Overview

UiPath Inc. (NYSE:PATH) is a robotic process automation company that has been publicly traded since Q2 2021. The company sells a suite of workflow automation products centered around the UiPath Automation Platform. This platform takes the form of an IDE (integrated development environment) with a visual interface, allowing non-technical users to leverage technical capabilities which, when combined, can automate various information processes in a business context. Technical capabilities come modularized and include common types of technology such as optical character recognition (OCR) for transcribing text.

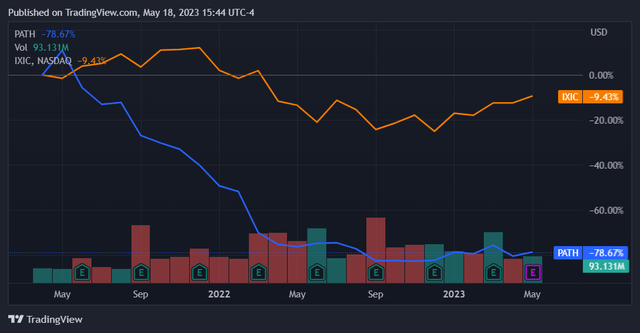

The company’s stock had initial buoyancy for a month after its IPO but has since cratered while significantly underperforming the NASDAQ Composite.

Seeking Alpha

The price return trendline this year has seen a change of pattern, with the company’s exceeding the NASDAQ Composite on a price return basis for most of the year. The monthly correlation of this instrument to the NASDAQ Composite has also been far lower than historical norms since mid-April, and the sell-off that again brought it below the Composite’s price return occurred with little correlation. The recent run-up that has settled the stock at a marginally higher price return saw it again correlating with the index.

Clearly, this stock has been seeing volatility and has had price action that is not purely derived from its general trading volatility as compared to the market (beta). It also experienced appreciation after its latest earnings report and is now set to release Q1 2023 earnings in less than a week, on May 24th.

Seeking Alpha

This article will review UiPath’s financials and see what we can garner about its performance heading into earnings.

Financials

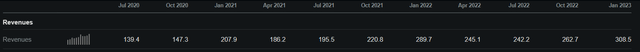

UiPath has overall continued to grow y/y even as it has experienced cyclicality in its business q/q. Since software businesses do not generally see their revenues fluctuate q/q, this is interesting to see; it is not immediately apparent why this would be the case. Additionally, growth appears to have fallen off a cliff in the most recent quarter, with a y/y growth rate of 6.51% that is the company’s worst-yet as a public firm.

Seeking Alpha Seeking Alpha

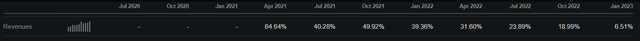

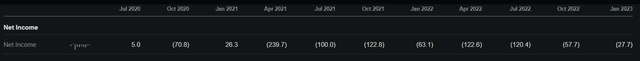

UiPath has also continued to operate unprofitably since becoming public. Worth noting here is that the firm did post a quarter of positive operating income for fiscal Q4 2022 (period ending Jan 2021), the quarter prior to which it went public. This came along with a net income margin of 12.63% that quarter, which was buoyed to a level beyond operating income by one-off EBITDA adjustments.

Seeking Alpha

While fiscal Q4 2022 was a good sign that the firm’s business model makes sense, I don’t consider that one quarter to be too indicative of its economics going forward. The company is now in the process of pivoting to profitability, as with many other middle-market technology firms at this time. It still generated only a -8.98% net margin in its most recent quarter.

Seeking Alpha

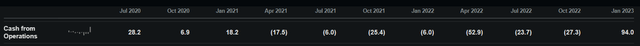

On the cash side of things UiPath appears to have more recent momentum. The picture here is similar to income; UiPath showed 3 quarters of positive cash from operations before going public and then appears to have doubled down on growth. It is still good to see that the latest quarter saw the firm post an impressive 30.5% cash operating margin.

Seeking Alpha

The company also has a clean balance sheet, with only $63.4M in total debt and little in the way of interest payments ($0 last quarter, never more than $1M any of the last 10 quarters).

The company also continues to make use of stock-based compensation, albeit at slower rates. As of the most recent quarter the company’s q/q common share growth was 0.53%. If we compound this rate 4 times (1.0053^4), we get a yearly common share growth rate of 2.14%. This appears to already be at the level in which it shouldn’t serve as too much of a concern for investors worried about share dilution from stock based compensation.

|

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

|

|

Common Shares Outstanding |

507.8 |

513.2 |

524.8 |

541.2 |

544.9 |

549.5 |

552.4 |

|

Shares Outstanding q/q |

1.06% |

2.26% |

3.13% |

0.68% |

0.84% |

0.53% |

Source: Excel, Seeking Alpha

Overall the financials here indicate that this was a fast-growing company that has hit the skids. This is less worrisome than it may be otherwise because UiPath has proven that it can be at least somewhat profitable in the quarter leading up to its IPO. Assuming that growth now continues in the single digits, the story for this stock will be contingent on its path to profitability. The next section will review how the company has progressed on this relative to expectations and determine how it should fare for its upcoming quarterly release.

