Dear readers/subscribers,

If you’re new to Marsh & McLennan (NYSE:MMC) as an investment potential, then this might be the right article for you. I’ve been writing about this particular potential investment going on for about a year at this point. The company reported 1Q relatively recently, and it makes a good case as to why Marsh & McLennan could be a core, defensive holding in your portfolio with above-average stability in an unstable world.

Let’s update the company based on the 1Q and the thesis and see why I am bumping my PT for Marsh & McLennan – but why I am not necessarily jumping on the company as a potential investment.

Marsh & McLennan – New targets after 1Q23

The company recently reported 1Q23, so let’s begin with that before we get into other things.

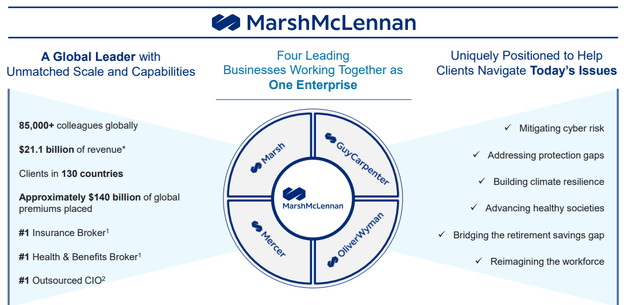

The company’s performance since the report should indicate to you what sort of results the company had for the quarter – market-beating and above expectations. First-quarter results generated top-line growth of 9%, on top of the 10% from the YoY period. This growth was broad-based, coming in from most of the company’s various businesses, segments, and geographies with attractive growth at Marsh, Carpenter, and Mercer.

MMC IR (MMC IR)

Of course, top-line growth is certainly not enough. Instead, what we have is operating income growth as well – double digits on an adjusted basis, with operating margin expansion on a YoY basis, implying cost control, among other things. This all resulted in an EPS growth on an adjusted basis in the double digits.

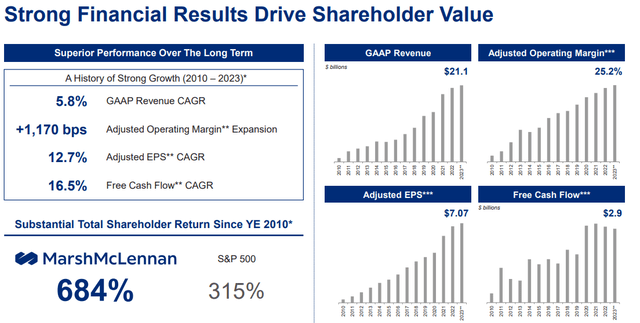

To be able to deliver such numbers in an environment like this speaks to this company’s quality, a quality I have been following for some time. What I am talking about is managing compelling underlying revenue growth over time, with proven resilience through multiple economic ups and downs. The company expects single-digit or better revenue growth in 2023. The company also has a history of delivering very solid margin increases despite complex operating environments and increased costs.

This is expressed through 16% margin expansion in around 17 years. 16%, in this segment, is never something to ignore or to take lightly. All of this has resulted in substantial FCF generation, nearly $3B for LTM 1Q23 with 16% CAGR in FCF generation in the past 13 years since the GFC.

The company is also an above-average capital allocator, prioritizing reinvestments into its own businesses, but also delivering growth through strategic acquisitions which have bolstered the company’s base.

MMC IR (MMC IR)

Looking at the overall comps, MMC is most often placed alongside insurance companies. This is a fair comparison, but at the same time, it’s not 100% correct either. Sure, 61% of the company’s revenue comes from Risk/insurance services, but almost 40% of the mix comes from consulting services which come at completely different COGS and OpEx. It does offer insurance brokering through the Marsh and Guy Carpenter arms, but part of the company’s appeal comes from Mercer, which provides HR services, which has very little to do with insurance. The same is true for Oliver Wyman, working with management/economic consultancy, which again has not that much to do with broad-stroke insurance segments.

Furthermore, about half of the company’s revenue is generated outside of NA, which makes this an international business.

Despite this mismatch on the comp side, the company is actually a market leader in terms of margins. The only level where it doesn’t go above average into the 80th or 90th percentile is when looking at gross margins – related to its COGS, which are different on the consulting side next to pure-play insurance businesses.

The company also isn’t debt-free, with a debt to equity of 1.37x and an interest coverage below 10x. This doesn’t make it a risky business, but it does give us at the very least a reason to impair the company a small amount.

Still, MMC has managed more profitability over the 10 years than 99.8% of the companies in its comparative segment. This makes it one of the most consistently profitable businesses in this sector, including peers (in part) such as Aon (AON), Brown & Brown (BRO), Steadfast Group, Willis Towers Watson (WTW), and others. As you can see, many of the comps are insurance brokers or straight insurance groups. I’ve written about some of them, like Aon, but MMC is still different.

Some insurance-related concerns. With inflation rising, this is driving insured values and loss costs up. Rates for insurance/reinsurance continue to increase, because carriers have to price in increased frequency of incidents and losses, which in turn drives higher reinsurance costs. This also comes from rising healthcare costs, which in turn is pressuring employers, which in turn pressures the labor market.

In short, everything costs more for everyone (more or less), and there is very little anyone can do about it.

This is both challenging and opportunistic for a company such as MMC. Insurance rate increases persisted, both on the property and their casual side. There was also a massive increase in cyber insurance rates. For reinsurance, the market remained challenging through all of April, and the risk appetite decline for prop insurance/catastrophe insurance plays that we see in Europe is also very clear across the pond in the US.

