uniQure N.V. (NASDAQ:QURE), a trailblazing gene therapy firm, stands out as a compelling investment opportunity poised to redefine the treatment landscape for various challenging diseases. As the company has already demonstrated remarkable success with HEMGENIX for hemophilia B and AMT-130 for Huntington’s disease, investors have a unique chance to back a biotech leader that consistently pushes the boundaries of medical innovation. In our view, uniQure’s strong financial position, diligent commitment to growth, and ever-expanding pipeline of groundbreaking gene therapies make it a prime target for investors seeking exposure to the lucrative gene therapy market.

Our enthusiasm for uniQure’s stock is underpinned by their continued financial growth, with impressive revenue expansion and substantial cash holdings bolstering their prospects. The company’s unparalleled investment in research and development indicates dedication to its mission of creating transformative gene therapies. With their favorable financials, we believe that uniQure’s capacity to convert net losses into gains will only strengthen as their therapies progress from research designs to patient care.

Impressive Financials Bolster Opportunity

Pioneering biotech firm uniQure N.V. has begun 2023 with robust financial outcomes, presenting a remarkably positive prospect for investors. A thorough review of their financial figures indicates an increasingly bright path for the company, supported by outstanding revenue expansion and substantial cash holdings boosting their advancement.

An assessment of uniQure’s cash status highlights the company’s fiscal solidity. They possess an astounding $315.3 million in cash and cash equivalents along with investment securities as of March 31, 2023. Although this amount is marginally below the $392.8 million reported as of December 31, 2022, this cash stockpile will certainly facilitate further research and development (R&D) endeavors to advance the company in their quest for cutting-edge biotechnology solutions.

The firm’s rising revenue further demonstrates its upward progression. In spite of the previous year’s obstacles, uniQure persisted and successfully generated $5.3 million in revenue for Q1 of 2023. This number is almost triple the $1.8 million identified during the same timeframe in 2022. Contract manufacturing revenues surged to $4.9 million, mainly due to the production of HEMGENIX for CSL Behring. Although collaboration revenues have decreased by $1.4 million, the overall growth in revenue is unquestionably remarkable.

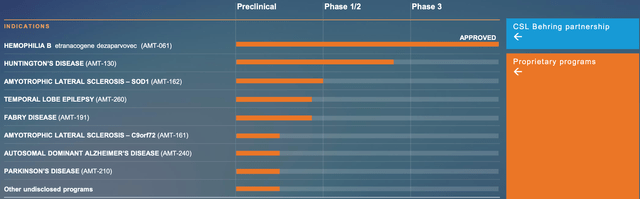

There has been a substantial increase in uniQure’s R&D expenditures as well. In Q1 of 2023, they amounted to $60.8 million, compared to $45.0 million in Q1 of 2022. Significant factors contributing to this rise include the $10.0 million payment to acquire AMT-162 and AMT-260, which is preclinical development for temporal lobe epilepsy. Additional expenses involve increased staff and contractual payments related to the European Medicines Agency (EMA) approval of HEMGENIX. This investment in research and development emphasizes a company dedicated to fostering innovation in the field, ultimately reinforcing their market standing.

Selling, general, and administrative expenses have also increased from $11.0 million in Q1 of 2022 to $17.8 million in Q1 of 2023. This escalation results from growth in personnel, contractor costs, and professional fees, mirroring the burgeoning expansion of the company. In light of the financial outcomes thus far, this investment in resources and expertise is warranted.

The year-over-year decrease in other non-operating elements, along with a widening net loss, should not dissuade investors. This is a foreseeable consequence given uniQure’s dedication to research, development, and overall expansion. The net loss expanded from a $46.7 million deficit (or a $1.00 loss per ordinary share) in the first quarter of 2022 to a $77.2 million deficit (or a $1.63 loss per ordinary share) in the first quarter of 2023. While this may seem concerning initially, investors should remain confident in the company’s capacity to transform this net loss into a net gain as their advanced research yields results.

uniQure’s Unique Products

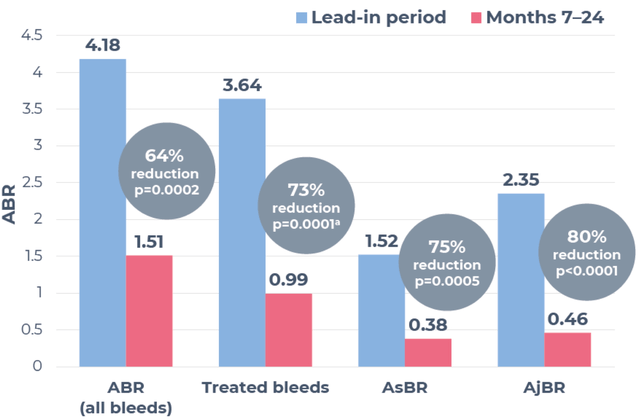

uniQure’s HEMGENIX gene therapy, which targets hemophilia B, has made notable progress lately. Employing an adeno-associated virus serotype 5 (AAV5) vector that bears the proprietary Padua variant of factor IX (FIX-Padua), HEMGENIX is designed to offer long-lasting FIX expression, normalize clotting functionality, and reduce bleeding incidents. In May 2021, the company awarded CSL Behring, a leading biopharmaceutical organization, the exclusive global commercialization rights to HEMGENIX.

