Investment thesis

Otis Worldwide Corporation (NYSE:OTIS) has shown great form since separating from its former parent in 2020. The company has grown and has several opportunities for future growth, including an initiative by management to “bring home” Otis elevators that are not currently serviced by the company. Macro drivers like urbanization and the growth of China – in which Otis has a strong position – could also act as a further tailwind to the company. Management also seems dedicated to rewarding shareholders via direct cash returns – and those cash returns are growing, too.

The Otis business model

In the 19th century, construction abilities evolved and demand for taller buildings grew. With it came a problem: Elevators of the time were unsafe causing several deadly accidents. Typically, accidents were caused by cables snapping. Today, elevators are considerably safer than stairs – there are many times more accidents on stairs than in elevators – and that is largely due to an invention revealed to the public in 1853 by US entrepreneur Elisha Otis: The “safety elevator” with a locking mechanism to prevent the elevator from dropping if cables fail.

Fast forward to today: Otis is now an international company serving most of the world with its largest areas of business in the US and China. China has the most elevators in the world, so that is the main area of growth – but more on that later. In much of the world, Otis shares the market with Finnish rival KONE and German counterparts thyssenKrupp and Schindler.

Otis leads the market for servicing elevators with around 2.2 million service contracts. Generally, the elevator market is tiered in 3: There is the selling of new elevators. The servicing of elevators. And then there is modernizing those elevators already in service. In terms of selling new elevators, the market is very consolidated with the 10 largest manufacturers sitting on more than 80% of the global market share. In terms of servicing, the market is much more fragmented with around 50 % of the market held by small service companies. This also presents growth opportunities I will discuss later.

Selling new elevators does make Otis money on the bottom line, but about 80% of earnings come from servicing elevators. So what this means is that the business of Otis is really servicing elevators – actually making and selling them is secondary from an economic standpoint. This makes a lot of sense, though: Servicing elevators is steady business because regulation requires regular service inspections, and that guarantees business for Otis. For developers and asset managers, servicing costs are merely recurring costs that are passed on to tenants or accepted as part of the cost of running a property. The fact that service is required should help insulate earnings against inflation.

How Otis is set to grow from here

Between 1975 and 2020, Otis was part of the industrial conglomerate United Technologies (now Raytheon Technologies (RTX)). The spin-off and IPO of Otis into a separate business has unleashed its growth potential, particularly in China. Before the spin-off, Otis was considered to be part of a US defense contractor. Not something the Chinese would ideally want to buy from. Now as a standalone company, Otis is better positioned to grow in China.

One of the key factors that is beneficial to Otis in China and elsewhere is urbanization. Research suggests that more and more people will live in cities. This leads to congestion that is fought in part by building high rises to optimize the use of lot space. This again causes demand for elevators. Between 2009 and 2016, China went from about 1 million elevators installed to 4 million – something that is largely due to the development of China’s main cities. One thing is selling new elevators in China, another is servicing them. Because of regulation requiring much more frequent service checks in China than in the US for instance, profit margins for servicing Chinese elevators are actually lower than that of US elevators. This is because salaries for technicians make up the vast majority of costs associated with performing the service, and elevators are much less dense in China than in many parts of the Western world. Less density means less efficiency – fewer elevators serviced per technician. This could change, however, if regulations in China change. Such regulatory change could increase margins for Otis.

As noted earlier, aside from selling new elevators and then servicing them later, modernizing “old” elevators is an area of potential growth for Otis. Real estate owners become more and more aware of ESG matters, including the environment. Optimizing elevators for better energy usage is something that could grow in popularity over time. And speaking of optimization: Otis uses technology to innovate and grow, too. A large part of elevators installed by Otis have sensors that help technicians.

There are about 2 million Otis elevators around the world not serviced by Otis. Otis knows this and is trying to get these elevators back under their service program: In 2021, Otis launched an initiative called “Bring it home”. The salesforce is incentivized to pursue the initiative through compensation structures. Managers are measured against the target. If Otis does get these elevators back under their umbrella, this alone would greatly increase service revenues. With the service business offering much higher profit margins than new sales, growth in this area should benefit Otis and shareholders to a great extent.

