The real estate and construction market has boomed in the past three years. The near-zero interest rates led to a demand influx for residential and commercial properties. However, prices have already skyrocketed as inflation stretched further than expected. With the cooling sales in 2022, market forecasts became bleak. The spillovers in the industry extended to property builders and building materials. The same scenario can be observed in Builders FirstSource, Inc. (NYSE:BLDR). In only a year, its operations had massive changes in revenues. Despite this, the company stabilized its operations and remained viable. It demonstrated its prudence and efficiency to navigate the rugged market. Today, this attribute is crucial as the specter of another recession seeps into every household and business. Thankfully, its solid market and financial positioning suggests high sustainability levels. BLDR can cover its operations and adjust its capacity to the changing market conditions. It may be the reason the stock price continues to increase amidst negative macroeconomic sentiments. Indeed, it is a secure company with enticing growth prospects. The only thing that makes one think twice about buying stocks is the slightly costly price.

Company Performance

The real estate and construction market basked in its massive expansion amidst the pandemic. However, the demand easily overwhelmed property availability and increased shortages. This trend led to home prices soaring and setting a new all-time high of $479,500 in 2022. Unsurprisingly, property demand and sales softened, but it still did not offset the demand. These extreme changes were some primary drivers of inflation, interest, and mortgage rate hikes. Even the builders and building material providers like Builders FirstSource, Inc. felt their impact. It remains challenging for BLDR since it also belongs to the consumer discretionary sector. As such, the company is still vulnerable to lower consumer spending. Even so, it exudes resilience and durability to withstand market headwinds and bounce back.

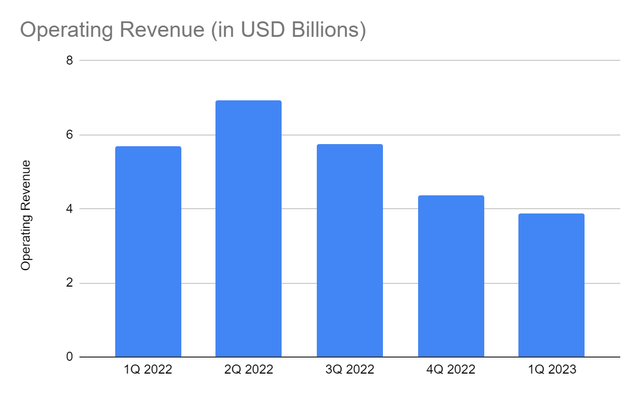

It started the year with an operating revenue of $3.88 billion, a 32% year-over-year decrease. It was most evident in the lumber and lumber sheet goods segment, given the 63% decrease. In 1Q 2022, it comprised 41% of revenues, but in 1Q 2023, it dropped to 23%. As a whole, all segments showed a noticeable change. This double-digit contraction seemed overwhelming at first, but the trend appears logical. The housing environment remains relatively weaker. It coincided with commodity deflation. With that, we can attribute the lower revenue to the combination of softer demand and lower prices of its products. It was also consistent with the 9% decrease in median home prices. Despite this, the company continued to capitalize on expansion through acquisitions.

Operating Revenue (MarketWatch)