www.uniqure.com/investors-media/events-presentations

In November 2022, HEMGENIX was approved by the FDA, followed by the European Commission in February 2023, becoming the first hemophilia B gene therapy to gain such approvals. Supported by positive findings from the Phase III HOPE-B trial, which showcased sustained elevations in FIX activity and considerable decreases in bleeding rates and factor usage, the therapy has also acquired Orphan Drug Recognition from the FDA and European Medicines Agency. The FDA has granted breakthrough therapy designation, while the EMA has bestowed priority medicines (PRIME) status. Importantly, HEMGENIX had no serious adverse events or inhibitors to FIX associated with its use.

Under the uniQure-CSL Behring agreement, a $100 million payment to uniQure follows the initial US commercial sale of HEMGENIX, with potential for an additional $75 million payout if the first European market sale occurs before July 2, 2023. The deal also encompasses tiered double-digit royalties on net HEMGENIX sales.

www.uniqure.com/investors-media/events-presentations

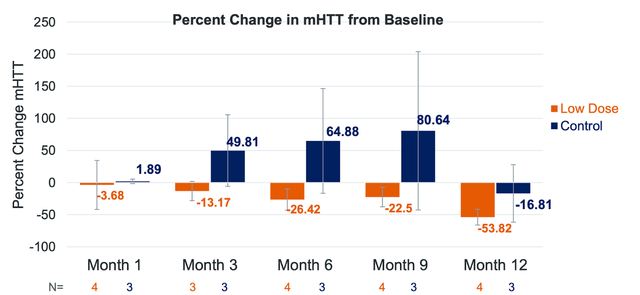

uniQure is also addressing Huntington’s disease-an untreatable neurodegenerative disorder-through its experimental gene therapy, AMT-130. Leveraging the company’s proprietary miQURE gene-silencing platform, AMT-130 aims to reduce mutant HTT protein production in the brain. As the foremost clinical gene therapy for Huntington’s disease, it has garnered orphan drug designation from the FDA and EMA, and fast track designation from the FDA.

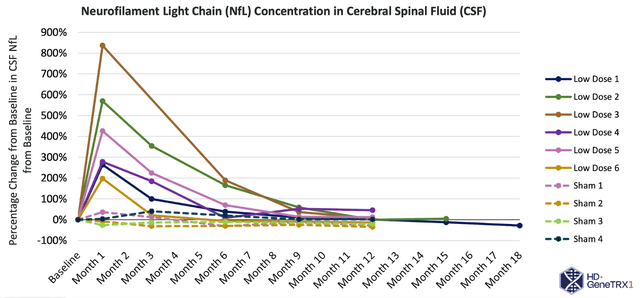

Presently, AMT-130 is undergoing Phase I/II clinical trials in individuals with early manifest Huntington’s disease in both the United States and Europe. American trials follow a randomized, controlled, and double-blinded design across two dose cohorts, while European trials are open-label. Primary goals center on safety and tolerability, with secondary objectives assessing biomarkers, imaging, and clinical disease outcomes.

www.uniqure.com/investors-media/events-presentations

uniQure is set to release follow-up data from its US trial in the second quarter of 2023, encompassing safety, tolerability, biomarkers, imaging, and functional findings for both cohorts. The company also anticipates European trial patient enrollment to commence in mid-2023.

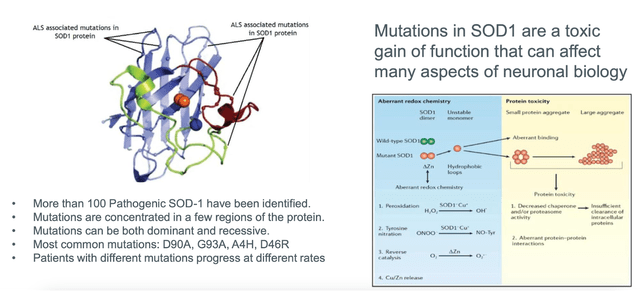

Moreover, uniQure is conducting several preclinical development initiatives targeting various conditions, including gene therapies for ALS, refractory temporal lobe epilepsy, Fabry disease, Parkinson’s disease, and Alzheimer’s disease. Late 2023 or early 2024 are the projected start dates for Phase I/II clinical studies for two of these programs, AMT-162 and AMT-260. Furthermore, uniQure plans to advance its other preclinical programs towards investigational new drug (IND)-enabling research.

uniQure Reaches Royalty Deal

Pioneering gene therapy firm uniQure N.V. has reached a decisive deal to sell a part of the royalty rights from CSL Behring’s HEMGENIX net sales to HealthCare Royalty and Sagard Healthcare for up to $400 million in cash. Which enables uniQure to further invest in its AAV gene therapy pipeline and platform, emphasizing innovative gene therapies such as AMT-130 for Huntington’s disease, AMT-260 tackling refractory temporal lobe epilepsy, and AMT-162 targeting SOD-1 ALS.

www.uniqure.com/investors-media/events-presentations

As per the agreement terms, uniQure will receive an immediate cash payment of $375 million, exchanged for the lowest royalty tier on CSL Behring’s global net sales of HEMGENIX. Additionally, uniQure stands to gain another $25 million if HEMGENIX’s net sales in 2024 surpass a predetermined threshold.