What I want to do here is to convey to you that the market is indeed very challenged, but also that MMC is in a good position to take advantage of chaotic circumstances – as reinsurance companies often are.

I also want to give you examples of what the company does in its non-insurance segment. MMC isn’t a simple HR staffing/Economy staffing firm. It does some of that, but its services are far more specialized. A good example is a recent case where the company representative from Oliver Wyman managed to deliver an executive compensation solution for a joint venture between 2 major medical device manufacturers. The company’s Mercer segment designed a new equity compensation rewards program for the joint venture. In the meantime, the company’s Oliver Wyman provided the modeling work for the rewards – and this is a good example of the type of high-stake work and solution that the company offers.

The company also continues to find savings potential in its organization.

But overall, we now expect roughly $300 million of savings by 2024, with total cost to achieve these savings of $375 million to $400 million.

(Source: MMC Earnings call)

What sort of risks and concerns should we be on the lookout for, from here on out?

Not much is my answer to that question. The main concern at this point is related to potential top- or bottom-line slowdown in growth. This is also why I’ve held MMC to a lower PT because I expected the company to actually not perform as well as it currently has been. However, for the time being, it seems that MMC will continue to outperform, or at least have a likelihood to do so.

Remaining conservative in my targeting is difficult – but I will show you why I, even after a quarter like this, am very comfortable remaining fairly conservative.

MMC Valuation – It remains prohibitively high and higher than before

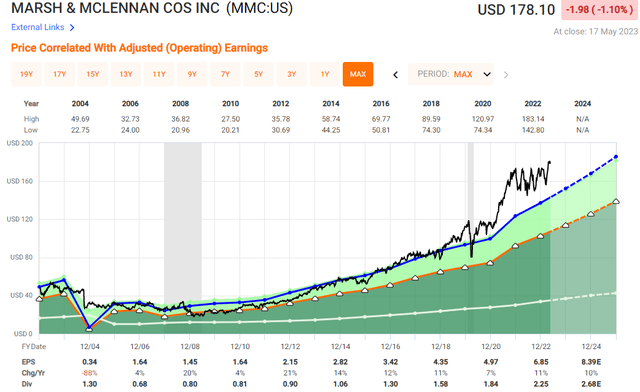

MMC Valuation (F.A.S.T Graphs)

As I am writing this article, Marsh & McLennan is at the place you see above. The company remains an A-rated stalwart, albeit with a very low yield of less than 1.5%. That makes it more of a potential “opportunistic” investment than an income one. At least, it would have been more opportunistic if the opportunity presented itself to acquire shares at an appealing share price. That is not the case here.

In order for you to find appeal in this company here, you have to subscribe to a massive premium for this business. And by massive, I mean well over 25x, which would be required to see market-beating double-digit RoR for the business. Should the company decline to 22-23x P/E, your returns become less than market-beating, and that’s even with a double-digit forecasted EPS growth rate based on continued expansion.

While I do not currently see any signs that the company is encountering any sort of significant margin pressure or issues on the demand side that could lead to any sort of fundamental decline, this is the danger or risk that we must keep our eye on. If it does, I find it likely that the company might decline. The instability, despite the outperformance, is apparent, as the company has been declining back down to its historical premium of 22-23x several times, only to straight back up again (and then back down).

What I see there is a valuation that’s too high – and I’m far from the only one. A conservative DCF with realistic, somewhat impaired single-digit growth rates puts the company at a range of $165-$180. While there is room for a $180 share price in that, that room is extremely limited. Several analysts are now considering the company to be at fair value (Source: GuruFocus, S&P Global), and I am no different.

Average S&P global targets start at $145 and go up to $205. The average currently is around $185. Even the somewhat exuberant targets here are less than 4.7% upside, and when we look at analyst recommendations/ratings for the stock, things get even worse. 17 analysts follow the company, but only 2 are currently at a “BUY”.

I believe this speaks very clear language, and that language/recommendation is “be careful”.

I can only add my voice to this chorus. When I invest, I look at investments that have a high likelihood, based upon historical valuation, fundamental qualities, and future projections I consider likely, which offer me a sustainable and continuous upside.

I believe sticking to such investments adds to my chance of overall, even as diversified as I am, beating the market over time. And my overall record with my portfolio and my own investments give some credence to this over the past 13 years.

So, this is what I am sticking to – and I am clearly telling you at this particular time, that Marsh & McLennan does not fulfill that particular goal. The company’s valuation is too stretched, and there’s too much potential downside in it for me to be attracted here.

Thesis

I consider the following thesis relevant for MMC here.

- The company is a world leader in brokering insurance and policies, and with business areas of risk, strategy, and other adjacent businesses, this organization is going nowhere. This makes it a quality business, but not necessarily the best investment for you at this time.

- With over 140+ years under its belt, this company is one of the largest out there in its respective businesses, and at a high valuation, this company becomes a no-nonsense “Buy” to me – at least at the right price.

- However, at current valuations, I consider MMC no more than a “Hold” at an overvaluation. I do not see how you can get a positive return from this company.

- As of this article in May of 2023, I view the relevant PT for MMC to be a conservative $155/share, from which we are currently removed.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

It’s not a business you should buy here. My 5 investment criteria are (italicized)…

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Because the company doesn’t fulfill any of my valuation-related criteria and scores 3 out of 5 here, it’s still a “Hold” for me.

Read the full article here