All values are in CAD unless noted otherwise.

The REIT

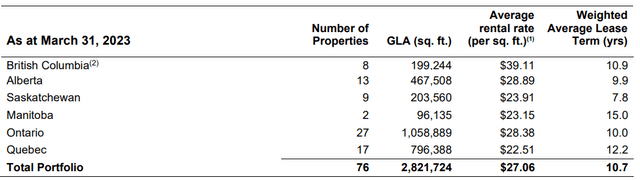

Started in 2015, Automotive Properties Real Estate Investment Trust or Auto REIT (TSX:APR.UN:CA) is a steadily growing business. It owns properties that are leased by automotive businesses to house their dealerships, repair facilities, service centers and vehicle service compound facilities. Auto REIT modus operandi is to buy the properties from automotive businesses meeting their operational cash flow or succession planning needs. With the larger names owning less than 15% of the 3,500 automotive dealerships in Canada, this REIT has a lots of room to add to the 76 income producing properties it owned at last count.

Q1-2023 MD&A

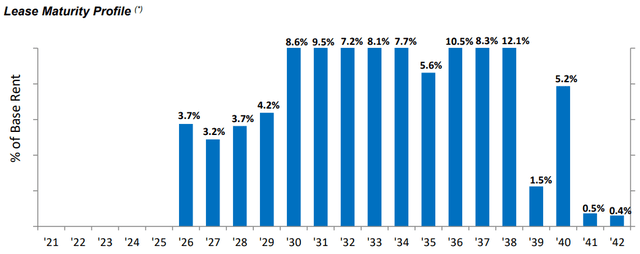

With a weighted average lease term of close to 11 years, Auto REIT does not have to deal with renewals until 2026.

Q1 2023 MD&A

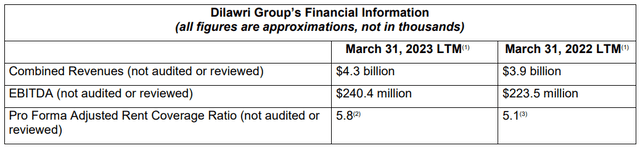

Back in 2015, Auto REIT had started off by acquiring 26 properties from the Dilawri Group and subsequently they became tenants of the REIT. Dilawri continues to remain this REIT’s largest tenant with close to 58% of its NOI coming from them in the last reported quarter. We are not too worried about this due to the financial strength of this tenant.

Q1-2023 MD&A

Dilawri also has skin in the game in the form of 31.5% effective ownership interest in the REIT. As long as this stays at or above 10%, Auto REIT has the first dibs on any property that suits its purpose that is developed or acquired by Dilawri in Canada and the US.

All its leases are triple-net in nature, which means that the tenants bear all the costs pertaining to the property except for those that relate to structural capital improvements.

Prior Coverage

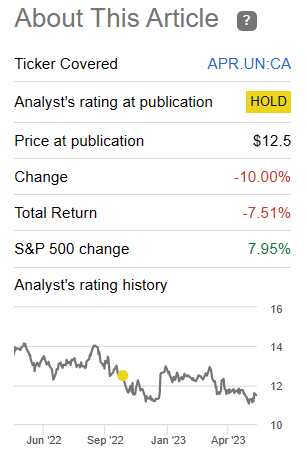

We have held this stock for some time now. When we started our coverage on this platform last October, we rated it a hold based on the stock price at the time. The positives outweighed the negatives in our analysis. The impressive weighted average lease terms and ownership of land in prime areas laid a solid foundation for this business. The challenges of adapting to the transition to electric vehicles and the heavy concentration in one tenant were manageable in our opinion. Despite waxing eloquent about Auto REIT back them, we did not recommend going hand over fist on it as the price was not right. We were buyers only under $12.

Seeking Alpha

We have the opportunity to add to our exiting position now, but we have not pulled the trigger yet due to a smorgasbord of bargains we see out there. While we are not adding, this REIT may still make a great addition for those that do not own any yet. We review the last quarter’s results to determine just that.

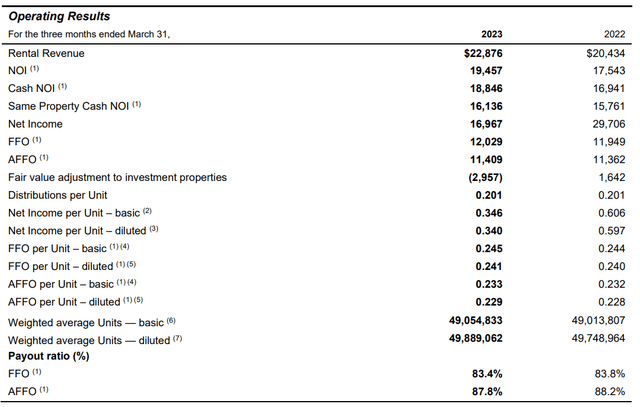

Q1-2023 Numbers

Property acquisitions and contractual annual rent increases continue to propel the revenue and net operating income or NOI numbers.

