Introduction and investment thesis

Dynatrace (NYSE:DT) continued to impress investors in its FY2023 Q4 quarter, cementing its leading position besides Datadog (DDOG) as a modern end-to-end observability company. If you are new to the company, I suggest reading my following article: ‘Dynatrace: Deserving A Richer Valuation As A Profitable Growth Stock‘, which gives a brief overview of DT’s position within the observability space.

Based on Q4 revenue and earnings dynamics I believe the company has the potential to stabilize its ARR growth rate around 30% in the upcoming years, while steadily increasing its already spectacular non-GAAP operating and FCF margin of ~25%. This way the company could operate as a Rule of 50-60 company in the upcoming years. The transition to the cloud, where observability plays a critical role is the main driver behind these fundamental dynamics, and the increasing prominence of AI could take this to another level. I believe the strong position of the company is not properly reflected in the current valuation of shares, so I continue to rate DT stock as a Strong Buy.

On the brink of potential ARR growth reacceleration

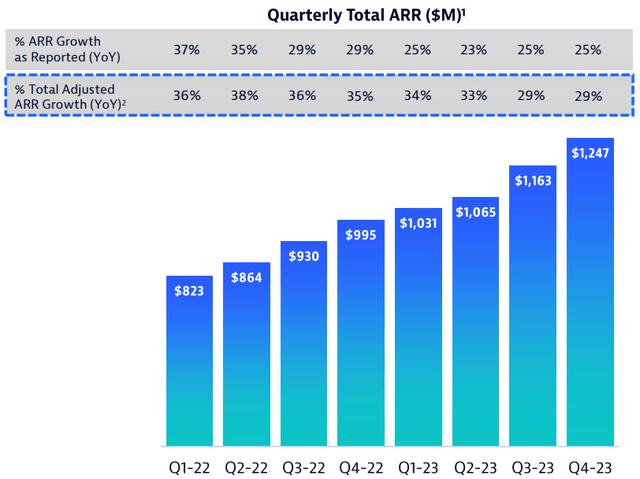

Dynatrace reported revenues of $314.5 million for the Q4 quarter beating the average analyst estimate by $10 million. A more important topline metric, adjusted Annual Recurring Revenue (ARR) (showing annualized value of active contracts at the end of the quarter adjusted for FX and a small technical item) grew 29% yoy, the same growth rate DT printed a quarter before:

Dynatrace Q4 earnings call presentation

This shows that after adjusting for FX movements the slowdown in topline growth seems to come to an end. As a sidenote it’s important to add that based on the Q4 earnings call $13 million of ARR resulted from early renewals, which will be then missing from the Q1 quarter. If we strip out this effect, adjusted ARR growth rate would have been one percentage point lower. However, this doesn’t change the fundamental picture to a material extent.

On the top of that remaining performance obligations (RPO) reached almost $2 billion for the end of the quarter growing 28% yoy. If we look at the current portion (expected to be recognized in the upcoming four quarters), which is not influenced by changing contract terms to a meaningful extent we can see 27% yoy growth after last quarter’s 25%. As RPO is a forward-looking indicator for ARR and revenues (especially at a company like Dynatrace, where RPO/Revenue ratio is high) this could signal that topline growth could possibly reaccelerate in the upcoming quarters. This has been a long-cherished aspiration of management, which has been delayed by the current global macroeconomic slowdown but seems to be within reach finally. There a several drivers behind this process, which I want to highlight in the following.

Key growth drivers

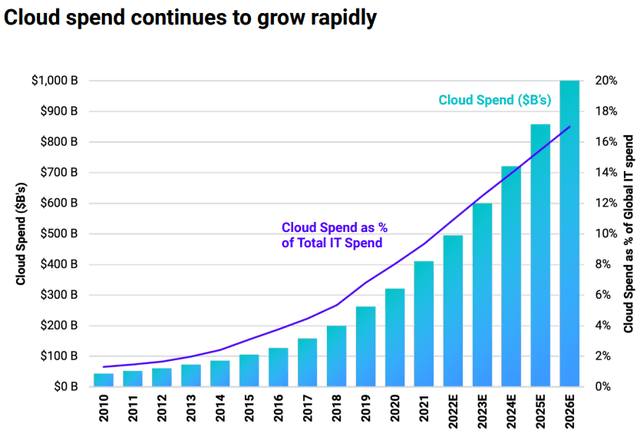

Following a top-down approach I want to begin at the macro level and continue with more company specific issues afterwards. The most obvious trend behind the success of Dynatrace is the transition of large enterprises to the cloud, which is the key customer segment Dynatrace targets (global top 15,000 companies). Dynatrace accompanies these enterprises on their gradual shift to the cloud updating or replacing their existing observability stack. As the solution of Dynatrace is both suited for on-prem and cloud environments it’s ideal for these large conglomerates. As things currently stand the transition to the cloud is still in its early innings, which is well represented by the chart below taken from competitor Datadog’s most recent earnings presentation:

Datadog Q1 earnings call presentation

Based on this (and other sources as well) global cloud spending could double from 2022 levels within the next 4 years providing a continuous tailwind for Dynatrace.

The increasing prominence of AI could further amplify these effects. The transition to the cloud makes things from an IT infrastructure point of view already more complex (e.g.: monolithic application vs microservices architecture). This could be further complicated through AI as for example it enables more effective and faster development of applications leading to a rapid increase of solutions to observe. On the other hand, the spreading of AI could possibly commoditize some parts of the observability market, but how this will evolve is a big question and remains to be seen. Dynatrace is utilizing AI and automation in its observability stack for a long time, so I believe they are well-positioned whatever changes are ahead of the market.