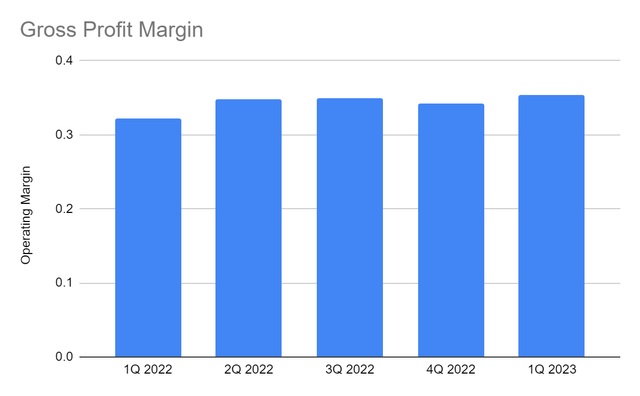

Despite this, things looked better from a bottom-line view. The operating leverage of the company increased from 20% to 26%. From this perspective, we can see that the company adjusted its capacity to keep up with the softening demand. Both operating costs and expenses decreased. Yet, we can also see that the operating expenses remained relatively flatter. The higher proportion of fixed costs to variable costs showed operational efficiency. The company lowered its production volume to manage the total cost amidst lower demand and the recent M&A. Given this, the decrease in revenue was also driven by the contraction of the production level. Nevertheless, it helped improve efficiency, as we can in its stable margins. The gross profit margin was 35% versus 32% in 1Q 2022. It was also the highest margin or the most efficient quarter. Meanwhile, the operating margin was 12% versus 14% in 1Q 2022. It was still logical since the SG&A expenses remained relatively flatter. After all, these were most fixed costs, including acquisition-related expenses.

Gross Profit Margin (MarketWatch)

This year, BLDR faces the same challenges as consumer spending remains lower than in 2022. It may have to be careful as The Fed anticipates a recession. Even so, the relaxing inflation may help the company maintain its viability. It also has increased domestic market presence, given its recent acquisition. More risks, opportunities, and company core strengths will be discussed further in the following section.

How Builders FirstSource, Inc. May Stay Solid This Year

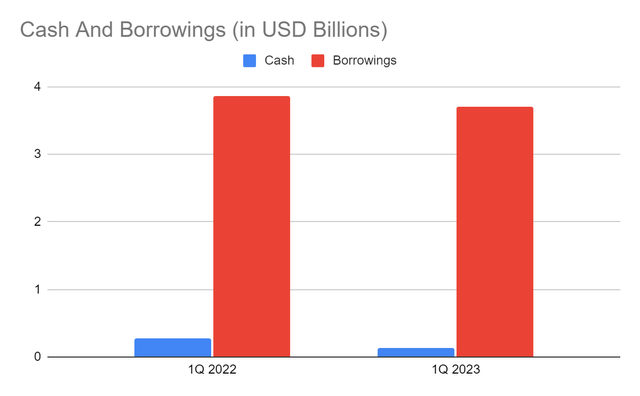

We already saw how Builders FirstSource, Inc. dealt with market volatility with ease and prudence. However, headwinds stay evident as interest rate hikes persist. It may be a problem for the company since higher interest rates may entice more savings rather than investments and borrowings. It is crucial for the company for two reasons. First, it directly works with the real estate market and property builders. Investments through REITs and debt refinancing drive the demand for properties. Second, BLDR is a capital-intensive company. The combined value of inventories and PPE comprise 33% of the total assets. Also, it relies heavily on borrowings, which are equivalent to 35% of the total assets.

Despite this, one must not lose hope as many opportunities are on the horizon. First, inflation has already relaxed at 4.9%, or 46% lower than the 9.1% peak in 2022. Its impact may not materialize this quarter, but improvements may start in the second half. If inflation stays flat or relaxes more, interest rates may become more stable. US interest rates are still increasing, but the actual increments have slowed down from 75 bps to 25 bps. Lower inflation may also increase purchasing, borrowing, and investment power. We already saw median home prices decrease in 1Q 2023. In turn, home sales have increased for three consecutive months. If it continues, BLDR may receive positive spillovers. Of course, it may take more time as property shortages remain high. Moreover, BLDR and similar companies may remain a staple for the economy. Property demand remains relatively lower than in 2022, but it outweighs market supply. This aspect is one of the reasons the US can avoid a crash. Aside from that, housing shortages are still high. The year started with 6.5 million shortages. As of this writing, shortages are higher at 7.3 million units. It proves the rebounding demand due to relaxing inflation. With that, the demand for property builders and building materials may also bounce back. There is also no speculative mania, overselling, and overlending in the property market.