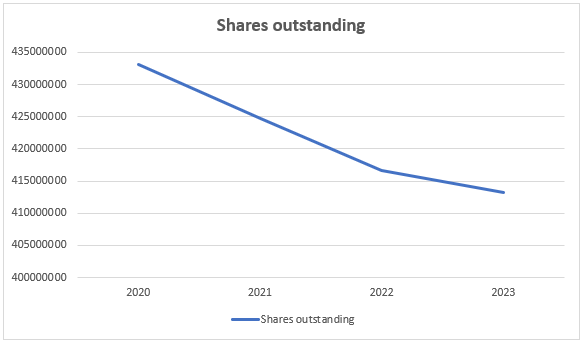

In terms of EPS, Otis uses share buybacks to grow EPS on top of the organic growth. Since going public in 2020, Otis has bought back a significant amount of shares:

Analyst’s presentation, data from company SEC filings

Aside from the buybacks, Otis pays a quarterly dividend. The annualized dividend is expected to be $1.31 per share.

Financials and Otis stock valuation

Latest quarterly results

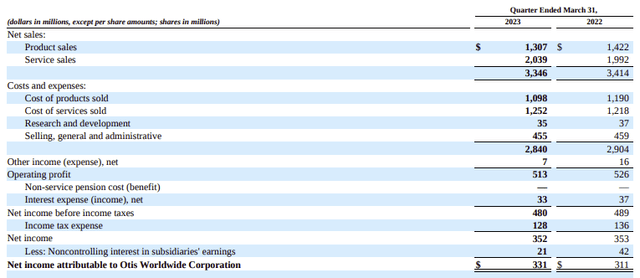

Otis last reported earnings on 26 April 2023 covering Q1 2023, topping consensus estimates.

EPS came in at $0.80, up from $0.76 the year prior. Sales for the quarter were $3,346 million, a 2 % year-over-year decrease. Net earnings were $518 million.

In its 10-Q, the company summed up results as follows:

Otis Q1 2023 10-Q

Going back a little further

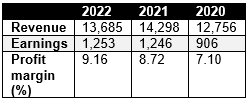

While the latest quarter showed declining revenue compared to a year prior, Otis has been able to grow their top-line since going public in 2020. Earnings and profit margins have come up too:

Analyst’s presentation, data from company SEC filings

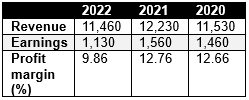

Otis outpaces their closest competitor KONE in terms of both revenue and earnings with KONE having lost ground, although KONE’s profit margin is somewhat better than that of Otis:

Analyst’s presentation, data from Companiesmarketcap.com

Valuation of the Otis stock

In 1937, John Burr Williams conceived the idea that the value of a business was equal to the amount of all future dividends paid out to investors in its lifetime (discounted to present-day value). This is now known as the dividend discount model (DDM). This has since become an authoritative model for valuing equities. At the time of the DDM’s conception, most cash returns to investors were in the form of dividends. Now in 2023, the majority of cash returns to investors in the United States come in the form of share repurchases/buybacks. Otis buys back shares, too. This makes valuing Otis based on dividends alone misleading as you’d be disregarding the value of the millions of dollars returned through buybacks. In other words, you’d be modelling a value of Otis that did not account for the obvious value attained from being less shareholders owning the same company.

For the purposes of this valuation, therefore, I will use a modified version of the dividend discount model – the so-called H-Model – and when discounting the expected dividends I will add in the expected future buybacks. You could say that in doing so I am considering the buybacks merely a different kind of dividend that I will add on top of the “classic” dividend, and then discount the total returns.

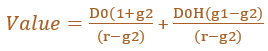

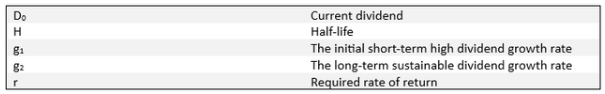

The H-Model itself consists of the following elements:

Analyst’s presentation

The elements of the H-model mean:

Analyst’s presentation

The general idea of the H-Model is to reflect that typically companies who increase their dividend will do so at a faster pace initially than later. One valuation is made for the period of high increases, one for the period of lower increases, and the two are added together for an aggregate valuation.