Going one step further the good relations of Dynatrace with the large hyperscalers and global system integrators (GSIs) could be another strong growth driver in the upcoming years in my opinion. On the hyperscaler front the company has the closest ties to AWS, where new ARR transacted grew by more than 80% yoy in FY2023. Regarding GSIs Dynatrace shared with investors on the Q4 earnings call that they have 10 different strategic partnerships including Deloitte and DXC who use the company’s observability solution in their reference architecture.

I believe the reason that Dynatrace is a popular choice among GSIs is that they developed an end-to-end observability platform, which is a perfect choice for enterprises who want to streamline their operations in difficult economic times. On the Q4 earnings management highlighted some competitive wins, where clients decided to replace several providers in their observability universe and use the unified solution of Dynatrace instead. However, not only existing but also new customers tend to utilize more and more Dynatrace solutions. In the Q4 quarter 65% of new customers landed with 3 or more modules a significant increase from 50% just one year ago. This is evidenced in the average new logo land of more than $130,000 on a twelve-month trailing basis, which stood “only” at $120,000 three quarters ago.

This motion has been further strengthened by Dynatrace last month when the company made DPS (Dynatrace Platform Subscription) available to all its customers. DPS is the frictionless cross-sell engine of the company, which allows customers to trial and deploy any solution of the company with a simple annual spending commitment. So, customers have the flexibility of switching between different products with no administrative burden. First experiences with the company’s largest customers show that they tend to experiment and use this option to gain exposure to other modules. Management shared that DPS is already ARR accretionary, and it could be an important growth lever in the future.

Another interesting part of the business which is worth to look out for in the upcoming years is IT security. The data observability companies handle is often the most detrimental for providing sufficient security to infrastructure and applications. This has been already recognized by several companies in the space, and Dynatrace hasn’t been an exception. The company focuses its security efforts on application security, a market that is expected to grow at a CAGR of 18% this decade. The company’s AppSec solution has already 400 customers with a goal to reach $100 million in ARR by the end of FY2025.

Based on these trends I believe that Dynatrace is positioned for strong topline growth in the upcoming years, enabling management to achieve their previously set goal of reaccelerating ARR growth north of 30%.

For the first sight, it could be conflicting that for FY2024 management guided for FX adjusted ARR growth of 18-19%. On the Q4 earnings call they shared that they continued to implement conservativism in their guidance by embedding further macroeconomic related headwinds throughout the financial year. I believe this could turn out overly conservative in retrospect as current trends show already signs of stabilization.

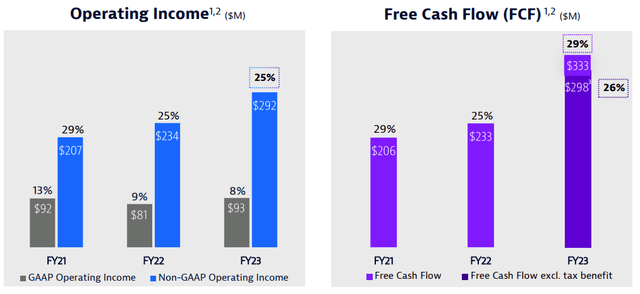

Further upside to margins from already enviable levels

An important distinction between Dynatrace and its peers from a financial perspective has been the evolution of margins in the past several years. Dynatrace has been emphasizing profitability for many years, while many SaaS companies began to pay more attention to their bottom line in recent turbulent economic times. Dynatrace reached both 25% non-GAAP operating income and free cash flow (FCF) for the second consecutive year in FY2023 and put the bar no lower than that for FY2024. With this, the company belongs to the elite of SaaS companies:

Dynatrace Q4 earnings call presentation

In the top of this, Rick McConnell, CEO made the following comment on the Q4 earnings call:

“I think there’s a significant opportunity for margin expansion long-term for the company. We’re going to be having an Investor Day here probably in the future. We haven’t set a date yet, and we’ll provide more insight on where we think maybe a long-term model could be for op margins. But you should expect that we think there’s significant room for accretion in the operating model. It’s obviously about rate and pace, when do you do that and how do you balance it based on the opportunities that you see in front of you.”

Besides eagerly expecting the upcoming Investor Day to learn more details I believe; this will pave the way for the Dynatrace to remain a Rule of 50-60 company (25-30% ARR growth + 25-30% FCF margin) for the foreseeable future. In the light of this I still wonder why the company is still so underrated within the investment community (11,800 followers on SA vs 51,500 for Datadog). I think this is also reflected in the company’s valuation.

Enough room for multiple expansion

Dynatrace shares are currently trading at ~10x FY2024 sales resulting from a market cap of $14 billion and expected annual revenue of $1.4 billion. For the first sight it could seem rich, but if we consider that only in 3 years’ time the forward P/S multiple could sink to ~4.5 assuming 30% annual topline growth I believe shares are not expensive at all. A P/S ratio of ~4.5 with a net margin of 25% (based on zero debt and 25%+ operating margin it should be a realistic assumption) would translate into a forward P/E of 18, which is equal to the current forward P/E of the S&P500 (SPX).

I believe in three years’ time it would be much better to acquire Dynatrace shares for the same price than the S&P500, which makes me conclude that there could be considerable room for share price appreciation. As a sidenote I didn’t take the dilutive effect of stock-based compensation into account, which should increase the valuation multiple by 2-3% a year. However, this doesn’t alter the picture to a material extent.

Conclusion

There are strong tailwinds blowing in the direction of Dynatrace’s business that could halt the deceleration in topline growth the company experienced throughout FY2023. This is coupled with further potential upside in already impressive margins, which makes shares a great long-term investment at current levels in my opinion.

Read the full article here