirdly high coupon will likely never actually be paid.

Though we were surprised by the choice WFC made, we were quite happy to book the 6% gain. We would look to sell WFC.PQ on any rallies above $25 in stripped price terms. In the remaining WFC preferreds suite, we favor the non-callable WFC.PL, trading at a 6.68% yield – the highest yield in the suite.

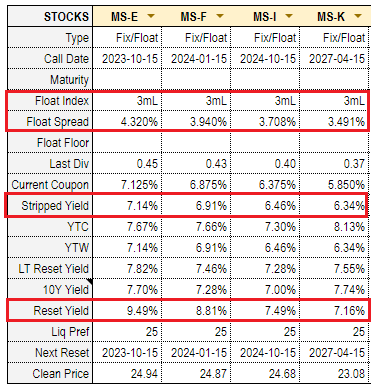

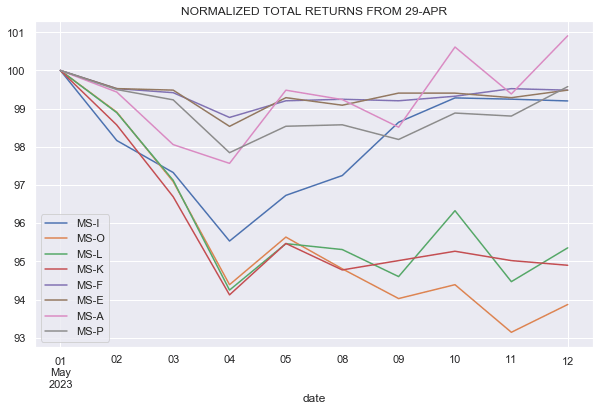

We have also made changes to a number of MS preferreds which will remain fixed-rate. We can see below that they will not transition to the higher expected reset yield and will continue to trade at current fixed-coupon stripped yields.

Systematic Income Preferreds Tool

Two of the Fix/Float preferreds did not react to this disappointing news. This is likely because they were expected to be redeemed anyway. MS.PK did react, falling sharply, in large part because its low stripped yield increased the chance it was not going to be redeemed but would continue to trade at a now much lower yield than expected. Finally, MS.PI sold off but subsequently rallied.

Systematic Income

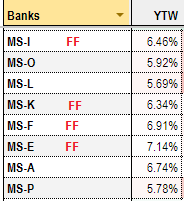

The table below shows the “failed floaters” or previously Fix/Float stocks as “FF”. In the MS suite, MS.PE looks most attractive to us.

Systematic Income Preferreds Tool

Read the full article here