For 2022, Otis paid a total of $465 million in dividends and made buybacks of $850 million for a total cash distribution of $1,315 million. This is $3.18 per share currently outstanding (annually).

Since going public, Otis has increased its dividend by an average of 19.4% per year. Since starting to buy back shares, buybacks have come up 17.2%, although based on just a single full year. Based on the strong possibilities of growth ahead for Otis and its relative “insulation” against inflation and recessions, I’m assuming Otis will be able to keep up relatively high growth numbers in the coming years. For this valuation, I’m assuming an initial high growth stage of 15% over the coming 5 years. Thereafter, I’m assuming a 6% perpetual growth rate. I’m discounting with a rate of 9%, somewhat in line with general stock market returns.

Under these assumptions, each share is modelled to be worth ~$136. This would suggest substantial undervaluation of the market at current prices of ~$85.

To ‘challenge’ my calculations in connection with the valuation according to the DDM model above, I would like to analyze valuation multiples and compare them to past levels. Otis’ 3-year average P/E ratio is ~28. This is almost completely in line with current P/E levels also at ~28. Assuming a value in accordance with the 3-year average, the Otis stock appears fairly valued. To me, however, the historic P/E is not very informative here because of Otis’ short time as a publicly traded company.

The analysis above suggests a “value range” of ~$85 to $136 per share of Otis. If you believe Otis can grow through the mechanisms described in the Growth section, and if you believe historic P/E levels are not very informative because of its short life as a publicly traded company, Otis could be substantially undervalued.

Risk factors

Otis management discusses the main risks surrounding their business in the 10-K Risk Factors section. Here, management has identified the following key risks that I would like to highlight:

Our international operations subject us to risk as our results of operations may be adversely affected by changes in local and regional economic conditions, such as fluctuations in exchange rates, risks associated with government policies on international trade and investments, and risks associated with China and other emerging markets.

As I covered in the Growth section, much of Otis’ future potential – and therefore also much of the modelled value of the stock – is directly dependent on growth in mainland China. With geopolitical unrest between the US and China, this risk is key to understanding what you are buying – and depending on – when investing in Otis. Management knows it, and so should you. Any changes in China’s regulation aimed at foreign companies could affect the results of Otis, especially if such regulation attempts to favour local manufacturers over foreign ones.

Another relevant risk is one that management defines in the following way:

We use a variety of raw materials, supplier-provided parts, components, sub-systems and third-party manufacturing services in our business, and significant shortages, supplier capacity constraints, supplier production disruptions or price increases could increase our operating costs and adversely impact the competitive positions of our products.

I personally see this risk as relevant but hard to eliminate. It’s something that needs constant addressing by top management but also local management. The COVID pandemic underlined the importance of robust supply chains. It demonstrated full on the vulnerability caused by “weak links”. While a new pandemic is not necessarily around the corner, other disruptions could cause similar constraints. If Otis is unable to obtain supplies, components and materials, then growth is threatened. For obvious reasons, actually making the revenue and earnings that are required to grow and justify the market price of Otis shares requires a lot in terms of extracting growth where ever possible.

Conclusion

In conclusion, I assess that Otis has been “set free” by the divestiture from United Technologies (now Raytheon). This enables growth in China. Coupled with a strong focus on “bringing home” Otis elevators under the company’s service program – a lucrative business for Otis – and initiatives regarding technology and buybacks, Otis appears set to keep growing. The steady business provided by required service inspections and urbanization should also push Otis forward.

On top of Otis’ growth potential, management seems intent on rewarding shareholders. As already mentioned, Otis boosts EPS through buybacks, but the company also offers a growing dividend yield.

Because Otis is a growing company with strong tailwinds to keep growing, and because management is focused on the bottom line and rewarding shareholders directly, I rate the Otis stock a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here