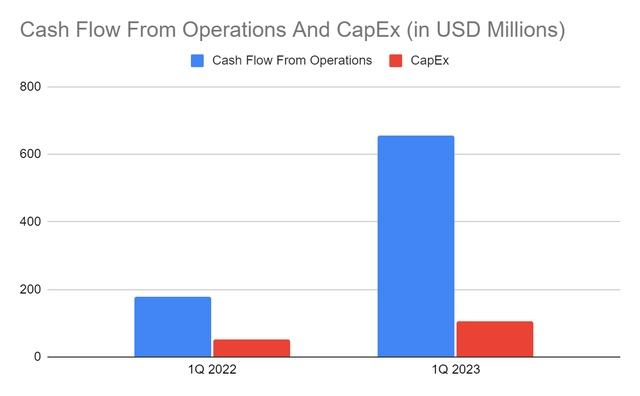

But what makes Builders a secure company is its high liquidity levels. Cash levels decreased, but we can attribute it to the recent acquisition. In 2022, it had a streak of acquisitions, including Trussway, Fulcrum Building, and National Lumber. Earlier this year, it announced its M&A with BMC Stock Holdings. This move may be strategic since the latter ranks fifth on the ProSales 100 list. Their combined value may create a revenue stream amounting to $11 billion. But the thing is, its levels improved in the most recent quarter. It is also higher than in 3Q and 4Q 2022, showing increased returns in 1Q 2023. Its average monthly cash burn is $11.7 million. So, it has a year to sustain its operations using cash alone. I did it by getting the net change in cash in 1Q 2022 versus 1Q 2023 and dividing it by the number of months between them. It also has a Net Debt/EBITDA of 0.92x. BLDR has enough earnings to cover its borrowings. Even if we exclude cash, the ratio will still be low at 0.95x. It is an impressive ratio considering that it is a capital-intensive company. We can confirm it in the Cash Flow Statement, given the Cash Flow From Operations versus CapEx. Its FCF remains high, showing that the company continues to generate returns without eroding shareholder value. Also, the FCF/Sales Ratio of 15% versus 3% in 1Q 2022 shows improved efficiency. It turns more revenues into cash to increase its liquidity. The company can sustain its operating capacity and cover borrowings and capital returns. It continues to balance viability with sustainability.

Cash And Equivalents And Borrowings (MarketWatch)

Cash Flow From Operations And CapEx (MarketWatch)

Stock Price Assessment

The stock price of Builders FirstSource, Inc. has increased over the years. But it sped up in the second half of 2022. At $122.76, the stock price is 95% higher than last year’s value. It may be enticing, but investors must be more cautious as recession fears continue. Given the massive increase in a short period, the upside potential may be limited. We can check the PB Ratio with the current BVPS and PB Ratio of 35.34 and 3.3x. If we use the current BVPS and the average PB Ratio of 3x, the target price will be $106.03. Meanwhile, the EV/EBITDA Model shows a higher target price of ($18.95 B – $3.55 B) / 131,767,000 shares = $116.87.

Moreover, BLDR capital returns are enticing even if it does not pay dividends. We can check it in the cumulative EPS and average stock price change since 2019. Its cumulative EPS reached $29.86, while the increase in the stock price was $98.76. It means that for every $1 increase in EPS, the stock price increases by $3.31. Indeed, the company had substantial investor returns. To assess the stock price better, we will use the DCF Model.

FCFF $892,000,000

Cash $144,000,000

Borrowings $3,702,000,000

Perpetual Growth Rate 4.4%

WACC 9.2%

Common Shares Outstanding 131,767,000

Stock Price $122.76

Derived Value $109.97

The derived value also shows that the stock price may be overvalued. There may be an 11% downside in the next 12-18 months. Investors may have to be careful before purchasing shares. Despite this, I am adding this stock to my watchlist. I may have to wait for a dip to $108 before reconsidering my decision to hold it for a while.

Bottomline

Builders FirstSource, Inc. remains a robust company amidst a riskier market landscape. It maintains its flexibility in its production capacity to maximize its growth potential. It remains viable, allowing it to generate stable returns. Despite the headwinds, BLDR maintains adequate reserves to cover its size and borrowings. Also, it is a stock with investment returns. Indeed, it is a stock that I would like to consider buying. The only thing that hinders me is the current stock price, which is way higher than my target. I may have to wait for a better entry point before making a position. Again, it is a solid company with high returns, but I still find it quite expensive. The recommendation, for now, is that Builders FirstSource, Inc. is a hold.

Read the full article here