This partial monetization of the royalty revenue confirms HEMGENIX’s significant global sales potential and considerably minimizes commercialization risks for uniQure. The transaction, which is expected to be finalized within 15 business days from the signing, reflects the company’s dedication to promoting its AAV gene therapy pipeline and the continued development of game-changing gene therapies for patients with serious medical conditions.

Underlying Risks

uniQure’s gene therapies, such as HEMGENIX for hemophilia B and AMT-130 for Huntington’s disease, hold significant potential in treating these challenging medical conditions. Nevertheless, it is essential to assess the potential risks associated with their mechanisms of action to ensure their success.

With HEMGENIXone potential concern is the immunogenicity of the AAV5 vector. Although the therapy has shown a favorable safety profile in clinical trials, there is a possibility that the patient’s immune system may recognize the viral vector as a foreign invader, leading to an immune response against the therapy. This immune response could potentially reduce the effectiveness of HEMGENIX or even result in adverse events. Additionally, the long-term durability of the therapy is crucial to monitor, as gene therapies face the challenge of maintaining stable and consistent gene expression in the target cells over time.

Turning to AMT-130 for Huntington’s disease, this therapy also utilizes an AAV5 vector carrying a microRNA to selectively inhibit the production of mutant HTT protein in the brain. One potential concern is off-target effects due to unintended silencing or interference with other essential genes or proteins, potentially leading to unintended consequences or adverse effects. Furthermore, achieving sufficient distribution of the therapy throughout the brain can be technically complex, and incomplete distribution may limit its effectiveness.

www.uniqure.com/investors-media/events-presentations

Moreover, it is essential to consider the long-term impact of AMT-130 on neuronal function and overall disease progression. While aimed at reducing the production of mutant HTT protein, the complex nature of Huntington’s disease involves multiple underlying mechanisms contributing to neuronal dysfunction and degeneration. Ultimately, addressing only one aspect of the disease may not be sufficient to fully halt or reverse disease progression. Therefore, comprehensively assessing the therapy’s impact on various disease mechanisms, as well as monitoring its long-term effects on neuronal function and patient outcomes, is crucial to this product’s success.

uniQure Is An Industry Leader

With HEMGENIX emerging as a novel gene therapy for hemophilia B, traditional treatment options such as prophylactic intravenous factor IX infusions, which often require frequent administration, face increasing competition. BioMarin Pharmaceutical’s (BMRN) investigational gene therapy for hemophilia A, Valrox, employs a similar AAV vector approach to deliver the clotting factor VIII gene. Despite Valrox’s potential to revolutionize hemophilia A treatment, HEMGENIX’s application to the comparatively less common hemophilia B remains unparalleled in the approved gene therapy landscape. Furthermore, HEMGENIX’s inclusion of the FIX-Padua variant may confer higher FIX expression and enhanced clinical efficacy, as evidenced by the HOPE-B trial results, providing a competitive advantage in gene therapy development for hemophilia.

In the context of Huntington’s disease treatments, uniQure’s AMT-130 rivals competing therapeutics focusing on lowering mutant HTT protein production, such as the antisense oligonucleotide (ASO) therapies developed by Roche (OTCQX:RHHBY) and Ionis Pharmaceuticals. (IONS) While ASO treatments require continuous administration and only achieve transient HTT silencing, AMT-130’s AAV vector-mediated gene transfer approach promises a long-lasting therapeutic effect after a one-time treatment. Additionally, AMT-130 leverages uniQure’s proprietary miQURE gene-silencing platform, further differentiating it from competitors by offering a specific, effective, and potentially safer method to selectively target the mutant HTT protein.

Looking Ahead

In conclusion, uniQure’s financial outlook can be viewed as indisputably bullish, given the impressive revenue growth, solid cash holdings, and aggressive investment in research and development. Riding on the wave of pioneering gene therapies like HEMGENIX and AMT-130, uniQure has set itself apart as an industry leader in the biotechnology sector, poised to revolutionize the therapeutic landscape for various challenging medical conditions.

From our perspective, uniQure’s steadfast commitment to innovation and growth signals a company that is destined to deliver transformative medical solutions. Equally noteworthy is the company’s strategic partnerships and monetization deals, which further strengthen their position in the global market, while minimizing potential commercialization risks.

uniQure’s robust financial grounding and unparalleled dedication to breakthrough therapies will create significant long-term value for investors, making it the ideal choice for those seeking exposure to the thriving gene therapy market. In our opinion, this combination of financial prowess and cutting-edge medical technology places uniQure at the forefront of biotech investments, set to make a profound impact on the future of patient care and medicine worldwide.

Read the full article here