A Leaner & Focused Investment Thesis

Shopify (NYSE:SHOP) has had an interesting FQ1’23 earnings call indeed, mostly attributed to the surprising sale of its logistics segment, Deliverr/Shopify Fulfillment Network to its partner, Flexport. In return, the former will receive 13% equity interest, with the latter being the official logistics partner henceforth.

Given how its logistics ambitions have been a root cause for the deterioration of its gross and operating margins for the past few quarters, we can understand why the management has decided to refocus its efforts to be a more profitable SaaS company, instead of engaging Amazon (AMZN) on a volume-based, low-margin, and high capex battle.

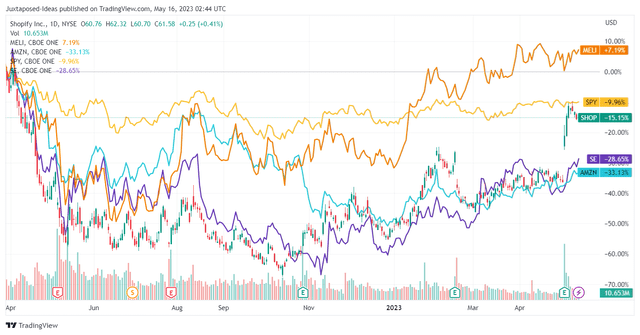

E-Commerce Stock 1Y Performance

Trading View

The announcement is timely as well, due to the peak recessionary fears and rising inflationary pressures impacting SHOP’s (and many other e-commerce’s) performance and stock prices thus far, one similarly experienced by AMZN. The latter had overly estimated the hyper-pandemic demand and expanded its footprint and headcount too aggressively, resulting in negative net income margins in FQ1’22 and FQ2’22.

While AMZN, the e-commerce market leader, has been drastically terminating projects and trimming expenses, its stock prices continue to underperform over the past six months, reflecting Mr. Market’s sustained pessimism as discretionary spending decelerated. As a result, we applaud SHOP’s strategic choice in restructuring its business into a more focused SaaS model.

For now, SHOP delivers excellent top-line growth with revenues of $1.51B (-12.7% QoQ/+25.8 % YoY) in FQ1’23, with its bottom line likely to improve ahead, from the current underwhelming adj EPS of $0.01 (-85.7% QoQ/-50% YoY).

The SaaS company also provided excellent forward guidance, with FQ2’23 revenues of ~$1.62B (+7.2% QoQ/+25.8% YoY) and gross margins of ~47.5% (inline QoQ/-3.1 points YoY). We suppose the latter will notably improve from H2’23 onwards, likely nearer to FY2021 levels of 53.8% (prior to the Deliverr acquisition in mid-2022), once the sale of its logistics segment is concluded by FQ2’23.

In addition, SHOP expects to achieve Free Cash Flow (FCF) profitability for “every quarter of 2023,” likely nearing an upper range of $500M for FY2023 (+368.1% YoY and in line with FY2021 levels).

This cadence is based on a similar FQ2’23 execution at FCF of ~$85M and potential doubling to ~$160M for FQ3’23 and FQ4’23), aided by the -23% reduction in workforce and consequently, operating expenses/Stock-Based Compensation from H2’23 onwards.

Given the massive improvement in its profitability, we may see SHOP generate an accelerated bottom-line expansion in FY2024, with market analysts already projecting FY2024 adj EPS of $0.50 (+63.2% YoY) and FCF of $410.23M (+34.8% YoY).

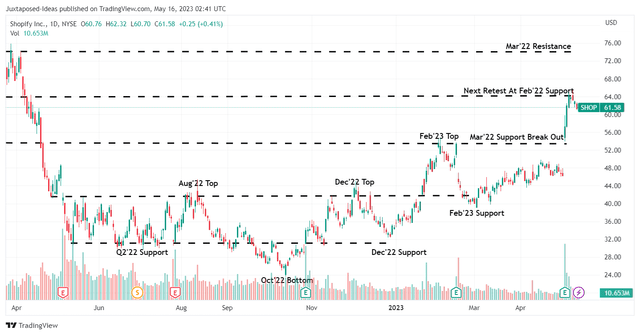

SHOP 1Y Stock Price

Trading View

Therefore, it is unsurprising to see the SHOP stock riding a massive wave of optimism, already breaking through its previous February 2023 top. However, we are not so bullish as to assume a successful rally beyond the previous February 2022 support levels of $64, since it may take two quarters for the restructuring results to take effect.

