The MELI Investment Thesis Remains Robust Here, With One Caveat

MercadoLibre, Inc. (NASDAQ:MELI) recently posted stellar double beats in FQ1’23, with revenues of $3.04B (+1.3% QoQ/ +35.1% YoY/ +58.4% YoY FXN) and GAAP EPS of $3.97 (+22.1% QoQ/ +205.3% YoY). These numbers are impressive indeed, seemingly unaffected by the supposed tightened discretionary spending and recessionary fears globally.

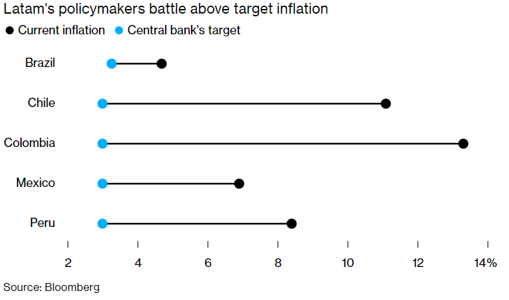

Latam’s Inflation Rate By April 2023

Bloomberg

This cadence also runs against the elevated inflation rates seen in the Latin American region, particularly in Mexico at 6.9% and Brazil at 4.7% compared to the central banks’ target of 3% and 3.3%, respectively. These two regions matter, since they comprise up to 71.2% (+0.2 points QoQ/ -0.6 YoY) of MELI’s net revenues in FQ1’23.

With the region’s core inflation still accelerating in April 2023 despite the central banks’ rate tightening thus far, we may see the e-commerce’s performance impacted in the near term, significantly worsened by the recent banking crisis and the Fed’s hike in the US thus far.

We are already seeing some signs of moderation in MELI’s ARPU, declining to $93.40 in FQ1’23 (-5.7% QoQ/ -1.2% YoY), compared to $99.12 in FQ4’22 and $94.62 in FQ1’22 (-2.2% QoQ/ +9.3% YoY). This cadence is naturally worrying, potentially impacting its top and bottom-line growth ahead.

Then again, this normalization may be well-balanced by the sustained increase in its active user base to 101M by the latest quarter (+4.1% QoQ/ +24.6% YoY). It naturally boosts its e-commerce metrics, such as Gross Merchandise Volume to $9.43B (-1.8% QoQ/ +23.1% YoY/ +43.3% YoY FXN) and items sold to 309M (-3.7% QoQ/ +15.7% YoY).

Hence, it is unsurprising that MELI’s profitability has been sustainably improving, with gross margins of 50.6% (+2.9 points YoY) and operating margins of 11.2% (+5 points YoY), with margin growth easily overcoming the growing COGS (+28.2% YoY) and expenses (+27.9% YoY) in FQ1’23. This also triggered the expansion of its retained earnings to $1.11B (+124.5% YoY) at the same time.

In response to the volatile market conditions, the e-commerce giant has also elongated its logistics capital expenditure through 2023, with FQ1’23 reporting only $89M (-20.5% QoQ/ -35% YoY).

As a result, MELI’s balance sheet remains more than healthy by the latest quarter, with $3.21B of cash/ short-term investments (+5.9% QoQ/ +57.3% YoY), minimal inventory of $199M (+30.9% QoQ/ -16.7% YoY), and moderating long-term debts of $2.46B (-5% QoQ/ -5% YoY).

In addition, it projected a headcount addition of 1.7K engineers in 2023, demonstrating its high-growth yet profitable stage at a time when many tech companies have been on layoff sprees, as highlighted by Pedro Arnt, the CFO of MELI:

We continue to manage the P&L in an aggressive way, striving first and foremost for market share gains and above market growth. But at the same time understanding that at the scale we have, we want that incremental market share to come in a way that’s profitable. And that continues to be the way that we’re managing those incremental investments across different markets. (Seeking Alpha)

Given the exemplary execution thus far, it is unsurprising that Insider Intelligence expects MELI to expand its “regional market share to roughly 22%” in 2023 (+1.8 points from 20.2% in 2021).

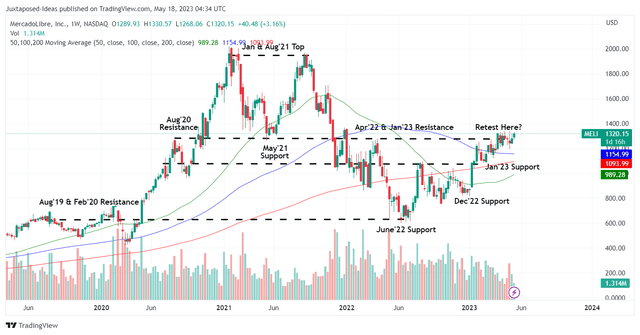

MELI 4Y Stock Price

Trading View

Therefore, we suppose macro headwinds were what contributed to the MELI stock’s failure in breaking through the April 2022 and January 2023 resistance levels, despite the excellent earnings call.

While we remain optimistic about its long-term prospects, the stock has also been trading sideways for the past four months. This cadence is likely attributed to Mr. Market’s unwillingness to fully give credit to the highly competent management, despite the stellar execution thus far.

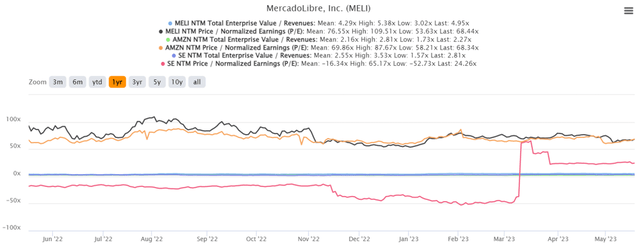

MELI & AMZN 1Y EV/Revenue and P/E Valuations

S&P Capital IQ

In addition, the MELI stock has also been priced in with notable premiums at NTM EV/ Revenues of 4.95x and NTM P/E of 68.44x, naturally elevated compared to its e-commerce peers, Amazon (AMZN) at 2.27x/ 68.34x and Sea Limited (SE) at 2.81x/ 24.26x, respectively.

While MELI may still have a massive runway toward our eventual price target of $1.65K with an upside potential of +24.9%, based on the market analysts’ projected FY2024 EPS of $24.15 and NTM P/E valuations, we prefer to prudently rate the stock as a cautious Buy here, with the caveat that the exercise subsequently matches investors’ dollar cost averages.

Otherwise, bottom-fishing investors may prefer waiting for another retracement to the $1Ks for an improved margin of safety, due to the excellent support at the January 2023 levels. With the global economic downturn likely impacting the stock market’s movement through 2025, there may be more chances for adding at lower entry points ahead.

Read the full article here