Profitability

The prior quarter saw UiPath generate a 22% non-GAAP operating margin and a -11.29% GAAP operating margin. The company’s guidance states that it is expecting non-GAAP operating margins of 9.5% for this current fiscal year. As GAAP profitability still appears a ways away we will focus on non-GAAP metrics.

Currently, the company is expected to post a non-GAAP EPS of $0.02 for the upcoming quarter. This represents an absolute EPS gain of $0.07 q/q and appears well in-line with recent trends; this represents 140% of last quarter’s absolute EPS growth but only 58% of what we saw going into Q3 2023. Since the company was previously able to post positive non-GAAP earnings, I think it is reasonable to extrapolate this trendline. Overall, I think consensus EPS is on the money here.

|

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

|

|

EPS |

-$0.23 |

-$0.22 |

-$0.10 |

-$0.05 |

|

EPS Change Absolute |

$0.01 |

$0.12 |

$0.05 |

Source: Excel, Seeking Alpha

Revenue is expected to come in at $271.24 for the quarter, a y/y gain of 10.68%. This seems optimistic to me given the prior quarter’s anemic y/y growth of 6.51%. Given ongoing macroeconomic uncertainty and its pressures on B2B technology spend, I am not inclined to believe that a return to double-digit growth will occur just yet.

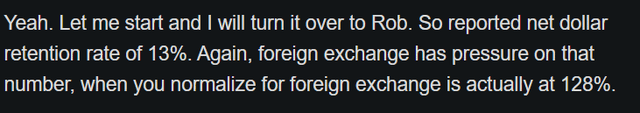

The caveat here is foreign exchange adjustments. This company has a high level of international sales (48% in fiscal Q3 2023, data for Q4 2023 not immediately available) and is quite sensitive to the Dollar exchange rate. Remarkably, FX pressures turned the company’s net dollar retention rate into an abysmal 13% in the latest quarter – normalized at 128%.

Seeking Alpha

The upward pressure on the Dollar has overall moderated, however, with this year so far seeing a much lower average price point than what we saw throughout 2022. While the exact impact of this will come down to the company’s hedging and contract timing, it is fair to say that this top-line pressure has eased materially.

DXY Seeking Alpha

As such I think the consensus estimate for a return to low double-digit growth actually makes sense. This leads me to believe that consensus is overall roughly correct for this company’s upcoming earnings.

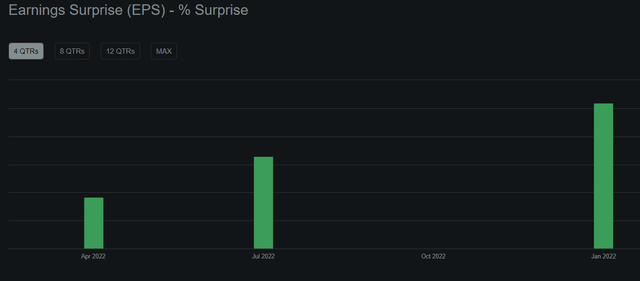

The kicker here is that UiPath has posted very high beats against consensus 3 out of the last 4 quarters. Last quarter’s EPS surprise of 129.81% was remarkably high. While revenue surprises have been less extreme and appear to be much closer to correct, on average.

Seeking Alpha

This trendline makes me think there is still a possibility for the company to post an EPS higher than consensus. Bottom line consensus for this stock has been too inaccurate to be considered predictive; last quarter’s record level of adjustment indicates this is still ongoing.

Using the absolute EPS gain from recent quarters is also reasonable because it accounts for how much operating leverage the company has to actually move the needle on EPS. Since the absolute EPS gain of $0.12 two quarters ago was the highest that we’ve seen across the past 4 quarters, this can be considered a reasonable proxy for an upside scenario. If UiPath can gain $0.12 on EPS q/q, this would yield quarterly earnings of $0.07 for this upcoming quarter’s results.

Conclusion

The other signal that we can’t ignore here is share price momentum. UiPath shares have been on the upswing this week, which is the week prior to its next earnings release. The shares have been quite volatile, frequently hitting their 2-sigma levels of volatility on a monthly rolling basis. Today saw sustained buying at these levels. This is a market signal for optimism on the company’s earnings performance.

Seeking Alpha

Given the fundamental and technical trendlines here, I will assert non-GAAP EPS of $0.04 for UiPath’s fiscal Q1 2024 quarter.

Overall, this makes the stock appear to be a buy heading into earnings. This is a particularly risky trade, however, as there has been a large amount of variance in both the share price (52 week range: $10.40 to $22.30) as well the non-GAAP earnings for this stock, creating a much wider range of near-term outcomes.

Read the full article here