Anyone looking to add here may also face more volatility in the short term, with the Fed still hiking interest rates in May 2023 despite the spreading contagion in the banking industry. With more banks likely falling victim to the elevated interest rates, the pessimism in the stock market is still highly palpable, with the SPY still trading sideways after twelve months of volatility.

Due to the potential underperformance from current levels, we prefer to rate the SHOP stock as a Hold here, as it is not prudent to chase this rally.

Meanwhile, tech investors should continue monitoring the stock, given the SaaS’ stellar headless commerce solutions with flexible customizations in both front-end and back-end, across different sizes and price points. It similarly offers logistical solutions with its (future) partner, on top of the payment solutions with Shopify Payments.

This cadence is already visible in SHOP’s expanding subscription solutions revenue to $382M (-4.5% QoQ/+10.7% YoY) and merchant solutions revenue to $1.12B (-15.7% QoQ/+31% YoY) in FQ1’23, partly attributed to the raised prices for its plans. This performance is impressive indeed, compared to the FQ1’22 cadence of -1.8% QoQ/+7.5% YoY and -16.5% QoQ/+28.5% YoY, respectively.

In addition, the SaaS company also reported an exemplary expansion in its Gross Merchandise Volume (GMV) to $49.6B in the latest quarter (+15% YoY), despite the supposedly tightened discretionary spending thus far.

This is on top of SHOP’s Monthly Recurring Revenue (MMR), which grew to $116M (+5.9% QoQ/+10% YoY) attributed to increased trial conversion to Standard plans and expanded utilization of its Point-of-Sale Pro solution.

Despite the hefty price of over $2K for the Plus subscription, the category comprised $39M (+6.5% QoQ/+22.6% YoY) or 33.6% (+0.2 points QoQ/+3.4 YoY) of the SaaS’ MMR by FQ1’23, demonstrating the growing stickiness of its premium SaaS offerings.

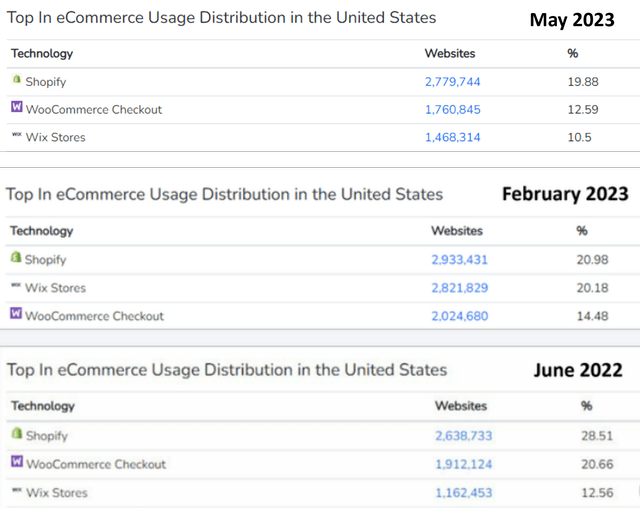

E-commerce Usage Distribution In The US

BuiltWith

Lastly, despite the uncertain macroeconomic outlook, SHOP’s usage distribution in the US remains market-leading and stable by April 2023, in comparison to its peers. The underwhelming performance is also witnessed through WIX’s revenue growth (WIX) at only +2.6% QoQ/+8.1% YoY in FQ4’22.

It is for these reasons that we remain confident SHOP may emerge stronger from this economic downturn, with its profitability likely accelerated by the logistics divestiture.

Read the full article here