Investment Thesis

Antero Resources (NYSE:AR) stock has been continuously declining recently, as natural gas prices declined from their highs in 2022. But now that we are moving into the second half of 2023, natural gas prices have a number of tailwinds, which could help to push them back up, including improving weather conditions and slowing natural gas production. This makes for a compelling case for Antero Resources, which has taken a significant hit from the natural gas price reversal over the past year. Now that a price turnaround could be around the corner, Antero’s stock, which has declined by 34% over the past year could be headed back up soon

What’s Driving Natural Gas Prices?

Usually, natural gas prices head upwards when El Nino, which is a weather event that usually results in hotter summers, strikes. With El Nino around the corner expect weather to be hotter on average across key regions including the United States and Europe, which should increase demand for natural gas.

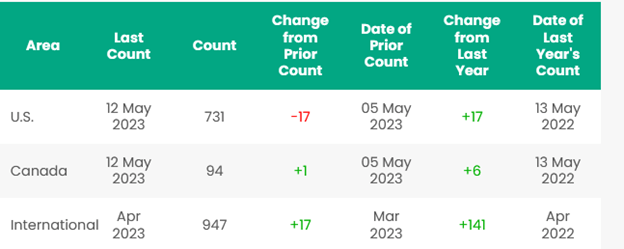

In addition to the issues related to El Nino, we are increasingly witnessing a broader production slowdown, as higher interest rates and unprofitable operations slowly wind down. As a result, prices have been heading up recently, as news from the Baker Hughes rig count showed a significant decline in activity from US natural gas producers.

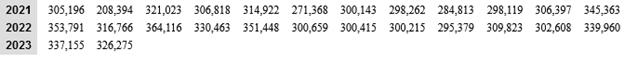

Rig Count Oil & Gas (Baker Hughes)

Prices have declined from a high of around $5.8 in 2022 to the recent Henry hub price of approximately $2.5, which is driving many natural gas producers to cut production. Regardless, production still remains relatively high, despite the slowdown, and analysts expect natural gas production to rise to 101.9 million BCF per day as we move through 2023, up from 98 BCF per day in 2022. (Source)

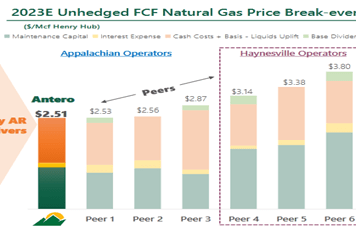

Despite the recent increase in prices Antero Energy will continue to struggle through the next quarter. With production declining by 3% during the most recent quarter, and with the company’s own breakeven at around $2.5, the company could see a negative print in terms of cash flow, when the next set of results comes out. Antero will be hoping that prices head toward the $3 range, as forecasted by the EIA, but until they do, things look bleak.

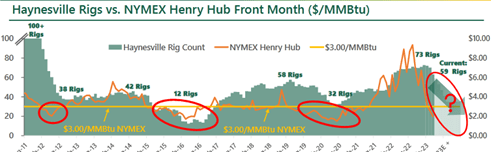

Historical Trends and Moving Into 2023

Historically speaking decline in prices leads to significant declines in rig counts, and with prices hovering in the $2-3 range once again, rig count should subsequently see a significant decline, this time as well. While increasing interest rates will continue to put pressure on some shale companies, debt which currently stands at around 62 billion, isn’t an overall worry, especially as many shale producers have significant amounts of cash on their books. And since many have also reduced debt significantly in recent years, as energy prices boomed, increasing interest rates, should not result in significant bankruptcies. Furthermore, these producers are likely to quickly ramp up production as prices rebound, which could lead to natural gas prices declining if they were to rise initially.

“Between the third quarters of 2019 and 2022, the 10 largest independent oil and gas producers by market capitalization had collectively sloughed off total debt by roughly 17%, down to $84 billion, according to FactSet.” – Wall Street Journal

Haynesville Production Decline (Antero Energy Presentation)

With the improving weather conditions and slowing production, the futures market expects natural gas prices to head towards $2.7 later this year, and with, the EIA currently predicting $3 by Q3, could mean Antero, whose stock has been hammered in recent times, may be on the verge of a turnaround as well.

