YETI (NYSE:YETI) just reported a relatively disappointing quarter where growth significantly decelerated. The good news is that it appears the company is well positioned to return to double digit growth in a few quarters. This is fundamental to the bullish thesis, as we said in our last article, that a ~20x P/E seems reasonable if the company can continue growing sales at a rapid pace, but with the growth rate significantly decelerating we have to analyze in detail what is happening to assess whether the current valuation continues to make sense or not.

For Q1 2023 sales increased a very modest 3%, as the company was impacted by a voluntary recall and a slow pace of orders in the North American wholesale channels. Not everything was bad news, as the company started to see positive y/y gross margin improvements which had not happened for a long time. This was in large part thanks to lower container shipping costs. International continues to perform well too, and it reached ~16% of sales, up from ~13% the previous year. The company believes international can continue to grow in importance and as a percentage of total sales. YETI is also making progress with its ESG targets, now with over 70% of its product portfolio having circularity programs. Importantly, the company has high confidence in a return to double digit top line growth by the fourth quarter. This is what CFO Michael McMullen had to say in that regard during the Q&A session of the earnings call, where he detailed what he believes will enable the company to get to that level of growth again.

So a couple of things that I would think about. I mean, first and foremost is going to be the planned reintroduction of the products that we — that are currently on stop sale. So we’ll get — not only the launch in the DTC, but we’ll get to sort of refill back into the channel were given all the products that we’ve taken back from the wholesale dealers. So I think that’s the first thing.

The second thing is we do — we are — when we look out over the year, even in Drinkware, we’re excited about the planned reintroductions that we have or the planned product introductions that we have. We feel like we’ve got an opportunity to continue to go Drinkware and that Drinkware growth will build throughout the year. And so it’s — the recall is obviously the biggest piece. But even if you normalize for that, we feel like we’ve got a good opportunity to continue to grow other parts of our business as well.

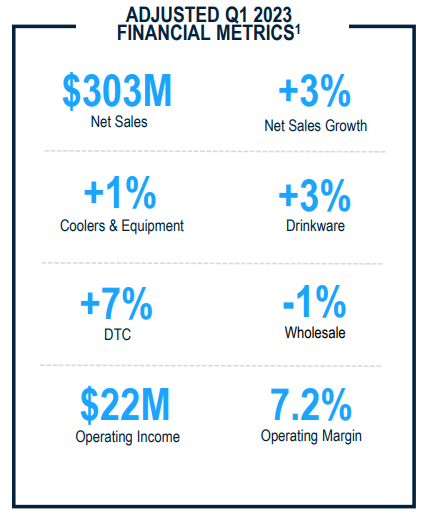

Q1 2023 Results

First quarter sales increased to $303 million compared to $294 million in the previous year, or ~3% growth. Product recalls had a negative impact of ~6%. International sales grew very significantly, roughly 33%, with strong growth across the company’s three regions of Europe, Australia and Canada. Gross profit increased ~4% to $161 million or 53% of sales compared to 52.7% in the previous year. The balance sheet remains quite strong with $168 million in cash, and total debt of $84 million.

Operating income decreased 43% to $22 million or 7.2% of sales compared to 13% during the previous year. Net income decreased 46% to $16 million or $0.18 per diluted share compared to $0.32 in the previous year. Clearly, this is a big decline in profitability, but we believe the company should see its profit margins recover significantly in the coming quarters.

YETI Investor Presentation

Growth

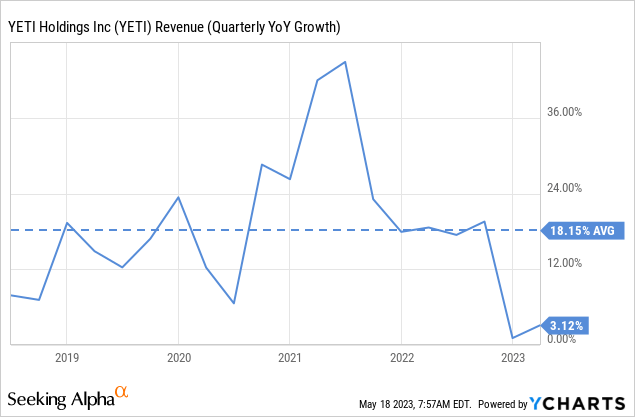

In the past five years, YETI has averaged quarterly y/y revenue growth of ~18%, which is exceptionally high for a consumer products company. This shows the strength of its brand and the strong appeal of its products, as well as a good expansion strategy. Due to a number of issues, including the product recall, the growth rate decline significantly to ~3%, but as already discussed, the company shared a number of reasons why it is confident that it can return to double-digit growth by the fourth quarter.

Guidance

Guidance for the full year is not particularly strong, with the company expecting sales to increase between 3% and 5% compared to the previous year. It even expects a small decline in sales for Q2, but the company believes it is on track to return to double-digit growth during the fourth quarter. YETI also believes it can return to over 20% operating margins in the fourth quarter as a result of double-digit revenue growth and continued gross margin gains. YETI expects full year adjusted earnings per diluted share of between $2.12 and $2.23 and free cash flow of $100 million to $150 million for the year.

Valuation

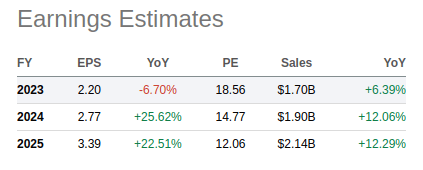

While revenue growth and earnings have significantly declined, shares look quite attractive if the company can indeed return to something close to its historical growth rate and profit margins. Analysts on average expect lower earnings for fiscal year 2023, but they are expected to meaningfully grow the next two years. A ~12x price/earnings ratio based on fiscal year 2025 estimates looks quite attractive if YETI can indeed reignite growth.

Seeking Alpha

Risks

The biggest risk we see is YETI failing to deliver double-digit revenue growth again. We are also concerned with the company’s ability to return profitability closer to historical levels. Longer-term, there is a risk the brand could weaken or potentially new competing brands becoming more popular and taking market share.

Conclusion

YETI appears to have hit a speed bump in terms of growth, and its results were also significantly impacted by the voluntary product recall. We do see increased risks compared to the last time we covered the company, as it now has to prove it can return to double-digit revenue growth. We continue to believe the valuation is quite reasonable, but given the increased risks, we are downgrading our rating to ‘Hold’ from ‘Buy’ previously.

Read the full article here