Q1-2023 MD&A

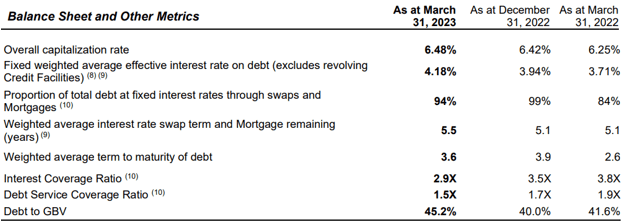

The net income was comparatively lower due to fair value adjustments for the properties and interest rate swaps. 94% of its total debt has fixed rate either directly or via swaps, with the weighted average interest rate being 4.18% as of March 31, 2023.

Q1-2023 MD&A

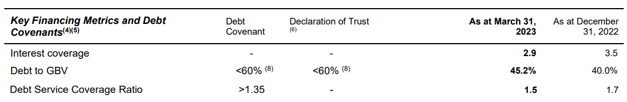

While the REIT’s NOI is increasing, it has not been fast enough to keep up with the rising interest costs from additional borrowings undertaken to fund its growth. We can see that above in the falling interest coverage ratio. The other metrics like debt to gross book value or GBV and debt service coverage ratio are still however still well within the limits set by the covenants in place.

Q1-2023 MD&A

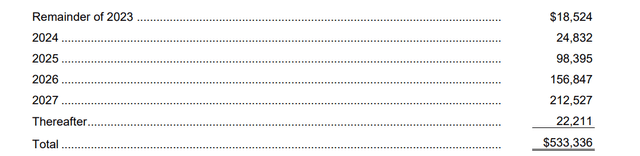

The increasing Debt to GBV is as per management expectations and they are targeting an even higher number (50%-53%) to stay on the growth course. In terms of principal repayments, around 3% was due for the remainder of 2023 as of the end of Q1.

Q1 2023 MD&A

Auto REIT was quite comfortable in terms of liquidity at March 31 with around $52 million in undrawn credit facilities, a number which increased to $82 million by the time the Q1 report was published. It also has four unencumbered properties approximately valued at $61.5 million. Monthly distributions have remained unchanged at $0.067 since 2015 and the REIT has annually paid out around 90% of its FFO for the last few years (except for 2020, which was higher). At the current price the stock yields 7.2%.

Our Current Outlook

The next couple of years may be a balancing act for this REIT. On one hand they will have the opportunity to pick up properties at good prices with the not so rosy macro environment. On the other hand, they will have to manage their rising interest costs.

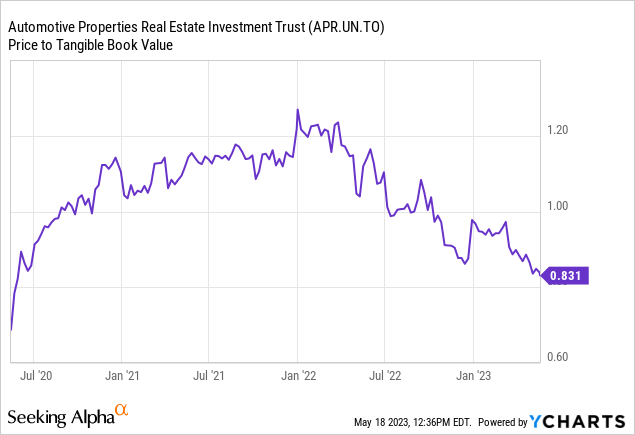

The REIT has been active in the capital markets in 2023 by buying 4 properties in Quebec in early 2023. One more was in the works at the time the Q1-2023 results were released. One reason it could do that was that the REIT traded close to its NAV for most of the last 3 years.

The current price though is problematic for the company to issue more equity and that means it will have to look for opportunities when the stock bounces to issue units. The acquisitions in 2023 were debt funded and that was ok as a one-off. But things will be challenging in the future.

From our perspective, the current price is attractive from an income investor’s standpoint and this is one of the few cases where we believe in the NAV stated by management. Automotive dealerships are built large parcels of land and most are in relatively attractive neighborhoods. This is one real case of where the phrase “buy land, they are not building any more” applies. The property value has two layers of buffer. The tenant with a long term lease and the underlying value of land in case of redevelopment. The implied cap rate is around 7.1% and, believe it or not, we think that Auto REIT at 7.1% is far more attractive than SmartCenters Real Estate Investment Trust (SRU.UN:CA) or RioCan Real Estate Investment Trust (REI.UN:CA) at 6.7%. The latter have far more risks and much weightier debt to EBITDA on their hands. Their capex requirements are astronomical for their redevelopment. So Auto REIT wins easily even though it gets lumped into retail. We think this is one of the few REITs in Canada that can be bought today, while bracing for volatility.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here