Unhedged FCF Level (Antero Energy Presentation)

Antero has far better long-term prospects with the futures market forecasting prices to head back above $3.5, with a potential to hit $4 if winter is especially cold, the company could have far better results towards the end of 2023. Meanwhile, 2022 was a wash, with 2022-2023 the winter period not being as cold as previously expected, which led to natural gas prices declining. But now with 2023-2024 expected to bring in a colder and wetter winter globally, should result in an increased demand for natural gas, which has been hammered over the past 6 months.

Global Outlook and Inventory

Antero’s short-term fortunes are not as bright as their long-term prospects, and natural gas supply cuts to Europe, have led to record imports for European countries. Europe’s natural gas storage is hitting record capacity, leading to prices falling on the European exchanges. I expect storage levels to decline, as the summer hits Europe, and exports from the US continue to tighten, but the short-term glut does not bode well for the price of natural gas.

“As of 1 April 2023, natural gas storage inventories were 56% full – the highest percentage on record for the end of a heating season (1 November through to 31 March) – according to data from Gas Infrastructure Europe’s Aggregated Gas Storage Inventory (AGSI+). On 1 April 2023, natural gas storage in Europe totaled 2.02 trillion ft3, exceeding the previous record of 1.98 trillion ft3 at the end of winter 2019 – 2020 and the five-year” (Source: EIA).

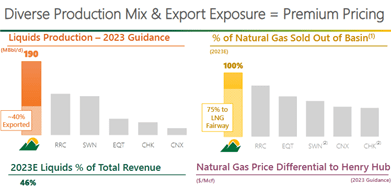

Therefore, as overall supplies tighten post-summer, Henry Hub prices should similarly continue to increase into the summer, and could suddenly rise to $3. This is especially important for Antero which exports a significant amount of its production including 40% of its liquids, and 100% of natural gas, which are sold out of the basin. Out of the amount that is sold out of the basin, 75% of that total is sold to LNG Fairways. Now with a significant amount of production expected to be exported at premium prices, the post-summer season could result in significant improvements to the company’s finances.

Production Diversity (Investor Presentation)

Regardless, LNG exports to Europe continue to be at record high levels for now, and demand is expected to continue to rise as well, which means if supply tightens, prices could quickly rise as well. While Antero is holding back on production currently, it should increase production as we move into the next few quarters, and that should bring cash up higher. Once prices head above break-even production is likely to be ramped up quickly as well.

-Antero holds 2.3 Bcf/d of firm transportation to LNG export areas, including Cove Point in Maryland and the Gulf Coast, an asset that makes the company “uniquely positioned to supply the increase in international demand,” CEO Paul Rady told analysts. (Source)

Natural Exports to Europe (EIA)

The premium pricing from European, currently allows Antero to realize prices at around a 6-7 cent premium to Henry Hub, so management will be waiting and watching, as it looks to see where prices head in the near future before it takes its next step. And if supply levels tighten, it will quickly look to increase its own production, and revenue and profits could once again rise.

Financial Outlook

Therefore, should prices increase, by the time we get into the latter half of the year, Antero could once again see significant cash flow increases, at which point the valuation, which currently stands at around 3x. But if prices don’t increase, Antero’s valuation is likely heading to 7x on a forward basis. Should conditions worsen and prices drop back to $2 levels, it’s likely the forward P/E will not be applicable, since the company is likely to be unprofitable. Finally, if prices do head towards something like $3 a share the valuation would likely trade at around $3 a share, which would be quite attractive for investors.

But the stock will continue to face pressure until then, with risks stemming from the global economy, risks that could keep prices muted, especially if demand remains muted. This, despite the tailwinds, such as hotter weather in the summer. Adding to the uncertainty is Europe, which is already facing record energy bills, and if prices continue to rise many households may seek alternative forms of energy, which may further dampen demand. Other risks include Antero’s debt to equity, which stands at a slightly high level of 0.68, albeit still within an overall reasonable range. But if the company is FCF negative and interest rates rise, this could affect production and payment.

Summary

In conclusion, Antero’s situation will continue to improve as we head into the year, and things are looking positive for now. It remains to be seen how things end up, but overall, the situation, for now, remains uncertain and is leaning towards the stock remaining where it is. If conditions improve then investors may consider potentially taking a position in the stock, until then the stock remains a hold.

Read the full article here